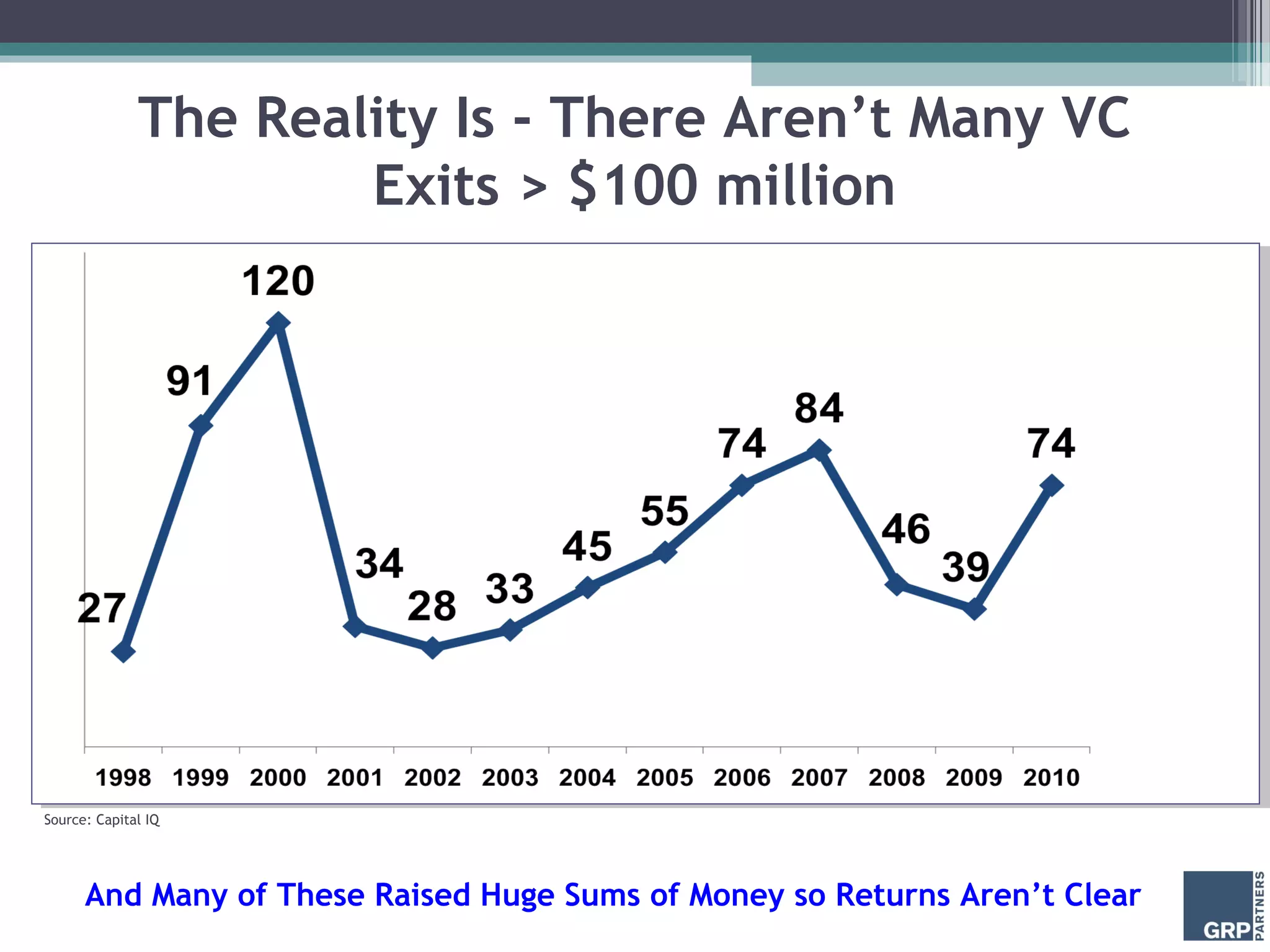

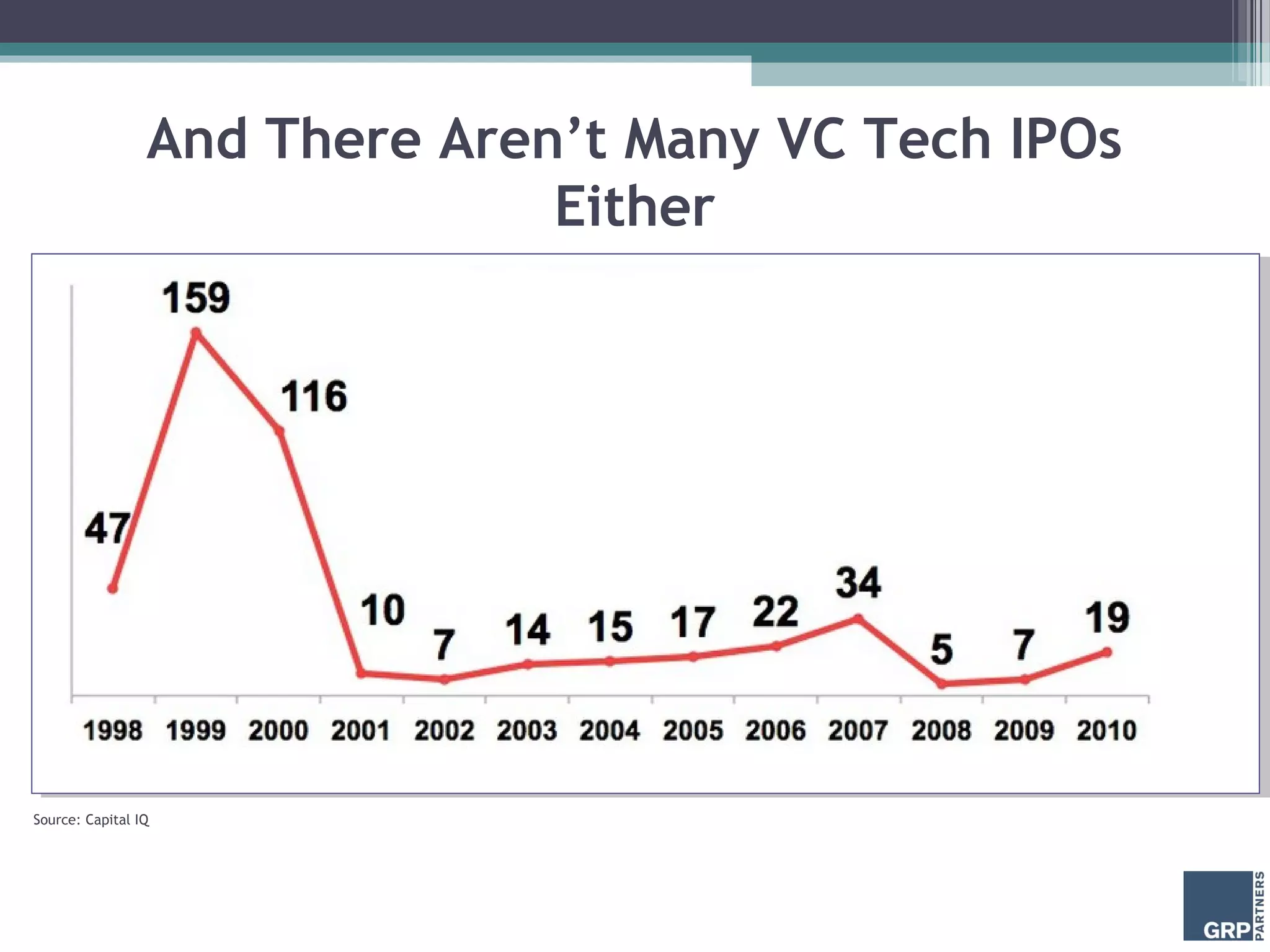

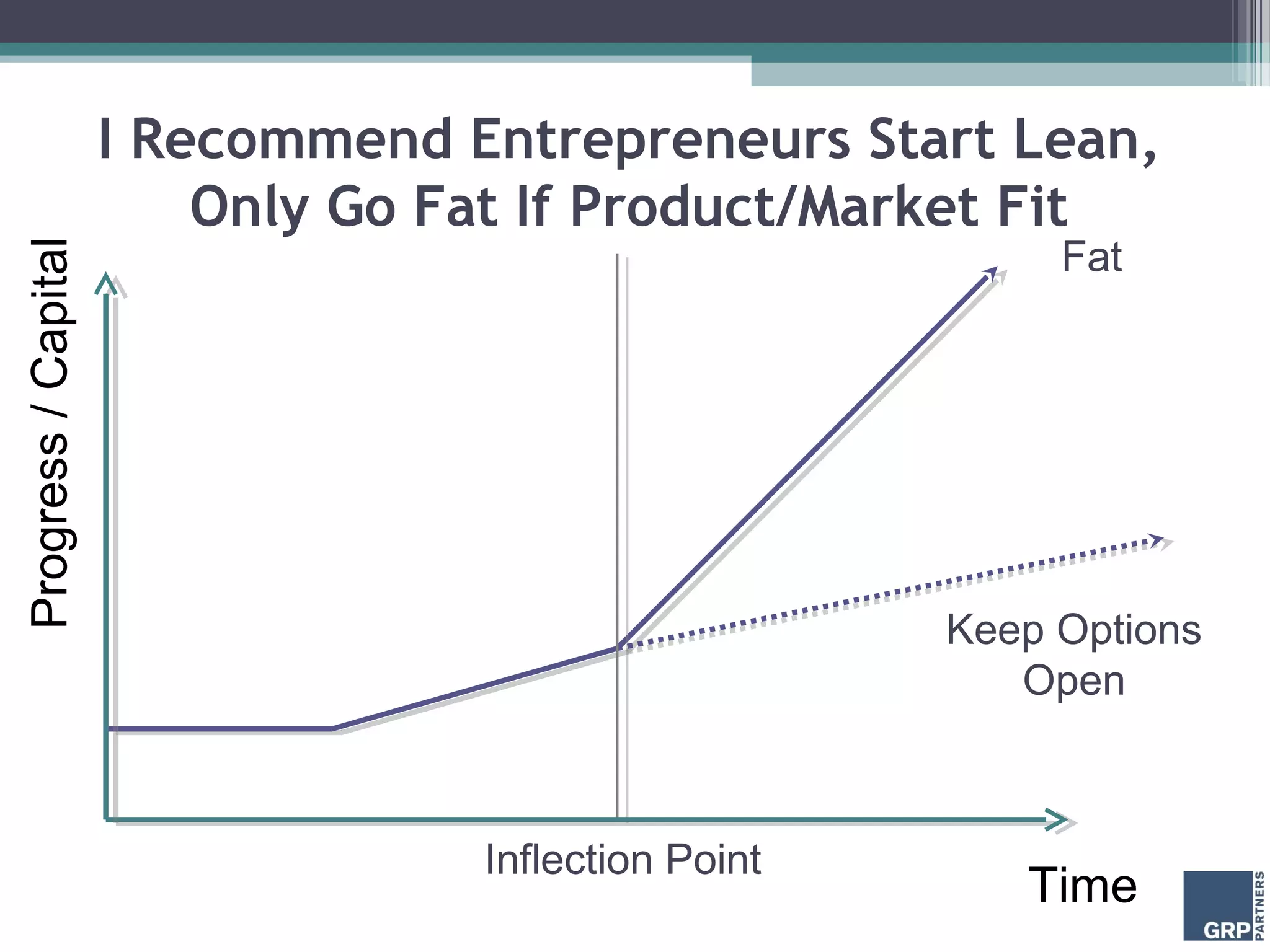

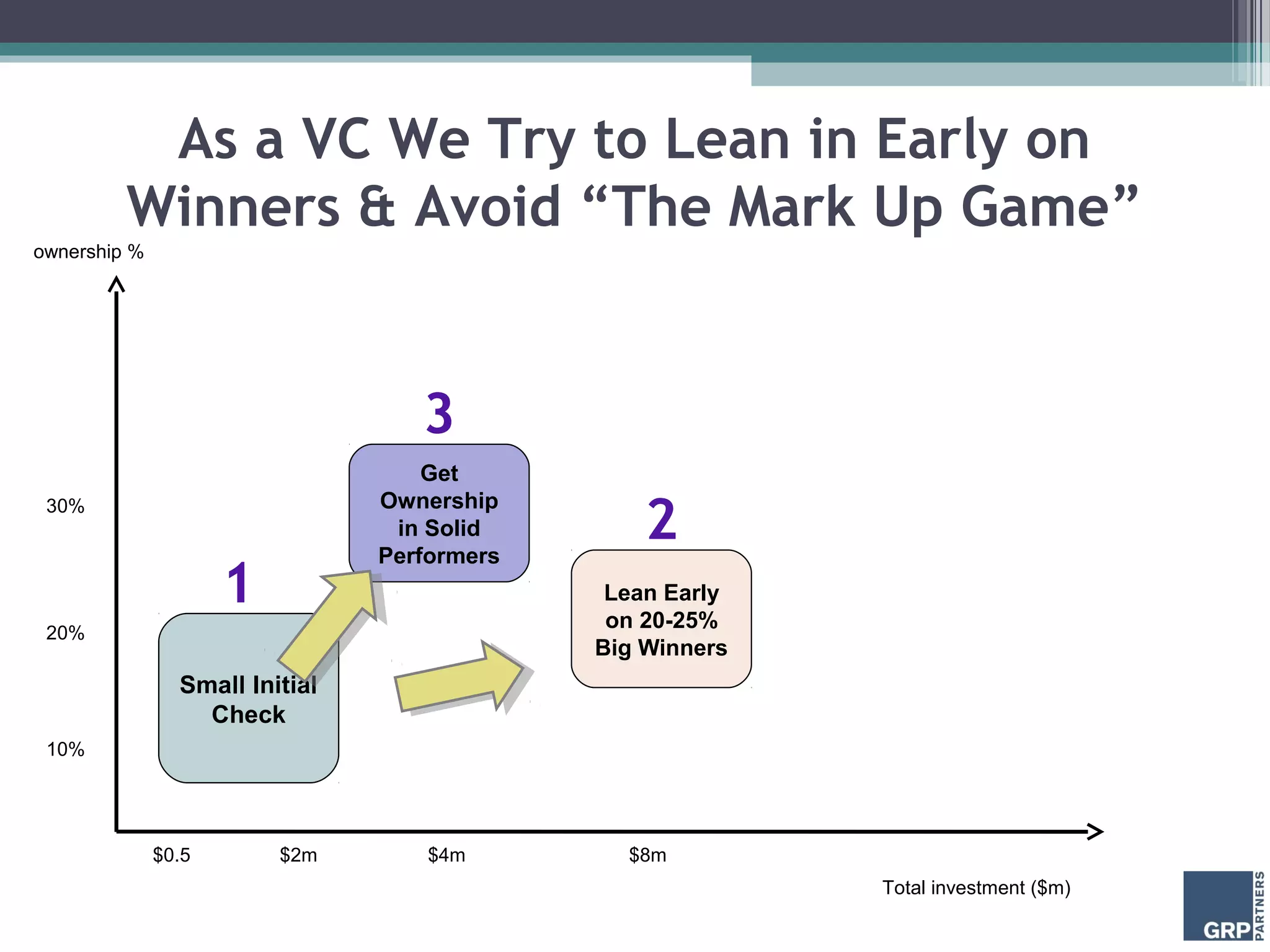

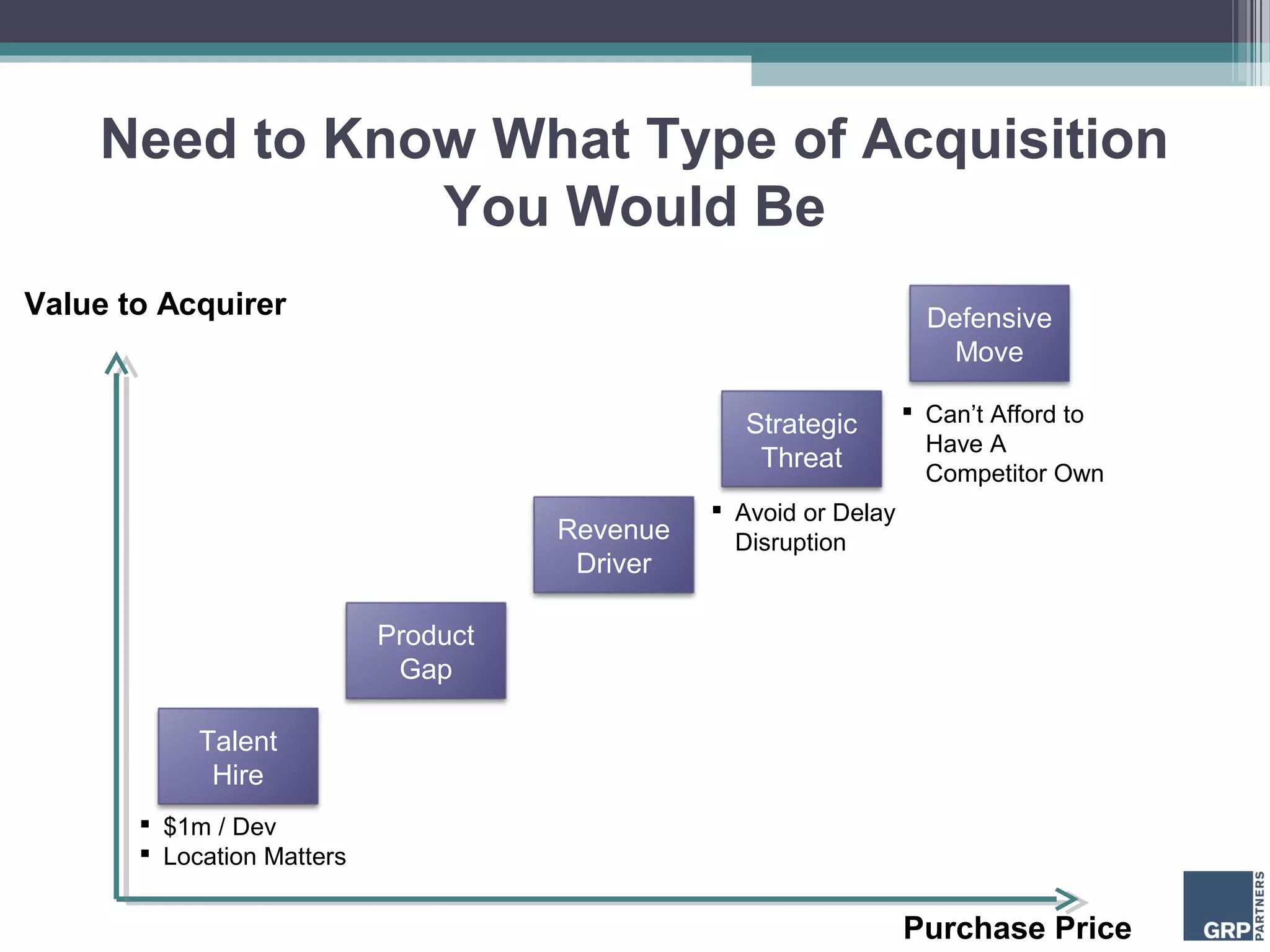

The document discusses strategies for entrepreneurs and VCs in planning for exits, highlighting that many have unrealistic expectations regarding exit values, which are often lower than anticipated. It advises entrepreneurs to start lean, keep options open, and emphasize the importance of building relationships and starting early in the sales process. Additionally, it underlines the significance of understanding different types of buyers and aligning incentives to facilitate successful exits.