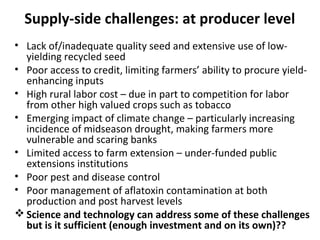

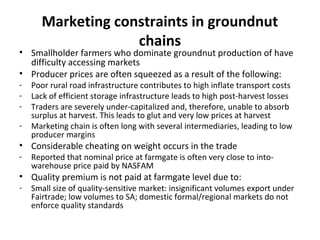

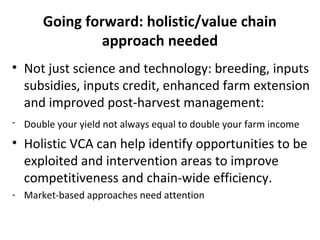

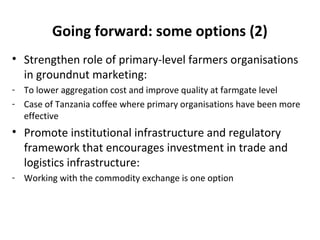

This document discusses the groundnut value chain in Malawi and opportunities to improve it. It notes that agriculture contributes significantly to Malawi's economy but it relies heavily on tobacco exports, which have declining demand prospects. Groundnuts provide income for many smallholder farmers but Malawi has lost its share of the global groundnut market due to high aflatoxin levels and other supply challenges. To regain its position, Malawi needs a holistic value chain approach that addresses issues like quality seeds, access to credit, marketing constraints, and enforcement of quality standards to give farmers incentives to improve practices. Strengthening farmers organizations and trade infrastructure can also help professionalize the sector.