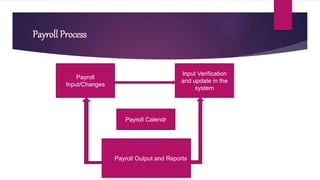

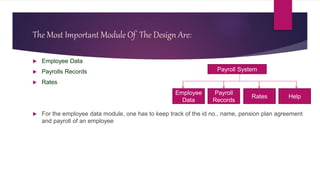

This document describes a payroll management system project. The system will manage employee records and calculate salaries. It aims to improve efficiency, store up-to-date employee information, make employees aware of company rules, and reduce database security costs. The system will computerize the payroll process, maintain work records, calculate pay and taxes automatically, and generate payroll reports. It will be developed using Java and SQLite and will require hardware like a Pentium processor and RAM.