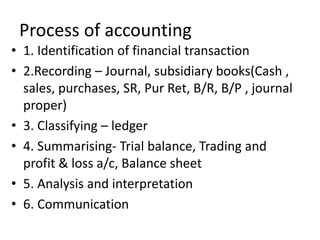

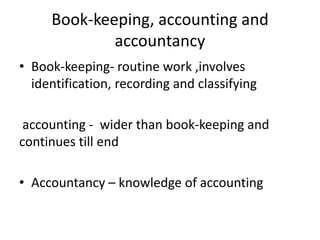

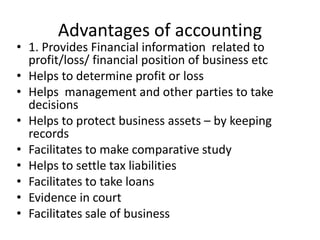

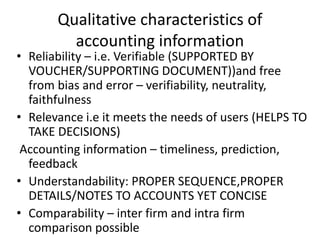

Accounting is the process of recording, classifying, and summarizing financial transactions to interpret results, involving various branches such as financial, cost, and management accounting. It serves multiple objectives, including maintaining records, determining profit or loss, and aiding decision-making, while also facing limitations such as estimates and qualitative aspects being ignored. Accounting information is crucial for various internal and external users, ensuring reliability, relevance, and comparability.