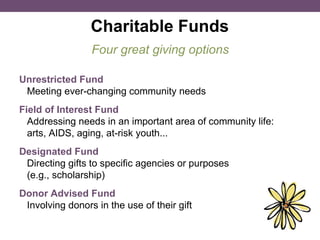

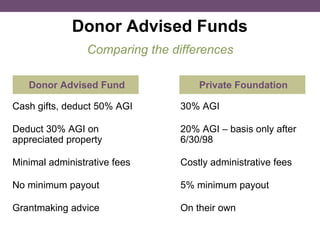

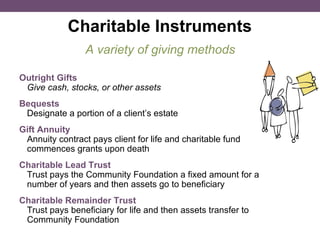

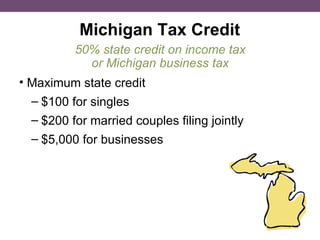

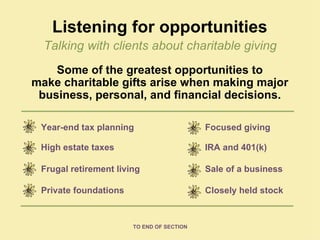

The document discusses various tools and methods for charitable giving through community foundations, including establishing named funds, unrestricted funds, field of interest funds, and designated funds. It provides details on donor advised funds, comparing them to private foundations. The document also discusses charitable instruments like outright gifts, bequests, gift annuities, charitable lead trusts, and charitable remainder trusts. It focuses on how financial advisors can have conversations with clients about charitable giving opportunities related to their financial situations and goals.