The document discusses key accounting concepts:

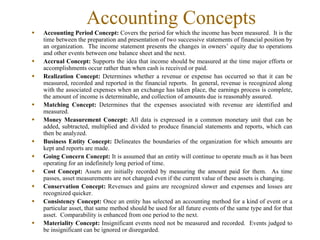

1) The accounting period concept covers the time period financial statements measure income and the relationship between balance sheets and income statements.

2) The accrual concept supports measuring income when efforts occur rather than when cash is received or paid.

3) The realization concept determines when revenue and expenses can be measured based on an exchange taking place and amounts being reasonably assured of collection.