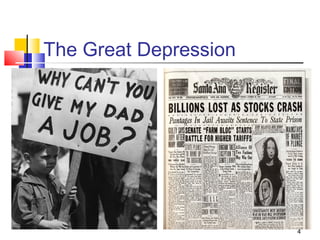

This document provides an overview of the simple Keynesian model of economics. It discusses the model's key assumptions, including that it is a one-sector closed economy model with constant prices and fixed resources in the short run. Equilibrium occurs when aggregate demand (planned expenditure) equals aggregate supply (actual output). The model was developed by John Maynard Keynes to explain unemployment during the Great Depression when demand was weak and actual output fell below potential output.