Daily Retail Report

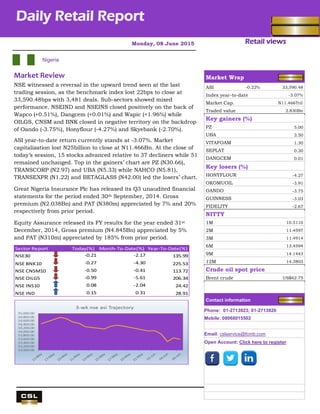

- 1. Retail views Nigeria Monday, 08 June 2015 Daily Retail Report . Market Review NSE witnessed a reversal in the upward trend seen at the last trading session, as the benchmark index lost 22bps to close at 33,590.48bps with 3,481 deals. Sub-sectors showed mixed performance. NSEIND and NSEINS closed positively on the back of Wapco (+0.51%), Dangcem (+0.01%) and Wapic (+1.96%) while OILGS, CNSM and BNK closed in negative territory on the backdrop of Oando (-3.75%), Honyflour (-4.27%) and Skyebank (-2.70%). ASI year-to-date return currently stands at -3.07%. Market capitalization lost N25billion to close at N11.466Bn. At the close of today’s session, 15 stocks advanced relative to 37 decliners while 51 remained unchanged. Top in the gainers’ chart are PZ (N30.66), TRANSCORP (N2.97) and UBA (N5.33) while NAHCO (N5.81), TRANSEXPR (N1.22) and BETAGLASS (N42.00) led the losers’ chart. Great Nigeria Insurance Plc has released its Q3 unaudited financial statements for the period ended 30th September, 2014. Gross premium (N2.038Bn) and PAT (N380m) appreciated by 7% and 20% respectively from prior period. Equity Assurance released its FY results for the year ended 31st December, 2014, Gross premium (N4.845Bn) appreciated by 5% and PAT (N310m) appreciated by 185% from prior period. Sector Report Today(%) Month-To-Date(%) Year-To-Date(%) NSE30 -0.21 -2.17 135.99 NSE BNK10 -0.27 -4.30 225.53 NSE CNSM10 -0.50 -0.41 113.72 NSE OILG5 -0.99 -5.61 206.34 NSE INS10 0.08 -2.04 24.42 NSE IND 0.15 0.31 28.91 Market Wrap ASI -0.22% 33,590.48 Index year-to-datee -3.07% Market Cap. N11.466Tril Traded value 2.830Bn Key gainers (%) PZ 5.00 UBA 3.50 VITAFOAM 1.30 SEPLAT 0.30 DANGCEM 0.01 Key losers (%) HONYFLOUR -4.27 OKOMUOIL -3.91 OANDO -3.75 GUINNESS -3.03 FIDELITY -2.67 NITTY 1M 10.5110 2M 11.4597 3M 11.4914 6M 13.4594 9M 14.1443 12M 14.3803 Crude oil spot price Brent crude US$62.75 Contact information Phone: 01-2713923; 01-2713920 Mobile: 08068015502 Email: cslservice@fcmb.com Open Account: Click here to register

- 2. Daily Retail Report Page 2 Retail views Stock Recommendations Banking Comment Current Price Target Price Potential Upside % EPS FY 2014 1 Yr forward EPS Last Dividend( N) P/BV 2014 Yield FY 2014 Yield FY 2015e Shares Outstanding (millions) Year End ACCESS BANK Buy 6.05 7.70 27% 1.90 0.40 0.60 0.50 9.80% 1.0% 22883.00 Dec. DIAMOND BANK Buy 4.44 5.30 19% 1.70 0.30 0.10 0.50 2.20% 1.6% 14475.00 Dec. FIDELITY BANK PLC Buy 1.82 1.90 4% 0.20 0.10 0.18 0.30 9.60% 4.8% 28974.00 Dec. FBN HOLDINGS Buy 9.00 12.90 43% 2.50 0.00 0.10 0.60 1.10% 0.0% 32632.00 Dec. GUARANTY TRUST BANK Buy 27.29 28.40 4% 3.40 2.20 1.75 2.20 6.40% 3.9% 29431.00 Dec. STANBIC HOLDINGS Hold 28.95 32.40 12% 2.90 3.60 1.25 2.70 0.30% 3.9% 10000.00 Dec. STERLING BANK Hold 2.03 1.60 -21% 0.40 0.30 0.06 0.50 2.90% 6.3% 21592.00 Dec. SKYE BANK Under review 2.52 Under review 1.10 1.1 0.30 0.3 21.70% 21.7% 13219.00 Dec. U B A Buy 5.33 7.90 48% 1.60 0.50 0.10 0.70 1.90% 2.7% 32981.00 Dec. ZENITH BANK Buy 19.80 24.60 24% 3.20 2.20 1.75 1.10 8.70% 4.6% 31396.00 Dec. Food & Beverage EPS 2014 EV/EBITDA (x) 2014 Yield FY 2014 Yield FY 2015e DANGOTE SUGAR REFINERY Under review 6.65 Under review 1.00 1.00 0.60 3.70 9.20% 9.2% 12000.00 Dec. CADBURY NIG. Under review 39.90 Under review 0.80 3.50 0.65 8.40 1.60% 5.2% 1878.00 Dec. FLOUR MILLS Hold 35.00 54.80 57% 1.90 3.50 1.60 6.80 2.10% 2.1% 2385.00 Mar. HONEYWELL FLOURMILLS Buy 3.81 5.20 36% 0.30 0.40 0.17 11.80 4.60% 4.6% 7930.00 Mar. NESTLE FOODS NIG. Hold 865.00 777.60 -10% 28.10 27.80 17.50 21.00 3.10% 2.8% 792.00 Dec. P Z INDUSTRIES Hold 30.66 34.60 13% 1.30 1.40 0.81 12.70 2.00% 2.2% 3970.00 May U A C N Buy 41.70 72.60 74% 3.60 3.60 1.75 4.70 5.60% 5.6% 1920.00 Dec. UNILEVER NIGERIA PLC Sell 45.17 24.30 -46% 0.60 0.50 0.10 27.50 0.20% 0.2% 3783.00 Dec. Building Materials EPS 2014e EV/EBITDA(x) 2014e Yield FY 2014e Yield FY 2015e LAFARGE WAPCO PLC Under review 99.50 Under review 9.40 9.40 3.50 8.10 3.30% 3.3% 3001.00 Mar. DANGOTE CEMENT Buy 177.01 198.40 12% 11.90 11.90 6.00 13.90 4.00% 4.0% 17040.00 Dec. Breweries EPS 2014 EV/EBITDA(x) 2014 Yield FY 2014 Yield FY 2015e GUINNESS NIG. Sell 160.00 111.00 -31% 6.30 6.30 7.00 9.10 1.90% 1.9% 1506.00 June INTERNATIONAL BREWERIES Hold 20.01 24.50 22% 1.30 1.30 0.30 16.20 2.30% 2.3% 3263.00 Mar. NIGERIAN BREWERIES Sell 147.20 127.70 -13% 5.60 5.60 3.50 13.20 3.20% 3.2% 7562.00 June Agriculture EPS 2014 EV/EBITDA(x) 2014e Yield FY 2014e Yield FY 2015e OKOMU OIL Buy 29.21 41.50 42% 3.00 3.00 0.25 8.30 7.20% 7.2% 953.00 Dec. PRESCO PLC Buy 34.50 42.70 24% 1.62 1.60 0.10 10.50 1.50% 1.5% 1000.00 Dec. Pharmaceuticals EPS 2014 EV/EBITDA (x) 2013 Yield FY 2013 Yield FY 2015e GLAXOSMITHKLINE BEECHAM NIG. Buy 44.11 78.60 78% 1.90 4.30 0.75 12.30 1.70% 4.4% 957.00 Dec. Oil & Gas EPS 2014 EV/DACF(x) 2014 Yield FY 2014 Yield FY 2015e SEPLAT Buy 339.01 598.00 76% 0.58 0.87 3.10 4.70% 4.9% Dec.

- 3. Daily Retail Report Page 3 Retail views Top Highlight Naira bonds JP Morgan extends it GBI-EM deadline for Nigeria. Why? At the beginning of this year JP Morgan announced that it was considering removing Nigeria from its index of emerging market local-currency bonds, the GBI-EM Index, with a review period of three to five months. Nigeria had been included in the index in October 2012. Now JP Morgan is announcing that it is extending its review period until the end of the year. The key issue for JP Morgan is liquidity in naira foreign exchange. We at CSL Stockbrokers have not encountered problems settling foreign exchange in the equity market, so we doubt that JP Morgan’s issue lies with specific instances of remitting funds to overseas investors. Rather, it is a matter of overall liquidity. Over-the-counter FX turnover fell from N3.3tn (US$16.6bn) in January to N1.7tn (US$8.6bn) in March according to data from market data provider FMDQ. The Central Bank of Nigeria in the last year has supplemented a policy of high rates and tight liquidity with multiple administrative measures. These have stabilised the currency after its effective devaluation this year (see CSL Nigerian Monetary Policy Committee Preview – The FX Conundrum, 23 March), but reduced liquidity. In the political arena it is possible that the government of President Muhammadu Buhari will dramatically improve Nigeria’s fiscal outcome, with benefits for the monetary side (eg, possibly stronger foreign exchange reserves). But the new government has only just come to power, and we might only see benefits six months from now. JP Morgan’s has decided to wait and see. Today’s news headlines JPMorgan may eject Nigeria from key bond index by December: JPMorgan will eject Nigeria from its Government Bond Index (GBI-EM) by the year-end unless the country restores liquidity to its currency market in a way that will allow foreign investors tracking the benchmark to transact with minimal hurdles.The international bank at the weekend said it had extended the deadline to eject Africa’s biggest economy by another six months to take into account the arrival of President Muhammadu Buhari. JPMorgan, which runs the most commonly used emerging debt indices had placed Nigeria on a negative index watch in January and then said it would assess its place on the index over a three to five months period. Source: businessdayonline.com 46 stocks get revival boost in SEC’s new price-floor: The new par value rule introduced by the Securities and Exchange Commission (SEC) last week is expected to revive the over 46 stocks that have been moribund for several years, with the attendant liquidity to both shareholders in the stocks and the bourse, BusinessDay can now reveal. The SEC, Nigeria’s apex capital market regulator, had last week approved the Par Value Rule submitted to it by the National Council of the Nigerian Stock Exchange, which revises the price floor of company shares traded on the Exchange to one kobo from the previous price floor of 50kobo. Source: businessdayonline.com Sustainable practices: CBN considers incentives for banks: The Central Bank of Nigeria is working on a set of incentives for banks in the country to apply sustainable banking practices. The Special Adviser to the CBN Governor on Sustainable Banking, Dr. Aisha Mahmood, revealed this in Abuja during an interview with journalists to mark the World Environment Day. Source: punchng.com

- 4. Daily Retail Report Page 4 Retail views Important Risk Warnings and Disclaimers CSL STOCKBROKERS LIMITED (CSLS) is regulated and authorized by the Securities and Exchange Commission (SEC) of Nigeria and the Nigerian Stock Exchange (NSE). The details of the authorization can be viewed at the SEC Website at http://www.sec.gov.ng/consolidated-list-of-capital-market-operators.html and at the NSE Website at http://www.nse.com.ng/Regulation/ForBrokers/Pages/Dealing-Members.asp. RELIANCE ON THIS NOTE FOR THE PURPOSE OF ENGAGING IN ANY INVESTMENT ACTIVITY MAY EXPOSE YOU TO A SIGNIFICANT RISK OF LOSS. By receiving this document, you will not be deemed a client or provided with the protections afforded to clients of CSLS. When distributing this document, CSLS or any member of the First City Group is not acting for any recipient of this document and will not be responsible for providing advice to any recipient in relation to this document. Accordingly, CSLS will not be responsible to any recipient for providing the protections afforded to its clients. If you are in the UK, the protections of the Financial Services and Markets Act 2000 (FSMA) or Financial Conduct Authority (FCA) do not apply to any investment activity engaged in as a result of this communication; and any resulting transaction would not fall within the jurisdiction of any FSMA or FCA dispute resolution or compensation scheme. By accepting this document you confirm that you are so aware of the above stated. If you do not accept the above stated and/or if the distribution of this document is otherwise unlawful where you are, you are required to return the document immediately to CSLS. This document is not an offer to buy or sell or to solicit an offer to buy or sell any security. This document does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it. The appropriateness of a particular investment will depend on an investor’s individual circumstances and objectives. The investments and shares referred to in this document may not be suitable for all investors. CSLS is a member of the FCMB Group Plc (“the Group”), a group of companies which includes First City Monument Bank Ltd., FCMB Capital Markets Ltd, First City Asset Management and FCMB UK. Either CSLS or any other member of the Group may effect transactions in shares mentioned herein, may take proprietary trading positions in those shares, and may receive remuneration for the publication of its research and for other services. Accordingly, this document may not be considered as objective or impartial. Additionally, information may be available to CSLS or the Group, which is not reflected in this material. Further information on CSLS’ policy regarding potential conflicts of interest in the context of investment research and CSLS’ policy on disclosure and conflicts in general are available on request. This document is based on information obtained from sources it believes are reliable but which it has not independently verified. Neither CSLS nor its advisors, directors or employees make any guarantee, representation or warranty as to its accuracy, reasonableness or completeness and neither CSLS nor its advisors, directors or employees accepts any responsibility or liability whatsoever (in negligence or otherwise) for any loss howsoever arising from any use of this document or its contents or otherwise arising in connection with this document. The opinions contained in this document are subject to change without notice and not to be relied upon and should not be used in substitution for the exercise of independent judgment. Past performance is not a guarantee of future performance. Investments may go down in value as well as up and you may not get back the full amount invested. Where an investment is denominated in a currency other than the local currency of the recipient of the research report, changes in the exchange rates may have an adverse effect on the value, price or income of that investment. In case of investments for which there is no recognized market it may be difficult for investors to sell their investments or to obtain reliable information about its value or the extent of the risk to which it is exposed. The information contained in this document is confidential and is solely for use of those persons to whom it is addressed and may not be reproduced, further distributed to any other person or published, in whole or in part, for any purpose. © CSLS 2013. All rights reserved CSL STOCKBROKERS LIMITED Member of the Nigerian Stock Exchange First City Plaza, 44 Marina, PO Box 9117, Lagos State, NIGERIA