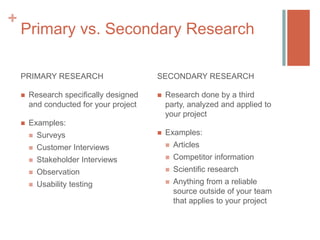

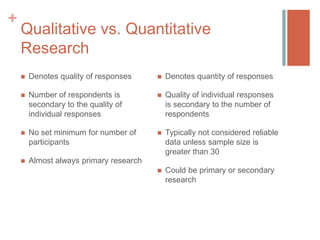

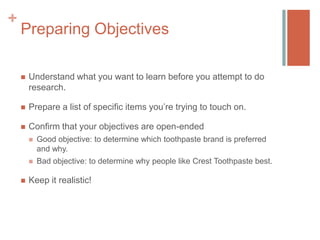

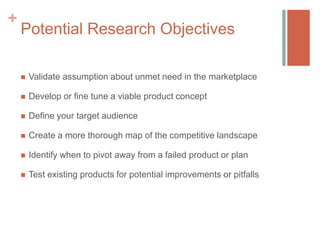

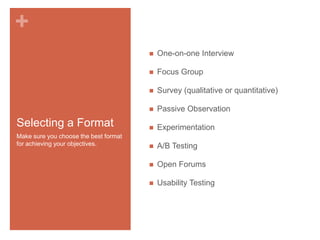

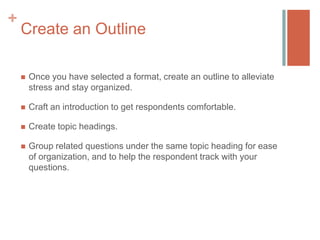

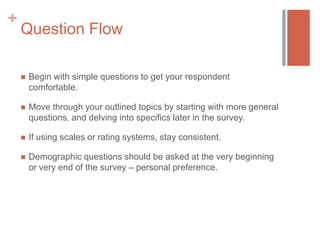

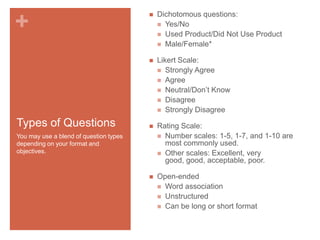

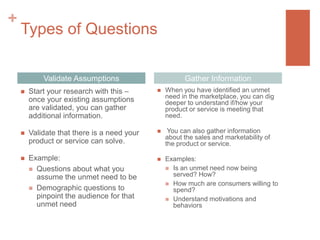

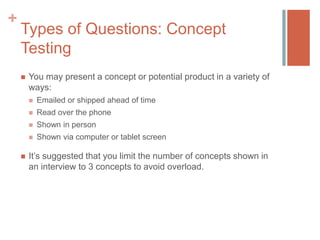

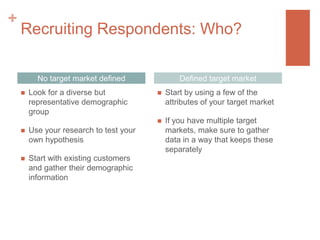

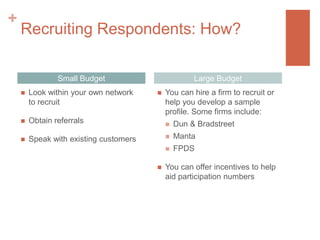

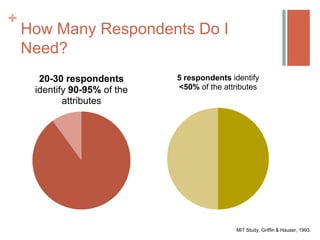

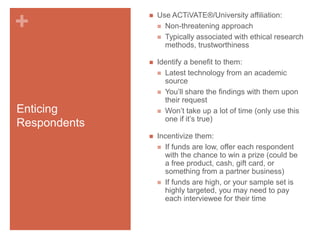

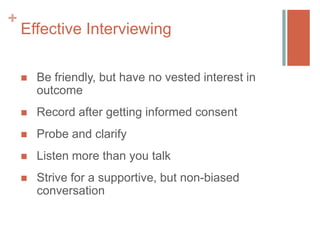

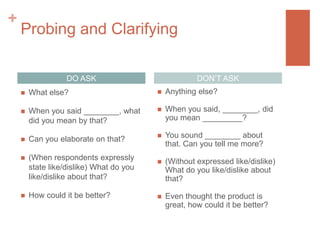

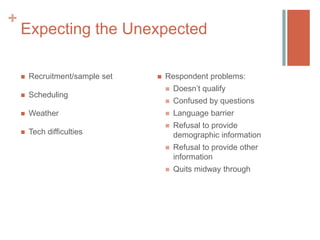

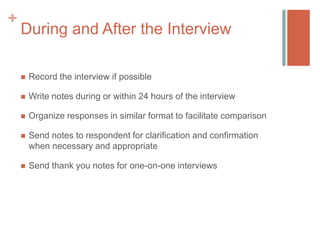

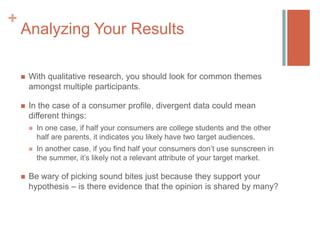

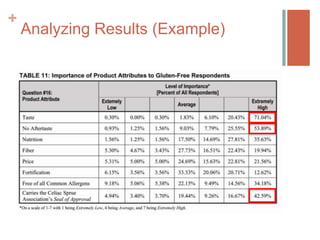

The document outlines the process and importance of conducting primary research, distinguishing it from secondary research. It provides guidance on research planning, recruiting respondents, conducting interviews, and analyzing results, emphasizing the need to validate assumptions and define objectives. Additionally, it discusses various research methods and question types to enhance data gathering and insights.