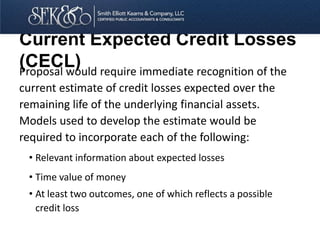

The FASB's exposure draft on the Current Expected Credit Loss (CECL) model proposes a single approach for recognizing credit losses on financial instruments, requiring earlier recognition of losses based on estimated lifetime credit losses. It removes the 'probable' threshold for loss recognition, leading to larger allowances for credit losses than current standards allow, and introduces flexibility in estimation methods for credit losses. While the proposal is principles-based and allows for continued use of existing methodologies, it mandates regular updates to loss allowances without relying solely on significant changes in expected cash flows.