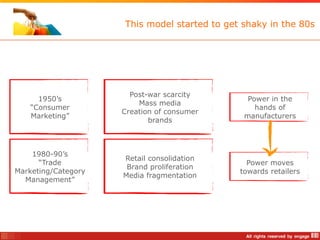

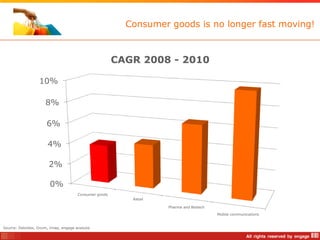

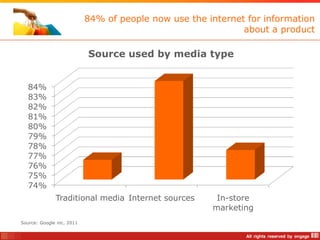

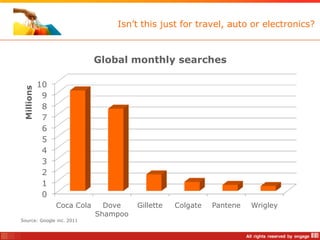

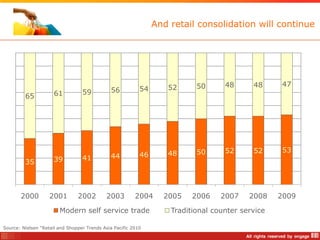

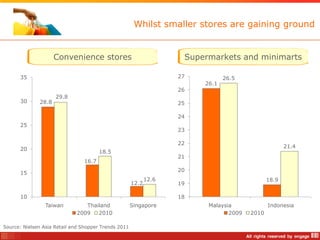

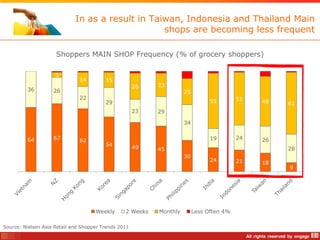

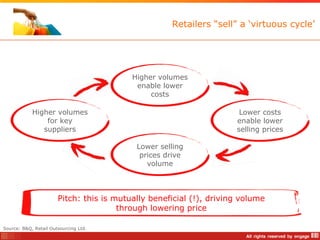

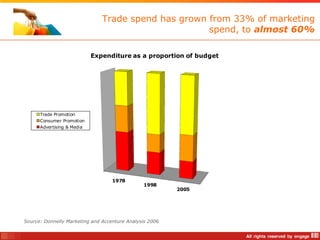

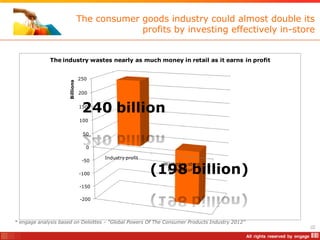

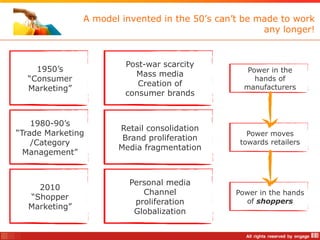

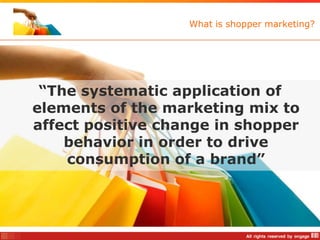

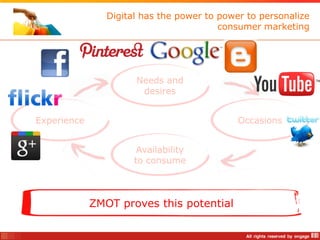

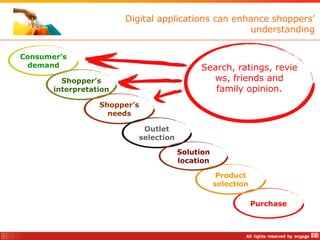

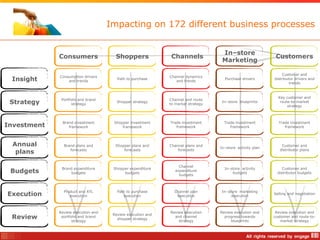

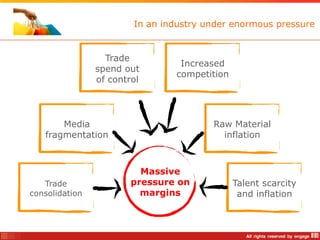

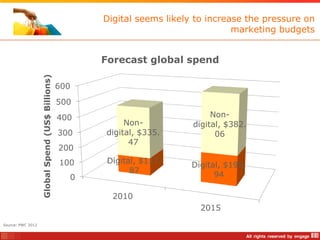

The consumer goods industry, led by the top 250 companies with a global turnover of $2.8 trillion, has experienced slow growth since 2008, driven by evolving consumer behaviors and media dynamics. Retail consolidation is ongoing, with traditional formats declining and digital influence growing, leading to challenges such as wasted marketing expenditures. Effective shopper marketing that integrates digital insights is critical for the industry to adapt and drive brand consumption amidst increasing competition and changing market conditions.