Collapse Of Long Term Management (LTCM)- FIXED INCOME project

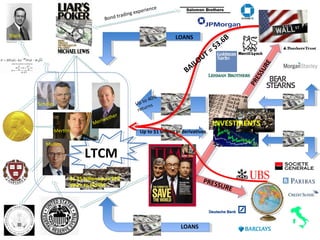

- 1. LTCM BAILOUT = $3.6BLOANS LOANS INVESTMENTS Merton Meriwether Scholes Mullins Black PRESSURE PRESSURE Bond trading experience $1.25 billion up to $7B down to $555M Up to 40% returns Up to $1 trillion in derivatives

- 2. Agenda • Introduction • Strategies • LTCM’s Success • When Genius failed • Counterparties • Bailout-Fed’s Intervention • Lessons Learnt • Conclusion

- 3. Background

- 4. Key Members • John Meriwether who founded Long Term Capital Management 1993. • Fixed Income Trader at Salomon Brothers. • Two Nobel Laureates: Robert Merton and Myron Scholes. • Former Regulator David Mullins. • Had huge respect in Wall Street more than Average Dealer or Broker.

- 5. Strategies • Spread Trades Relative-value trades paired trades Convergence trades • Fixed Income Arbitrage-Yield Curve Trades • Pooled mortgage market Investments • Buying and selling volatility • Merger Arbitrage/Risk Arbitrage Cash Merger Stock Merger

- 6. It was a Game • It was unregulated. • Free to operate in any market. • No capital charges. • Only few reporting to US Securities & Exchange Commission (SEC). • Interest rate swaps on market rate with no initial margin.

- 7. Borrow From a bank Buy Securities with that Cash Borrow From another bank keeping securities as collateral This theory could leverage to infinity

- 8. Background

- 10. Background • The hedge fund incorporated a Delaware limited partnership LTCM L P,but the Fund, LTC Portfolio L P, was a Cayman Islands entity. • By 1997, the equity had risen to $7 billion, but by the beginning of 1998 this had fallen to $4.8 billion ($2.7 billion or 36 percent of its capital having been returned to investors in 1997.

- 11. Borrowings • LTCM borrowed a further $124.5 billion, giving a leverage ratio of 25:1,and the asset base was four times that of the next largest hedge fund. • At that time, most hedge funds did not borrow more than their equity, and it was rare for the leverage ratio to exceed 10:1

- 12. Returns For a few years LTCM offered investors spectacular returns after hefty fees of 2 percent for administration plus an incentive fee of 25 percent.

- 13. The SEC for June 30 1998 showed that LTCM had equity stakes in 77 companies, worth $541 million. It also got into emerging markets , including Russia. Russia was "8% of its book" which would come to $10 billion. Meriwether applied a formula which brought in new investment During 1997, under this formula.

- 14. • UBS put in $800 mn in the form of a loan and $266 mn in straight equity. • Credit Suisse Financial Products put in a $100 mn loan and $33 mn in equity. • Other loans may have been secured in this way, but they haven’t been made public. • Investors in LTCM were pledged to keep in their money for at least two years. • LTCM entered 1998 with its capital reduced to $4.8 bn.

- 16. • In 1997 the fund’s assets had grown to about $120 billion and its capital to about $7.3 billion despite that high leverage—an assets-to-equity ratio of over 16 to 1 • The management concluded that the capital base was too high to earn the rate of return on capital for which they were aiming. • They returned $2.7 billion of capital to shareholders, reducing the capital to $4.8 billion and increasing its leverage ratio to around 25 to 1.

- 17. FACTORS AGAINST LTCM • The time-frame within which rates would converge again • Counterparties had lost confidence in themselves and LTCM. • Many counterparties had put on the same convergence trades, some of them as disciples of LTCM. • Some counterparties saw an opportunity to trade against LTCM’s known or imagined positions ( taking the opposite position). • Most of LTCM’s bets had been variations on the same theme, convergence between liquid treasuries and more complex instruments that commanded a credit or liquidity premium. Unfortunately convergence turned into dramatic divergence and lost $550 million in one day. • Hence LTCM was being forced to liquidate to meet margin calls.

- 18. THE BIG TROUBLE •Big trouble for LTCM started on:- •July 17 1998 when Salomon Smith Barney announced it was liquidating its dollar interest arbitrage positions. That month, the fund dropped about 10% because Salomon Brothers was selling all the things that Long-Term owned.

- 19. RUSSIA DEFAULTS •ON Aug 17, 1998 the Russian government devalued the ruble and declared a moratorium on future debt repayments of $13.5billion. •This lead to the large increases in the spreads between the prices of Western government and emerging market bonds and the fund had bet massively on those spreads’ narrowing. •This resulted the decline of LTCM’s capital down to $2.3 billion at the end of August 1997 and the fund had lost over half of the equity capital it had had at the start of the year. The Assets got reduced to $107 billion from $ 120 billion so its leverage ratio had climbed to over 45 : 1 which is a very high ratio that to in a volatile environment.

- 20. •As its losses mounted, meeting margin calls became difficult for the fund and needed more collateral to ensure that it could meet its obligations to counterparties. •The fund was running short of high-quality assets for collateral to maintain its positions, and it also had great difficulty liquidating its positions: many of its positions were relatively illiquid even in normal times and hence still more difficult to sell in the declining markets. •By September 19 the fund’s capital was down to only $600 million. •The fund had an asset base of $80 billion, and its leverage ratio was approaching stratospheric.

- 21. SWAPS • LTCM had done swap upon swap with 36 different counterparties. • In many cases it had put on a new swap to reverse a position rather than unwind the first swap, which would have required a mark-to-market cash payment in one direction or the other. • LTCM’s on balance sheet assets totalled around $125 billion, on a capital base of $4 billion, a leverage of about 30 times. • But that leverage was increased tenfold by LTCM’s off balance sheet business whose notional principal ran to around $1 trillion.

- 23. 3/1994 1/1995 1/1996 1/1997 1/1998 $4.50 4.00 3.00 2.00 1.00 0.00 Gross value of $1 invested March 1994 - October 1998 in LTCM When Genius Failed pp. xiv Fall down Graph 80% loss over 5 weeksRussia defaults

- 24. • US Fed hearing LTCM problem from Wall Street banks. • Bear stearns (clear house) wanted $500 mn collateral to continue trade.

- 25. Counterparties • 20 Counterparties • Probable Loss of $3 bn. • Looking for single buyer of the portfolio. • AIG was looking to buy. • LTCM’s capital base dwelled $600 mn. • UBS $800 mn credit and $266 mn sent team to study portfolio. • Vice president Peter Fischer, JP Morgan, Merrill Lynch, Goldman sachs and UBS.

- 27. Was LTCM a bailout?

- 28. Counterparties & Bail-out • LTCM borrowed $470 mn from Chase Manhattan Bank. • Fed planned to chip $250 mn from 16 banks to total LTCM’s capital $4 bn. • Warren Buffet offered to Buy portfolio $250 mn & Recapitalize it from: $3 bn from Berkshire Hathaway group $700 mn from AIG $300 mn from Goldman Sachs Condition: John Meriwether and team will have no Management.

- 29. Bail-out • Fed cannot bail-out as LTCM was in Caynes Island. • JP Morgan did not reply. • Bear Stearns denied as it already had lost from it. • Lehman Brothers also denied. • 13 banks left to bail-out at last. • Meriwether left with 10% stake.

- 30. Bail-out Funds Bank Amount Contributed Bankers Trust $300M Barclays 300M Chase 300M CSFB 300M Deutsche Bank 300M Goldman Sachs 300M Merrill Lynch 300M JP Morgan 300M Morgan Stanley 300M Salomon 300M UBS 300M Société Générale 125M Lehman Bros 100M Paribas 100M Bear Stearns $0. (Karma) Total: $3.625B

- 31. The Losers • LTCM partners: $1.1 bn • Liechtenstein Global Trust: $30 mn • Bank of Italy: $100 mn • Credit Suisse: $55 mn • UBS: $690 mn (Biggest Loser) • Merrill Lynch (deferred employees payment): $22 mn • Donald Marron, chairman, Paine Webber: $10 mn • Sandy Well, co-ceo, Citigroup: $10 mn • McKinsey executives: $10 mn • Bear Stearns executives: $10 mn • Dresdner Bank: $145 mn • Sumitomo Bank: $100 mn • Prudential Life Corp: $5.43 mn

- 32. Was LTCM successful (as a bailout)?

- 33. After Story • Mid 1998, LTCM making again profit of $400 mn. • June 1999, 14% up of net fees of members. • Meriwether looking for $4.7 bn fund redeem. • July 1999, LTCM paid $300 mn to original investors who had 9% stake. • $1 bn to 14 consortium members.

- 34. Relevance to Current Crisis • Investment strategies • Market dynamics • Moral hazards

- 35. Lessons The account of collapse of LTCM made us analyze and think of things which were essential to be considered to make sure such type of mistakes doesn’t happen the next time. They are

- 36. Risk Factor Risk is basically anything affecting the efficient performance. Transparency It is basically to deal with relationship management and openness. Trading Credit Taking leverage to multiply the profits. Good ? To a certain level. Frequent Market Analysis A hedge fund should make frequent analysis about market conditions so as to anticipate the worst case scenario since there are lots of risk factor involved in it. Regulations There must be proper regulations to hedge funds as well . Though it is not confined to retail investors it is still public money and something should have a strict enforcement in using the same.

- 37. Risk types •Liquidity Risk Operational efficiency to meet the margin requirements, budgeted planning etc. •Market Risk Market perceptions, factors driving the market, psychological aspects on making a instrument liquid and illiquid etc. •Credit Risk Efficient formulation of credit policies and ensuring lesser deviations, in such formed policies. •Governance Risk Corporate governance, responsibility and regulatory measures. •Operational Risk Maintaining secrecy of operational information, trying to avoid small mistakes as it could lead to bigger problems. •Reputational Risk Maintaining the so earned reputation with good transparency with clients, employees,shareholders, investors etc.

- 38. Reference List • Shirreff, D (n.d.) “Lessons from the Collapse of Hedge Fund, Long-term Capital Management”. • Butler et al (2007) “Long Term Capital Management case study” Cornell University, New York. • Halstead, J,M et al (2005) “Hedge Fund Crisis and Financial Contagion: Evidence from Long Term Capital Management” pp.65-67. • The Trillion Dollar Bet (2000) [Accessed from www.youtube.com on 6’ November’ 2015].

- 39. LTCM BAILOUT = $3.6BLOANS LOANS INVESTMENTS Merton Meriwether Scholes Mullins Black PRESSURE PRESSURE Bond trading experience $1.25 billion up to $7B down to $555M Up to 40% returns Up to $1 trillion in derivatives

Editor's Notes

- DREW Investment strategies -risk hedging -for leveraging -quantitative analysis Moral hazards -Meriwether suffered (at the time he thought he was invincible; how has his behavior changed?) -what should/did Thain, O’Neal etc learn? Market dynamics -transparency for lender/investors -trust in financial experts -beating the markets (more conscious today, ppl knew they were playing the bubble)