Nigeria Stock Exchange sees slight gains

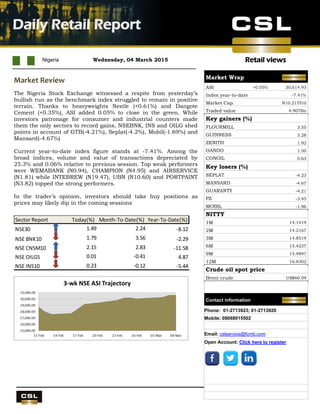

- 1. Retail views UBA Q4 results Nigeria Wednesday, 04 March 2015 Daily Retail Report . Market Review The Nigeria Stock Exchange witnessed a respite from yesterday’s bullish run as the benchmark index struggled to remain in positive terrain. Thanks to heavyweights Nestle (+0.61%) and Dangote Cement (+0.35%), ASI added 0.05% to close in the green. While investors patronage for consumer and industrial counters made them the only sectors to record gains, NSEBNK, INS and OILG shed points in account of GTB(-4.21%), Seplat(-4.2%), Mobil(-1.69%) and Mansard(-4.67%) Current year-to-date index figure stands at -7.41%. Among the broad indices, volume and value of transactions depreciated by 25.3% and 0.06% relative to previous session. Top weak performers were WEMABANK (N0.94), CHAMPION (N4.95) and AIRSERVICE (N1.81) while INTEBREW (N19.47), UBN (N10.60) and PORTPAINT (N3.82) topped the strong performers. In the trader’s opinion, investors should take buy positions as prices may likely dip in the coming sessions Sector Report Today(%) Month-To-Date(%) Year-To-Date(%) NSE30 1.49 2.24 -8.12 NSE BNK10 1.79 3.56 -2.29 NSE CNSM10 2.15 2.83 -11.58 NSE OILG5 0.01 -0.41 4.87 NSE INS10 0.23 -0.12 -5.44 Market Wrap ASI +0.05% 30,614.93 Index year-to-date -7.41% Market Cap. N10.215Tril Traded value 4.907Bn Key gainers (%) FLOURMILL 3.55 GUINNESS 3.28 ZENITH 1.92 OANDO 1.50 CONOIL 0.63 Key losers (%) SEPLAT -4.23 MANSARD -4.67 GUARANTY -4.21 PZ -3.45 MOBIL -1.96 NITTY 1M 14.1419 2M 14.2167 3M 14.8519 6M 15.4227 9M 15.9897 12M 16.8302 Crude oil spot price Brent crude US$60.59 Contact information Phone: 01-2713923; 01-2713920 Mobile: 08068015502 Email: cslservice@fcmb.com Open Account: Click here to register

- 2. Daily Retail Report Page 2 Retail views 0 Stock Recommendations Banking Comment Current Price Target Price Potential Upside % EPS FY 2013 1 Yr forward EPS Last Dividend (N) P/BV 2013 Yield FY 2013 Yield FY 2014e Shares Outstanding (millions) Year End ACCESS BANK Buy 6.50 7.73 19% 1.60 1.90 0.35 0.80 7.10% 11.5% 22883.00 Dec. DIAMOND BANK Buy 4.28 5.27 23% 2.00 1.70 0.30 0.60 5.40% 5.4% 14475.00 Dec. FIDELITY BANK PLC Buy 1.33 1.86 40% 0.30 0.50 0.14 0.30 7.40% 11.6% 28974.00 Dec. FBN HOLDINGS Buy 8.25 12.86 56% 2.20 2.30 1.10 0.80 10.00% 10.0% 32632.00 Dec. GUARANTY TRUST BANK Buy 23.00 28.42 24% 3.20 3.30 1.45 2.20 6.90% 7.3% 29431.00 Dec. STANBIC HOLDINGS Hold 26.02 32.37 24% 1.90 2.60 1.20 3.10 2.70% 3.5% 10000.00 Dec. STERLING BANK Hold 2.32 1.57 -32% 0.40 0.40 0.25 0.80 10.90% 8.7% 21592.00 Dec. SKYE BANK Under review 2.13 -100% 1.20 1.10 0.30 0.30 11.10% 20.7% 13219.00 Dec. U B A Buy 3.70 5.70 54% 1.40 1.50 0.50 0.70 10.10% 10.1% 32981.00 Dec. ZENITH BANK Buy 19.10 24.60 29% 3.00 3.00 1.75 1.30 8.10% 8.3% 31396.00 Dec. Food & Beverage EV/EBITDA (x) 2013 Yield FY 2013e DANGOTE SUGAR REFINERY Under review 6.49 Under review N/A 0.89 1.20 0.60 4.70 7.40% 7.4% 12000.00 Dec. CADBURY NIG. Under review 37.90 Under review N/A 2.90 3.20 1.30 7.60 0.00% 4.7% 1878.00 Dec. FLOUR MILLS Hold 35.00 54.80 57% 2.90 3.50 1.60 8.90 3.30% 4.0% 2385.00 Mar. HONEYWELL FLOURMILLS Buy 2.90 5.20 79% 0.40 0.30 0.17 12.00 5.70% 4.7% 7930.00 Mar. NESTLE FOODS NIG. Hold 820.00 821.80 0% 28.10 31.30 24.00 24.90 2.60% 3.0% 792.00 Dec. P Z INDUSTRIES Hold 27.99 34.60 24% 1.20 1.30 0.19 7.80 2.70% 3.0% 3970.00 May U A C N Buy 36.00 72.60 102% 2.90 3.60 1.75 5.40 4.00% 4.7% 1920.00 Dec. UNILEVER NIGERIA PLC Sell 34.86 31.80 -9% 1.30 1.60 1.25 13.70 3.80% 3.8% 3783.00 Dec. Building Materials EPS 2013e EV/EBITDA(x) 2013e Yield FY 2013e LAFARGE WAPCO PLC Under review 87.99 Under review N/A 9.40 9.40 3.30 8.20 3.30% 3.3% 3001.00 Mar. DANGOTE CEMENT Buy 152.53 258.50 N/A 11.80 11.90 7.00 16.10 3.40% 3.5% 17040.00 Dec. Breweries EPS 2013e EV/EBITDA(x) 2013e Yield FY 2013e GUINNESS NIG. Sell 126.00 111.00 -12% 7.90 5.90 7.00 14.50 4.30% 3.0% 1506.00 June INTERNATIONAL BREWERIES Hold 19.47 24.50 26% 0.90 1.30 0.30 16.20 1.00% 1.5% 3263.00 Mar. NIGERIAN BREWERIES Sell 150.00 121.20 -19% 5.70 5.60 4.50 13.30 2.90% 2.1% 7562.00 June Agriculture EPS 2013e EV/EBITDA (x) 2013e Yield FY 2013e OKOMU OIL Buy 30.56 41.50 36% 2.20 3.00 1.00 9.00 3.20% 6.7% 953.00 Dec. PRESCO PLC Buy 32.38 42.70 32% 1.29 1.60 0.10 9.20 0.40% 1.7% 1000.00 Dec. Pharmaceuticals EV/EBITDA (x) 2013 Yield FY 2013 GLAXOSMITHKLINE BEECHAM NIG. Buy 40.00 78.60 0.97 3.10 4.30 1.30 8.90 2.50% 3.8% 957.00 Dec. Note – for full report on the recommended stocks kindly send an email to cslcsu@firstcitygroup.com

- 3. Daily Retail Report Page 3 Retail views Top Highlight Brewers- NB launches Ace Root Nigerian Breweries (NB) (Sell, price target: N121.1, current price: N149.9) recently launched a ready-to-drink brand, Ace Root. Ace Root is positioned as a herbal ready-to-drink brand and we see the product as a direct response to Guinness Nigeria’s (Guinness) (Sell, price target: N111.1, current price: N122.0) widely-popular Orijin ready-to-drink. Guinness’s Orijin is believed to be leading Guinness’s recovery in the current period. With Guinness’s Sales growing by 4.8% year-on-year (y/y) in H1 2015 and NB suffering its first Sales decline in over 10 years in FY2014, we are of the view that brewers will attempt to compete based on relative product pricing and product innovation. Nigerian Breweries, prior to the merger with Consolidated Breweries (CB), did not have a ready-to-drink brand in its product portfolio. Guinness has a June year-end. Nigerian Breweries has a December year-end. NB obtained its first recognisable ready-to-drink product, the Bacardi Breezer, following its merger with CB. Following the launch of Ace Root, NB now has two ready-to-drink brands with which it aims challenge Guinness’s dominance in the Nigerian ready-to-drink segment. The addition of Ace Root increases NB’s brand portfolio to 19. While we expected NB to respond to Guinness’s Orijin, we did not anticipate the immediate launch of a closely-related brand less than a year after Orijin’s launch. However, given NB’s wide distribution network and marketing spend, we believe NB’s ready-to-drink brands could pose problems for Guinness. NB’s launching of Ace Root supports our broad view that competition in the beer market is set to intensify from FY2015. With NB and Guinness producing brands which compete across all segments, it won’t be farfetched to expect SABMiller’s (N/R) to launch its own brand of ready-to-drink in an effort to compete in this specific segment. Today’s news headlines Fuel scarcity: FG pays marketers N100bn (US$500m): The Federal Government on Tuesday expressed concern over the long queues of motorists at petrol filling stations in Lagos, Abuja and other parts of the country, stating that a Sovereign Debt Note of N100bn had been issued by the Debt Management Office to settle part of the subsidy arrears owed to oil marketers. The Minister of Finance, Dr. Ngozi Okonjo-Iweala, confirmed the issuance of the SDN through a statement issued by her Special Adviser on Communications, Paul Nwabuikwu. Source: punchng.com NNPC faces new AG query over N2.3trn (US$11.5bn) illegal ECA deduction: Fresh troubles appear to be unfolding for the embattled Nigerian National Petroleum Corporation (NNPC) and other government agencies in the petroleum sector, as the Auditor General of the Federation has queried the diversion of N2.30 trillion from the Federal Government’s (FG) account. Source: businessdayonline.com Manufacturers condemn new electricity tariff: The recent increase in electricity tariffs approved by the Nigerian Electricity Regulatory Commission will cripple the operations of industries in the country, the Manufacturers Association of Nigeria (MAN) has said. The association also decried the “astronomical increase” in electricity fixed charges from N25,000 to about N250,000 on average for industrial outfits. Source: punchng.com

- 4. Daily Retail Report Page 4 Retail views Important Risk Warnings and Disclaimers CSL STOCKBROKERS LIMITED (CSLS) is regulated and authorized by the Securities and Exchange Commission (SEC) of Nigeria and the Nigerian Stock Exchange (NSE). The details of the authorization can be viewed at the SEC Website at http://www.sec.gov.ng/consolidated-list-of-capital-market-operators.html and at the NSE Website at http://www.nse.com.ng/Regulation/ForBrokers/Pages/Dealing-Members.asp. RELIANCE ON THIS NOTE FOR THE PURPOSE OF ENGAGING IN ANY INVESTMENT ACTIVITY MAY EXPOSE YOU TO A SIGNIFICANT RISK OF LOSS. By receiving this document, you will not be deemed a client or provided with the protections afforded to clients of CSLS. When distributing this document, CSLS or any member of the First City Group is not acting for any recipient of this document and will not be responsible for providing advice to any recipient in relation to this document. Accordingly, CSLS will not be responsible to any recipient for providing the protections afforded to its clients. If you are in the UK, the protections of the Financial Services and Markets Act 2000 (FSMA) or Financial Conduct Authority (FCA) do not apply to any investment activity engaged in as a result of this communication; and any resulting transaction would not fall within the jurisdiction of any FSMA or FCA dispute resolution or compensation scheme. By accepting this document you confirm that you are so aware of the above stated. If you do not accept the above stated and/or if the distribution of this document is otherwise unlawful where you are, you are required to return the document immediately to CSLS. This document is not an offer to buy or sell or to solicit an offer to buy or sell any security. This document does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it. The appropriateness of a particular investment will depend on an investor’s individual circumstances and objectives. The investments and shares referred to in this document may not be suitable for all investors. CSLS is a member of the FCMB Group Plc (“the Group”), a group of companies which includes First City Monument Bank Ltd., FCMB Capital Markets Ltd, First City Asset Management and FCMB UK. Either CSLS or any other member of the Group may effect transactions in shares mentioned herein, may take proprietary trading positions in those shares, and may receive remuneration for the publication of its research and for other services. Accordingly, this document may not be considered as objective or impartial. Additionally, information may be available to CSLS or the Group, which is not reflected in this material. Further information on CSLS’ policy regarding potential conflicts of interest in the context of investment research and CSLS’ policy on disclosure and conflicts in general are available on request. This document is based on information obtained from sources it believes are reliable but which it has not independently verified. Neither CSLS nor its advisors, directors or employees make any guarantee, representation or warranty as to its accuracy, reasonableness or completeness and neither CSLS nor its advisors, directors or employees accepts any responsibility or liability whatsoever (in negligence or otherwise) for any loss howsoever arising from any use of this document or its contents or otherwise arising in connection with this document. The opinions contained in this document are subject to change without notice and not to be relied upon and should not be used in substitution for the exercise of independent judgment. Past performance is not a guarantee of future performance. Investments may go down in value as well as up and you may not get back the full amount invested. Where an investment is denominated in a currency other than the local currency of the recipient of the research report, changes in the exchange rates may have an adverse effect on the value, price or income of that investment. In case of investments for which there is no recognized market it may be difficult for investors to sell their investments or to obtain reliable information about its value or the extent of the risk to which it is exposed. The information contained in this document is confidential and is solely for use of those persons to whom it is addressed and may not be reproduced, further distributed to any other person or published, in whole or in part, for any purpose. © CSLS 2013. All rights reserved CSL STOCKBROKERS LIMITED Member of the Nigerian Stock Exchange First City Plaza, 44 Marina, PO Box 9117, Lagos State, NIGERIA