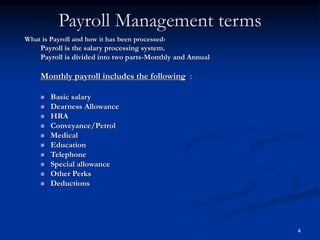

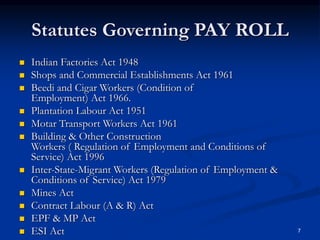

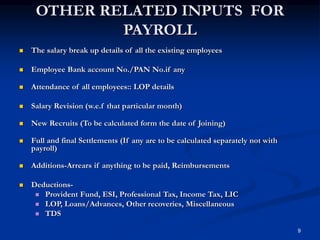

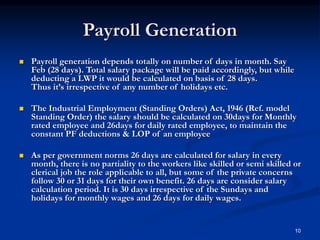

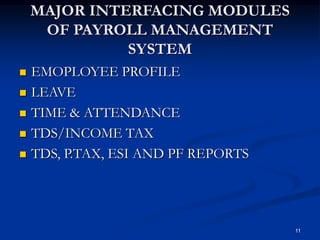

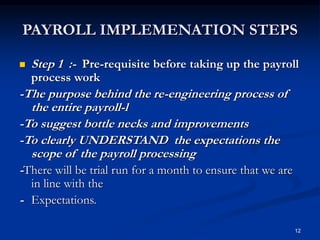

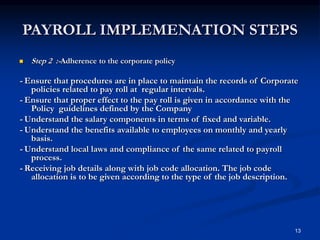

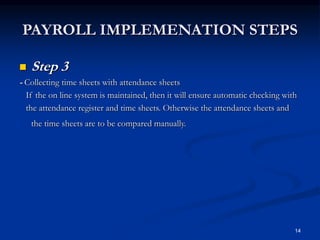

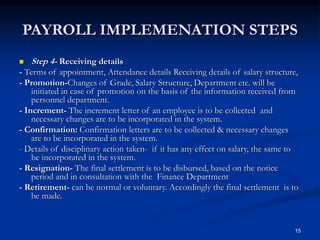

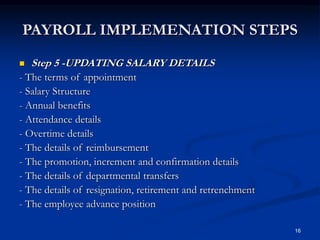

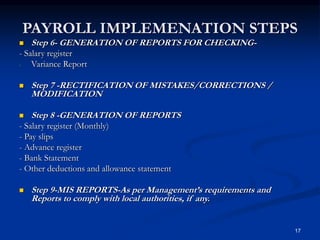

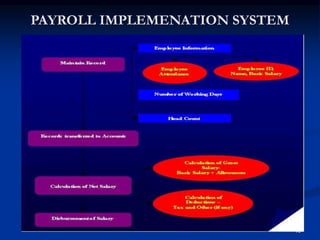

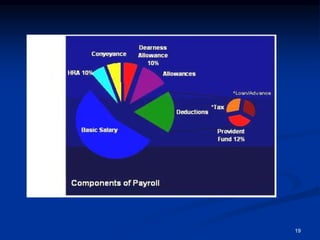

Payroll is an important human resources and financial process that involves calculating employee salaries, withholdings for taxes, and distributing payment. It has administrative, legal, human resources, managerial, financial, and macroeconomic dimensions. Implementing an effective payroll system requires collecting employee data, attendance and leave records, salary structures, and tax details; calculating payments; generating reports; and ensuring compliance with changing employment laws.