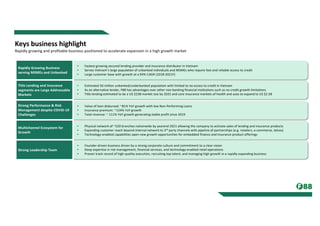

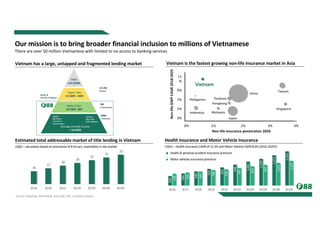

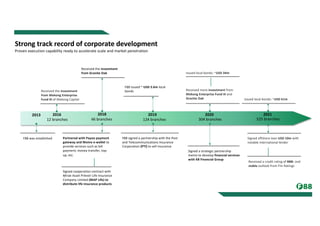

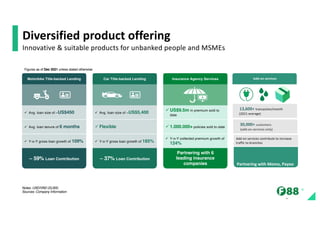

F88 Investment JSC is a rapidly growing financial services firm in Vietnam that provides lending and insurance products. It has over 520 branches nationwide and growing loan and insurance premiums of around 80% and 120% respectively each year. The company aims to serve Vietnam's large unbanked population and sees opportunities in title lending and insurance. It has a strong leadership team and corporate culture focused on its mission of expanding access to financial services in Vietnam.