This document provides an analysis of the key changes to service tax proposed in the Union Budget of 2011-2012.

1. Two new services - restaurant services and hotel/inn/guest house services - have been brought under the service tax net. The scope of 7 existing services has also been modified.

2. Seven new service tax exemptions have been provided and the scope of 3 existing exemptions changed.

3. Several sections of the Finance Act governing service tax have been amended to change interest rates, penalties and introduce prosecution provisions. New Point of Taxation Rules have also been introduced to change the taxation point from cash to mercantile basis.

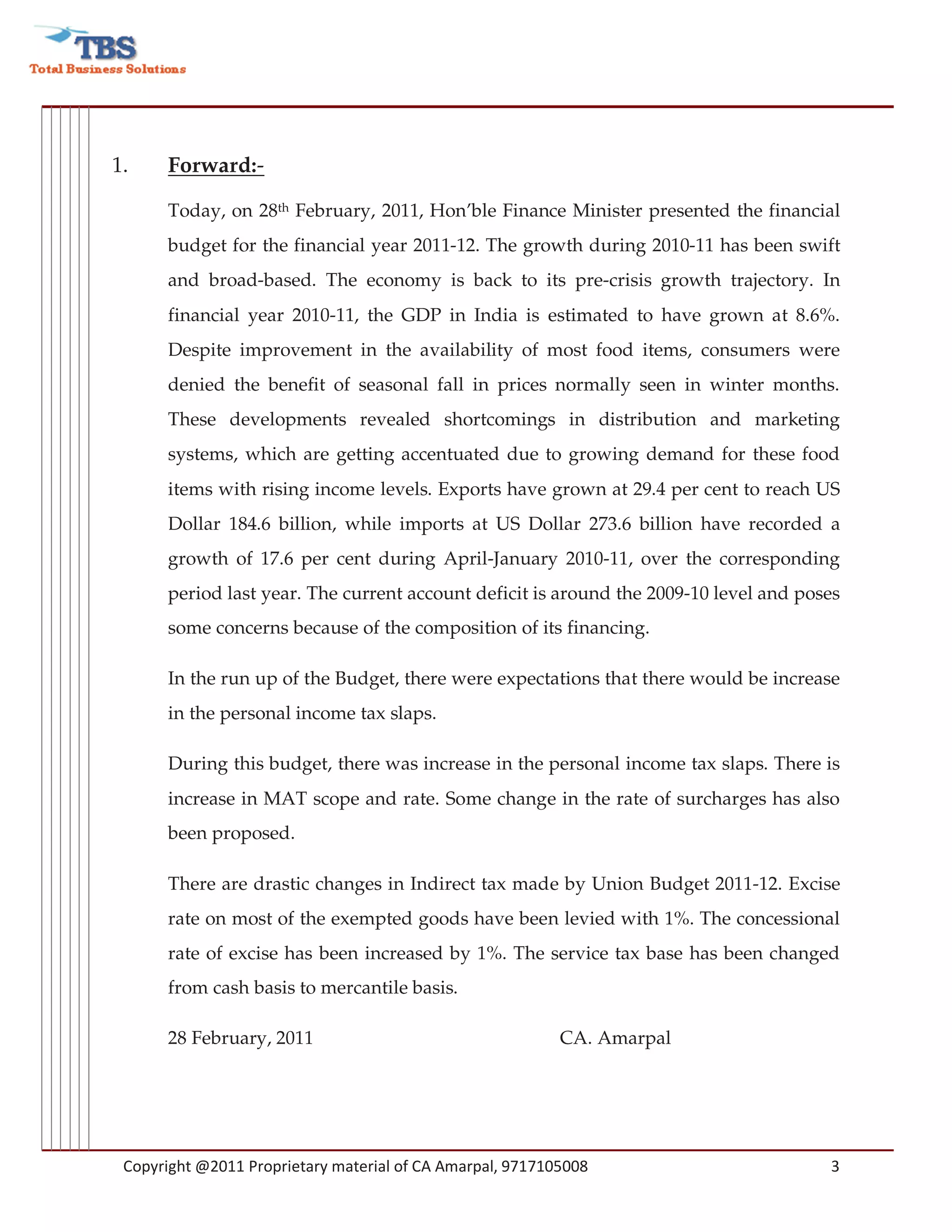

![3. Newly Inserted services

The following new services have been brought under the service tax net:

(I) RESTAURANT SERVICES [65(105)(zzzzv)]

(a) Applicability

The restaurants which have the facility of air-conditioning in any part of the

restaurant, at any point of time during the financial year, have the license to

serve alcoholic beverages.

(b) Scope of the Services

All types of services provided by such restaurant in relation to serving the food

and/or beverages including alcoholic beverages, in its own premises.

(c) Date of Applicability

From the date to be notified after enactment of Finance Bill, 2011

(II) HOTEL, INN, GUEST HOUSE, CLUB ETC SERVICES [65(105)(zzzzw)]

(a) Applicability

All hotels, inn, guest house, club or campsite or any other same type of

establishment providing the accommodation services.

(b) Scope of the Services

Accommodation Services provided for a continuous period of less than 3

months.

(c) Date of Applicability

From the date to be notified after enactment of Finance Bill, 2011

Copyright @2011 Proprietary material of CA Amarpal, 9717105008 5](https://image.slidesharecdn.com/finallecture-110308004820-phpapp01/75/Service-Tax-Analysis-of-Budget-2011-5-2048.jpg)

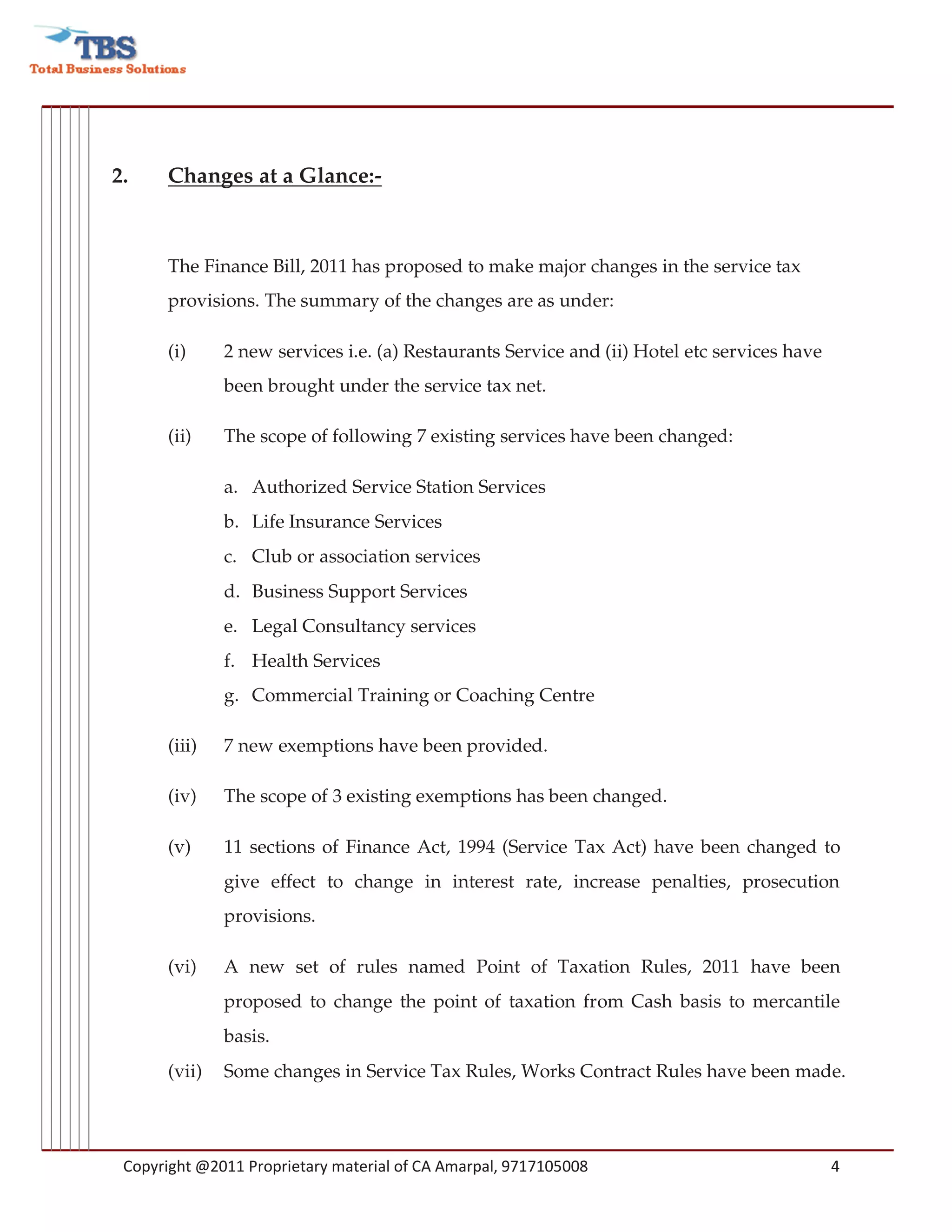

![4. Modification in the scope of existing services

The scope of the following services has been enlarged:

(I) Authorized Service Station Services [Sec. 65(105)(zo)]

The scope of the above services has been enlarged,

a) To cover the services of repair, reconditioning, etc provided by service

stations (whether authorized or not).

b) To cover all services of decoration and similar services along with the services

already covered.

c) However, services provided in relation to (i) 3 wheeler scooter auto-rickshaw,

and (ii) motor vehicles meant for goods carriage, shall not be covered.

(II) Life Insurance Services [Sec. 65(105)(zx)

The scope of the ‘Life Insurance serves’ has been widened to cover all the

services provided to any person provided by any insurer including re-insurer

carrying on life insurance business. Earlier it was limited to the service provided

to policyholders only.

Further more, it is also being provided that tax shall be charged on the portion of

the premium other than what is allocated for investment, when the break-up of

premium is shown separately in any document given to the policy holder.

The composition rate is being increased from 1% to 1.5%.

(III) Club or association service [Sec. 65(105)(zzze)

The scope of club or association services has been extended to cover the services

provided to its non-members along with it members.

Copyright @2011 Proprietary material of CA Amarpal, 9717105008 6](https://image.slidesharecdn.com/finallecture-110308004820-phpapp01/75/Service-Tax-Analysis-of-Budget-2011-6-2048.jpg)

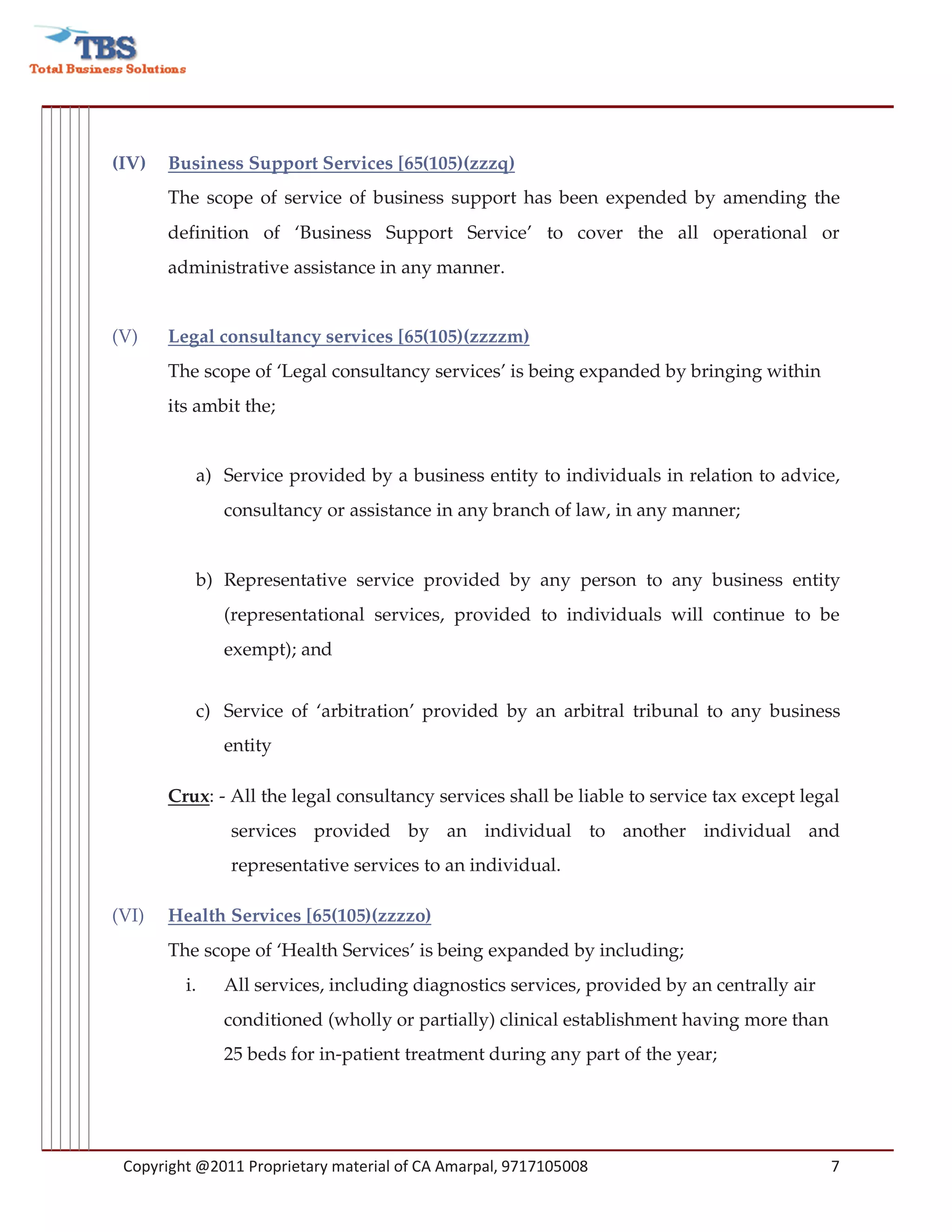

![5. Changes in Service Tax Act

The following changes have been proposed to amend the other provision of

Finance Act, 1994 (Service Tax Act).

(I) Penalty for delay in filing service tax return [Sec. 70]

Section 70 prescribes the maximum penalty in case of delay of return filing. The

maximum penalty, under this section has been increased from Rs. 2,000 to 20,000.

However, the existing rate of penalty per day as prescribed under rule 7C of the

Service Tax Rules are being retained without any change.

(II) Reduction in penalty amount [Sec. 73]

The benefit of reduction of penalty in cases of fraud, collusion etc. which was

available under section 73 has been withdrawn by omitting sub-section (1A) of

section 73 together with both the proviso to sub-section (2) of section.

Further, a new sub-section (4A) is being inserted in section 73 to provide that

reduction of penalty shall be available in cases where during the audit,

verification or investigation, it is found that the transaction not reported to the

department are available in the records or invoices. Moreover, the penalty is

being reduced to 1% per month of tax amount upto a maximum of 25%.

(III) Reduction in interest [Sec. 73B and section 75]

Appropriate provisos has been inserted both in section 73B and section 75 to

reduce the interest rate by 3% for the assessees whose value of taxable services

during the financial year does not exceed Rs. 60 Lakhs.

Copyright @2011 Proprietary material of CA Amarpal, 9717105008 9](https://image.slidesharecdn.com/finallecture-110308004820-phpapp01/75/Service-Tax-Analysis-of-Budget-2011-9-2048.jpg)

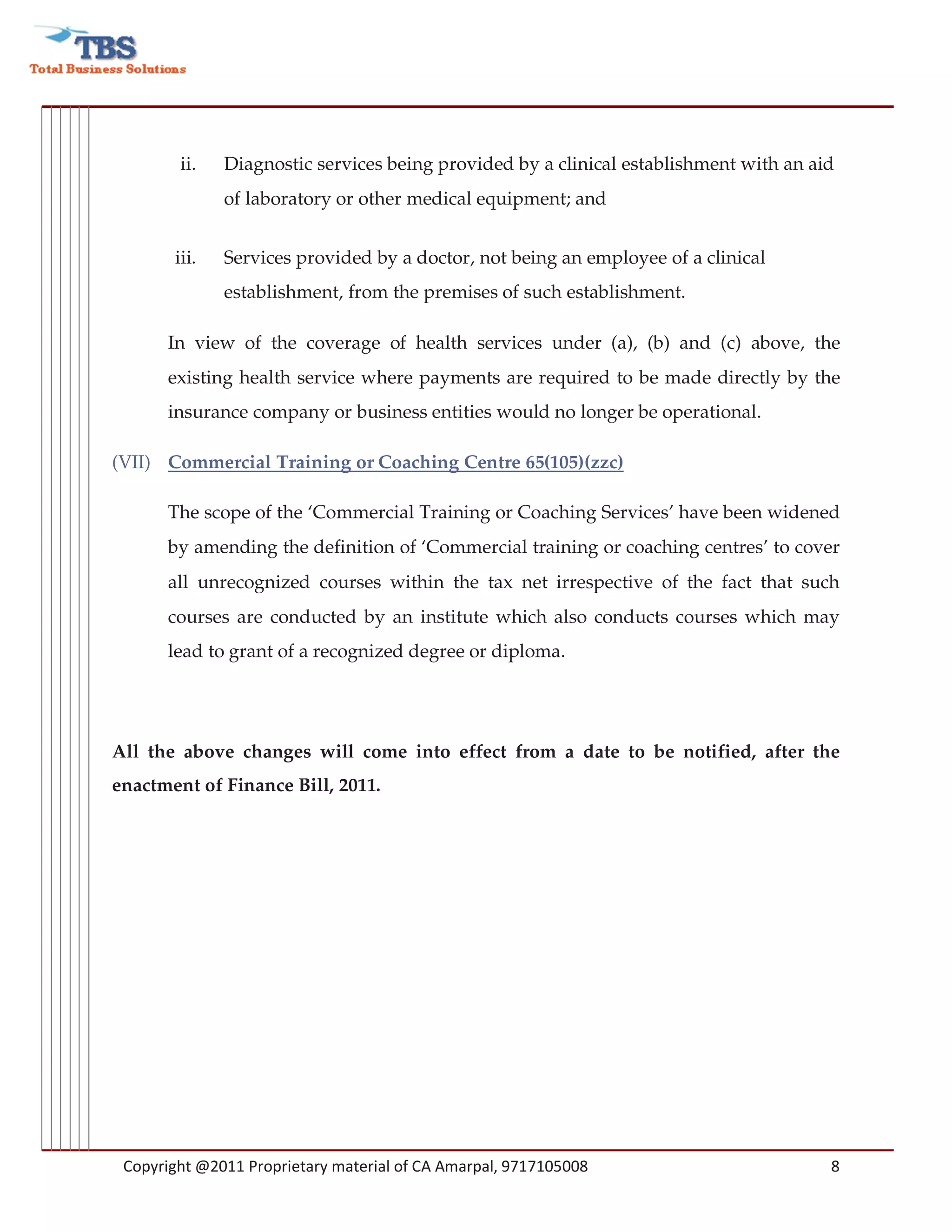

![(IV) Penalty for delay in payment of service tax [Sec.76]

The penalty for delay in making the payment of service tax has been reduced

from Rs. 200 per day to Rs. 100 per day or from 2% to 1% per month whichever is

higher.

Also the maximum penalty has been reduced from 100% to 50% of the tax

amount.

(V) Penalty for contravention of rules and provision of act [Sec. 77]

The penalty prescribed u/s 77 for contravention of rules and provisions of the act

for which no penalty is specified elsewhere, has been increased from Rs. 5,000/-

to Rs. 10,000/-.

(VI) Penalty for suppressing etc of value of taxable services [Sec. 78]

Section 78 has been amended to revise the maximum penalty. Hereafter, penalty

will be mandatory and equal to tax evaded. Moreover, in cases, where the

transactions which are available on records are not reported to the department,

shall be equal to 50% of the tax amount.

Further, the penalty is being reduced to 25% of the tax amount in cases where tax

dues are paid within 30 days along with interest and reduced penalty.

Furthermore, for assessees whose value of taxable services during the any year

covered by the SCN does not exceed Rs. 60 Lakhs, the period of 30 days shall be

revised to 90 days.

Copyright @2011 Proprietary material of CA Amarpal, 9717105008 10](https://image.slidesharecdn.com/finallecture-110308004820-phpapp01/75/Service-Tax-Analysis-of-Budget-2011-10-2048.jpg)