Income statementsamsung fiscal year is january december. all values

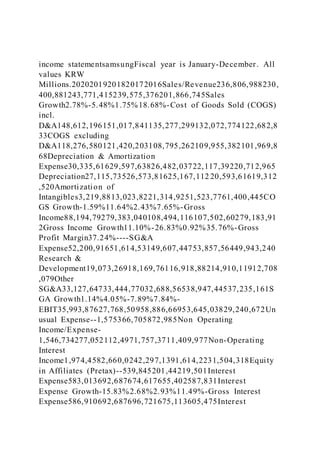

- 1. income statementsamsungFiscal year is January-December. All values KRW Millions.20202019201820172016Sales/Revenue236,806,988230, 400,881243,771,415239,575,376201,866,745Sales Growth2.78%-5.48%1.75%18.68%-Cost of Goods Sold (COGS) incl. D&A148,612,196151,017,841135,277,299132,072,774122,682,8 33COGS excluding D&A118,276,580121,420,203108,795,262109,955,382101,969,8 68Depreciation & Amortization Expense30,335,61629,597,63826,482,03722,117,39220,712,965 Depreciation27,115,73526,573,81625,167,112 20,593,61619,312 ,520Amortization of Intangibles3,219,8813,023,8221,314,9251,523,7761,400,445CO GS Growth-1.59%11.64%2.43%7.65%-Gross Income88,194,79279,383,040108,494,116107,502,60279,183,91 2Gross Income Growth11.10%-26.83%0.92%35.76%-Gross Profit Margin37.24%----SG&A Expense52,200,91651,614,53149,607,44753,857,56449,943,240 Research & Development19,073,26918,169,76116,918,88214,910,11912,708 ,079Other SG&A33,127,64733,444,77032,688,56538,947,44537,235,161S GA Growth1.14%4.05%-7.89%7.84%- EBIT35,993,87627,768,50958,886,66953,645,03829,240,672Un usual Expense--1,575366,705872,985Non Operating Income/Expense- 1,546,734277,052112,4971,757,3711,409,977Non-Operating Interest Income1,974,4582,660,0242,297,1391,614,2231,504,318Equity in Affiliates (Pretax)--539,845201,44219,501Interest Expense583,013692,687674,617655,402587,831Interest Expense Growth-15.83%2.68%2.93%11.49%-Gross Interest Expense586,910692,687696,721675,113605,475Interest

- 2. Capitalized3,897-22,10419,71117,644Pretax Income35,838,58730,019,22961,159,95856,195,96730,713,652P retax Income Growth19.39%-50.92%8.83%82.97%-Pretax Margin15.13%----Income Tax9,937,2858,693,32416,815,10114,009,2207,987,560Income Tax - Current Domestic7,700,7885,736,01913,520,33510,943,9335,916,818Inc ome Tax - Deferred Domestic2,236,4972,957,3053,294,7663,065,2872,070,742Equit y in Affiliates506,530412,960---Consolidated Net Income26,407,83221,738,86544,344,85742,186,74722,726,092 Minority Interest Expense316,986233,811453,980842,178310,437Net Income26,090,84621,505,05443,890,87741,344,56922,415,655N et Income Growth21.32%-51.00%6.16%84.45%-Net Margin11.02%----Net Income After Extraordinaries26,090,84621,505,05443,890,87741,344,56922,4 15,655Net Income Available to Common26,090,84621,505,05443,890,87741,344,56922,415,655 EPS (Basic)3841.033165.926460.735990.883155.64EPS (Basic) Growth21.32%-51.00%7.84%89.85%-Basic Shares Outstanding6,7936,7936,7936,9017,103EPS (Diluted)3841.033165.926460.735990.883155.65EPS (Diluted) Growth21.32%-51.00%7.84%89.85%-Diluted Shares Outstanding6,7936,7936,7936,9017,103 EBITDA66,329,49257,3 66,14785,368,70675,762,43049,953,637EBITDA Growth15.62%-32.80%12.68%51.67%-EBITDA Margin28.01%- --- EBIT35,993,87627,768,50958,886,66953,645,03829,240,672113 .770176782.81683791126.543959115.596885684.97958937sour cehttps://www.google.com/search?q=apple+company+wsj&oq=a pple+&aqs=chrome.1.69i59l3j69i57j46i433j69i60l3.7083j0j7&s ourceid=chrome&ie=UTF-8 balance sheetAssetsFiscal year is January-December. All values KRW Millions.202020192018201720165-year trendCash & Short Term

- 3. Investments124,652,843108,779,703100,939,94383,184,20188,1 82,313Cash Only29,382,57826,885,99930,340,50530,545,13032,132,983Sho rt-Term Investments95,270,26581,893,70470,599,43852,639,07156,049, 330Cash & Short Term Investments Growth000-0-Cash & ST Investments / Total Assets32.96%30.85%29.74%27.57%33.63%Total Accounts Receivable34,569,59739,310,46336,948,46631,804,95627,800,4 08Accounts Receivables, Net3096505800.00%3513134300.00%3386773300.00%2769599 500.00%2427921100.00%Accounts Receivables, Gross31,343,27635,530,41934,470,34228,362,52324,725,603Ba d Debt/Doubtful Accounts-378,218-399,076-602,609-666,528- 446,392Other Receivables3,604,5394,179,1203,080,7334,108,9613,521,197Ac counts Receivable Growth-12.06%6.39%16.17%14.40%- Accounts Receivable Turnover685.00%586.00%660.00%753.00%7.26Inventories32,0 43,14526,766,46428,984,70424,983,35518,353,503Finished Goods10,434,2899,132,7209,870,0547,304,4375,905,339Work in Progress11,818,0909,886,63411,066,5117,113,9015,017,384Ra w Materials9,790,7667,747,1108,048,13910,565,0177,430,780Oth er Current Assets9,789,0249,654,31710,594,5279,289,60310,160,057Prepa id Expenses2,266,1003,833,0535,497,9745,588,8924,942,021Misc ellaneous Current Assets7,522,9245,821,2645,096,5533,700,7115,218,036Total Current Assets201,054,609184,510,947177,467,640149,262,1151 44,496, 281Net Property, Plant & Equipment128,952,892119,825,474115,416,724111,665,64891,4 73,041Property, Plant & Equipment -

- 4. Gross328,606,313304,075,769279,158,166256,528,604225,172, 654Buildings55,026,36948,839,43945,033,84341,639,04536,474 ,462Land & Improvements9,850,9429,828,3099,346,2859,409,2767,869,679 Machinery & Equipment233,056,501211,416,021206,407,913184,392,999155, 285,378Construction in Progress20,175,91723,930,0199,705,05613,910,74918,773,986O ther Property, Plant & Equipment10,496,58410,061,9818,665,0697,176,5356,769,149A ccumulated Depreciation199,653,421184,250,295163,741,442144,862,95613 3,699,613Buildings20,474,36518,369,81915,687,93313,580,889 12,098,636Land & Improvements78,78653,755---Machinery & Equipment172,062,371159,266,085142,591,682126,477,201116, 983,323Other Property, Plant & Equipment7,037,8996,560,6365,461,8274,804,8664,617,654Tot al Investments and Advances21,854,96417,561,32815,628,29314,661,28212,642,16 0LT Investment - Affiliate Companies8,076,7797,591,6127,313,2066,802,3515,837,884O th er Long-Term Investments13,778,1859,969,7168,315,0877,858,9316,804,276I ntangible Assets18,468,50220,703,50414,891,59814,760,4835,344,020Net Goodwill5,673,6426,250,4395,833,6785,703,1381,343,580Net Other Intangibles12,794,86014,453,0659,057,9209,057,3454,000,440 Other Assets6,468,7818,583,88213,255,2038,620,5265,963,949Deferr ed Charges1,355,502589,8325,572,0354,260,2674,391,922Tangible Other Assets5,113,2797,994,0507,683,1684,360,2591,572,027Total Assets378,235,718352,564,497339,357,244301,752,090262,174, 324Assets - Total - Growth0000-Asset Turnover1----Return On

- 5. Average Assets7.14%----Liabilities & Shareholders' EquityAll values KRW Millions.202000.00%20192018201720165-year trendST Debt & Current Portion LT Debt17,269,52815,239,55813,620,04616,046,23813,979,606Sho rt Term Debt16,553,42914,393,46813,586,66015,767,61912,746,789Cur rent Portion of Long Term Debt716,099846,09033,386278,6191,232,817Accounts Payable9,739,2228,718,2228,479,9169,083,9076,485,039Accou nts Payable Growth11.71%2.81%-6.65%40.07%-Income Tax Payable4,430,2721,387,7738,720,0507,408,3482,837,353Other Current Liabilities44,165,32938,437,21138,261,49834,636,62131,402,09 7Miscellaneous Current Liabilities44,165,32938,437,21138,261,49834,636,62131,402,09 7Total Current Liabilities75,604,35163,782,76469,081,51067,175,11454,704,09 5Current Ratio2.662.892.572.222.64Quick Ratio2.242.472.151.852.31Cash Ratio1.651.711.461.241.61Long-Term Debt2,947,8533,172,4791,047,0572,767,8071,302,780Long- Term Debt excl. Capitalized Leases948,137975,298996,9352,710,2691,237,653Non- Convertible Debt948,137975,298996,9352,710,2691,237,653Capitalized Lease Obligations--50,12257,53865,127Provision for Risks & Charges1,515,8861,081,8801,167,683854,246531,782Deferred Taxes17,374,87515,674,44612,464,7378,928,7455,038,641Defer red Taxes - Credit18,810,84517,053,80815,162,52311,710,7817,293,514Def erred Taxes - Debit1,435,9701,379,3622,697,7862,782,0362,254,873Other Liabilities3,408,7674,593,1455,145,2944,752,7145,379,120Othe r Liabilities (excl. Deferred Income)3,408,7674,593,1455,145,2944,752,7145,379,120Total Liabilities102,287,70289,684,07691,604,06787,260,66269,211,2

- 6. 91Total Liabilities / Total Assets27.04%25.44%26.99%28.92%26.40%Common Equity (Total)267,670,331254,915,472240,068,993207,213,416186,424 ,328Common Stock Par/Carry Value897,514897,514897,514897,514897,514Additional Paid-In Capital/Capital Surplus4,403,8934,403,8934,403,8934,403,8934,403,893Retaine d Earnings96,328,64686,260,02691,179,30576,182,00550,079,125 Cumulative Translation Adjustment/Unrealized For. Exch. Gain-10,989,715-5,645,769-8,612,742-9,192,002- 2,930,886Unrealized Gain/Loss Marketable Securities4,975,7562,573,5301,462,2661,879,7741,390,624Othe r Appropriated Reserves-2,712,054-1,957,019-840,775- 364,812142,195,663Unappropriated Reserves174,766,291168,383,297151,579,532139,635,231138,7 21Treasury Stock----6,228,187-9,750,326Common Equity / Total Assets70.77%72.30%70.74%68.67%71.11%Total Shareholders' Equity267,670,331254,915,472240,068,993207,213,416186,424, 328Total Shareholders' Equity / Total Assets70.77%72.30%70.74% 68.67%71.11%Accumulated Minority Interest8,277,6857,964,9497,684,1847,278,0126,538,705Total Equity275,948,016262,880,421247,753,177214,491,428192,963, 033Liabilities & Shareholders' Equity378,235,718352,564,497339,357,244301,752,090262,174, 324Debt ratio=0.27043374580.25437636730.26993402560.28917997550. 2639895850.38214060410.35181888060.38157392110.4211149 2430.371256754626090846215050544389087741344569224156 55roa0.068980386460.060996084920.12933531780.1370150212 0.085499047570.097473806310.084361509450.1828260970.199 52650650.1202399667ie583,013692,687674,617655,402587,831 tieFALSE113.7701767sourcehttps://www.google.com/search?q= apple+company+wsj&oq=apple+&aqs=chrome.1.69i59l3j69i57j

- 7. 46i433j69i60l3.7083j0j7&sourceid=chrome&ie=UTF-8 cashflow samsungOperating ActivitiesFiscal year is January- December. All values KRW Millions.20202019201820172016Net Income before Extraordinaries26,407,83221,738,86544,344,85742,186,74722,7 26,092Net Income Growth21.48%-50.98%5.12%85.63%- Depreciation, Depletion & Amortization30,335,61629,597,63826,482,03722,117,39220,712 ,965Depreciation and Depletion27,115,73526,573,81625,167,11220,593,61619,312,52 0Amortization of Intangible Assets3,219,8813,023,8221,314,9251,523,7761,400,445Other Funds8,421,137-3,407,8326,129,3358,478,4495,127,540Funds from Operations65,164,58547,928,67176,956,22972,782,58848,566,5 97Changes in Working Capital122,424-2,545,756-9,924,366- 10,620,547-1,180,953Receivables1,741,0161,828,5914,513,604- 7,676,1751,313,276Inventories-7,540,6562,134,632-5,979,475- 8,444,506-2,830,602Accounts Payable3,885,742-1,269,177- 533,6094,006,410200,240Other Accruals5,332,676- 1,707,265501,5361,292,4201,136,440Other Assets/Liabilities- 3,296,354-3,532,537-8,426,422201,304-1,000,307Net Operating Cash Flow65,287,00945,382,91567,031,86362,162,04147,385,644Net Operating Cash Flow Growth43.86%-32.30%7.83%31.18%-Net Operating Cash Flow / Sales27.57%19.70%27.50%25.95%23.47%Investing ActivitiesAll values KRW Millions.20202019201820172016Capital Expenditures- 40,271,813-28,617,670-30,576,923-43,775,974- 25,190,641Capital Expenditures (Fixed Assets)-37,592,034- 25,367,756-29,556,406-42,792,234-24,142,973Capital Expenditures (Other Assets)-2,679,779-3,249,914-1,020,517- 983,740-1,047,668Capital Expenditures Growth- 40.72%6.41%30.15%-73.78%-Capital Expenditures / Sales- 17.01%-12.42%-12.54%-18.27%-12.48%Net Assets from

- 8. Acquisitions-49,420-1,021,105-99,108-8,754,268-622,050Sale of Fixed Assets & Businesses384,931513,265565,0441,562,858284,106Purchase/S ale of Investments-13,633,932-10,877,650- 22,131,0411,615,560-4,143,738Purchase of Investments- 26,913,224-16,236,889-22,483,388-1,569,896- 12,234,162Sale/Maturity of Investments13,279,2925,359,239352,3473,185,4568,090,424Oth er Uses-57,197--2,289-28,455-Other Sources7,02753,28911,93573326,880Net Investing Cash Flow - 53,620,404-39,949,871-52,232,382-49,379,546-29,645,443Net Investing Cash Flow Growth-34.22%23.52%-5.78%-66.57%-Net Investing Cash Flow / Sales-22.64%-17.34%-21.43%-20.61%- 14.69%Financing ActivitiesAll values KRW Millions.20202019201820172016Cash Dividends Paid - Total- 9,676,760-9,639,202-10,193,695-6,804,297-3,114,742Common Dividends-9,676,760-9,639,202-10,193,695-6,804,297- 3,114,742Change in Capital Stock---875,111-8,350,424- 7,707,938Repurchase of Common & Preferred Stk.---875,111- 8,350,424-7,707,938Issuance/Reduction of Debt, Net1,340,730156,392-4,029,4902,588,1802,139,930Change in Current Debt2,191,186865,792- 2,046,4702,730,6761,351,037Change in Long-Term Debt- 850,452-709,400-1,983,017-142,492788,897Issuance of Long- Term Debt14,495-3,580998,3111,041,743Reduction in Long- Term Debt-864,947-709,400-1,986,597-1,140,803-252,846Net Financing Cash Flow-8,336,026-9,482,810-15,098,293- 12,566,537-8,682,746Net Financing Cash Flow Growth12.09%37.19%-20.15%-44.73%-Net Financing Cash Flow / Sales-3.52%-4.12%-6.19%-5.25%-4.30%Exchange Rate Effect-833,861595,26094,187-1,782,270417,243Net Change in Cash2,496,718-3,454,506-204,625-1,566,3129,474,698Free Cash Flow27,694,97520,015,15937,475,45719,369,80723,242,671Fre e Cash Flow Growth38.37%-46.59%93.47%-16.66%-Free Cash Flow Yield3.27%----

- 9. sourcehttps://www.google.com/search?q=apple+company+wsj& oq=apple+&aqs=chrome.1.69i59l3j69i57j46i433j69i60l3.7083j0 j7&sourceid=chrome&ie=UTF-8 is-appleApple Inc.Consolidated Income StatementUS$ in millions12 months ended:Sep 26, 2020Sep 28, 2019Sep 29, 2018Sep 30, 2017Sep 24, 2016Products220,747213,883225,847196,534— Services53,76846,29139,74832,700—Net sales (legacy)——— —215,639Net sales274,515260,174265,595229,234215,639Products(151,286)( 144,996)(148,164)(126,337)— Services(18,273)(16,786)(15,592)(14,711)—Cost of sales (legacy)————(131,376)Cost of sales(169,559)(161,782)(163,756)(141,048)(131,376)Gross margin104,95698,392101,83988,18684,263Research and development(18,752)(16,217)(14,236)(11,581)(10,045)Selling, general and administrative(19,916)(18,245)(16,705)(15,261)(14,194)Operati ng expenses(38,668)(34,462)(30,941)(26,842)(24,239)Operating income66,28863,93070,89861,34460,024Interest and dividend income3,7634,9615,6865,2013,999Interest expense(2,873)(3,576)(3,240)(2,323)(1,456)Other income (expense), net(87)422(441)(133)(1,195)Other income (expense), net8031,8072,0052,7451,348Income before provision for income taxes67,09165,73772,90364,08961,372Provision for income taxes(9,680)(10,481)(13,372)(15,738)(15,685)Net income57,41155,25659,53148,35145,687Based on: 10-K (filing date: 2020-10-30), 10-K (filing date: 2019-10-31), 10-K (filing date: 2018-11-05), 10-K (filing date: 2017-11-03), 10-K (filing date: 2016-10-26), 10-K (filing date: 2015-10-28).-23.35224504-18.38282998- 22.50092593-27.58889367- 42.1510989sourcehttps://www.google.com/search?q=apple+com pany+wsj&oq=apple+&aqs=chrome.1.69i59l3j69i57j46i433j69i

- 10. 60l3.7083j0j7&sourceid=chrome&ie=UTF-8 bs-appleAssetsFiscal year is October-September. All values USD Millions.202020192018201720165-year trendCash & Short Term Investments90,979100,58066,30174,18167,155Cash Only19,98028,12419,65814,51612,267Short-Term Investments70,99972,45646,64359,66554,888Cash & Short Term Investments Growth-9.55%51.70%-10.62%10.46%-Cash & ST Investments / Total Assets28.09%29.71%18.13%19.76%20.88%Total Accounts Receivable37,44545,80448,99535,67329,299Accounts Receivables, Net16,12022,92623,18617,87415,754Accounts Receivables, Gross16,12022,92623,18617,93215,807Bad Debt/Doubtful Accounts----58-53Other Receivables21,32522,87825,80917,79913,545Accounts Receivable Growth-18.25%-6.51%37.34%21.76%-Accounts Receivable Turnover7.325.685.436.417.31Inventories4,0614,1063,9564,855 2,132Finished Goods4,0614,1063,9564,8552,132Other Current Assets11,22812,32912,08713,9368,283Miscellaneous Current Assets11,22812,32912,08713,9368,283Total Current Assets143,713162,819131,339128,645106,869Net Property, Plant & Equipment45,33637,37841,30433,78327,010Property, Plant & Equipment - Gross112,09695,95790,40375,07661,245Buildings17,95217,085 16,21613,58710,185Machinery & Equipment75,29169,79765,98254,21044,543Other Property, Plant & Equipment10,2839,0758,2057,2796,517Accumulated Depreciation66,76058,57949,09941,29334,235Total Investments and Advances102,624106,698170,799194,714170,430Other Long-Term Investments102,624106,698170,799194,714170,430Intangible Assets---8,0158,620Net Goodwill---5,7175,414Net Other Intangibles---2,2983,206Other Assets32,21531,62122,28310,1628,757Tangible Other Assets32,21531,62122,28310,1628,757Total Assets323,888338,516365,725375,319321,686Assets - Total -

- 11. Growth-4.32%-7.44%-2.56%16.67%-Asset Turnover0.83---- Return On Average Assets17.33%----Liabilities & Shareholders' EquityAll values USD Millions.202020192018201720165-year trendST Debt & Current Portion LT Debt15,22916,24020,74818,47311,605Short Term Debt6,4325,98011,96411,9778,105Current Portion of Long Term Debt8,79710,2608,7846,4963,500Accounts Payable42,29646,23655,88849,04937,294Accounts Payable Growth-8.52%-17.27%13.94%31.52%-Other Current Liabilities47,86743,24240,23033,29230,107Miscellaneous Current Liabilities47,86743,24240,23033,29230,107Total Current Liabilities105,392105,718116,866100,81479,006Current Ratio1.361.541.121.281.35Quick Ratio1.331.51.091.231.33Cash Ratio0.860.950.570.740.85Long-Term Debt107,04991,80793,73597,20775,427Long-Term Debt excl. Capitalized Leases98,66791,80793,73597,20775,427Non- Convertible Debt98,66791,80793,73597,20775,427Capitalized Lease Obligations637----Provision for Risks & Charges28,17029,54533,589--Deferred Taxes- 16,91911,52039,91134,719Deferred Taxes - Credit- 16,91911,52039,91134,719Other Liabilities17,9384,0392,8683,3404,285Other Liabilities (excl. Deferred Income)17,9384,039715041,355Deferred Income-- 2,7972,8362,930Total Liabilities258,549248,028258,578241,272193,437Total Liabilities / Total Assets79.83%73.27%70.70%64.28%60.13%Common Equity (Total)65,33990,488107,147134,047128,249Common Stock Par/Carry Value50,77945,17440,20135,86731,251Retained Earnings14,96645,89870,40098,33096,364Cumulative Translation Adjustment/Unrealized For. Exch. Gain-1,375- 1,463-1,055-354-578Unrealized Gain/Loss Marketable Securities1,846707-3,2093281,174Other Appropriated Reserves- 877172810-12438Common Equity / Total Assets20.17%26.73%29.30%35.72%39.87%Total Shareholders'

- 12. Equity65,33990,488107,147134,047128,249Total Shareholders' Equity / Total Assets20.17%26.73%29.30%35.72%39.87%Total Equity65,33990,488107,147134,047128,249Liabilities & Shareholders' Equity323,888338,516365,725375,319321,686sourcehttps://ww w.google.com/search?q=apple+company+wsj&oq=apple+&aqs= chrome.1.69i59l3j69i57j46i433j69i60l3.7083j0j7&sourceid=chr ome&ie=UTF-8 cs-appleOperating ActivitiesFiscal year is October-September. All values USD Millions.202020192018201720165-year trendNet Income before Extraordinaries57,41155,25659,53148,35145,687Net Income Growth3.90%-7.18%23.12%5.83%-Depreciation, Depletion & Amortization11,05612,54710,90310,15710,505Depreciation and Depletion11,05612,54710,903--Deferred Taxes & Investment Tax Credit-215-340-32,5905,9664,938Deferred Taxes-215-340- 32,5905,9664,938Other Funds6,7325,4164,8964,6744,210Funds from Operations74,98472,87942,74069,14865,340Changes in Working Capital5,690-3,48834,694- 5,550484Receivables8,4703,176-13,332-6,3471,044Inventories- 127-289828-2,723217Accounts Payable-4,062- 1,9239,1759,6181,791Other Assets/Liabilities 1,409- 4,45238,023-6,098-2,568Net Operating Cash Flow80,67469,39177,43463,59865,824Net Operating Cash Flow Growth16.26%-10.39%21.76%-3.38%-Net Operating Cash Flow / Sales29.43%26.69%29.13%27.82%30.73%Investing ActivitiesAll values USD Millions.202020192018201720165- year trendCapital Expenditures-7,309-10,495-13,313-12,795- 13,548Capital Expenditures (Fixed Assets)-7,309-10,495- 13,313-12,451-12,734Capital Expenditures (Other Assets)---- 344-814Capital Expenditures Growth30.36%21.17%- 4.05%5.56%-Capital Expenditures / Sales-2.67%-4.04%-5.01%- 5.60%-6.32%Net Assets from Acquisitions-1,524-624-721-329- 297Purchase/Sale of Investments5,33558,09330,845-33,147- 30,634Purchase of Investments-115,148-40,631-73,227- 159,486-142,428Sale/Maturity of

- 13. Investments120,48398,724104,072126,339111,794Other Uses- 791-1,078-745-395-1,498Other Sources---220-Net Investing Cash Flow-4,28945,89616,066-46,446-45,977Net Investing Cash Flow Growth-109.35%185.67%134.59%-1.02%-Net Investing Cash Flow / Sales-1.56%17.65%6.04%-20.32%- 21.46%Financing ActivitiesAll values USD Millions.202020192018201720165-year trendCash Dividends Paid - Total-14,081-14,119-13,712-12,769-12,150Common Dividends-14,081-14,119-13,712-12,769-12,150Change in Capital Stock-71,478-66,116-72,069-32,345-29,227Repurchase of Common & Preferred Stk.-72,358-66,897-72,738-32,900- 29,722Sale of Common & Preferred Stock880781669555495Proceeds from Stock Options880781669555495Issuance/Reduction of Debt, Net2,499-7,81943229,01422,057Change in Current Debt-963- 5,977-373,852-397Change in Long-Term Debt3,462- 1,84246925,16222,454Issuance of Long-Term Debt16,0916,9636,96928,66224,954Reduction in Long-Term Debt-12,629-8,805-6,500-3,500-2,500Other Funds-3,760-2,922- 2,527-1,247-1,163Other Uses-3,760-2,922-2,527-1,874- 1,570Other Sources---627407Net Financing Cash Flow-86,820- 90,976-87,876-17,347-20,483Net Financing Cash Flow Growth4.57%-3.53%-406.58%15.31%-Net Financing Cash Flow / Sales-31.67%-35.00%-33.06%-7.59%-9.56%Net Change in Cash-10,43524,3115,624-195-636Free Cash Flow73,36558,89664,12151,14753,090Free Cash Flow Growth24.57%-8.15%25.37%-3.66%-Free Cash Flow Yield3.01%---- sourcehttps://www.google.com/search?q=apple+company+wsj& oq=apple+&aqs=chrome.1.69i59l3j69i57j46i433j69i60l3.7083j0 j7&sourceid=chrome&ie=UTF-8 ratiosFinancial diagnostic categoriesyrSamsungApple1.) Liquidity of short-term assets-Current ratio20162.641.352720172.221.276120182.571.132920192.891. 540120202.661.3636-Cash ratio20161.610.8520171.240.7420181.460.5720191.710.952020

- 14. 1.650.86-Quick ratio20162.311.3320171.851.2320182.151.0920192.471.520202. 241.332.) Long-term debt-paying ability-Debt ratio201626.460.13201728.9264.28201826.9970.7201925.4473. 27202027.0479.83-Debt-equity ratio20160.370.678620170.420.86320180.381.068520190.351.1 9420200.381.7208-Times interest earned201685-422017116- 282018127-23201983-182020114-233.) Profitability-Net income/sales (profit margin)2016021.18682017021.09242018022.41422019021.2381 202011.0220.9136-Net income/assets (ROA)20160.08514.202420170.13712.882620180.12916.277520 190.06116.32320200.06917.7256-Net income/shareholder equity (ROE)20160.1238.190620170.236.070220180.18355.560120190 .08461.064520200.09787.86644.) Asset utilization/ management efficiency-Total asset turnover201600.6703201700.6108201800.7262201900.7686202 00.650.8476-Inventory turnover measures201661.62161.621201729.052129.0521201841.394341. 3943201939.401439.4014202041.75341.753-Accounts receivable turnover20167.267.359920177.536.42620186.65.420920195.865 .680220206.857.33125.) Market measures-Price/earnings ratio20160.560.1520170.260.5920180.150.8720190.250.562020 0.470.25-Earnings per common share201600201789.8510.8420187.8429.322019-51- 0.17202021.3210.23-Dividend payout20160.7634.620170.82.3320180.60.2320190.2331.420200 .20.5 Business Research Methods, 14e/Schindler 1

- 15. >cases State Farm, the nation’s largest auto insurer, distributed a list of the 10 most dangerous intersections in the United States based on crashes resulting in claims by its policyholders. What started as a study to reduce risk turned into an ongoing study that directs a major public relations effort: State Farm provides funds for communities to further research their dangerous intersections and initiate improve- ments based on the research. This case tells you how the State Farm Dangerous Intersections initiative got started and how it is done. www.statefarm.com >Abstract >The Scenario State Farm Insurance has a rich history of proactive safety involvement in auto and appliance design to reduce injury and property loss. In June 2001, State Farm Insurance, Inc., released the second report in its Dangerous Intersection reporting series. State Farm modeled its program after an initiative by the Insurance Corporation of British Columbia, Canada (ICBC), and the American Automobile Association of Michigan (AAA) to help position the nation’s largest auto insurer as the most safety- conscious insurer. ICBC had patterned its program on an earlier effort in Victoria, Australia. AAA, in turn, benchmarked its program on the ICBC program. AAA

- 16. invited State Farm to help fund one of its intersection studies. State Farm saw this as an opportunity to expand its effort into a nationwide campaign in 1999. “The 2001 study is part of a larger effort focused on loss prevention and improving the safety of intersections around the U.S.A.,” shared State Farm research engineer John Nepomuceno. State Farm has allocated significant resources as well as funds to the initiative. Since its inception, every city with an intersection on the overall list of dangerous intersections is eligible to apply for a $20,000 grant to defray the cost of a comprehensive traffic engineering study of the intersection. Additionally, each city named to the national top 10 dangerous intersection list is eligible for a grant of $100,000 per intersection to defray some of the cost of making improvements. All totaled, State Farm offered $4.44 million to the safety initiative in its first year. Due to its large market share, State Farm is the only U.S. insurer in a position to mine its databases for the requisite information on accidents to come up with a viable U.S. list. But it found that although it had the interest to do so, its data warehouse did not have sufficient information to tally accident rates for intersections. To rectify this, in 1998 State Farm included a location field as part of the data that its claims adjusters regularly complete. This location information, in open-text format, indicates whether the accident took place in an intersection or as part of

- 17. an incident related to an intersection accident, and identifies the intersection. Following the 1999 study, the fields for identifying intersections were further refined. In the first study using 1998 data (reported in June 1999) as well as the 2001 State Farm: Dangerous Intersections Used with permission of Pamela S. Schindler ©2001. Business Research Methods, 14e/Schindler 2 study, State Farm looked at accidents involving only intersecting roads. They excluded any accident that occurred at the intersection of a road and a highway access or egress ramp. State Farm also looked only at accidents where the State Farm–insured driver was at fault. Because of the study’s focus on road safety engineering, the first study ignored accident severity and made no attempt to isolate demographic (age or gender of driver, driving record, etc.) or geographic (weather conditions, population of area, etc.) factors related to the accident. It also looked only at State Farm’s own internal

- 18. incident reports, not at any public records involving traffic patterns or volume or police incident reports. Based on industry market share information, State Farm was able to estimate the total number of crashes at a given intersection. “There was good reason to exclude police reports and traffic counts,” explained Nepomuceno. “The reporting threshold for police filing reports on accidents differs widely from jurisdiction to jurisdiction. Some will only fill out reports when personal injury or criminal behavior is involved. Others will fill them out only when a vehicle is damaged to the degree that it needs to be towed from the scene. Still others fill out such reports on every incident. Traffic volume reports are often prepared infrequently and often by independent sources. Not only may the data quality be questionable, but the time period in which the data was collected may not match our 1998 incident reports in every city involved. Also, when traffic volumes are factored in, low volume roads with relatively few crashes are often deprioritized. Now that we’re through with the 2001 study, we are asking ourselves if intersection volume should be factored in, and if so, how it can be included without significantly increasing our effort in data processing.” In the 1998 study, State Farm identified 172 dangerous intersections. The top 10 most dangerous intersections in the United States were released publicly

- 19. (www.statefarm. com). Public affairs staff for each state could request that up to 10 intersections be identified for their state. “This was usually determined by the resources that our local public affairs staff were willing to put toward the program,” shared Nepomuceno. “Each state had to recognize a top 10 national intersection, but they could request that no more be released or that up to 10 intersections within their state be released.” As of August 2001, 97 cities (56.4 percent) had applied for State Farm grants. “While some in the media claimed we had ‘hit a home run’ with the program, we quickly learned that there was a lot more at stake than we had anticipated in generating goodwill with transportation engineers,” indicated Nepomuceno. “This is, after all, a traffic safety program and we would not achieve that goal without having the cooperation of the traffic and transportation engineering community. First, while initially they lauded us for the attention our listing brought to traffic concerns, we and they soon discovered that the spotlight generated demand for immediate solutions, solutions that they often didn’t have budgets to implement. Also, from their perspective, not all accidents are the same; locations with accidents that result in injuries and death should be given more attention. Some jurisdictions were upset that we didn’t consider intersection volume and we didn’t include accident rate

- 20. data.1 The fact that the State Farm grants were intended to study the intersection State Farm: Dangerous Intersections Business Research Methods, 14e/Schindler 3 more completely wasn’t always seen as a solution to their immediate problems.” To include accident severity, State Farm needed a measurement system for classifying accidents. For the 2001 study, which used 1999 and 2000 accident data, State Farm calculated a median property damage accident payout (approximately $1,700). Incidents requiring payout of more than the median amount were classified as “high severity”; those requiring less, “low severity.” Additionally, State Farm chose to classify each accident using a multipoint scale. Zero was assigned to “no property damage, no personal injury” incidents and a higher number was assigned to “High property damage, personal injury” incidents, with numbers in between assigned to levels of property damage and personal injury (see Exhibit SF 1–1). Accident scores were summed to create an aggregate danger index for each intersection. Each intersection was then weighted by dividing the danger index by State Farm’s market

- 21. share in the area. Of the 224 intersections identified, the top 10 were released to the national media. Each of those 224 is now eligible for the $20,000 grant to study the intersection to identify specific improvements; the top 10 are also eligible for $100,000 grants for improvements. In this second round, State Farm has committed $5.48 million to the safety program. State Farm is making plans to track the success of the Dangerous Intersection program. Once cities notify them of the completion of an intersection’s improvements, State Farm will start tracking accidents for that intersection for a period of one year. The first post-improvement evaluation study is expected in 2002. Additionally, State Farm is taking steps to learn from the characteristics of the dangerous intersections. Each grant application for an affected city’s study of a dangerous intersection must include: • Collection and analysis of police report data. • An engineer’s “geometric review”2of the intersection. • A capacity profile of the intersection. • A traffic conflict study.3 • A benefit-cost analysis. • A schedule of improvements (short-term, intermediate-term, and long-term).4 State Farm plans to use the new data to identify patterns of problems. This may lead to a model of desired intersection traits against which improvement plans can

- 22. be assessed, further increasing the effectiveness of the loss prevention program and making life a little easier for the transportation engineers with whom they must partner to achieve safety success. Exhibit SF 1–1 Danger Codes No Personal Injury With Personal Injury No property damage 0 Y Low property damage 1 1 + Y High property damage X X + Y State Farm: Dangerous Intersections Business Research Methods, 14e/Schindler 4 1 Identify the various constructs and concepts involved in the study. 2 What hypothesis might drive the research of one of the cities on the top 10 dangerous intersection list? 3 Evaluate the methodology for State Farm’s research. 4 If you were State Farm, how would you address the concerns of transpor- tation engineers? 5 If you were State Farm, would you use traffic volume counts as part of the

- 23. 2003 study? What concerns, other than those expressed by Nepomuceno, do you have? >>>>>Discussion >>>>>Sources >Notes 1 Accident rate is calculated by dividing the number of accidents in a given period by the total traffic volume over the same period. 2 The intersection geometry or physical layout of the intersection can play an important role in influencing driver behavior at intersections. For example, a curve on the approach to an intersection may impede the sight distance to a traffic signal, preventing drivers from stopping in time. Or, a driver approaching two signalized intersections very closely spaced may see the traffic signals at both intersections and become confused about which traffic signal to obey. 3 A traffic conflict study is an observation study of traffic conflicts that do not necessarily end in an accident but have the potential to do so. Recording and studying observations of driver behavior is expected to help traffic engineers understand the same problems that result in collisions. Some examples of conflicts are the sound of sharply applied breaks; sudden, unsignaled lane changes; or drivers hitting their horns.

- 24. 4 Short-term improvements might include sign changes, changes in lane markings, or signal- timing changes. Most short-term improvements can be implemented in less than two years. Intermediate-term improvements might involve lane widening, the addition of turn lanes, etc., and be accomplished within 2–5 years. Examples of long- term improvements include grade separation of the intersecting roads and can take 5–10 years to implement. This case is based on information provided by John Nepomuceno in interviews that took place on August 9, 2001, and September 13, 2001. Other sources include: “Miami Area Intersection Tops State Farm List of Most Dangerous in the United States,” State Farm press release, June 27, 2001 (http://www.statefarm. com/media/release/danger00.htm); “Research” (http:// www.statefarm.com/media/methods.htm); and “State Farm 1999 Dangerous Intersection National Status List” (http://www.statefarm.com/media/statustop.htm); and “State Farm’s Dangerous Intersection Initiative,” Institute of Transportation Engineers press release, June 27, 2001 (http://www.ite.org/press_release.htm). State Farm: Dangerous Intersections Criteria Ratings Points Content -

- 25. Part I - Initial Post 9 to >8.0 pts Advanced Author responded to all case study questions by posted deadlines. Insightful throughout. Completely developed all relevant information. Critical issues and key areas that supported each question were clearly identified, analyzed, and supported. 8 to >7.0 pts Proficient Author responded to all case study questions by posted deadlines. Specific, solid. Less carefully developed. Some insights. Critical issues and key areas that supported each question were partially identified, analyzed, and supported. 7 to >0.0 pts

- 26. Developing Author responded to at least 4 questions by posted deadlines. Vague, obvious, underdeveloped, or too broad. One or more main issues not identified. Limited evidence of critical thinking. Critical issues and key areas that supported each question were not clearly identified, analyzed, and supported. 0 pts Not Present 9 pts Content - Part I - Direct Application of Scholarly Research & Integration of Biblical Principles 9 to >8.0 pts

- 27. Advanced Author accurately applied 5 or more scholarly (peer reviewed) sources to the discussion. Author accurately applied at least 1 scholarly (peer-reviewed) source to each question. Author accurately applied at least 1 scriptural/Biblical principles in each question response. 8 to >7.0 pts Proficient Author accurately applied at least 4 scholarly (peer reviewed) sources to the discussion. Author accurately applied at least 1 scholarly (peer-reviewed) source to each question. Author accurately applied at least 1 scriptural/Biblical principle in each question response. 7 to >0.0 pts Developing

- 28. Author accurately applied 1 -3 scholarly (peer reviewed) sources to the discussion. Author accurately applied at least 1 scholarly (peer-reviewed) source to some questions. Author accurately applied at least 1 scriptural/Biblical principle in each question response. 0 pts Not Present 9 pts Content - Part I - Mechanics, APA Style & Word Count 7 to >6.0 pts Advanced Correct spelling and grammar are used throughout the essay. There are 0–1 errors in grammar or spelling that distract the reader from

- 29. the content. There are 0–1 minor errors in APA format in the required items: citations and references. The word count of 800-1000 words is met. 6 to >5.0 pts Proficient There are 2-3 errors in grammar or spelling that distract the reader from the content. There are 2–3 minor errors in APA format in the required items. The word count of at least 750 words is met. 5 to >0.0 pts Developing There are 4-5 errors in grammar or spelling that distract the reader from the content. There are more than 3 errors in APA format in the required items. The word count of 500–749 words. 0 pts

- 30. Not Present 7 pts Discussion Grading Rubric | BUSI600_C01_202140 Criteria Ratings Points Content - Part II - Two Individual Response Posts 9 to >8.0 pts Advanced Author responded to at least 2 different peers by posted deadlines. Insightful throughout. Completely developed all relevant information. Critical issues and key areas that supported each question were clearly identified, analyzed, and supported. Offer at least 1 strength and 1 weakness for each reply.

- 31. 8 to >7.0 pts Proficient Author responded to at least 2 different peers by posted deadlines. Specific, solid. Less carefully developed. Some insights. Critical issues and key areas that supported each question were partially identified, analyzed, and supported. Offer at least 1 strength and 1 weakness for each reply. 7 to >0.0 pts Developing Author responded to at least 1 different peer by posted deadlines. Vague, obvious, underdeveloped, or too broad. One or more main issues not identified. Limited evidence of critical thinking. Critical issues and key areas that supported each question were not clearly identified, analyzed, and supported. Offer at least 1 strength and 1 weakness for one reply.

- 32. 0 pts Not Present 9 pts Content - Part II - Direct Application of Scholarly Research & Integration of Biblical Principles 9 to >8.0 pts Advanced Author accurately applied 2 or more scholarly (peer reviewed) sources to each peer response. Author accurately applied at least 1 scriptural/Biblical principles in each question response (no more than 10% of the total response).

- 33. 8 to >7.0 pts Proficient Author accurately applied at least 2 scholarly (peer reviewed) sources to each peer response. Author accurately applied at least 1 scriptural/Biblical principle in each question response (no more than 10% of the total response). 7 to >0.0 pts Developing Author accurately applied 1 or 2 scholarly (peer reviewed) sources to some peer response. Author accurately applied at least 1 scriptural/Biblical principle in each question response (no more than 10% of the total response). 0 pts Not Present

- 34. 9 pts Content - Part II - Mechanics, APA Style & Word Count 7 to >6.0 pts Advanced Correct spelling and grammar are used throughout the essay. There are 0–1 errors in grammar or spelling that distract the reader from the content. There are 0–1 minor errors in APA format in the required items: citations and references. The word count of 450–600 words is met for each response. 6 to >5.0 pts Proficient There are 2-3 errors in grammar or spelling that distract the reader from the content. There are 2–3 minor errors in APA

- 35. format in the required items. The word count of at least 400 words is met for each response. 5 to >0.0 pts Developing There are 4-5 errors in grammar or spelling that distract the reader from the content. There are more than 3 errors in APA format in the required items. The word count of 300 - 399 words is met for each response. 0 pts Not Present 7 pts Total Points: 50 Discussion Grading Rubric | BUSI600_C01_202140