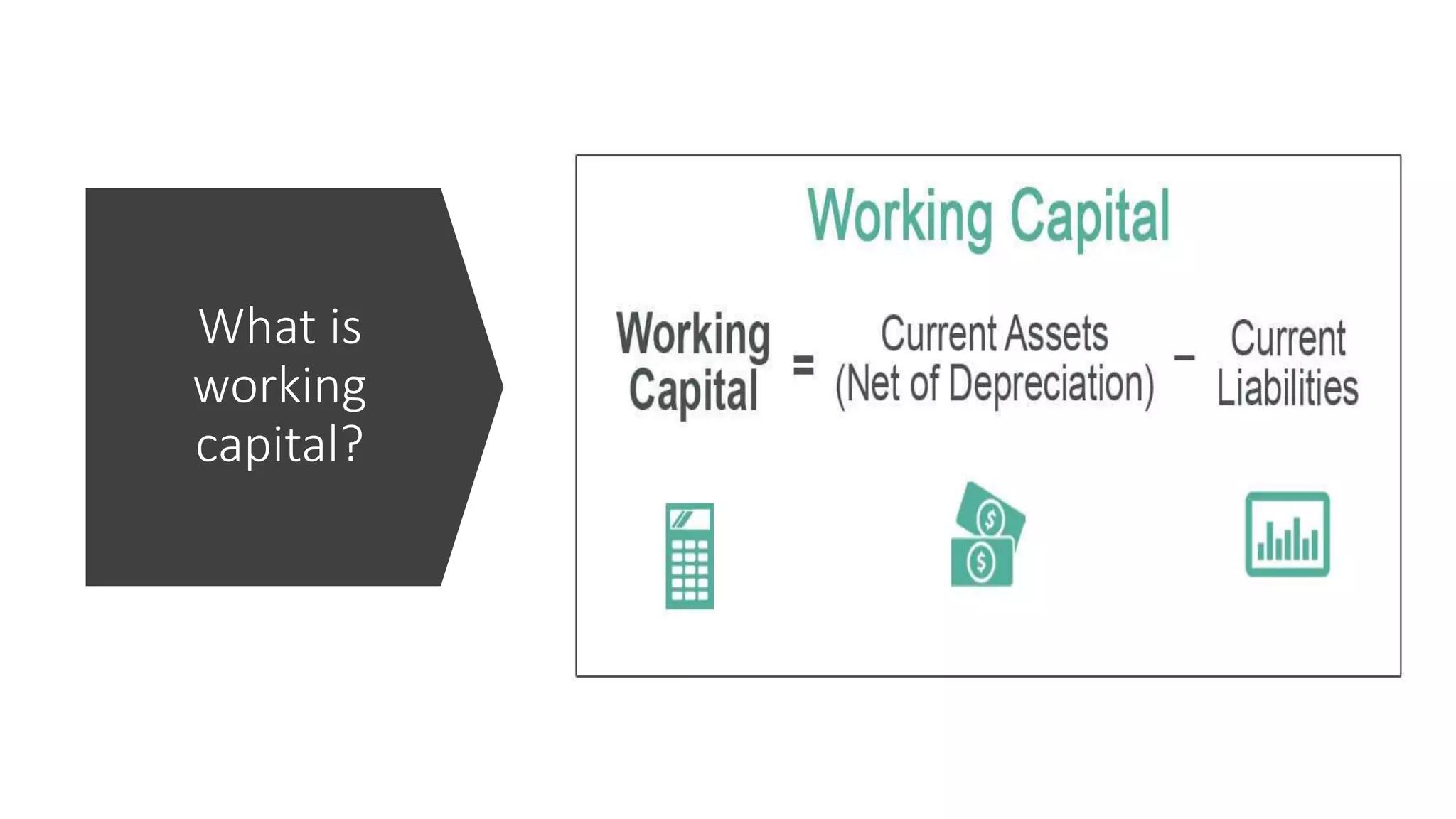

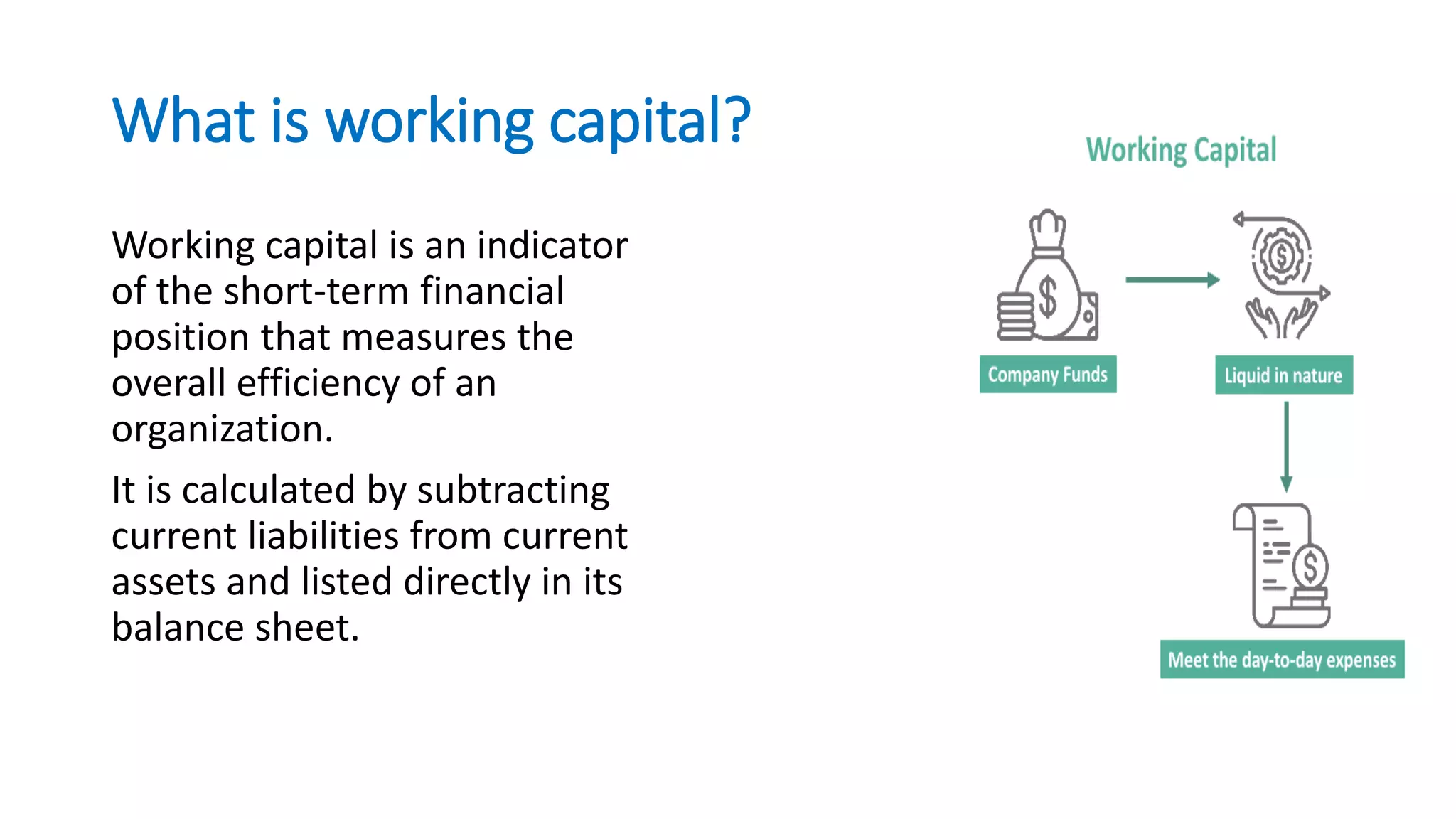

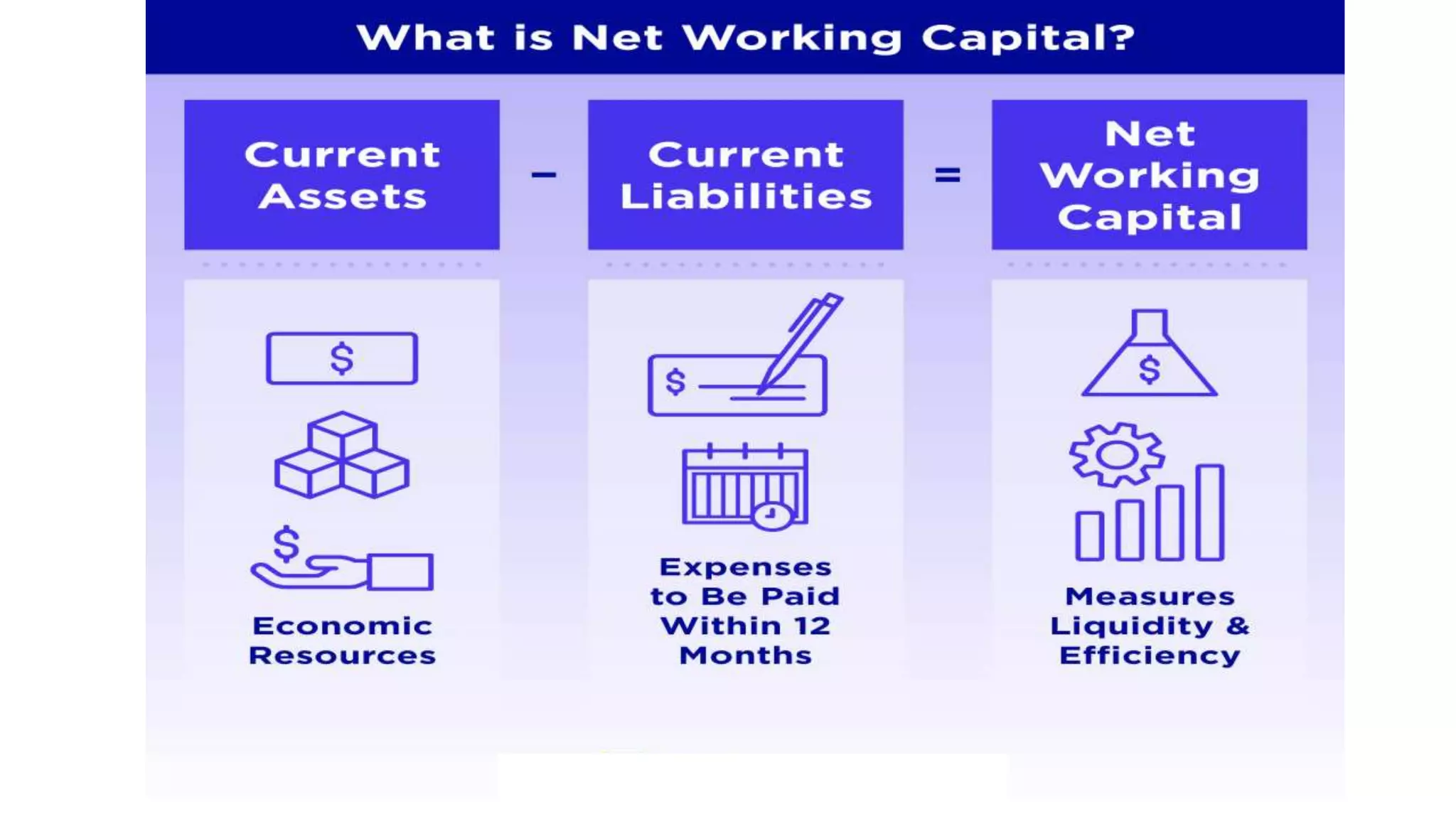

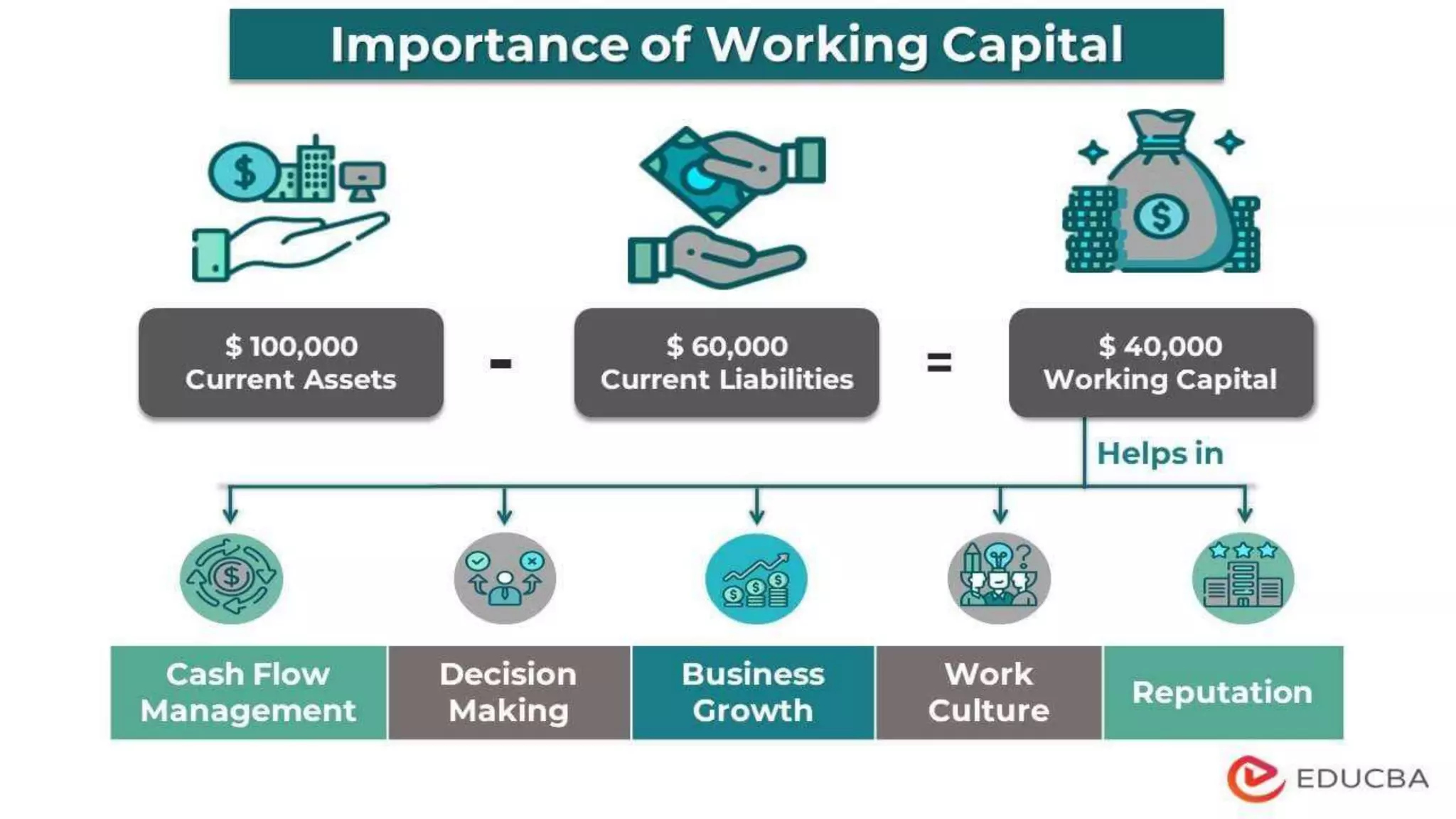

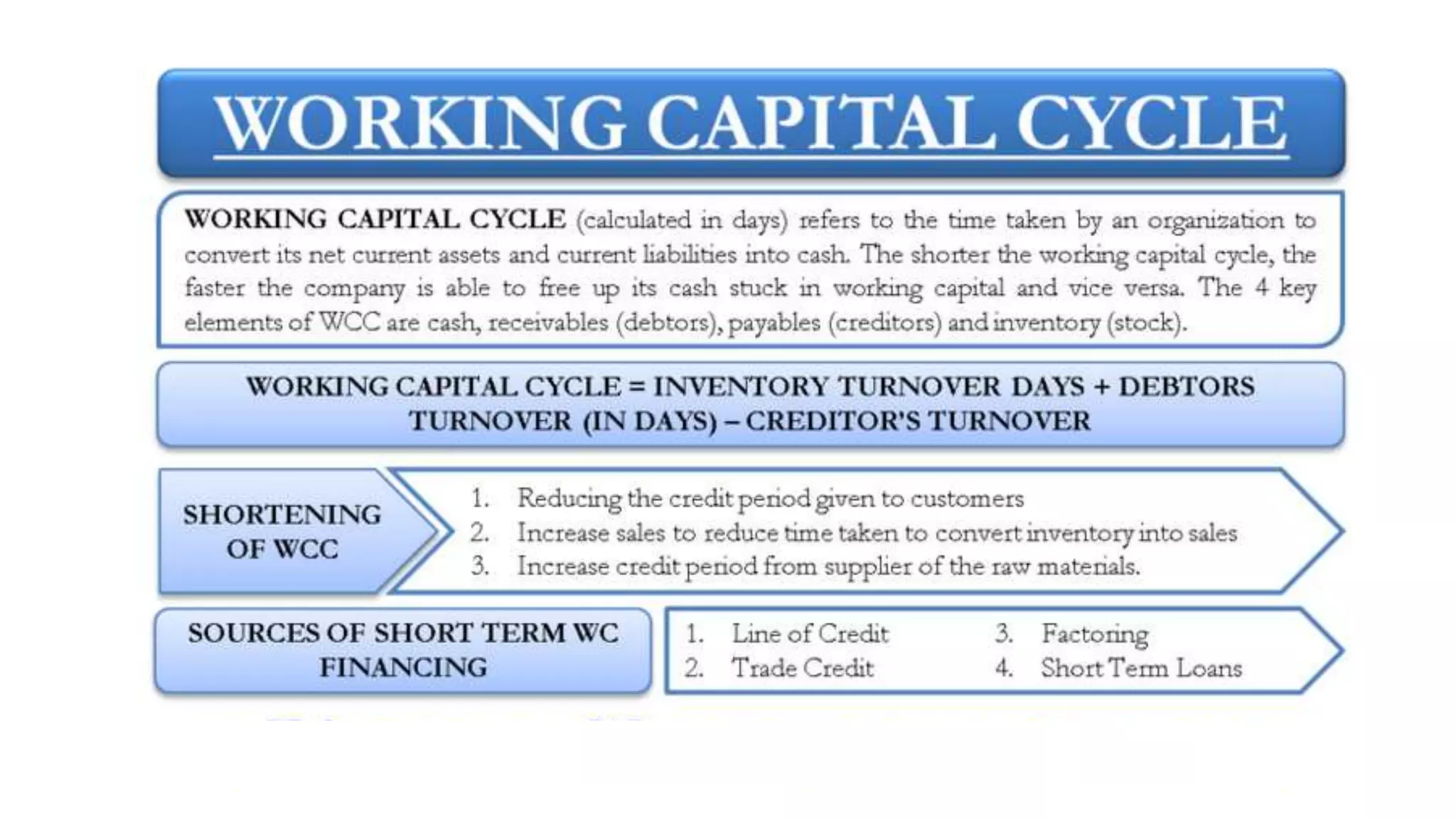

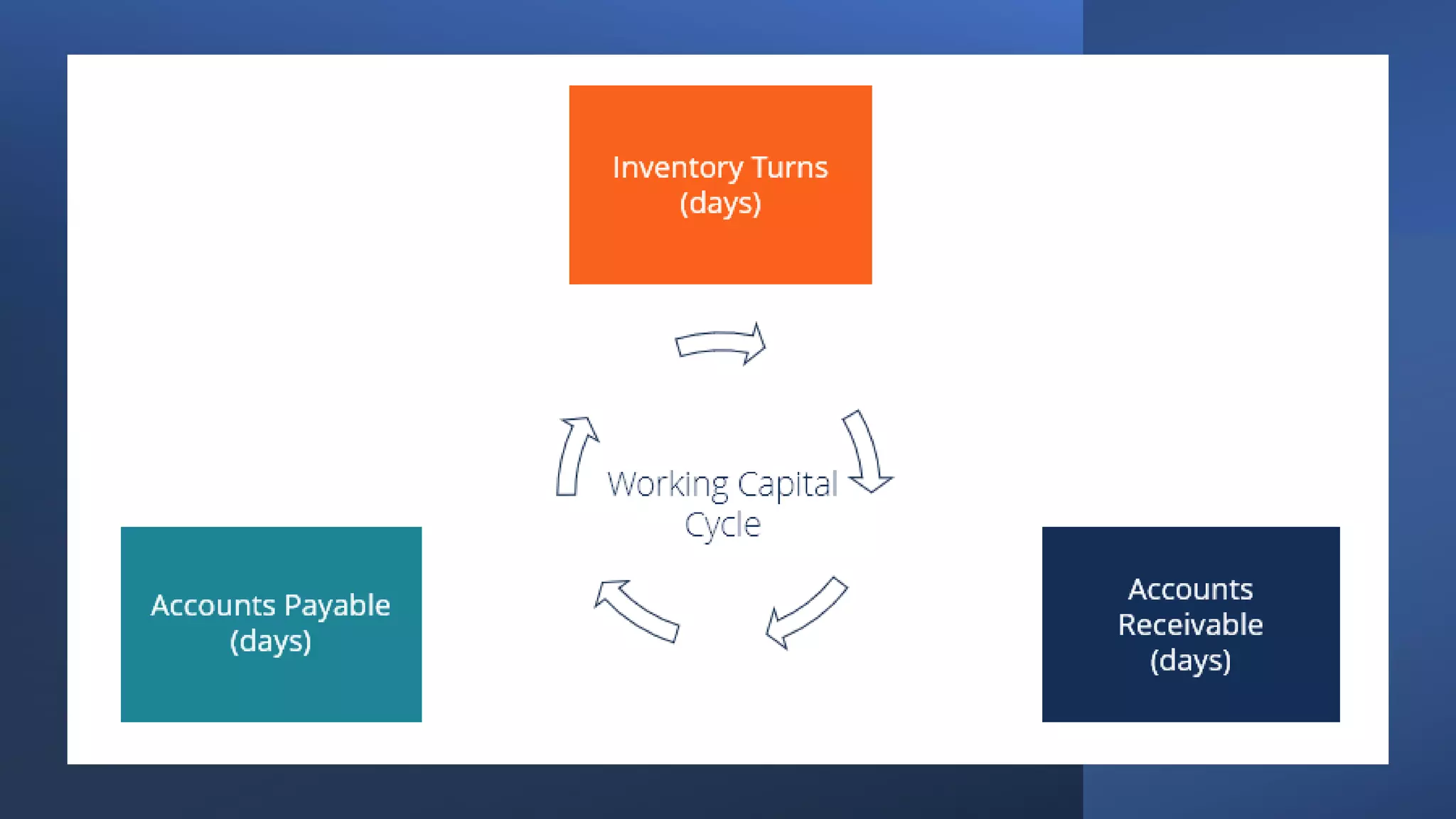

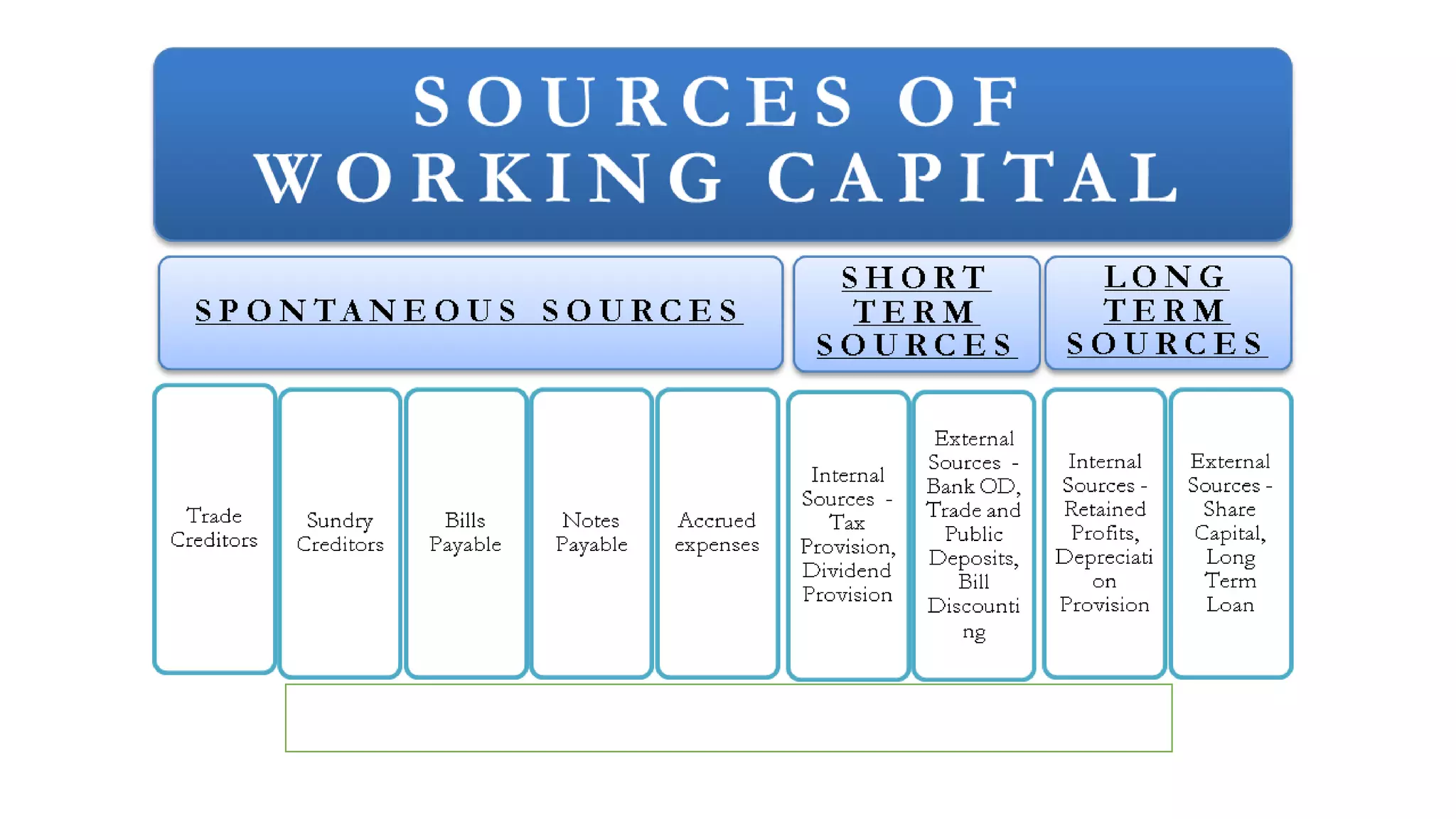

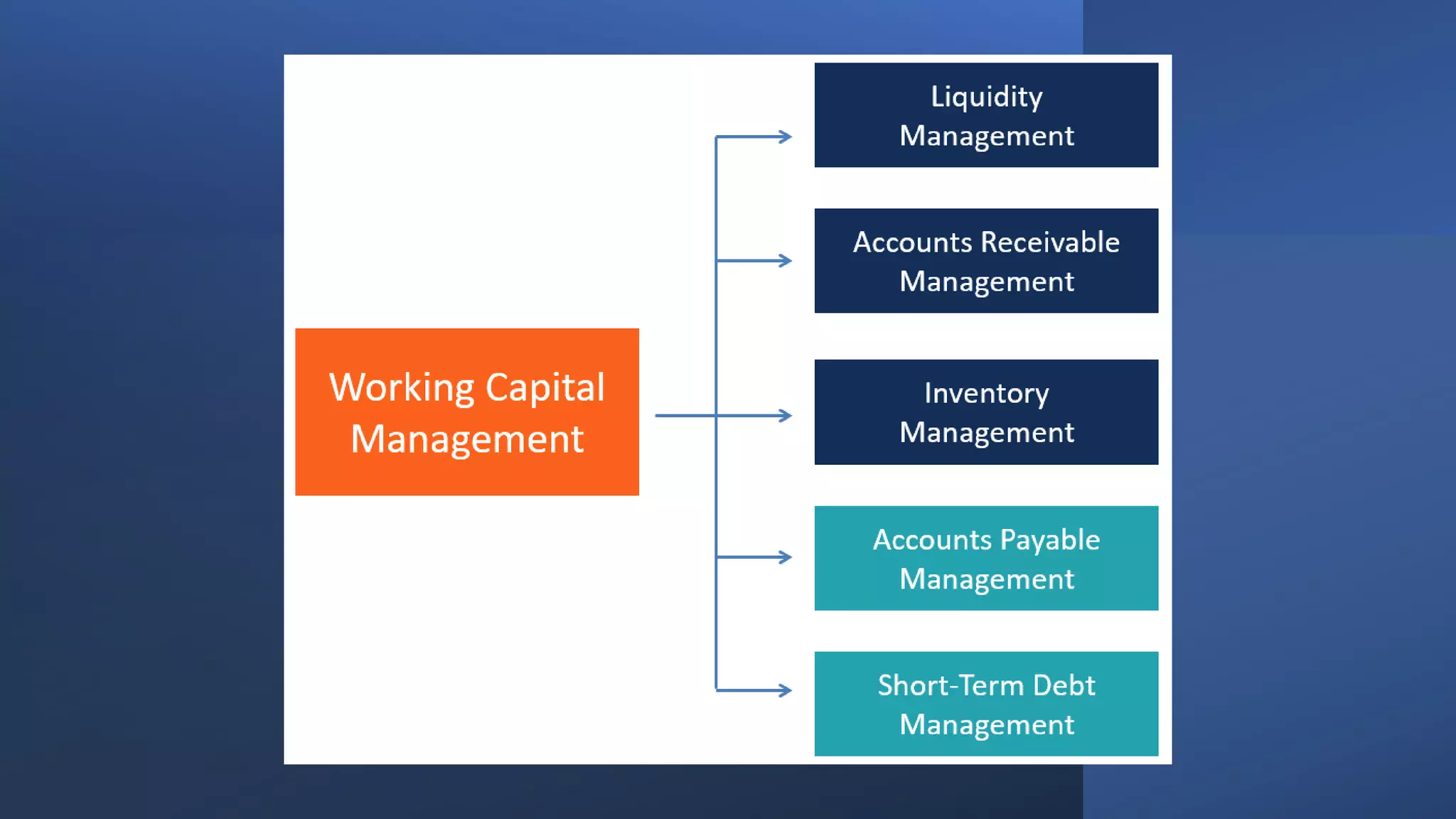

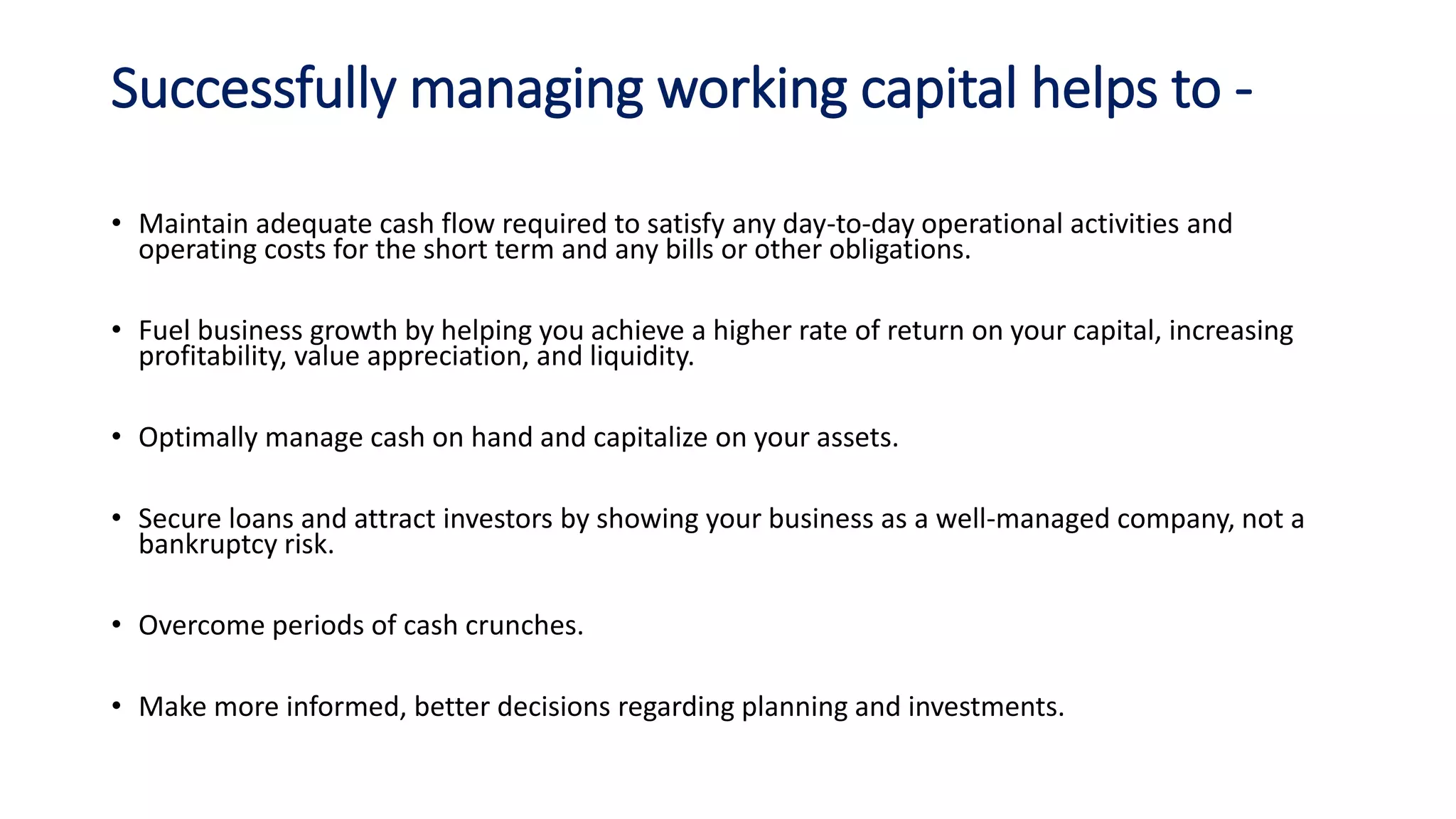

Working capital is a measure of an organization's short-term financial health, calculated by subtracting current liabilities from current assets. Effective management of working capital is vital for maintaining cash flow, supporting business growth, and making informed investment decisions. Best practices include reviewing margins, managing invoicing, and avoiding common missteps such as poor inventory management and neglecting budget control.