Financial InformationMicrosoftMicrosoftIncome StatementBalance She

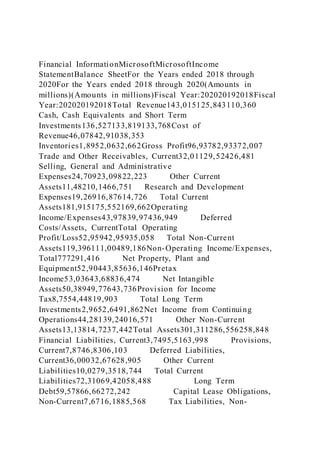

- 1. Financial InformationMicrosoftMicrosoftIncome StatementBalance SheetFor the Years ended 2018 through 2020For the Years ended 2018 through 2020(Amounts in millions)(Amounts in millions)Fiscal Year:202020192018Fiscal Year:202020192018Total Revenue143,015125,843110,360 Cash, Cash Equivalents and Short Term Investments136,527133,819133,768Cost of Revenue46,07842,91038,353 Inventories1,8952,0632,662Gross Profit96,93782,93372,007 Trade and Other Receivables, Current32,01129,52426,481 Selling, General and Administrative Expenses24,70923,09822,223 Other Current Assets11,48210,1466,751 Research and Development Expenses19,26916,87614,726 Total Current Assets181,915175,552169,662Operating Income/Expenses43,97839,97436,949 Deferred Costs/Assets, CurrentTotal Operating Profit/Loss52,95942,95935,058 Total Non-Current Assets119,396111,00489,186Non-Operating Income/Expenses, Total777291,416 Net Property, Plant and Equipment52,90443,85636,146Pretax Income53,03643,68836,474 Net Intangible Assets50,38949,77643,736Provision for Income Tax8,7554,44819,903 Total Long Term Investments2,9652,6491,862Net Income from Continuing Operations44,28139,24016,571 Other Non-Current Assets13,13814,7237,442Total Assets301,311286,556258,848 Financial Liabilities, Current3,7495,5163,998 Provisions, Current7,8746,8306,103 Deferred Liabilities, Current36,00032,67628,905 Other Current Liabilities10,0279,3518,744 Total Current Liabilities72,31069,42058,488 Long Term Debt59,57866,66272,242 Capital Lease Obligations, Non-Current7,6716,1885,568 Tax Liabilities, Non-

- 2. Current204233541 Deferred Income/Customer Advances/Billings in Excess of Cost, Non- Current3,1804,5303,815 Payables and Accrued Expenses, Non-Current29,43229,61230,265 Other Non-Current Liabilities10,6327,5815,211 Total Non-Current Liabilities110,697114,806117,642Total Liabilities183,007184,226176,130 Equity Attributable to Parent Stockholders118,304102,33082,718 Paid in Capital80,55278,52071,223 Retained Earnings/Accumulated Deficit34,56624,15013,682 Reserves/Accumulated Comprehensive Income/Losses3,186(340)(2,187)Total Equity118,304102,33082,718Total Equity and Liabiltiies301,311286,556258,848 3-Horizontal Analysis ISMicrosoftIncome StatementFor the Years ended 2018 through 2020(Amounts in millions)2019201820202019$ Change% Change20192018$ Change% Change2082018$ Change% ChangeTotal Revenue143,015125,84317,17213.6%125,843110,36015,48314.0 %110,360110,360- 00.0%Cost of Revenue46,07842,9103,1687.4%42,91038,3534,55711.9%38,35 338,353- 00.0%Gross Profit96,93782,93314,00416.9%82,93372,00710,92615.2%72,00 772,007- 00.0% Selling, General and Administrative Expenses24,70923,0981,6117.0%23,09822,2238753.9%22,2232 2,223- 00.0% Research and Development Expenses19,26916,8762,39314.2%16,87614,7262,15014.6%14,7 2614,726- 00.0%Operating Income/Expenses43,97839,9744,00410.0%39,97436,9493,0258. 2%36,94936,949- 00.0%Total Operating Profit/Loss52,95942,95910,00023.3%42,95935,0587,90122.5%3 5,05835,058- 00.0%Non-Operating Income/Expenses, Total77729(652)-89.4%7291,416(687)-48.5%1,4161,416- 00.0%Pretax Income53,03643,6889,34821.4%43,68836,4747,21419.8%36,47 436,474- 00.0%Provision for Income

- 3. Tax8,7554,4484,30796.8%4,44819,903(15,455)- 77.7%19,90319,903- 00.0%Net Income from Continuing Operations44,28139,2405,04112.8%39,24016,57122,669136.8% 16,57116,571- 00.0% 3- Horizontal Analysis BSMircosoftBalance SheetHorizontal Analysis for the Years ended 2018through 2020(Amounts in millions)20202019$ Change% Change20192018$ Change% Change20182018$ Change% Change Cash, Cash Equivalents and Short Term Investments136,527133,8192,7082.0%133,819133,768510.0%13 3,768133,768- 00.0% Inventories1,8952,063(168)- 8.1%2,0632,662(599)-22.5%2,6622,662- 00.0% Trade and Other Receivables, Current32,01129,5242,4878.4%29,52426,4813,04311.5%26,481 26,481- 00.0% Other Current Assets11,48210,1461,33613.2%10,1466,7513,39550.3%6,7516,7 51- 00.0% Total Current Assets181,915175,5526,3633.6%175,552169,6625,8903.5%169, 662169,662- 00.0% Deferred Costs/Assets, Current Total Non-Current Assets119,396111,0048,3927.6%111,00489,18621,81824.5%89, 18689,186- 00.0% Net Property, Plant and Equipment52,90443,8569,04820.6%43,85636,1467,71021.3%36, 14636,146- 00.0% Net Intangible Assets50,38949,7766131.2%49,77643,7366,04013.8%43,73643, 736- 00.0% Total Long Term Investments2,9652,64931611.9%2,6491,86278742.3%1,8621, 86 2- 00.0% Other Non-Current Assets13,13814,723(1,585)- 10.8%14,7237,4427,28197.8%7,4427,442- 00.0%Total Assets301,311286,55614,7555.1%286,556258,84827,70810.7%2 58,848258,848- 00.0% Financial Liabilities, Current3,7495,516(1,767)- 32.0%5,5163,9981,51838.0%3,9983,998- 00.0% Provisions, Current7,8746,8301,04415.3%6,8306,10372711.9%6,1036,103- 00.0% Deferred Liabilities,

- 4. Current36,00032,6763,32410.2%32,67628,9053,77113.0%28,90 528,905- 00.0% Other Current Liabilities10,0279,3516767.2%9,3518,7446076.9%8,7448,744- 00.0% Total Current Liabilities72,31069,4202,8904.2%69,42058,48810,93218.7%58, 48858,488- 00.0% Long Term Debt59,57866,662(7,084)-10.6%66,66272,242(5,580)- 7.7%72,24272,242- 00.0% Capital Lease Obligations, Non- Current7,6716,1881,48324.0%6,1885,56862011.1%5,5685,568- 00.0% Tax Liabilities, Non-Current204233(29)- 12.4%233541(308)-56.9%541541- 00.0% Deferred Income/Customer Advances/Billings in Excess of Cost, Non- Current3,1804,530(1,350)- 29.8%4,5303,81571518.7%3,8153,815- 00.0% Payables and Accrued Expenses, Non-Current29,43229,612(180)- 0.6%29,61230,265(653)-2.2%30,26530,265- 00.0% Other Non-Current Liabilities10,6327,5813,05140.2%7,5815,2112,37045.5%5,2115 ,211- 00.0% Total Non-Current Liabilities110,697114,806(4,109)-3.6%114,806117,642(2,836)- 2.4%117,642117,642- 00.0%Total Liabilities183,007184,226(1,219)- 0.7%184,226176,1308,0964.6%176,130176,130- 00.0% Equity Attributable to Parent Stockholders118,304102,33015,97415.6%102,33082,71819,612 23.7%82,71882,718- 00.0% Paid in Capital80,55278,5202,0322.6%78,52071,2237,29710.2%71,223 71,223- 00.0% Retained Earnings/Accumulated Deficit34,56624,15010,41643.1%24,15013,68210,46876.5%13,6 8213,682- 00.0% Reserves/Accumulated Comprehensive Income/Losses3,186(340)3,526-1037.1%(340)(2,187)1,847- 84.5%(2,187)(2,187)- 00.0%Total Equity118,304102,33015,97415.6%102,33082,71819,61223.7%8 2,71882,718- 00.0%Total Equity and Liabiltiies301,311286,55614,7555.1%286,556258,84827,70810.

- 5. 7%258,848258,848- 00.0% 3 Vertical Analysis ISMicorsoftIncome StatementVertical Analysis for the Years ended 2018 through 2020(Amounts in millions)2020%2019%2018%Total Revenue143,015100.0%110,360100.0%110,360100.0%Cost of Revenue46,07832.2%38,35334.8%38,35334.8%Gross Profit96,93767.8%72,00765.2%72,00765.2% Selling, General and Administrative Expenses24,70917.3%22,22320.1%22,22320.1% Research and Development Expenses19,26913.5%14,72613.3%14,72613.3%Operating Income/Expenses43,97830.8%36,94933.5%36,94933.5%Total Operating Profit/Loss52,95937.0%35,05831.8%35,05831.8%Non- Operating Income/Expenses, Total770.1%1,4161.3%1,4161.3%Pretax Income53,03637.1%36,47433.1%36,47433.1%Provision for Income Tax8,7556.1%19,90318.0%19,90318.0%Net Income from Continuing Operations44,28131.0%16,57115.0%16,57115.0% 3 Vertical Analysis BSMicrosoft.Vertical Analysis for the Years ended 2018 through 2020(Amounts in millions)2020%2019%2018% Cash, Cash Equivalents and Short Term Investments136,52745.3%133,81946.7%133,76851.7% Inventories1,8950.6%2,0630.7%2,6621.0% Trade and Other Receivables, Current32,01110.6%29,52410.3%26,48110.2% Other Current Assets11,4823.8%10,1463.5%6,7512.6% Total Current Assets181,91560.4%175,55261.3%169,66265.5% Deferred Costs/Assets, Current Total Non-Current Assets119,39639.6%111,00438.7%89,18634.5% Net Property, Plant and Equipment52,90417.6%43,85615.3%36,14614.0% Net Intangible Assets50,38916.7%49,77617.4%43,73616.9% Total Long Term Investments2,9651.0%2,6490.9%1,8620.7%

- 6. Other Non-Current Assets13,1384.4%14,7235.1%7,4422.9%Total Assets301,311100.0%286,556100.0%258,848100.0% Financial Liabilities, Current3,7491.2%5,5161.9%3,9981.5% Provisions, Current7,8742.6%6,8302.4%6,1032.4% Deferred Liabilities, Current36,00011.9%32,67611.4%28,90511.2% Other Current Liabilities10,0273.3%9,3513.3%8,7443.4% Total Current Liabilities72,31024.0%69,42024.2%58,48822.6% Long Term Debt59,57819.8%66,66223.3%72,24227.9% Capital Lease Obligations, Non- Current7,6712.5%6,1882.2%5,5682.2% Tax Liabilities, Non-Current2040.1%2330.1%5410.2% Deferred Income/Customer Advances/Billings in Excess of Cost, Non- Current3,1801.1%4,5301.6%3,8151.5% Payables and Accrued Expenses, Non- Current29,4329.8%29,61210.3%30,26511.7% Other Non- Current Liabilities10,6323.5%7,5812.6%5,2112.0% Total Non-Current Liabilities110,69736.7%114,80640.1%117,64245.4%Total Liabilities183,00760.7%184,22664.3%176,13068.0% Equity Attributable to Parent Stockholders118,30439.3%102,33035.7%82,71832.0% Paid in Capital80,55226.7%78,52027.4%71,22327.5% Retained Earnings/Accumulated Deficit34,56611.5%24,1508.4%13,6825.3% Reserves/Accumulated Comprehensive Income/Losses3,1861.1%(340)-0.1%(2,187)-0.8%Total Equity118,30439.3%102,33035.7%82,71832.0%Total Equity and Liabiltiies301,311100.0%286,556100.0%258,848100.0% REFERENCESReferences: TABFINANCIAL INFORMATIONU.S. Securities and Exchange Commission (2019). 2019 Annual SEC Form 10-K Report, Costco Wholesale Corporation. Retrieved from https://www.sec.gov/Archives/edgar/data/909832/000090983219 000019/cost10k9119.htmThis is an example of your reference.

- 7. You will use the actual reference from your company. You will create one for each different SEC Form 10K report you will cite CIVL125 Physics and Statics Humber College - Faculty of Applied Science and Technology CIVL125 – Physics and Statics-Test 1 Cheating, by obtaining answers to questions through unauthorized means (from another student, from internet etc.) is an academic offence and is punishable by academic penalty. An academic penalty begins with the assignment of a grade of zero (0) in such situations and can be extended up to and including suspension from a program/ course and expulsion from the College. Student Name & Signature: ___________________________________________________ Student Number: _________________ Date: February 5, 2021 10:00am-1:25pm

- 8. Test Format: Yourlastname_Yourfirstname_CIVL125Test1 o [email protected] Good luck! Organization/Neatness of the Assignment Not a single pdf file -10% File Name not as Required -5% Messy work -10%

- 9. Missing Units -10% CIVL125 Physics and Statics Humber College - Faculty of Applied Science and Technology Some Multiples and Conversions: Giga=109 Mega=106 kilo=103 milli=10-3 micro=10-6 1ft=0.3048m 1in=25.4mm 1lb=4.4482N 1Pa=N/m2

- 10. A Cosine Law: A Sine Law: CIVL125 Physics and Statics Humber College - Faculty of Applied Science and Technology Question 1: Calculations, Dimensional Analysis and Trigonometry. Show all calculations step by step otherwise the mark will be zero. Pick up your personalized data from the table below. (20%)

- 11. First Letter of Your First Name “a” Second Letter of Your First Name “b” First Letter of Your Last Name “c” Second Letter of Your Last Name “d” A-G 50 A-G 6 A-G 400 A-G 0.6 H-M 60 H-M 7 H-M 500 H-M 40 N-R 70 N-R 8 N-R 600 N-R 50 S-Z 80 S-Z 9 S-Z 700 S-Z 12 a) Evaluate the following to three significant digits and and express the answer in SI units (N,m,kg) using an appropriate prefix: (a MN)(b km)/(c mg) (6%)

- 12. b) Convert d kips/ft to kN/m. Evaluate the answer to three significant digits and an appropriate prefix: (6%) c) Convert a pcf to kN/m3. Evaluate the answer to three significant digits and an appropriate prefix: (8%) CIVL125 Physics and Statics Humber College - Faculty of Applied Science and Technology Question 2: An Egyptian piramid has a square base and symmetrical sloping faces. The inclination of each slopping face is α. At a distance AO from the base, on level ground, the angle of inclination to the apex is β. Pick up your personalized data from the table below. (20%)

- 13. First Letter of Your First Name “α” (degrees) Second Letter of Your First Name “β” (degrees) First Letter of Your Last Name “AO” A-G 53007’ A-G 27009’ A-G 600 ft H-M 51051’ H-M 30027’ H-M 500 ft N-R 47032’ N-R 22048’ N-R 400 ft S-Z 60015’ S-Z 20051’ S-Z 700 ft a) Circle your data in the table above with a red marker. Then draw your sketch with your personal data. Draw in scale. (2%) b) Find the vertical height TB. (6%) c) Find the slant height TA. (6%) d) Find the width of the pyramid base. (6%)

- 14. CIVL125 Physics and Statics Humber College - Faculty of Applied Science and Technology Question 3: The coplanar concurrent force system shown is made of two forces F1 and F2. Pick up your personalized data from the table below . (20%) First Letter of Your First Name “F1” Second Letter of Your First Name “F2” First Letter of Your Last Name “α” A-G 75 lb A-G 60 lb A-G 300 H-M 80 lb H-M 55 lb H-M 320 N-R 90 lb N-R 50 lb N-R 340 S-Z 100 lb S-Z 45 lb S-Z 360 a) Circle your data in the table above with a red marker. Then draw your sketch

- 15. with your personal data. Draw in scale. (2%) b) Determine the magnitude of the resultant force graphically. Use triangle and/or parallelogram method. (6%) c) Determine the magnitude of the resultant force analytically. (6%) d) Analytically, determine the direction angle φx of the resultant force measured counterclockwise from negative X axis. (6%) CIVL125 Physics and Statics Humber College - Faculty of Applied Science and Technology

- 16. Question 4: The transformer with weight F is being lifted by two forces F1 and F2 shown below. Pick up your personalized data from the table below (20%) First Letter of Your First Name “F” Second Letter of Your First Name “F1” First Letter of Your Last Name “α” A-G 6000 lb A-G 5000 lb A-G 250 H-M 6500 lb H-M 4800 lb H-M 270 N-R 7000 lb N-R 4600 lb N-R 290 S-Z 7500 lb S-Z 4400 lb S-Z 310 a) Circle your data in the table above with a red marker. Then draw your structure with your personal data. Draw in scale. (2%) b) Graphically determine the magnitude of the force F2 so that the resultant of the lifting force (which is equal to F) will act vertically upward. Use the

- 17. triangle and/or parallelogram method. (6%) c) Determine the magnitude of force F2 analytically. (6%) d) Analytically, determine the direction angle θ. (6%) CIVL125 Physics and Statics Humber College - Faculty of Applied Science and Technology Question 5: The resultant force F of three concurrent forces F1, F2, F3 shown, is acting vertically upward along the Y axis. Pick up your personalized data from the table below. (20%) First Letter of Your First

- 18. Name “F” Second Letter of Your First Name “F2” First Letter of Your Last Name “F3” Second Letter of Your Last Name “α” A-G 300 lb A-G 500 lb A-G 240 lb A-G 300 H-M 350 lb H-M 550 lb H-M 260 lb H-M 320 N-R 400 lb N-R 460 lb N-R 280 lb N-R 340 S-Z 450 lb S-Z 600 lb S-Z 300 lb S-Z 360 a) Circle your data in the table above with a red marker. Then draw your structure with your personal data. Draw in scale. (2%) b) Graphically determine the magnitude of the force F1 using component method. (6%)

- 19. c) Determine the magnitude of force F1 analytically using component method. (6%). d) Analytically, determine the direction angle θ. (6%) Running Head: MICROSOFT Annual Report Project 3 1 MICROSOFT 9 Annual Report Project 3 Lakisha Trammel Dr. Ron Stunda GUC ACC-616-0500 January 27, 2021

- 20. Introduction The main purpose of this report is to analyze horizontally and vertically, both income statement and balance sheet within the last three years of Microsoft. The years we are looking for are from 2018 - 2020, with June 30th, year-end date. Vertical and Horizontal Analysis of Income Statement Microsoft's vertical income statement demonstrations that the company has increased its bottom-line profitability, and has done so by improving their controlling expenses. The cost of revenue decreased from 34.8% in 2018 to 34.1% in 2019, and then decreased to 32.2% in the financial year ended on June 30, 2020. That caused the gross profit to increase from 65.2% to 67.8% over the same time period. The company controlled its expenses by covering them in a regular manner. As a result, the ratio for SG&A expenses decreased from 20.1 % to 18.4 % in 2011, to 17.3 % in 2012, and then further decreased to 16.7 % in 2016 and then further to 16.3 % in 2017. However, the company has gradually increased its R&D expenses as it is necessary for the development and growth of the company. In turn, operating profits more than doubled from 31.8% in 2018 to 37% in 2020. Non-operating costs also declined by a small amount in the second year compared to the first. The overall amount of taxable income increased from 33.1% in 2018 to 34.7% in 2019, and then to 37.1% in 2020. Although income tax expenditure as a proportion of federal

- 21. revenue decreased from 18% in 2018 to 6.1% in 2020, it continues to decrease in figures. With the rise of every fiscal year, the net income rose from 15%, 2018 to more than 31% by the end of the calendar year 2020. Microsoft's revenue increased % for 2019 as opposed to 2018, and then increased 13.6 % in 2020. In 2018, the lower sales cost decreased faster than the beginning and advancing of the 2018- 2020 period, but in 2019 and 2020, the income revenue jumped by 11.9% in 2019 and 7.4% in 2020, respectively. Aside from the double-digit increase in revenues and gross profit for both years, the growth in these two segments was also higher than the growth in revenue. As a result of improvements in advertisement, revenues, and general and administrative cost costs, a larger amount of revenue was achieved. However, non- operating income has been declining since last year, and this year's decrease does not appear to be related to interest income. Income taxes decreased by 78 % in 2018, but jumped back up to an unexpected level in 2020. As a result, net income rose by 136.8% in 201, a further 12.8% in 2020. Balance Sheet Vertical and Horizontal Analysis The percentage by which cash and cash equivalents fell in the last three years from more than half to less than half of total deposits. Inventory levels declined as compared to years past while receivables and other current assets increased a tiny amount. Since 2018, total current assets fell by 2%, from $29 billion to $28.4 billion. The decrease in your current assets will help you decrease your current liabilities. Yet liability remains roughly the same over the past three years. Total liabilities increased, but assets increased. Even more impressive is the increase in net worth since depreciation, and also the increase in property, plant and equipment, because of depreciation. The result of all these factors was that both tangible and intangible assets increased. It rationalizes the decline in assets, mostly cash, as the company has misused some of its internal capital to fund a few acquisitions. The long term investments have been increasing over time, albeit at a

- 22. slow pace. Current liabilities have increased substantially, but not enough to offset the large increase in provisions and other current liabilities. Even though the inventory of current and non-current assets are low, the stocks of non-current assets decreased gradually over the last three years and reached 60.7 % of the total assets. The amount of long term debt, which is declining, was on a rise up to a number of 28.0%, then it went down to 22.1%. The amount of both payable and accrued liabilities has declined slightly over the last three years, but remains small compared to the total assets of the company. As a result, total liabilities decreased from 45.4% down to 37.7% The stock price increased due to the issuance of new shares and retained earnings. In short, in 2018, the retained earnings amount decreased to 5.3% while in 2020, the retained earnings percentage continues to rise up to 11.5%. Overall total current assets increased as the level of current assets increased. The horizontal review in the balance sheet reveals that cash, inventory, and investments rose marginally in 2020 as compared to 2019. The total value of non-current assets also increased with the rise in the value of the company's plant and equipment. Over time the overall investments increased but the percentage of total investments decreased. Some assets are expected to decrease by more than 11% in 2020 compared to the previous year while others are expected to rise by just about 98% in 2019. The liabilities are expected to grow by 18.7% in the next three years and around 4.2% in the next two years. The main part of the rise came from the summer expense of development due to provisions and borrowing and from other current liabili ties. Long-term liabilities in the company's balance sheet dropped considerably as the company paid down long-term debt. Other non-current liabilities, however, are actually increasing in the past few years.

- 23. Although total equity increased in the first half of this year, half of the increase came from the issuance of new equity. References Microsoft, (2020). Annual Report 2020- Satya Nadella, Chief Executive Officer. Retrieved from https://microsoft.gcs- web.com/static-files/4e7064ed-bbf7-4140-a8cb-79aba77421b9 Microsoft, (2019). Annual Report 2019- Satya Nadella, Chief Executive Officer. Retrieved from https://www.microsoft.com/investor/reports/ar19/index.html Nadella, S., & London, S. (2018). Microsoft’s Next Act. The McKinsey Quarterly.

- 24. Appendix Total Current Assets18191517555216966260.4%61.3%65.5% Deferred Costs/Assets, Current Total Non-Current Assets1193961110048918639.6%38.7%34.5% Net Property, Plant and Equipment52904438563614617.6%15.3%14.0% Net Intangible Assets50389497764373616.7%17.4%16.9% Total Long Term Investments2965264918621.0%0.9%0.7% Other Non-Current Assets131381472374424.4%5.1%2.9% Total Assets301311286556258848100.0%100.0%100.0% Financial Liabilities, Current3749551639981.2%1.9%1.5% Provisions, Current7874683061032.6%2.4%2.4% Deferred Liabilities, Current36000326762890511.9%11.4%11.2% Other Current Liabilities10027935187443.3%3.3%3.4% Total Current Liabilities72310694205848824.0%24.2%22.6% Long Term Debt59578666627224219.8%23.3%27.9%

- 25. Capital Lease Obligations, Non- Current7671618855682.5%2.2%2.2% Tax Liabilities, Non-Current2042335410.1%0.1%0.2% Deferred Income/Customer Advances/Billings in Excess of Cost, Non- Current3180453038151.1%1.6%1.5% Payables and Accrued Expenses, Non- Current2943229612302659.8%10.3%11.7% Other Non-Current Liabilities10632758152113.5%2.6%2.0% Total Non-Current Liabilities11069711480611764236.7%40.1%45.4% Total Liabilities18300718422617613060.7%64.3%68.0% Equity Attributable to Parent Stockholders1183041023308271839.3%35.7%32.0% Paid in Capital80552785207122326.7%27.4%27.5% Retained Earnings/Accumulated Deficit34566241501368211.5%8.4%5.3% Reserves/Accumulated Comprehensive Income/Losses3186-340-21871.1%-0.1%-0.8% Total Equity1183041023308271839.3%35.7%32.0% Total Equity and Liabiltiies 301311286556258848100.0%100.0%100.0% MSFT_BalanceSheet_Annua Horizontal 202020192018202020192018 Cash, Cash Equivalents and Short Term Investments136527133819133768102.0%100.0%100.0% Inventories18952063266291.9%77.5%100.0% Trade and Other Receivables, Current320112952426481108.4%111.5%100.0% Other Current Assets11482101466751113.2%150.3%100.0% Total Current Assets181915175552169662103.6%103.5%100.0% Deferred Costs/Assets, Current Net Property, Plant and

- 26. Equipment529044385636146120.6%121.3%100.0% Net Intangible Assets503894977643736101.2%113.8%100.0% Total Long Term Investments296526491862111.9%142.3%100.0% Other Non-Current Assets1313814723744289.2%197.8%100.0% Total Non-Current Assets11939611100489186107.6%124.5%100.0% Total Assets301311286556258848105.1%110.7%100.0% Financial Liabilities, Current37495516399868.0%138.0%100.0% Provisions, Current787468306103115.3%111.9%100.0% Deferred Liabilities, Current360003267628905110.2%113.0%100.0% Other Current Liabilities1002793518744107.2%106.9%100.0% Total Current Liabilities723106942058488104.2%118.7%100.0% Long Term Debt59578666627224289.4%92.3%100.0% Capital Lease Obligations, Non- Current767161885568124.0%111.1%100.0% Tax Liabilities, Non- Current20423354187.6%43.1%100.0% Deferred Income/Customer Advances/Billings in Excess of Cost, Non-Current31804530381570.2%118.7%100.0% Payables and Accrued Expenses, Non- Current29432296123026599.4%97.8%100.0% Other Non-Current Liabilities1063275815211140.2%145.5%100.0% Total Non-Current Liabilities11069711480611764296.4%97.6%100.0% Total Liabilities18300718422617613099.3%104.6%100.0% Equity Attributable to Parent Stockholders11830410233082718115.6%123.7%100.0%

- 27. Paid in Capital805527852071223102.6%110.2%100.0% Retained Earnings/Accumulated Deficit345662415013682143.1%176.5%100.0% Reserves/Accumulated Comprehensive Income/Losses3186-340-2187-937.1%15.5%100.0% Total Equity11830410233082718115.6%123.7%100.0% Total Equity and Liabiltiies 301311286556258848105.1%110.7%100.0% MSFT_Income Statement Verical 202020192018202020192018 Total Revenue143,015 125,843 110,360 100.0%100.0%100.0% Cost of Revenue46,078 42,910 38,353 32.2%34.1%34.8% Gross Profit96,937 82,933 72,007 67.8%65.9%65.2% Selling, General and Administrative Expenses24,709 23,098 22,223 17.3%18.4%20.1% Research and Development Expenses19,269 16,876 14,726 13.5%13.4%13.3% Operating Income/Expenses43,978 39,974 36,949 30.8%31.8%33.5% Total Operating Profit/Loss52,959 42,959 35,058 37.0%34.1%31.8% Non-Operating Income/Expenses, Total77 729 1,416 0.1%0.6%1.3% Pretax Income53,036 43,688 36,474 37.1%34.7%33.1% Provision for Income Tax8,755 4,448 19,903 6.1%3.5%18.0% Net Income from Continuing Operations44,281 39,240 16,571 31.0%31.2%15.0% MSFT_IncomeStatement_Horizontal 202020192018202020192018 Total Revenue143,015 125,843 110,360 113.6%114.0%100.0% Cost of Revenue46,078 42,910 38,353 107.4%111.9%100.0% Gross Profit96,937 82,933 72,007 116.9%115.2%100.0%

- 28. Selling, General and Administrative Expenses24,709 23,098 22,223 107.0%103.9%100.0% Research and Development Expenses19,269 16,876 14,726 114.2%114.6%100.0% Operating Income/Expenses43,978 39,974 36,949 110.0%108.2%100.0% Total Operating Profit/Loss52,959 42,959 35,058 123.3%122.5%100.0% Non-Operating Income/Expenses, Total77 729 1,416 10.6%51.5%100.0% Pretax Income53,036 43,688 36,474 121.4%119.8%100.0% Provision for Income Tax8,755 4,448 19,903 196.8%22.3%100.0% Net Income from Continuing Operations44,281 39,240 16,571 112.8%236.8%100.0% Running Head: MICROSOFT MICROSOFT 2 MICROSOFT Lakisha Trammel GCU 1/12/2021

- 29. In the MD&A of the 2019 annual report, Microsoft highlighted various factors such as increasing revenues, a potential rise in market-share due to new product (Azure), stiff competition and emergence of artificial intelligence (AI) as the main factors influencing its future business viability. According to Microsoft, the future will be influenced by AI and Microsoft is confident that it will expand market share due to its new product called Azure. The four key issues are business, market for equity, the management and exhibits. These four issues have been expanded significantly in the report and a summary is included in this study. The first issue is the exhibit that seeks to disclose the schedules for other reports the periods ending as well as the date of release. Among such include the income statement, balance sheet, cash flow statement, shareholders’ equity statements, reports of independent account firms and finally the notes to financial statement (Nadella & London, 2018). These are most import documents to the investors because they give financial position of the company. It is from her that investors know whether company is making profits or losses. Such documents either scars away investors or invites them in. The second issue is the executive and the management. The company has seven senior management offices. The company is lead by a chief executive officer. Below the chief executive office are five executive vice presidents. The company resident doubles as the chief legal officer. The chief executive office`s name is Satya Nadella who was, according to the 2019 10K report, appoint in the year 2014. The chief marketing officer, one of the vice presidents was appointed in the year 2016. Other vice presidents have always been appointing from the human resource pool that the company has trained over the years. Business: this issue covers the company mission and vision about the future. It is in this section that the company explains its products. Among the products offered by the company include operating system, server application, tools to manage

- 30. server and desktop, video games, cross device productivity application and also business solution application. The ambition that drives the business in the to create more personal computing power, to improve on the artificial intelligent and finally to reinvent productive. The latest of its product is the Azure SQL database where AI is incorporated in server management (Microsoft, 2019). The last issue addressed is the market for registration of the common stock. In this section, the available information is about the prices of the shares sold in the market. In accordance with April 2019, there had been 8, 547, 612 shares that were purchased at $ 122.85 and this was approximated to $ 14.55 billion. The dividend was declared on June 12 the same and after recording on august 15, the were paid on September 12. Each share received $ 0.46 and this total to $ 3.516 billion. The Microsoft continues that $ 7.7 billion was return as repurchases to shareholders. References Fitchett, L. (2019). A Strategic Audit of Microsoft Azure. Microsoft, (2019). Annual Report 2019- Satya Nadella, Chief Executive Officer. Retrieved from https://www.microsoft.com/investor/reports/ar19/index.html Nadella, S., & London, S. (2018). Microsoft’s Next Act. The McKinsey Quarterly. TO:

- 31. FROM: DATE: SUBJECT: Heading 1 Notes: Memos are single-spaced professional documents. However, APA in-text citations and reference pages are still required since you are submitting this for grading. Do not include salutations or closings as part of the memo text as that information is already included in the header, above. Heading 2 Text here…