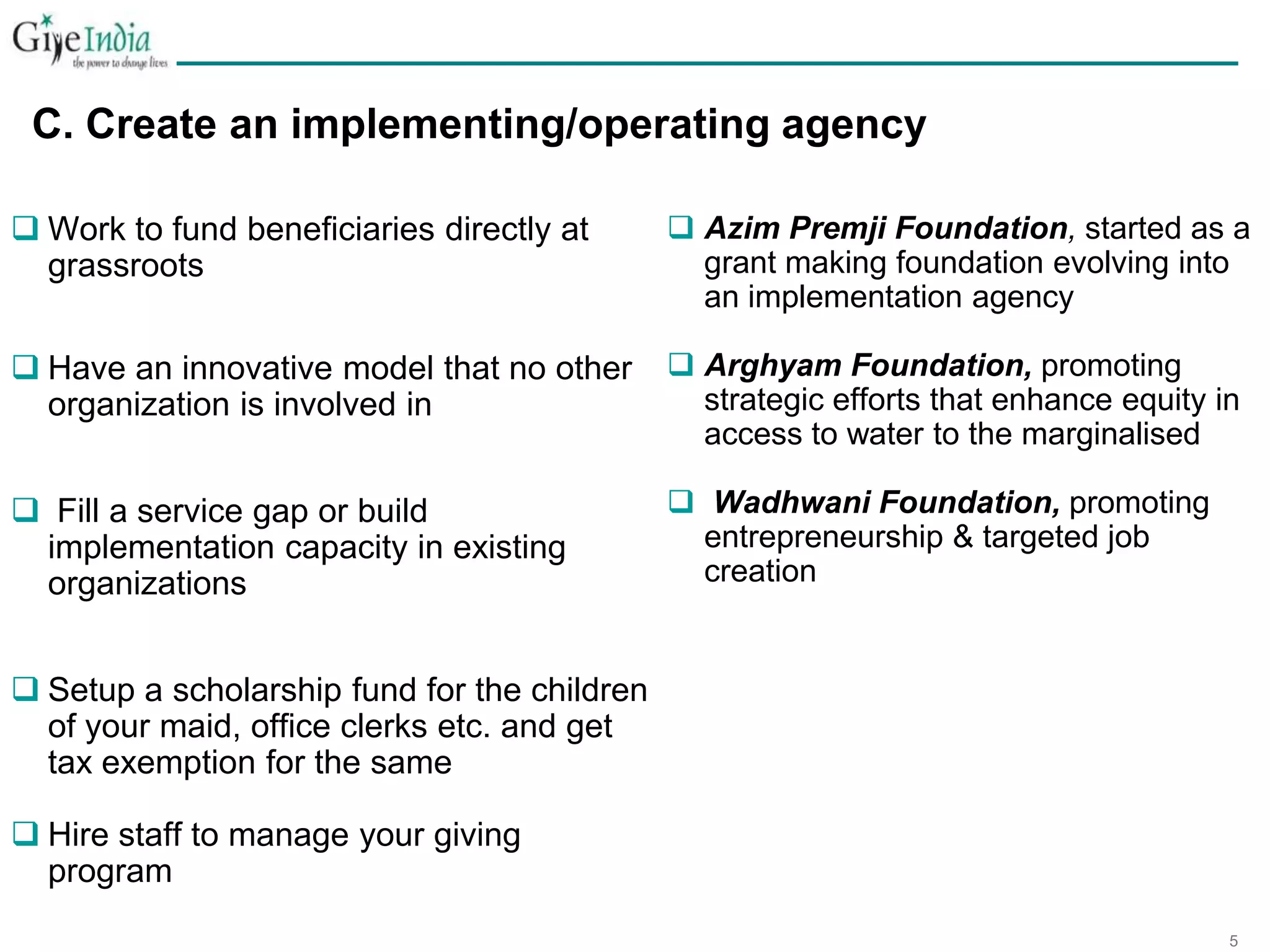

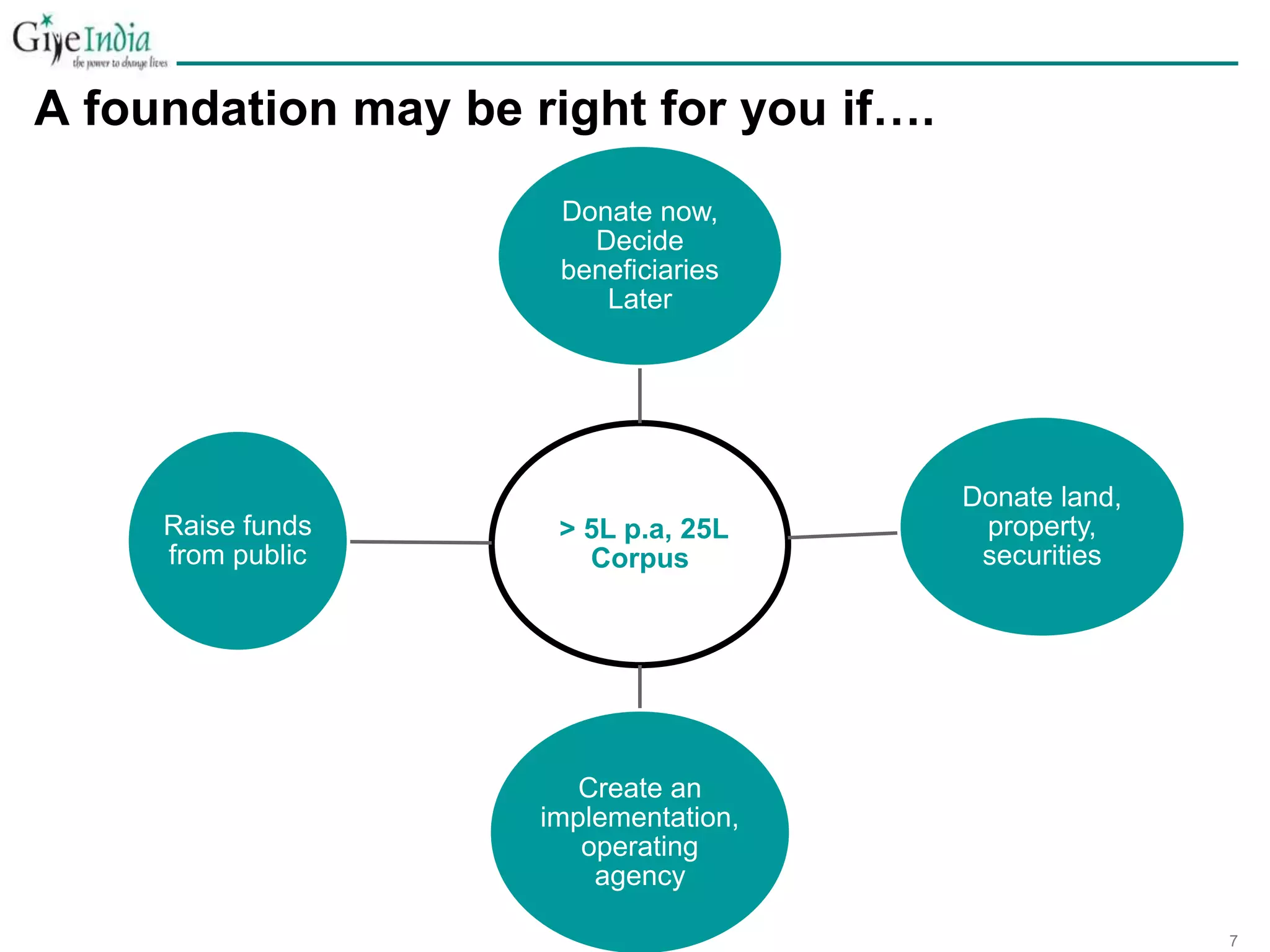

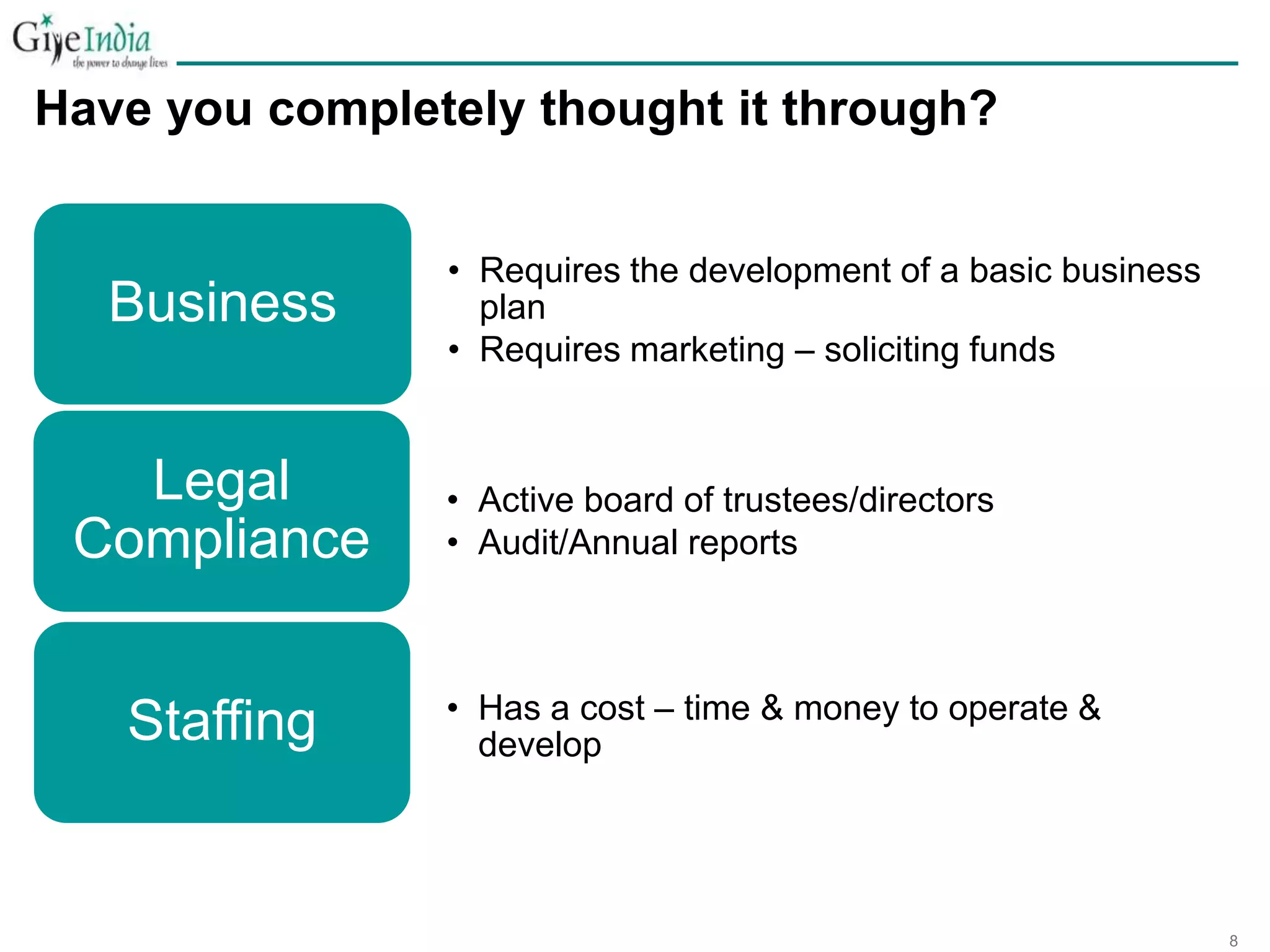

You can set up your own charitable foundation or trust if you plan to donate at least 5 L per year or 25 L total and your goals meet one of the following: donate now but decide beneficiaries later, donate land/property/securities, create an implementing organization, or raise money from the public. Setting up your own foundation allows you to receive tax benefits, have flexibility in donations, channel donation requests formally, invest assets tax-free, fund beneficiaries directly, fill service gaps, and leverage your network to raise more funds. You should completely think through your goals and structure before setting up a foundation to ensure it is the best fit.