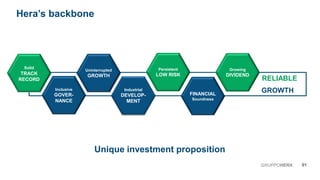

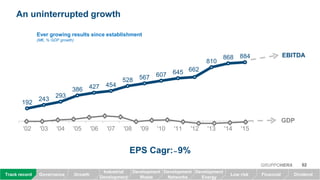

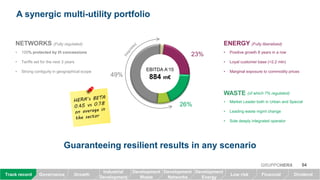

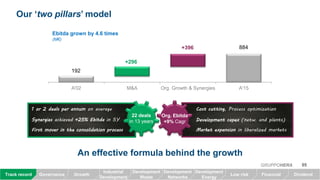

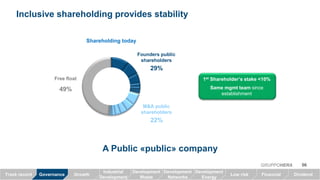

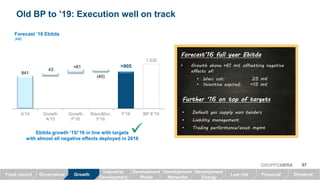

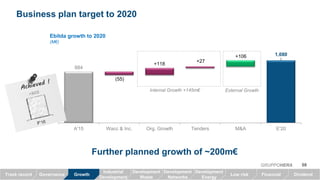

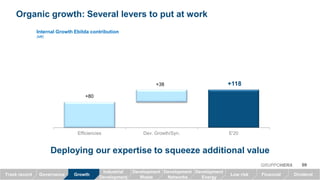

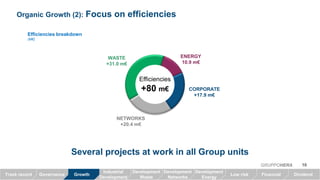

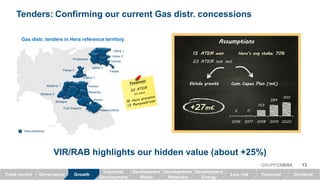

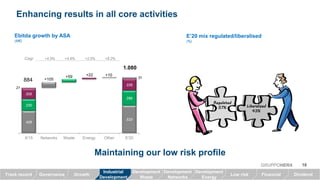

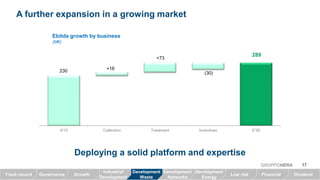

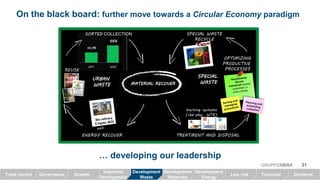

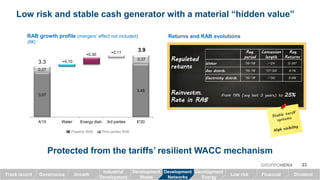

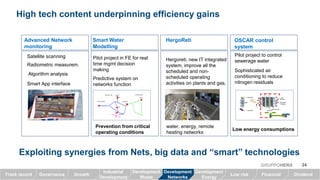

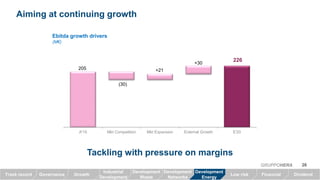

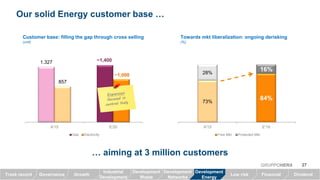

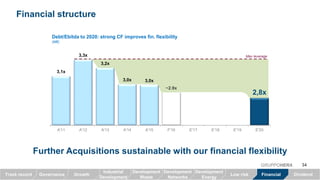

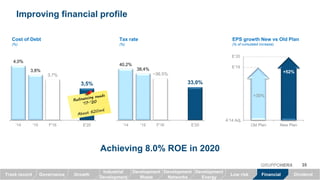

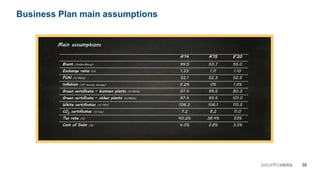

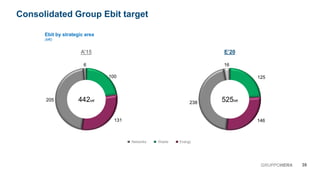

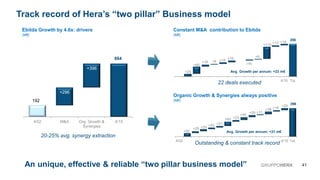

Gruppo Hera provides an investment proposition focused on reliable growth in its core multi-utility business sectors of networks, waste, and energy. It has demonstrated an uninterrupted track record of growth since being established in 2002 through organic growth and acquisitions. The company aims to continue this growth trajectory with its 2020 business plan targeting over 200 million euro in additional EBITDA through organic initiatives and M&A activity focused on its core regions in Northern and Central Italy. Hera maintains a low risk profile through a balanced portfolio across regulated and liberalized sectors.