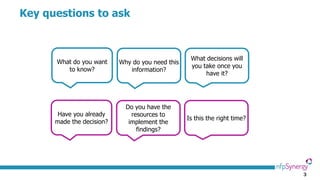

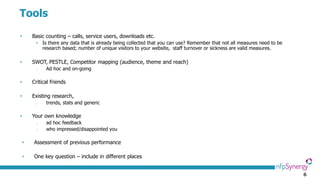

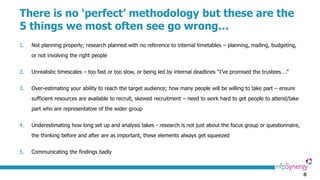

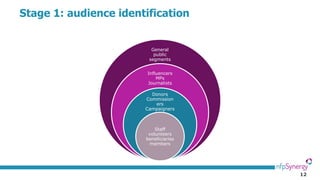

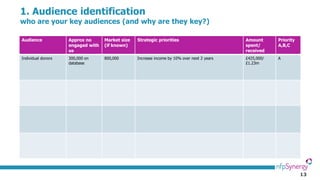

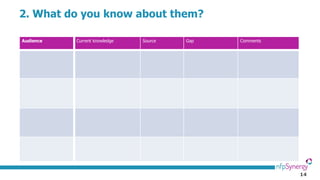

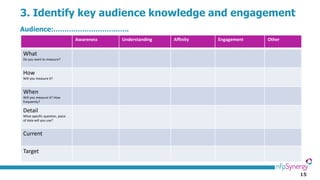

The document outlines essential components of good research, emphasizing the importance of asking the right questions and the proper design of surveys. It provides various tips for effective question formulation, audience identification, and reporting methodologies, while also acknowledging common pitfalls in research. The document concludes by underscoring the need to clearly define key audiences and gather relevant data to inform strategic objectives.