Operating AssumptionsMatch Valuation Model - Operating Assumptions.docx

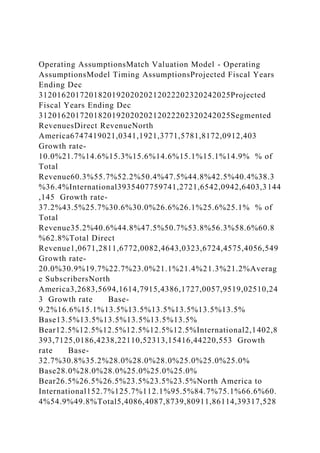

- 1. Operating AssumptionsMatch Valuation Model - Operating AssumptionsModel Timing AssumptionsProjected Fiscal Years Ending Dec 312016201720182019202020212022202320242025Projected Fiscal Years Ending Dec 312016201720182019202020212022202320242025Segmented RevenuesDirect RevenueNorth America6747419021,0341,1921,3771,5781,8172,0912,403 Growth rate- 10.0%21.7%14.6%15.3%15.6%14.6%15.1%15.1%14.9% % of Total Revenue60.3%55.7%52.2%50.4%47.5%44.8%42.5%40.4%38.3 %36.4%International3935407759741,2721,6542,0942,6403,3144 ,145 Growth rate- 37.2%43.5%25.7%30.6%30.0%26.6%26.1%25.6%25.1% % of Total Revenue35.2%40.6%44.8%47.5%50.7%53.8%56.3%58.6%60.8 %62.8%Total Direct Revenue1,0671,2811,6772,0082,4643,0323,6724,4575,4056,549 Growth rate- 20.0%30.9%19.7%22.7%23.0%21.1%21.4%21.3%21.2%Averag e SubscribersNorth America3,2683,5694,1614,7915,4386,1727,0057,9519,02510,24 3 Growth rate Base- 9.2%16.6%15.1%13.5%13.5%13.5%13.5%13.5%13.5% Base13.5%13.5%13.5%13.5%13.5%13.5% Bear12.5%12.5%12.5%12.5%12.5%12.5%International2,1402,8 393,7125,0186,4238,22110,52313,15416,44220,553 Growth rate Base- 32.7%30.8%35.2%28.0%28.0%28.0%25.0%25.0%25.0% Base28.0%28.0%28.0%25.0%25.0%25.0% Bear26.5%26.5%26.5%23.5%23.5%23.5%North America to International152.7%125.7%112.1%95.5%84.7%75.1%66.6%60. 4%54.9%49.8%Total5,4086,4087,8739,80911,86114,39317,528

- 2. 21,10525,46730,796 Growth rate- 18.5%22.9%24.6%20.9%21.4%21.8%20.4%20.7%20.9%ARPUN orth America0.210.210.220.220.220.220.230.230.230.23 Growth rate- 0.7%4.4%(0.5%)1.5%1.8%1.0%1.4%1.4%1.3%International0.18 0.190.210.190.200.200.200.200.200.20 Growth rate- 3.4%9.7%(7.0%)2.1%1.6%- 1.1%0.8%0.4%0.1%Total0.200.200.210.200.210.210.210.210.21 0.21 Growth rate- 1.3%6.5%(3.9%)1.5%1.4%(0.5%)0.8%0.5%0.2%Indirect RevenueIndirect Revenue51495343434344464748 Growth rate- -2.6%6.6%-17.5%0.0%0.0%2.0%3.0%3.0%3.0% % of Total Revenue4.5%3.7%3.0%2.1%1.7%1.4%1.2%1.0%0.9%0.7%Total Indirect Revenue51495343434344464748 Growth rate- (2.6%)6.6%(17.5%)-%-%2.0%3.0%3.0%3.0%Total GAAP revenuesTotal revenues 1,1181,3311,7302,0512,5073,0753,7164,5025,4526,597Growth rate- 19.0%30.0%18.6%22.2%22.6%20.9%21.1%21.1%21.0%COGS, SG&A, Other ExpensesRevenues 1,1181,3311,7302,0512,5073,0753,7164,5025,4526,597Expense s as % of revenue Cost of revenues Base(17.5%)(21.0%)(23.7%)(25.7%)(23.5%)(24.3%)(24.5%)(24. 1%)(24.3%)(24.3%)Base(23.5%)(24.3%)(24.5%)(24.1%)(24.3%) (24.3%)Bear(25.0%)(25.8%)(26.0%)(25.6%)(25.8%)(25.8%) Selling General & Admin Exp. Base(44.1%)(41.3%)(34.7%)(33.3%)(36.4%)(34.8%)(34.8%)(35. 4%)(35.0%)(35.1%)Base(36.4%)(34.8%)(34.8%)(35.4%)(35.0%) (35.1%)Bear(38.4%)(36.8%)(36.8%)(37.4%)(37.0%)(37.1%) Stock-Based Compensation(0.2%)(1.0%)(0.0%)-%-%-%-%-%- %-% R & D Exp.(7.0%)(7.6%)(7.6%)(7.4%)(7.5%)(7.5%)(7.5%)(7.5%)(7.5% )(7.5%) Other operating expenses-%-%-%-%-%-%-%-%-%- %EBITDA Margin31.2%29.1%33.9%33.6%(90.7%)(88.3%)(88.9%)(89.3%) (88.8%)(89.0%)Working CapitalAccounts receivable (% of

- 3. revenues)5.7%8.8%5.7%5.7%7.4%6.9%7.3%7.9%8.1%8.6%Une arned Revenue (% of revenues)14.4%14.9%12.1%10.7%12.6%11.8%11.7%12.0%11.8 %11.8%Accounts payable (% of cost of revenues)(3.8%)(3.6%)(2.3%)(3.8%)(3.3%)(3.1%)(3.4%)(3.3%)( 3.3%)(3.3%)Accrued expenses (% of cost of revenues)(26.3%)(21.2%)(19.3%)(33.9%)(24.8%)(26.0%)(28.2 %)(26.3%)(26.9%)(27.1%)working capital -77.5-146.7-198.6- 207.0-200.4-274.0-355.4-410.7-506.8-609.4PP&E, Depreciation and Capex AssumptionsNet PP&E as % of Revenues5.6%4.6%3.4%5.3%5.4%5.4%5.5%5.5%5.5%5.5%Dep reciation as % of Net PP&E(44.0%)(53.0%)(56.5%)(29.7%)(45.0%)(45.0%)(45.0%)(4 5.0%)(45.0%)(45.0%)Capex as % of revenues(4.1%)(2.2%)(1.8%)(1.9%)(3.0%)(3.0%)(3.0%)(3.0%)( 3.0%)(3.0%)PP&E beginning balance (net)109135167203247299Depreciation28333332496175911111 35Capex(46)(29)(31)(39)(75)(92)(111)(135)(164)(198)PP&E ending balance (net)636258109135167203247299363DebtTotal Debt ending balance1,1761,2531,5161,6031,9322,3942,7453,2954,0154,819I nterest expense(82)(78)(73)(92)(111)(137)(157)(188)(230)(276)Interest expense as % of total debt(7.0%)(6.2%)(4.8%)(5.7%)(5.7%)(5.7%)(5.7%)(5.7%)(5.7% )(5.7%)New issuance4005252603906377137661,0031,2351,465New issuance as % of Operating expenses69.7%79.0%35.5%46.7%57.8%54.8%48.7%52.0%53.3 %52.2%Debt repayment1445- 0300308251415453515662Debt repayment as % of total debt37.8%- %19.8%19.2%13.0%17.3%16.5%15.6%16.5%Total debt beginning balance1,1761,2531,5161,6031,9322,3942,7453,2954,015Other AssumptionsAmortization as of % Goodwill and Intangibles(1.2%)(0.1%)(0.1%)(0.6%)-0.3%-0.3%-0.4%-0.3%-

- 4. 0.3%-0.4%TaxesTax Rate26.1%(41.2%)3.0%3.7%20.0%20.0%20.0%20.0%20.0%20.0 % FinancialsMatch Valuation Model - FinancialsHistorical and Projected Income StatementProjected Fiscal Years Ending Dec 31($ in millions of U.S. dollars except per share amounts)2016201720182019202020212022202320242025Total Direct Revenue1,0671,2811,6772,0082,4643,0323,6724,4575,4056,549 Total Indirect Revenue51495343434344464748Total GAAP accounting revenues1,1181,3311,7302,0512,5073,0753,7164,5025,4526,597 Cost of revenues(196)(279)(410)(527)(588)(747)(910)(1,084)(1,324)(1, 602)Gross profit9221,0511,3201,5241,9192,3282,8063,4184,1284,995Marg in82.5%79.0%76.3%74.3%76.5%75.7%75.5%75.9%75.7%75.7% Selling General & Admin Exp.(493)(550)(600)(682)(913)(1,070)(1,294)(1,592)(1,908)(2,3 13)Stock-Based Compensation(2)(13)(1)-------R & D Exp.(78)(101)(132)(152)(189)(231)(278)(339)(410)(495)Other operating expenses---------- EBITDA3493875876908161,0271,2331,4881,8112,187Margin31 .2%29.1%33.9%33.6%32.6%33.4%33.2%33.0%33.2%33.1%Dep reciation(28)(33)(33)(32)(49)(61)(75)(91)(111)(135)Amort. of Goodwill and Intangibles(17)(1)(1)(9)(4)(5)(6)(5)(5)(5)EBIT30435355364976 39611,1531,3921,6952,047Margin27.2%26.5%32.0%31.6%30.4 %31.3%31.0%30.9%31.1%31.0%16%57%17%18%26%20%21% 22%21%Interest expense(82)(78)(73)(92)(111)(137)(157)(188)(230)(276)Interest income--5-------Currency Exchange Gains (Loss)20(10)5------- Other Non-Operating Inc. (Exp.)(1)(13)(2)(2)------Earnings before taxes2412524885556538249961,2031,4651,771Tax expense(63)104(15)(20)(131)(165)(199)(241)(293)(354)Net income (loss)1783564735345226597979631,1721,417Earnings

- 5. of Discontinued Ops.(6)(6)(0)-------Minority interest(1)(0)50--- ---Net income attributable to company1713504785355226597979631,1721,417Basic shares outstanding252264277280280280280280280280Diluted shares outstanding270296297295295295295295295295Diluted earnings (loss) per share0.641.181.611.811.772.232.703.263.974.80xHistorical and Projected Cash Flow StatementProjected Fiscal Years Ending Dec 312016201720182019202020212022202320242025Funds From Operating ActivitiesNet income (loss)1713504785355226597979631,1721,417Depreciation And Amortization4534344153658196116140Stock-Based Compensation52696690------Net Cash From Discontinued Ops.4(6)--------Other Operating Activities(17)(85)(24)1(33)4863297079Change in Acc. Receivable(11)(52)17(18)(69)(26)(60)(85)(86)(123)Change in Acc. Payable(24)(17)2129(1)484810Change in Unearned Rev.1933139964871107104136Change in Inc. Taxes30(1)13(4)- -----Change in Other Net Operating Assets(5)(11)(15)(24)------ Cash flow from operating activities2643156036585697999591,1141,3841,659Funds From Investing ActivitiesCapital Expenditure(46)(29)(31)(39)(75)(92)(111)(135)(164)(198)Cash Acquisitions(1)(0)1(4)------Divestitures-96--------Invest. in Marketable & Equity Securt.1151(4)-------Net (Inc.) Dec. in Loans Originated/Sold----------Other Investing Activities4(0)(4)1------Cash flow from investing activities(31)118(38)(42)(75)(92)(111)(135)(164)(198)Funds From Financing ActivitiesShort Term Debt Issued----------Long- Term Debt Issued4005252603906377137661,0031,2351,465Total Debt Issued4005252603906377137661,0031,2351,465Short Term Debt Repaid----------Long-Term Debt Repaid(450)(445)- (300)(308)(251)(415)(453)(515)(662)Total Debt Repaid(450)(445)- (300)(308)(251)(415)(453)(515)(662)Issuance of Common

- 6. Stock39590-------Repurchase of Common Stock(30)(254)(341)(420)------Common Dividends Paid---------- Special Dividend Paid--(556)-------Other Financing Activities(21)(309)(12)(7)------Cash flow from financing activities(61)(424)(650)(337)329461351550721803Effect of exchange rate on cash(6)10(2)(1)------Beginning cash balance882542731874661,2882,4563,6545,1837,124Change in cash & equivalents16619(86)2798221,1681,1981,5291,9412,265Ending cash balance2542731874661,2882,4563,6545,1837,1249,389CheckO KOKOKOKOKOKOKOKOKOKSupplemental ItemsCash Interest Paid827271NACash Taxes Paid441522NALevered Free Cash Flow61328422448Unlevered Free Cash Flow112377468506Change in Net Working Capital131(69)(52)(8)Net Debt Issued(50)8026090Net Cash From Discontinued Ops. - Investing(4)(1)--xHistorical and Projected Balance Sheet StatementProjected Fiscal Years Ending Dec 312016201720182019202020212022202320242025CheckOKOK OKOKOKOKOKOKOKOKAssetsCurrent AssetsCash & equivalents2542731874661,2882,4563,6545,1837,1249,389Acco unts Receivable, Net6411799116186212272357443565Deferred Income Tax Asset (Short-Term)131619-------Other Current Assets160393894949494949494Short-Term Investments--------- -Total Current Assets4904453446761,5682,7624,0205,6347,66110,048Net PP&E636258109135167203247299363Goodwill and other intangibles1,4241,4781,4821,4681,4641,4591,4541,4491,4441,4 39Other Noncurrent Assets11112524242424242424Long-term Investment551195555555Deferred Income Tax Asset (Long- Term)5123134141141141141141141141Total Assets2,0492,1302,0532,4243,3374,5585,8477,5009,57412,020 Liabilities & Shareholders EquityCurrent LiabilitiesAccounts Payable7101020192331354353Accrued Exp.515979179146194257286356435Curr. Port. of LT Debt-----

- 7. -----Unearned Revenue, Current161198210219315363434541645781Other Current Liabilities945157-------Total Current Liabilities3143193554184805807228621,0441,269Long-Term Debt1,1761,2531,5161,6031,9322,3942,7453,2954,0154,819Def. Tax Liability, Non-Curr.25282018181818181818Other Non- Current Liabilities30233664646464646464Total Liabilities1,5461,6231,9272,1032,4943,0563,5484,2385,1416,16 9Common Stock0000000000Additional Paid-in Capital49181---- ----Retained Earnings (Accumulated Deficit)1825324549891,5112,1702,9673,9295,1016,519Treasury Stock--(134)(350)(350)(350)(350)(350)(350)(350)Accumulated Other Comprehensive Income(176)(112)(195)(319)(319)(319)(319)(319)(319)(319)Tot al Common Equity4975011263208421,5022,2983,2614,4335,850Minority Interest66-1111111Total Shareholders' Equity5035071263218431,5022,2993,2624,4345,851Total Liabilities & Shareholders' Equity2,0492,1302,0532,4243,3374,5585,8477,5009,57512,020 CheckOK`OKOKOKOKOKOKOKOKOK ValuationMatch Valuation ModelAssumptionsFinancials SummaryHistoricalProjected Fiscal Years Ending March 3110- Year US Treasury0.64% Yunzhi FENG: Yunzhi FENG: Last updated on May 6, 2020. Data source: FRED Forecast Summary20192020202120222023202420251.0Expected Market Return6.67%Revenues2,0512,5073,0753,7164,5025,4526,5971.0 Market Risk Premium6.03% Yunzhi FENG: Yunzhi FENG: Last updated on May 1, 2020. Data source: Aswath Damodaran WebsiteRevenue Growth Rate18.6%22.2%22.6%20.9%21.1%21.1%21.0%1.0Beta1.02EBI

- 8. TDA6908161,0271,2331,4881,8112,1871.0CAPM Cost of Equity6.8%EBITDA Growth Rate17.5%18.4%25.8%20.1%20.6%21.7%20.8%1.0Cost of Debt5.9%EBITDA Margin33.6%32.6%33.4%33.2%33.0%33.2%33.1%1.0Tax Rate25.0%Net income5345226597979631,1721,4171.0After-tax Cost of Debt4.5%NI Growth Rate13.0%(2.3%)26.3%20.8%20.8%21.8%20.9%1.0Target Gearing10.0% NI Margin26.1%20.8%21.4%21.4%21.4%21.5%21.5%1.0WACC6.6 %1.01.0Valuation date5-May-201.0Next year end date31-Dec- 201.01.01.0Match Valuation Model - Discounted Cash Flow Valuation1.0FCFF Valuation 1.0($ in millions of U.S. dollars except per share amounts)Projected Fiscal Years Ending March 311.0Free Cash Flows2020202120222023202420251.0EBIT * (1-tax rate)6117699221,1131,3561,6381.0Depreciation And Amortization536581961161401.0Non-cash Interest Adjustment- -----1.0Capex(75)(92)(111)(135)(164)(198)1.0Net Change in Working Capital(7)748155961031.0Free Cash Flows to Firm (FCFF)3831,3522,5854,1326,5409,5161.0Years to Discount0.661.662.663.664.665.661.0Cost of Capital6.6%6.6%6.6%6.6%6.6%6.6%1.0Discount Factor0.960.900.840.790.740.701.0PV Free Cash Flows to Firm (FCFF)3671,2172,1843,2754,8666,6441.01.0FCFF Fair Value Multiple Method1.0EBITDA Multiple16.9x Yunzhi FENG: Yunzhi FENG: Source: Siblis Research, Multiples of EV/EBITDA of Internet companies1.0Terminal Year EBITDA2,1871.0Terminal Value36,9131.0Present Value of Terminal Value27,4611.0Terminal Value as % of Total Value69.8%1.0Present Value of Forecast FCF11,9091.0Forecast Period as % of Total Value30.2%1.0Enterprise Value39,3701.0- Debt(2,098)1.0+ Cash7911.0Equity Value38,0631.0Shares outstanding2831.0Fair Value Share Price134.591.0Current Share Price80Upside68.0%Match Valuation Model - Residual

- 9. Income Valuation1.0Abnormal Earnings Valuation 1.0($ in millions of U.S. dollars except per share amounts)HistoricalProjected Fiscal Years Ending March 311.0Abnormal Earnings20192020202120222023202420251.0Net Income5345226597979631,1721,4171.0Equity Value3208421,5022,2983,2614,4335,8501.0Equity Charge22571021562213011.0Cost of Equity6.8%6.8%6.8%6.8%6.8%6.8%1.0Residual Income5016026958079511,1161.0Years to Discount0.661.662.663.664.665.661.0Cost of Equity6.8%6.8%6.8%6.8%6.8%6.8%1.0Discount Factor0.960.900.840.790.740.691.0PV Residual Income to Equity4795405836347007701.01.0Residual Inome Valuation Method1.0Current Equity Book Value320Growth Rate3%1.0Present Value of Perpetuity with Growth20,9131.0Terminal Value as % of Total Value83.9%1.0Present Value of Forecast Residual Income3,7071.0Forecast Period as % of Total Value14.9%1.0Equity Value24,9401.0Shares outstanding2831.0Fair Value Share Price88.191.0Current Share Price80.100Upside10.1%