The lecture discusses judgment and decision-making from various psychological perspectives, highlighting heuristics, biases, and the differences between clinical and actuarial predictions. It emphasizes the challenges of dynamic decision-making and group processes, noting the influence of factors such as framing effects and sunk costs on decision quality. The document concludes that individuals often make inconsistent decisions and may perform suboptimally, particularly in group settings.

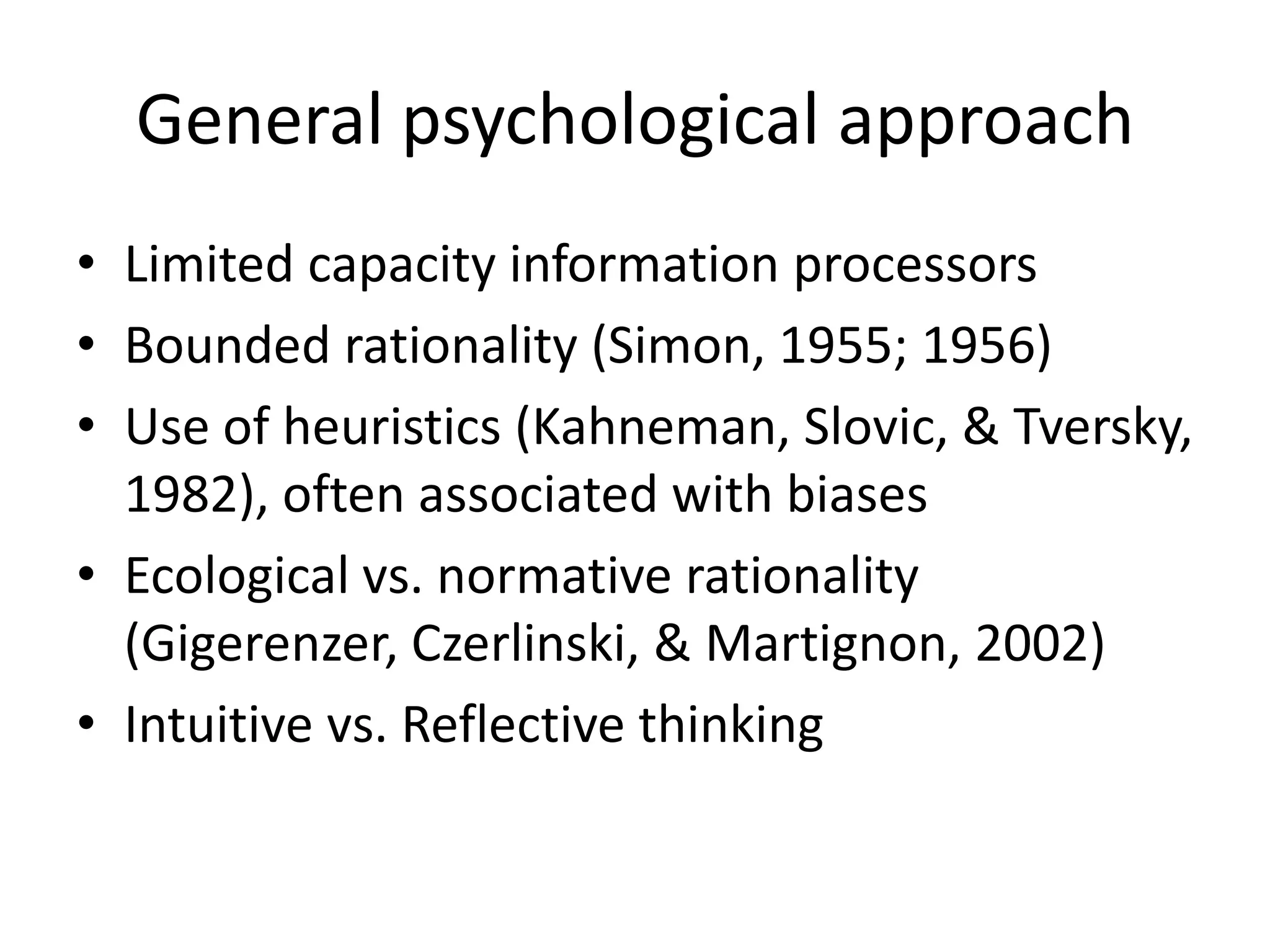

![Framing effects

Imagine that the US is preparing for the outbreak of an

unusual Asian disease that is expected to kill 600 people. Two

alternative programs to combat the disease have been

proposed. Assume that the exact scientific consequences of

the programs are as follows.

Program A. If Program A is adopted 200 people will be saved.

[72%]

Program B. If Program B is adopted there is a 1/3 probability

that 600 people will be saved and a 2/3 probability that no

people will be saved. [28%]

Which of the two programs would you favour?](https://image.slidesharecdn.com/judgmentanddecisionmakingeditedversion-121031103903-phpapp02/75/Judgment-and-decision-making-8-2048.jpg)

![Framing effects

Imagine that the US is preparing for the outbreak of an

unusual Asian disease that is expected to kill 600 people. Two

alternative programs to combat the disease have been

proposed. Assume that the exact scientific consequences of

the programs are as follows.

Program C. If Program C is adopted 400 people will die. [22%]

Program D. If Program D is adopted there is a 1/3 probability

that nobody will die and a 2/3 probability that 600 people will

die. [78%]

Which of the two programs would you favour?](https://image.slidesharecdn.com/judgmentanddecisionmakingeditedversion-121031103903-phpapp02/75/Judgment-and-decision-making-9-2048.jpg)

![References

Key reading:

Hardman, D. (2009). Judgment and decision making psychological perspectives.

Chichester, UK: BPS-Blackwell. [see especially chapters 11 and 13]

Selected papers:

Bonaccio, S., & Dalal, R.S. (2006). Advice taking and decision-making:An integrative

literature review, and implications for the organizational sciences. Organizational

Behavior and Human Decision Processes, 101, 127-151.

Diehl, E., & Sterman, J.D. (1995). Effects of feedback complexity on dynamic decision

making. Organizational Behavior and Human Decision Processes, 62 (2), 198-215.

Gonzalez, C. (2004). Learning to make decisions in dynamic environments: Effects of

time constraints and cognitive abilities. Human Factors, 46 (3), 449-460.

Hastie, R., & Kameda, T. (2005). The robust beauty of majority rules in group decisions.

Psychological Review, 112 (2), 494-508.

Sterman, J.D. (1989). Modeling managerial behavior: Misperceptions of feedback in a

dynamic decision making experiment. Management Science, 35 (3), 321-339.](https://image.slidesharecdn.com/judgmentanddecisionmakingeditedversion-121031103903-phpapp02/75/Judgment-and-decision-making-23-2048.jpg)