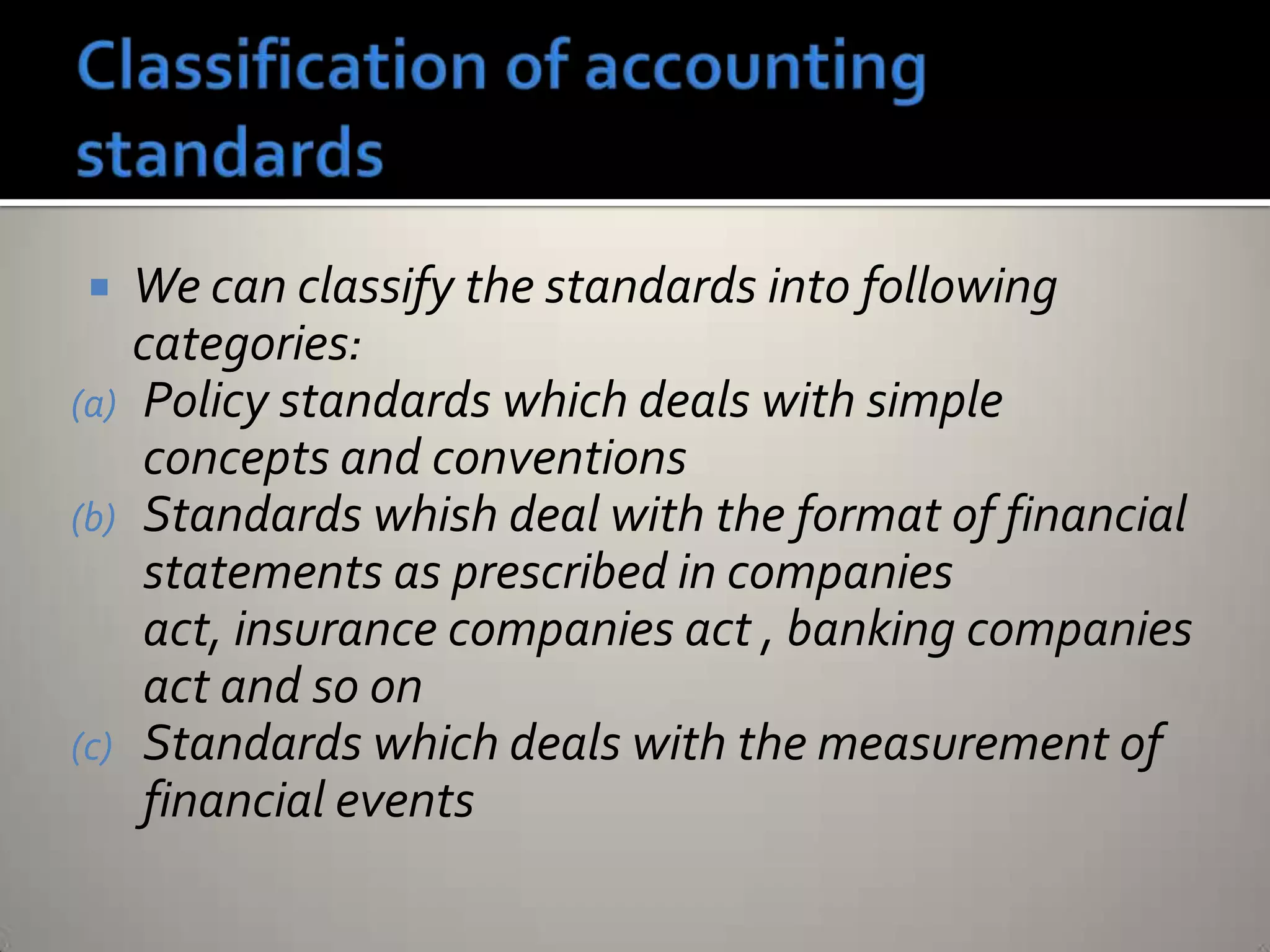

This document discusses accounting standards and concepts. It defines accounting as recording, classifying, and summarizing financial transactions and events. Accounting standards provide uniform guidelines for recognizing, measuring, presenting, and disclosing accounting information to ensure comparability and credibility of financial statements. The standards deal with issues like recognition, measurement, presentation and disclosure of transactions to communicate information clearly to users.