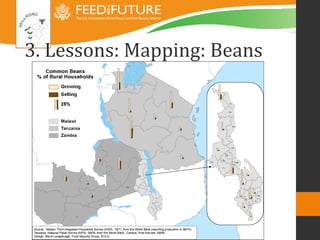

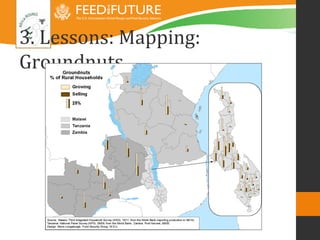

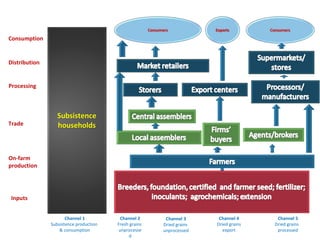

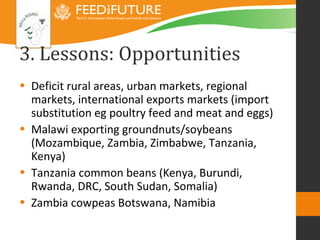

The document discusses a project aimed at enhancing grain legume value chains in East and Southern Africa through partnerships, value chain analyses, and best-bet technology cataloging. It identifies key outputs such as mapping production, marketing, and constraints, while also outlining lessons learned regarding market opportunities and challenges. Additionally, it evaluates the project's execution, highlighting successes and areas for improvement in stakeholder engagement and planning.