Daily Retail Market Report

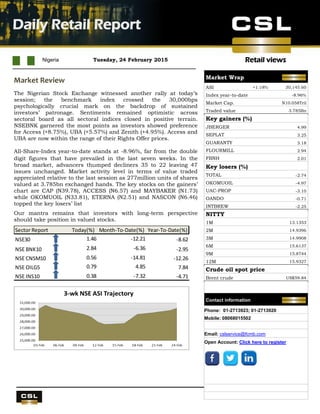

- 1. Retail views UBA Q4 results Nigeria Tuesday, 24 February 2015 Daily Retail Report . Market Review The Nigerian Stock Exchange witnessed another rally at today’s session; the benchmark index crossed the 30,000bps psychologically crucial mark on the backdrop of sustained investors’ patronage. Sentiments remained optimistic across sectoral board as all sectoral indices closed in positive terrain. NSEBNK garnered the most points as investors showed preference for Access (+8.75%), UBA (+5.57%) and Zenith (+4.95%). Access and UBA are now within the range of their Rights Offer prices. All-Share-Index year-to-date stands at -8.96%, far from the double digit figures that have prevailed in the last seven weeks. In the broad market, advancers thumped decliners 35 to 22 leaving 47 issues unchanged. Market activity level in terms of value traded appreciated relative to the last session as 277million units of shares valued at 3.785bn exchanged hands. The key stocks on the gainers’ chart are CAP (N39.78), ACCESS (N6.57) and MAYBAKER (N1.73) while OKOMUOIL (N33.81), ETERNA (N2.51) and NASCON (N6.46) topped the key losers’ list Our mantra remains that investors with long-term perspective should take position in valued stocks. Sector Report Today(%) Month-To-Date(%) Year-To-Date(%) NSE30 1.46 -12.21 -8.62 NSE BNK10 2.84 -6.36 -2.95 NSE CNSM10 0.56 -14.81 -12.26 NSE OILG5 0.79 4.85 7.84 NSE INS10 0.38 -7.32 -4.71 Market Wrap ASI +1.18% 30,145.60 Index year-to-date -8.96% Market Cap. N10.058Tril Traded value 3.785Bn Key gainers (%) JBERGER 4.99 SEPLAT 3.25 GUARANTY 3.18 FLOURMILL 2.94 FBNH 2.01 Key losers (%) TOTAL -2.74 OKOMUOIL -4.97 UAC-PROP -3.10 OANDO -0.71 INTBREW -2.25 NITTY 1M 13.1353 2M 14.9396 3M 14.9908 6M 15.6137 9M 15.8744 12M 15.9327 Crude oil spot price Brent crude US$59.84 Contact information Phone: 01-2713923; 01-2713920 Mobile: 08068015502 Email: cslservice@fcmb.com Open Account: Click here to register

- 2. Daily Retail Report Page 2 Retail views Stock Recommendations Banking Comment Current Price Target Price Potential Upside % EPS FY 2013 1 Yr forward EPS Last Dividend (N) P/BV 2013 Yield FY 2013 Yield FY 2014e Shares Outstanding (millions) Year End ACCESS BANK Buy 6.57 7.73 18% 1.60 1.90 0.35 0.80 7.10% 11.5% 22883.00 Dec. DIAMOND BANK Buy 4.10 5.27 29% 2.00 1.70 0.30 0.60 5.40% 5.4% 14475.00 Dec. FIDELITY BANK PLC Buy 1.22 1.86 52% 0.30 0.50 0.14 0.30 7.40% 11.6% 28974.00 Dec. FBN HOLDINGS Buy 7.61 12.86 69% 2.20 2.30 1.10 0.80 10.00% 10.0% 32632.00 Dec. GUARANTY TRUST BANK Buy 22.70 28.42 25% 3.20 3.30 1.45 2.20 6.90% 7.3% 29431.00 Dec. STANBIC HOLDINGS Hold 25.75 32.37 26% 1.90 2.60 1.20 3.10 2.70% 3.5% 10000.00 Dec. STERLING BANK Hold 2.25 1.57 -30% 0.40 0.40 0.25 0.80 10.90% 8.7% 21592.00 Dec. SKYE BANK Under review 2.14 -100% 1.20 1.10 0.30 0.30 11.10% 20.7% 13219.00 Dec. U B A Buy 3.75 5.70 52% 1.40 1.50 0.50 0.70 10.10% 10.1% 32981.00 Dec. ZENITH BANK Buy 18.75 24.60 31% 3.00 3.00 1.75 1.30 8.10% 8.3% 31396.00 Dec. Food & Beverage EV/EBITDA (x) 2013 Yield FY 2013e DANGOTE SUGAR REFINERY Under review 6.17 Under review N/A 0.89 1.20 0.60 4.70 7.40% 7.4% 12000.00 Dec. CADBURY NIG. Under review 38.80 Under review N/A 2.90 3.20 1.30 7.60 0.00% 4.7% 1878.00 Dec. FLOUR MILLS Hold 35.00 54.80 57% 2.90 3.50 1.60 8.90 3.30% 4.0% 2385.00 Mar. HONEYWELL FLOURMILLS Buy 2.90 5.20 79% 0.40 0.30 0.17 12.00 5.70% 4.7% 7930.00 Mar. NESTLE FOODS NIG. Hold 824.01 821.80 0% 28.10 31.30 24.00 24.90 2.60% 3.0% 792.00 Dec. P Z INDUSTRIES Hold 28.49 34.60 21% 1.20 1.30 0.19 7.80 2.70% 3.0% 3970.00 May U A C N Buy 37.00 72.60 96% 2.90 3.60 1.75 5.40 4.00% 4.7% 1920.00 Dec. UNILEVER NIGERIA PLC Sell 34.18 31.80 -7% 1.30 1.60 1.25 13.70 3.80% 3.8% 3783.00 Dec. Building Materials EPS 2013e EV/EBITDA(x) 2013e Yield FY 2013e LAFARGE WAPCO PLC Under review 86.00 Under review N/A 9.40 9.40 3.30 8.20 3.30% 3.3% 3001.00 Mar. DANGOTE CEMENT Buy 154.00 258.50 N/A 11.80 11.90 7.00 16.10 3.40% 3.5% 17040.00 Dec. Breweries EPS 2013e EV/EBITDA(x) 2013e Yield FY 2013e GUINNESS NIG. Sell 125.49 111.00 -12% 7.90 5.90 7.00 14.50 4.30% 3.0% 1506.00 June INTERNATIONAL BREWERIES Hold 17.10 24.50 43% 0.90 1.30 0.30 16.20 1.00% 1.5% 3263.00 Mar. NIGERIAN BREWERIES Sell 139.00 121.20 -13% 5.70 5.60 4.50 13.30 2.90% 2.1% 7562.00 June Agriculture EPS 2013e EV/EBITDA (x) 2013e Yield FY 2013e OKOMU OIL Buy 33.81 41.50 23% 2.20 3.00 1.00 9.00 3.20% 6.7% 953.00 Dec. PRESCO PLC Buy 32.38 42.70 32% 1.29 1.60 0.10 9.20 0.40% 1.7% 1000.00 Dec. Pharmaceuticals EV/EBITDA (x) 2013 Yield FY 2013 GLAXOSMITHKLINE BEECHAM NIG. Buy 42.00 78.60 0.87 3.10 4.30 1.30 8.90 2.50% 3.8% 957.00 Dec. Note – for full report on the recommended stocks kindly send an email to cslcsu@firstcitygroup.com

- 3. Daily Retail Report Page 3 Retail views Top Highlight Islamic banking – Islamic banking starts from a low base The Central Bank of Nigeria’s (CBN) new guidelines for the regulation and supervision of non-interest (Islamic) financial institutions in Nigeria provide for the establishment of an advisory body at the CBN on Islamic banking and finance. The body is to be called the Financial Regulation Advisory Council of Experts (FRACE) and will advise the CBN on matters relating to Islamic commercial jurisprudence for regulation and supervision of Non-Interest Financial Institutions (NIFIs) in Nigeria. The CBN over the weekend released guidelines that would guide the operations and activities of the FRACE. Jaiz Bank Plc was the first licensed Islamic bank in Nigeria and it began operations in 2012. Conventional banks like Stanbic IBTC and Sterling Bank also have licenses to offer or sell products and services in line with the principles under this model through appropriate subsidiaries and branches. Under Islamic banking, interest is prohibited and thus, the providers of funds share the business risk and profits based on mutual agreements. When disbursing loans, the banks function as quasi-investment banks, whereby both the investor and the bank not only share the benefits of high returns on investments, but also share any losses. Islamic banks also refrain from funding transactions that are prohibited by Shari’ah principles like brewing, gambling, etc. In our view, the successful and wide spread take-off of Islamic Banking in Nigeria depends to a large extent on the ability of its promoters to create better awareness of Islamic banking products and to help to address any misconceptions’ surrounding Islamic banking in a country where religion can be a sensitive issue. Today’s news headlines Rice: FG targets extra 2.9 million metric tonnes: The Minister of Agriculture and Rural Development, Dr. Akinwumi Adesina, has said about 2.9 million metric tonnes of high quality milled rice will be added to the existing stock in the country. This was contained in a statement issued by the Federal Ministry of Agriculture and Rural Development after the minister inspected a 420-hectare rice farm and mill belonging to OLAM Nigeria in Rukubi, near Doma, Nasarawa State. Adesina noted that the addition would ‘‘bring Nigeria closer to being self-sufficient in rice production and a potential exporter of milled rice.” According to him, 1.9 million metric tonnes of rice were produced in the country in the 2013 dry and wet seasons, contributing N320bn to the Gross Domestic Product and creating 670,000 jobs in the process. Source: punchng.com Alison-Madueke meets marketers in Lagos to avert fuel crisis: In a move to avert a looming scarcity of petroleum products in the country, the Minister of Petroleum Resources, Mrs. Diezani Alison-Madueke, on Monday met with the Chief Executive Officers of Oil Marketing and Trading companies in Lagos. During the protracted meeting at the Eko Hotel, solutions to the threats by the banks and marketers to stop financing and importing products, were sought. Source: thisdaylive.com Aliko Dangote, Africa’s richest man, loses $7.8 billion as Naira, stocks plunge: Aliko Dangote, Africa’s richest man, is the biggest loser among Nigeria’s richest people as the Naira’s slump, coupled with falling stock prices, have erased more than $7.8 billion of his fortune since February, when FORBES locked in the values for its annual ranking of the world’s billionaires. Dangote was worth $25 billion at the time; but at the close of market last Tuesday, his net-worth had dropped to US$17.2 billion. More than half of the drop in his fortune has happened since early November. As of November 7, Dangote was worth $21.6 billion, $4.4 billion more than now. Source: thisdaylive.com

- 4. Daily Retail Report Page 4 Retail views Important Risk Warnings and Disclaimers CSL STOCKBROKERS LIMITED (CSLS) is regulated and authorized by the Securities and Exchange Commission (SEC) of Nigeria and the Nigerian Stock Exchange (NSE). The details of the authorization can be viewed at the SEC Website at http://www.sec.gov.ng/consolidated-list-of-capital-market-operators.html and at the NSE Website at http://www.nse.com.ng/Regulation/ForBrokers/Pages/Dealing-Members.asp. RELIANCE ON THIS NOTE FOR THE PURPOSE OF ENGAGING IN ANY INVESTMENT ACTIVITY MAY EXPOSE YOU TO A SIGNIFICANT RISK OF LOSS. By receiving this document, you will not be deemed a client or provided with the protections afforded to clients of CSLS. When distributing this document, CSLS or any member of the First City Group is not acting for any recipient of this document and will not be responsible for providing advice to any recipient in relation to this document. Accordingly, CSLS will not be responsible to any recipient for providing the protections afforded to its clients. If you are in the UK, the protections of the Financial Services and Markets Act 2000 (FSMA) or Financial Conduct Authority (FCA) do not apply to any investment activity engaged in as a result of this communication; and any resulting transaction would not fall within the jurisdiction of any FSMA or FCA dispute resolution or compensation scheme. By accepting this document you confirm that you are so aware of the above stated. If you do not accept the above stated and/or if the distribution of this document is otherwise unlawful where you are, you are required to return the document immediately to CSLS. This document is not an offer to buy or sell or to solicit an offer to buy or sell any security. This document does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it. The appropriateness of a particular investment will depend on an investor’s individual circumstances and objectives. The investments and shares referred to in this document may not be suitable for all investors. CSLS is a member of the FCMB Group Plc (“the Group”), a group of companies which includes First City Monument Bank Ltd., FCMB Capital Markets Ltd, First City Asset Management and FCMB UK. Either CSLS or any other member of the Group may effect transactions in shares mentioned herein, may take proprietary trading positions in those shares, and may receive remuneration for the publication of its research and for other services. Accordingly, this document may not be considered as objective or impartial. Additionally, information may be available to CSLS or the Group, which is not reflected in this material. Further information on CSLS’ policy regarding potential conflicts of interest in the context of investment research and CSLS’ policy on disclosure and conflicts in general are available on request. This document is based on information obtained from sources it believes are reliable but which it has not independently verified. Neither CSLS nor its advisors, directors or employees make any guarantee, representation or warranty as to its accuracy, reasonableness or completeness and neither CSLS nor its advisors, directors or employees accepts any responsibility or liability whatsoever (in negligence or otherwise) for any loss howsoever arising from any use of this document or its contents or otherwise arising in connection with this document. The opinions contained in this document are subject to change without notice and not to be relied upon and should not be used in substitution for the exercise of independent judgment. Past performance is not a guarantee of future performance. Investments may go down in value as well as up and you may not get back the full amount invested. Where an investment is denominated in a currency other than the local currency of the recipient of the research report, changes in the exchange rates may have an adverse effect on the value, price or income of that investment. In case of investments for which there is no recognized market it may be difficult for investors to sell their investments or to obtain reliable information about its value or the extent of the risk to which it is exposed. The information contained in this document is confidential and is solely for use of those persons to whom it is addressed and may not be reproduced, further distributed to any other person or published, in whole or in part, for any purpose. © CSLS 2013. All rights reserved CSL STOCKBROKERS LIMITED Member of the Nigerian Stock Exchange First City Plaza, 44 Marina, PO Box 9117, Lagos State, NIGERIA