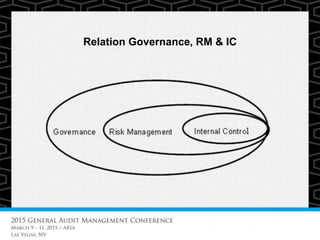

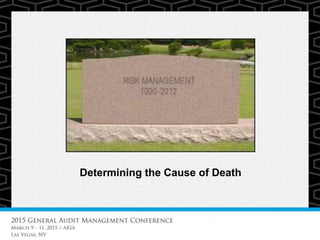

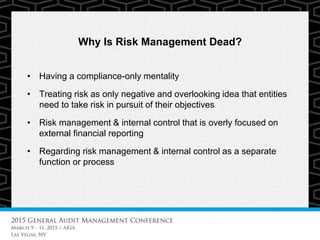

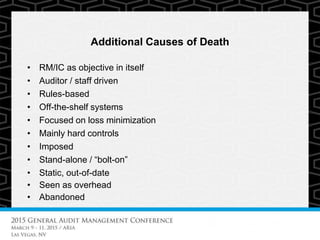

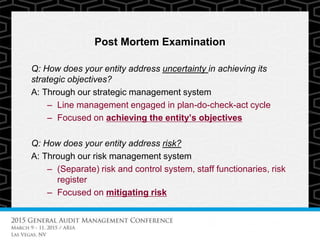

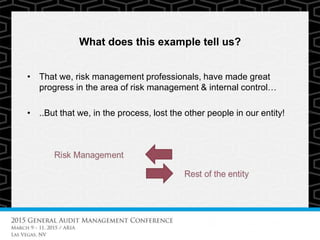

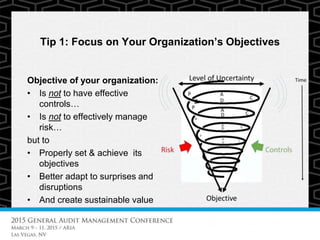

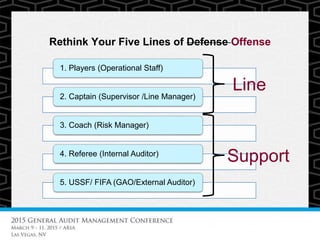

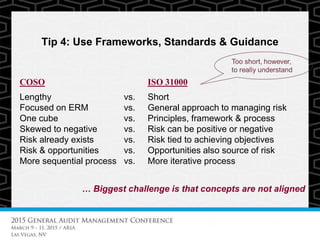

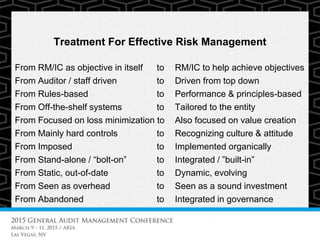

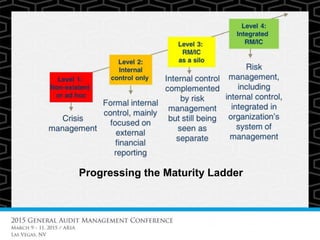

The document discusses the decline of risk management practices due to a compliance-focused mentality and emphasizes the need to integrate risk management into organizational objectives. It offers strategies to revive risk management, including making objective owners responsible for risk, adapting processes to fit organizational needs, and using frameworks that align with business goals. The internal auditor's role is highlighted as critical in championing effective risk management and ensuring its integration with the overall management system.