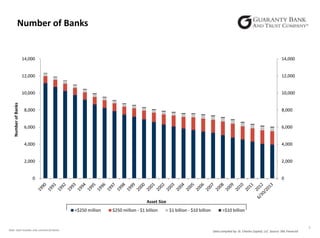

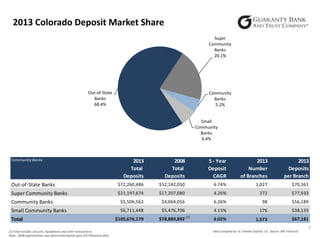

The document summarizes key trends in the Colorado banking environment over the past 5 years and provides projections for 2014. Specifically, it notes that from 2008-2013:

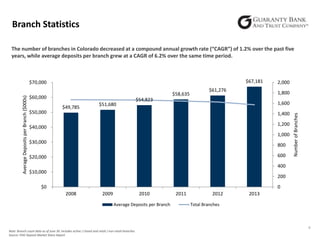

- The number of bank branches in Colorado decreased 1.2% annually on average while deposits per branch grew 6.2% per year

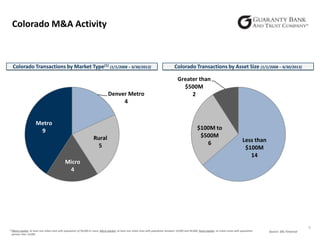

- Most M&A activity involved smaller Colorado banks under $100M in assets

For 2014, it predicts continued consolidation in the industry, loan growth, higher compliance costs, further branch closures, and advancing technology.