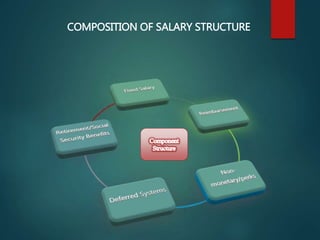

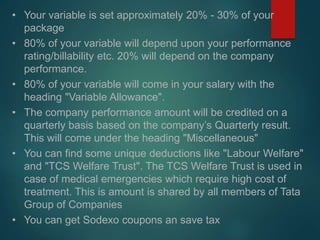

This document summarizes the components and structure of a typical salary package. It includes fixed payments like basic salary and allowances for housing, transport, education and other expenses. It also includes variable payments like bonuses and incentives, as well as non-monetary benefits like company cars and stock options. Retirement benefits like provident fund contributions and insurance are also covered. The objectives of compensation planning and governance/compliance considerations are outlined. Specific examples of the breakdown of various salary components are provided.