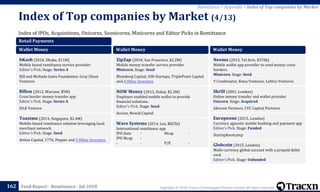

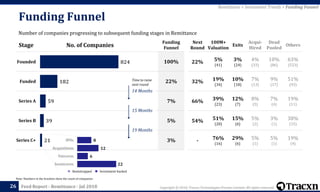

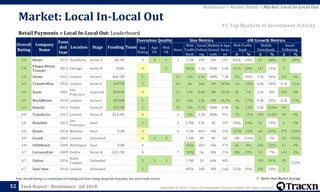

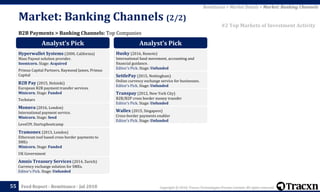

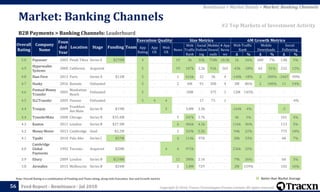

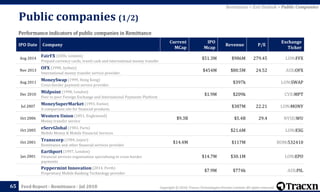

The document provides an overview of the remittance sector and market as of July 2018. It discusses key investment trends, including total funding amounts and notable deals. It also summarizes details on major companies and markets in the sector, including retail payments, B2B payments, enablers, and blockchain companies. The document is a feed report on the remittance sector from Tracxn Technologies.

![Copyright © 2018, Tracxn Technologies Private Limited. All rights reserved.Feed Report - Remittance - Jul 2018

Pantera Capital

74

Portfolio in Remittance | Exits | Funds Link | Website | LinkedIn | Twitter

Remittance > Investors > Pantera Capital

People

Investments

[Soonicorn] Circle (2013, Boston, $246M, Series E)

Digital currency wallet for global money transfers

[Soonicorn] BitPesa (2013, Nairobi, $10M, Series A)

Bitcoin based remittance service provider.

[Minicorn] Veem (2014, San Francisco, $40M, Series B)

B2B payment platform.

[Minicorn] Coins.ph (2013, Manila, $10M, Series A)

Bitcoin wallet for transactions in Philippines

Remittance Notable Portfolio

[Soonicorn] Chain (2014, San Francisco, $43.7M, Series B)

Designing blockchain applications for organizations

[Soonicorn] Xapo (2012, Palo Alto, $40M, Series A)

Cold Storage Vault & Bitcoin Wallet

[Minicorn] Filament (2012, Reno, $35.6M, Series C)

Decentralized Internet of Things stack

[Minicorn] Abra (2014, Mountain View, $30M, Series B)

Fiat money remittance based on bitcoin

[Minicorn] ShapeShift (2014, San Francisco, $12.5M, Series A)

Instant inter crypto currency conversion

[Minicorn] Bitstamp (2011, London, $11.4M, Series A)

European Union bitcoin exchange

[Minicorn] Chronicled (2014, San Francisco, $5.3M, Series A)

Product authentication on blockchain

[Editor's Pick] Basis (2017, Hoboken, $133M, Series B)

Stable Cryptocurrency

[Editor's Pick] Polychain (2016, San Francisco, $10M, Series A)

Protocol level token oriented investment fund.

Other Notable Portfolio

Top Exits

Recent News on Fund & Portfolio

Dan Morehead

Founder & CEO

Geographical Spread Stage of Entry

Jan 2018

Baidu seeks new investors for finance unit in up to $2 bn

deal, BTVI Live

Dec 2017 Circle's CENTRE Raises $20 Million in SAFT Sale, CoinDesk

Nov 2017

Circle to Launch Cryptocurrency Investment App in 2018

, CoinDesk

Oct 2017

Circle enables US Instant withdrawals for cross-border

bank transfers, Finextra

Oct 2017

Circle Acquires Trigger Finance To Help Deliver

Investment Products For Crypto Assets, Inside Bitcoins

Oct 2017

Circle Announces Open Source Project Centre And

Foundation, Coinspeaker

Oct 2017

Circle Is Building a Master Mobile Payments Network on

Ethereum, CoinDesk

Sep 2017

Circle pushes OTC crypto trading, launches in France and

Italy and adds group payments, International Business

Times

Jun 2017

Circle Launches Free Cross-Border Mobile Payments

Based on Blockchain, Crowdfund Insider

Oct 2016

Baidu just set up a $3 billion fund to back maturing

startups, TechCrunch

None

2

1 11

2

1

2013 2014 2015 2016 2017 2018

Follow On New Investments

-

-

1

1

2

Undisclosed

Series C+

Series B

Series A

Seed2

1

1

-

-

US

SEA

Kenya](https://image.slidesharecdn.com/finalremittancelonglist15306191883191-180705054619/85/Tracxn-Remittance-Startup-Landscape-74-320.jpg)

![Copyright © 2018, Tracxn Technologies Private Limited. All rights reserved.Feed Report - Remittance - Jul 2018

Fenway Summer Ventures

75

Portfolio in Remittance | Exits | Funds Link | Website | LinkedIn | Twitter

Remittance > Investors > Fenway Summer Ventures

People

Investments

[Soonicorn] Circle (2013, Boston, $246M, Series E)

Digital currency wallet for global money transfers

[Minicorn] Veem (2014, San Francisco, $40M, Series B)

B2B payment platform.

Remittance Notable Portfolio

[Soonicorn] Prosper (2005, San Francisco, $410M, Series G)

P2P Lending Marketplace

[Soonicorn] Flexport (2013, San Francisco, $304M, Series C)

Online freight forwarder

[Soonicorn] Future Finance (2013, Dublin, $111M, Series C)

Lending platform for Education Loans

[Minicorn] Nav (2012, San Mateo, $103M, Series C)

Business credit monitoring and financing

[Minicorn] MAX Exchange (2009, Atlanta, $18.1M, Series A)

Online peer-to-peer exchange for purchase and sale of residential

mortgage loans

[Minicorn] PayJoy (2015, California, $17.8M, Series A)

Online purchase financing platform.

[Minicorn] Wunder (2013, Boulder, $15.7M, Series B)

Financing for commercial solar PV systems

[Minicorn] Trunomi (2013, San Jose, $9.5M, Series A)

Enterprise KYC and onboarding solutions

[Editor's Pick] RevolutionCredit (2012, Irvine, $14.3M, Series A)

Credit scoring based on consumer behaviour

[Editor's Pick] LedgerX (2014, New York City, $11.4M, Series B)

Institutional derivatives exchange.

Other Notable Portfolio

Top Exits

Recent News on Fund & Portfolio

Raj Date

CEO & MD

Geographical Spread Stage of Entry

Jan 2018

Baidu seeks new investors for finance unit in up to $2 bn

deal, BTVI Live

Dec 2017 Circle's CENTRE Raises $20 Million in SAFT Sale, CoinDesk

Nov 2017

Circle to Launch Cryptocurrency Investment App in 2018

, CoinDesk

Oct 2017

Circle enables US Instant withdrawals for cross-border

bank transfers, Finextra

Oct 2017

Circle Acquires Trigger Finance To Help Deliver

Investment Products For Crypto Assets, Inside Bitcoins

Oct 2017

Circle Announces Open Source Project Centre And

Foundation, Coinspeaker

Oct 2017

Circle Is Building a Master Mobile Payments Network on

Ethereum, CoinDesk

Sep 2017

Circle pushes OTC crypto trading, launches in France and

Italy and adds group payments, International Business

Times

Jun 2017

Circle Launches Free Cross-Border Mobile Payments

Based on Blockchain, Crowdfund Insider

Oct 2016

Baidu just set up a $3 billion fund to back maturing

startups, TechCrunch

None

1

3

2013 2014 2015 2016 2017 2018

Follow On New Investments

-

1

-

-

2

Undisclosed

Series C+

Series B

Series A

Seed3

-

-

-

-

US](https://image.slidesharecdn.com/finalremittancelonglist15306191883191-180705054619/85/Tracxn-Remittance-Startup-Landscape-75-320.jpg)

![Copyright © 2018, Tracxn Technologies Private Limited. All rights reserved.Feed Report - Remittance - Jul 2018

ACE and Company

76

Portfolio in Remittance | Exits | Funds Link | Website | LinkedIn | Twitter

Remittance > Investors > ACE and Company

People

Investments

[Unicorn] TransferWise (2010, London, $397M, Series E)

International money transmitter based on currency swaps

[Editor's Pick] Toastme (2014, Singapore, $2.4M, Seed)

Mobile-based remittance solution leveraging local merchant network.

Remittance Notable Portfolio

[Unicorn] Uber (2009, San Francisco, $22.5B, Series G)

Mobile app that connects passengers with vehicle drivers for hire

[Unicorn] Airbnb (2008, San Francisco, $3.4B, Series F)

Marketplace for vacation rental accommodations

[Unicorn] SpaceX (2002, Hawthorne, $2.2B, Series I)

Reusable Space launch vehicles

[Unicorn] Pinterest (2009, San Francisco, $1.5B, Series G)

Visual social bookmarking service

[Unicorn] WME Entertainment (2009, Beverly Hills, $250M,

Funded)

Talent Agency

[Unicorn] Docker (2008, San Francisco, $243M, Series E)

LXC based OS-level virtualization technology and PaaS

[Soonicorn] ChargePoint (2007, Campbell, $298M, Series G)

EV charging points and charging network operator

[Soonicorn] PlanGrid (2011, San Francisco, $66M, Series B)

Blueprints collaboration on web and mobile for field construction

[Soonicorn] GoCardless (2011, London, $47.5M, Series C)

Online payments solutions for recurring payments

[Soonicorn] GrubMarket (2014, San Francisco, $32.1M, Series B)

Open marketplace for farm to home deliveries

Other Notable Portfolio

Top Exits

Recent News on Fund & Portfolio

Adam Said

Co-Founder & CEO

Christopher Kile

Co-Founder & Board

Member

Geographical Spread Stage of Entry

Dec 2017

A look through TransferWise’s early pitch deck,

TechCrunch

Nov 2017

TransferWise reports doubled revenue for last fiscal year,

AltFi

Oct 2017

TransferWise changes fees for GBP transfers, introduces

complicated flat transaction fees, Tech News Universe

Sep 2017

TransferWise founders to rake in millions from first share

sales, Business Matters

Aug 2017 TransferWise lines up investment round, Finextra

Aug 2017

IVC Poised to Invest in Fintech Unicorn Transferwise,

Crowdfund Insider

Aug 2017

England-based TransferWise brings its 'Borderless' bank

account to Canada, Financial Post

Aug 2017 TransferWise is said to seek new funding round, PE Hub

Aug 2017

Money Transfer Provider TransferWise Links With Apple

Pay, CryptoCoinsNews

Jul 2017

TransferWise CEO Hinrikus steps aside for co-founder

Käärmann, Finextra

Jun 2017

Transferwise Updates on US Business Progress,

Crowdfund Insider

None

1

2013 2014 2015 2016 2017 2018

Follow On New Investments

-

-

-

-

2

Undisclosed

Series C+

Series B

Series A

Seed1

1

-

-

-

Europe

SEA](https://image.slidesharecdn.com/finalremittancelonglist15306191883191-180705054619/85/Tracxn-Remittance-Startup-Landscape-76-320.jpg)

![Copyright © 2018, Tracxn Technologies Private Limited. All rights reserved.Feed Report - Remittance - Jul 2018

500 Startups

123

Portfolio in Remittance | Exits | Funds Link | Website | LinkedIn | Twitter

Remittance > Investors > 500 Startups

People

Investments

[Soonicorn] Flywire (2009, Boston, $43.2M, Series C)

Global money transfer in local currency

[Minicorn] ZipZap (2010, San Francisco, $2.2M, Seed)

Mobile money transfer service provider

Remittance Notable Portfolio

[Unicorn] Grab (2012, Singapore, $4.4B, Series G)

Taxi Booking App

[Unicorn] Credit Karma (2007, San Francisco, $370M, Series D)

Aggregator of various consumer financial products.

[Unicorn] Twilio (2007, San Francisco, $240M, Public)

Cloud Communications API provider

[Unicorn] Canva (2012, Surry Hills, $82.6M, Series B)

Online design platform

[Soonicorn] Udemy (2010, San Francisco, $173M, Series D)

Marketplace for online courses

[Soonicorn] Carousell (2012, Singapore, $172M, Series C)

P2P mobile listing platform

[Soonicorn] Smule (2008, San Francisco, $144M, Series F)

Developer of social music-making & sharing apps

[Soonicorn] Breather (2012, Montreal, $120M, Series D)

On-demand Private Room Reservation

[Soonicorn] Ipsy (2011, San Mateo, $107M, Series B)

Subscription for beauty products

[Soonicorn] Life360 (2008, San Francisco, $89.7M, Series C)

Mobile app that connects family members and close friends

Other Notable Portfolio

Top Exits

Recent News on Fund & Portfolio

Dave McClure

Founder, Partner

Geographical Spread Stage of Entry

Jun 2018

Flywire and UnionPay Partner to Take the Cost Out of

Cross-Border Payments from China, GlobeNewswire

May 2018

EY Names Flywire CEO Entrepreneur of the Year Finalist

in New England, Citybizlist

Nov 2017

Flywire Continues to Expand its Cross-Border Payment

and Receivables Business in the UK and Ireland, Citybizlist

Nov 2017

Flywire Nominated for Global FinTech Award in

Singapore , GlobeNewswire

Oct 2017

Flywire Adds Trustly As Preferred Payment Option,

PYMNTS

Oct 2017

Flywire’s International Payment and Receivables

Business Thrives in Spain, GlobeNewswire

Aug 2017

Flywire Simplifies Compliance with New Cross-Border

Education Payment Requirements in Ireland,

GlobeNewswire

Aug 2017

Flywire Offers Tuition Discounts For Using A Mastercard,

PYMNTS

Aug 2017

Flywire And Volvo Pair Up On Cross-Border Vehicle

Leasing, PYMNTS

None

1 1

2

2

1

2013 2014 2015 2016 2017 2018

Follow On New Investments

4

-

-

1

5

Undisclosed

Series C+

Series B

Series A

Seed7

3

-

-

-

US

SEA](https://image.slidesharecdn.com/finalremittancelonglist15306191883191-180705054619/85/Tracxn-Remittance-Startup-Landscape-123-320.jpg)

![Copyright © 2018, Tracxn Technologies Private Limited. All rights reserved.Feed Report - Remittance - Jul 2018

Startupbootcamp

124

Portfolio in Remittance | Exits | Funds Link | Website | LinkedIn | Twitter

Remittance > Investors > Startupbootcamp

People

Investments

[Minicorn] Kuan (2015, London, $32.6k, Seed)

P2P matching technology based money transfer service provider.

[Minicorn] Monuva (2016, London, Seed)

International payment service.

[Editor's Pick] Toastme (2014, Singapore, $2.4M, Seed)

Mobile-based remittance solution leveraging local merchant network.

[Editor's Pick] Europeone (2015, London, Funded)

Currency agnostic mobile banking and payment app

Remittance Notable Portfolio

[Minicorn] Bellabeat (2012, Mountain View, $18.8M, Series A)

Women health & wellness assistance

[Minicorn] BondIT (2012, Herzliya, $18.2M, Series B)

Bond portfolio management solution

[Minicorn] BabyScripts (2012, Washington D.C., $11M, Series A)

A clinical, mobile prescription for pregnancy assistance

[Minicorn] NarrativeDx (2014, Austin, $6.9M, Series A)

Provides actionable insights from patient narratives

[Minicorn] Mediconecta (2011, Miami, $4.1M, Seed)

online platform for tele-consultation

[Minicorn] Hijro (2014, Lexington, $2.5M, Seed)

Software platform for cross-border B2B trade

[Minicorn] Epiphyte (2013, London, $70.4k, Seed)

Enterprise software for integrating financial institutions with

cryptofinancial networks.

[Minicorn] Virtual Broker (2015, Sofia, Seed)

Software platform for Insurance brokers and consumers

Other Notable Portfolio

Top Exits

Recent News on Fund & Portfolio

Patrick De

Zeeuw

Co-Founder & CEO

Carsten Kolbek

Co-Founder

Alex Farcet

Co-Founder &

Managing Director

Philip Kiracofe

Co-Founder & CEO

Fermin Bueno

Co-Founder &

Managing Partner

Ruud Hendriks

Co Founder

Michael Dooijes

Co-Founder &

Managing Director

Steven Tong

CEO

Geographical Spread Stage of Entry

Jan 2017

Startupbootcamp selects 10 startups for its FinTech

program, Indiatimes

Nov 2016

Online remittance startup Toast raises $1.5m to be a bank

for migrant workers, Tech in Asia

May 2016

Meet the 8 Malaysian startups who will rock TOP100

Echelon Asia!, E27

May 2016

Money-changing app Curren$eek scores top prize at the

Asean Fintech Challenge, E27

Apr 2016

Currency exchange rate aggregator get4x lands in 3 new

cities; allows users to order currency, E27

Jan 2016

Startup Wise Guys announces participants for the B2B

program, EU-Startups

Jan 2016

Startup Wise Guys BusinessTech opens 6th program,

Startup Wise GuysNone

1 1 1

2013 2014 2015 2016 2017 2018

Follow On New Investments

5

-

-

-

2

Undisclosed

Series C+

Series B

Series A

Seed3

3

1

1

-

SEA

Europe

India

US](https://image.slidesharecdn.com/finalremittancelonglist15306191883191-180705054619/85/Tracxn-Remittance-Startup-Landscape-124-320.jpg)

![Copyright © 2018, Tracxn Technologies Private Limited. All rights reserved.Feed Report - Remittance - Jul 2018

Techstars

125

Portfolio in Remittance | Exits | Funds Link | Website | LinkedIn | Twitter

Remittance > Investors > Techstars

People

Investments

[Soonicorn] Remitly (2011, Seattle, $227M, Series D)

Cross-border money transfer using banking networks.

[Minicorn] B2B Pay (2015, Helsinki, Funded)

European B2B payment transfer services

[Editor's Pick] SimbaPay (2013, London, Funded)

Digital money transfer provider to Kenya and Nigeria.

[Editor's Pick] Bridge21 (2014, Denver, Funded)

Bitcoin-based international money transfer

[Editor's Pick] Vala (2015, Tel Aviv, Funded)

Money transfer using marketplace of remitters.

Remittance Notable Portfolio

[Unicorn] Uber (2009, San Francisco, $22.5B, Series G)

Mobile app that connects passengers with vehicle drivers for hire

[Unicorn] Twilio (2007, San Francisco, $240M, Public)

Cloud Communications API provider

[Soonicorn] ClassPass (2011, New York City, $222M, Series C)

Membership programs for fitness classes across multiple gyms

[Soonicorn] Leanplum (2012, San Francisco, $145M, Series D)

Mobile A/B testing, personalization & analytics platform

[Soonicorn] DataRobot (2012, Boston, $125M, Series C)

Automated machine learning platform for data science applications

[Soonicorn] Outreach (2013, Seattle, $125M, Series D)

SaaS based Lead Engagement Tools

[Soonicorn] DigitalOcean (2011, New York City, $124M, Series

B)

Cloud computing platform to build, deploy and scale cloud applications

Other Notable Portfolio

Top Exits

Recent News on Fund & Portfolio

Brad Feld

Co-Founder

David Brown

Co-Founder and co-

CEO

David Cohen

Founder and co-CEO

Geographical Spread Stage of Entry

Jun 2018

Remitly expands C-suite as headcount passes 700, The

Business Journals

Dec 2017

US firm says PH is biggest, most mature remittance

market globally, Newsbytes

Oct 2017

Remitly is raising up to $115M led by Naspers' PayU to

double down on remittances in India, TechCrunch

Sep 2017

Remitly recruits former Xoom exec Nigro as VP of global

business development, Finextra

Jul 2017

Remitly Moving $3 Billion across the Globe with Money

Transfer Platform Customized for Emerging Markets,

Business Wire

Jun 2017

SimbaPay agrees ATM distribution with Interswitch,

Telecompaper

Apr 2017

US payments startup backed by Amazon founder expands

to UK - Tech News, The Star Online

Apr 2017 Remitly arrives in the UK, Finextra

Feb 2017

Remitly doubles annual remittance volumes to $2 billion,

Finextra

Sep 2016

Remitly raises another $38M, adds World Bank’s IFC as it

pushes into emerging markets, TechCrunch

None

1

2013 2014 2015 2016 2017 2018

Follow On New Investments

5

-

-

-

1

Undisclosed

Series C+

Series B

Series A

Seed3

2

1

-

-

Europe

US

Israel](https://image.slidesharecdn.com/finalremittancelonglist15306191883191-180705054619/85/Tracxn-Remittance-Startup-Landscape-125-320.jpg)