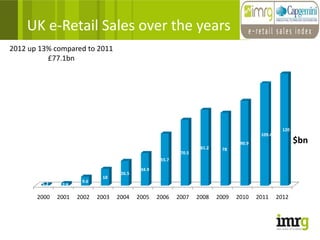

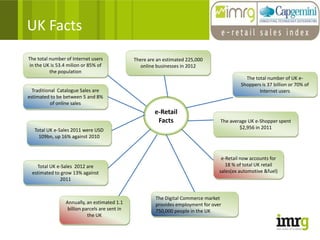

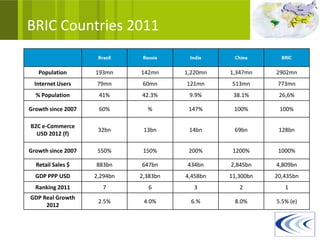

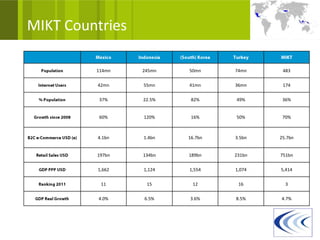

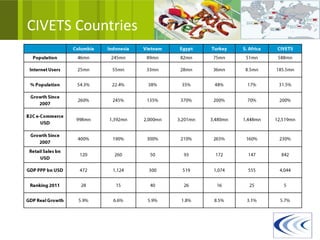

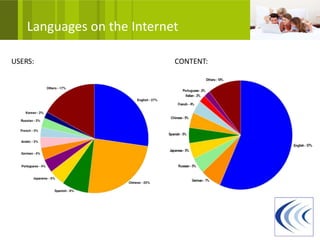

This document discusses global e-commerce trends and cross-border opportunities. It provides statistics on the growth of e-commerce in various countries and regions. The UK e-commerce market has grown significantly in recent years and now accounts for 18% of total UK retail sales. Globally, e-commerce sales are expected to double to $1.125 trillion by 2012. Emerging markets like Brazil, Russia, India and China are leading growth. Cross-border shopping is also increasing, with up to 50% of consumers in some countries making online purchases from other countries. The document identifies opportunities for cross-border sales but also barriers to overcome like language, customer tastes, delivery and payment issues.