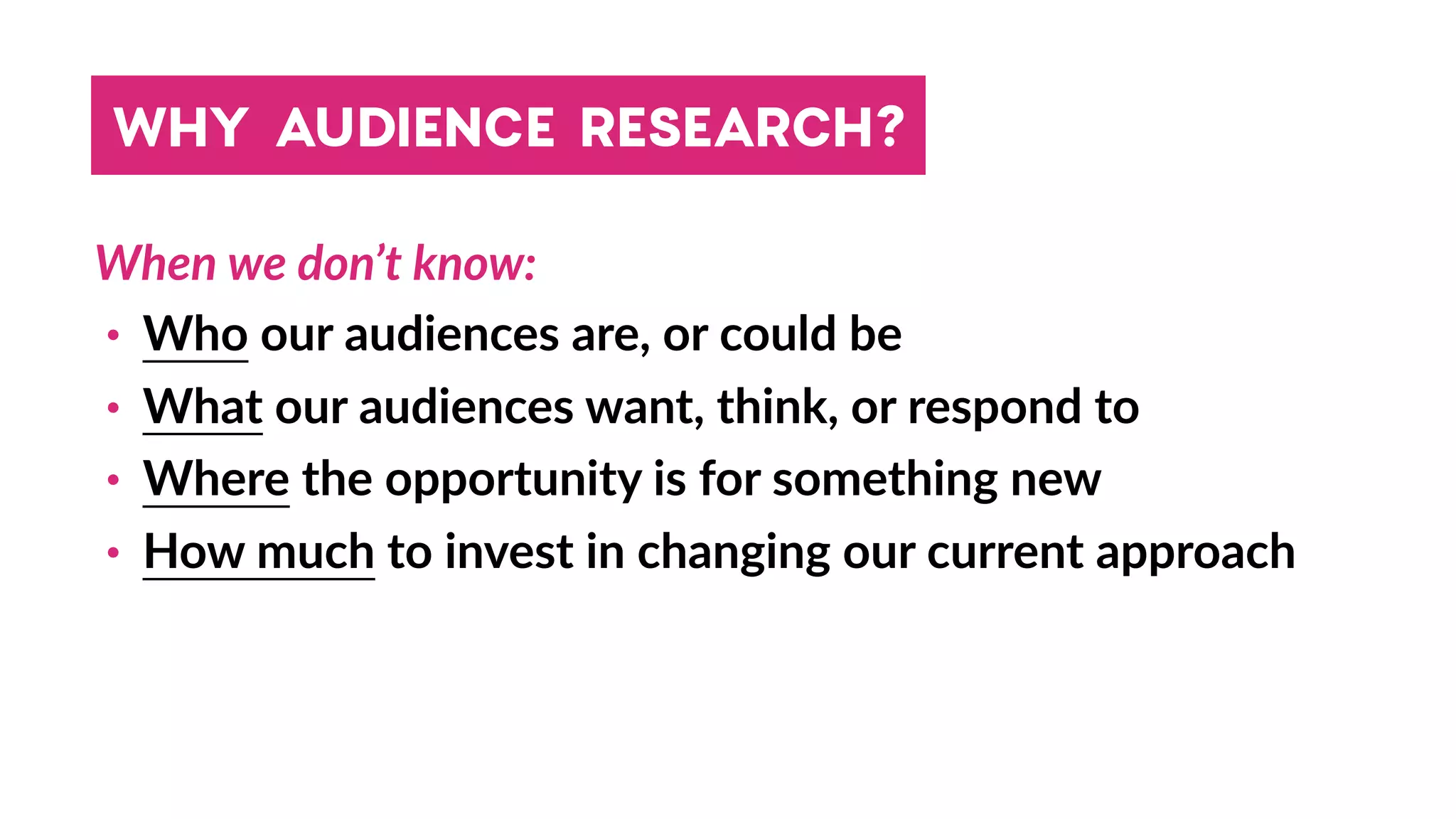

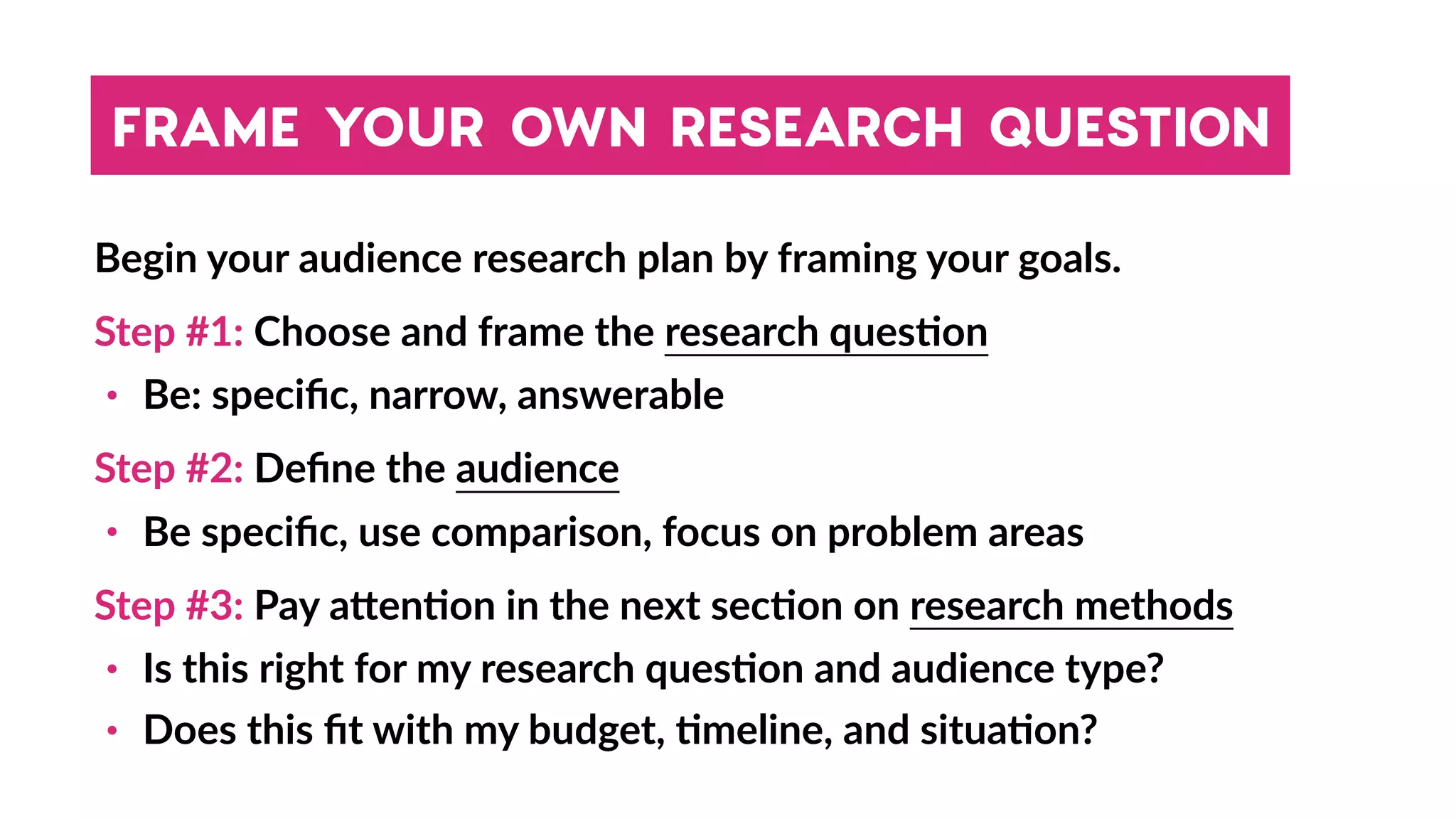

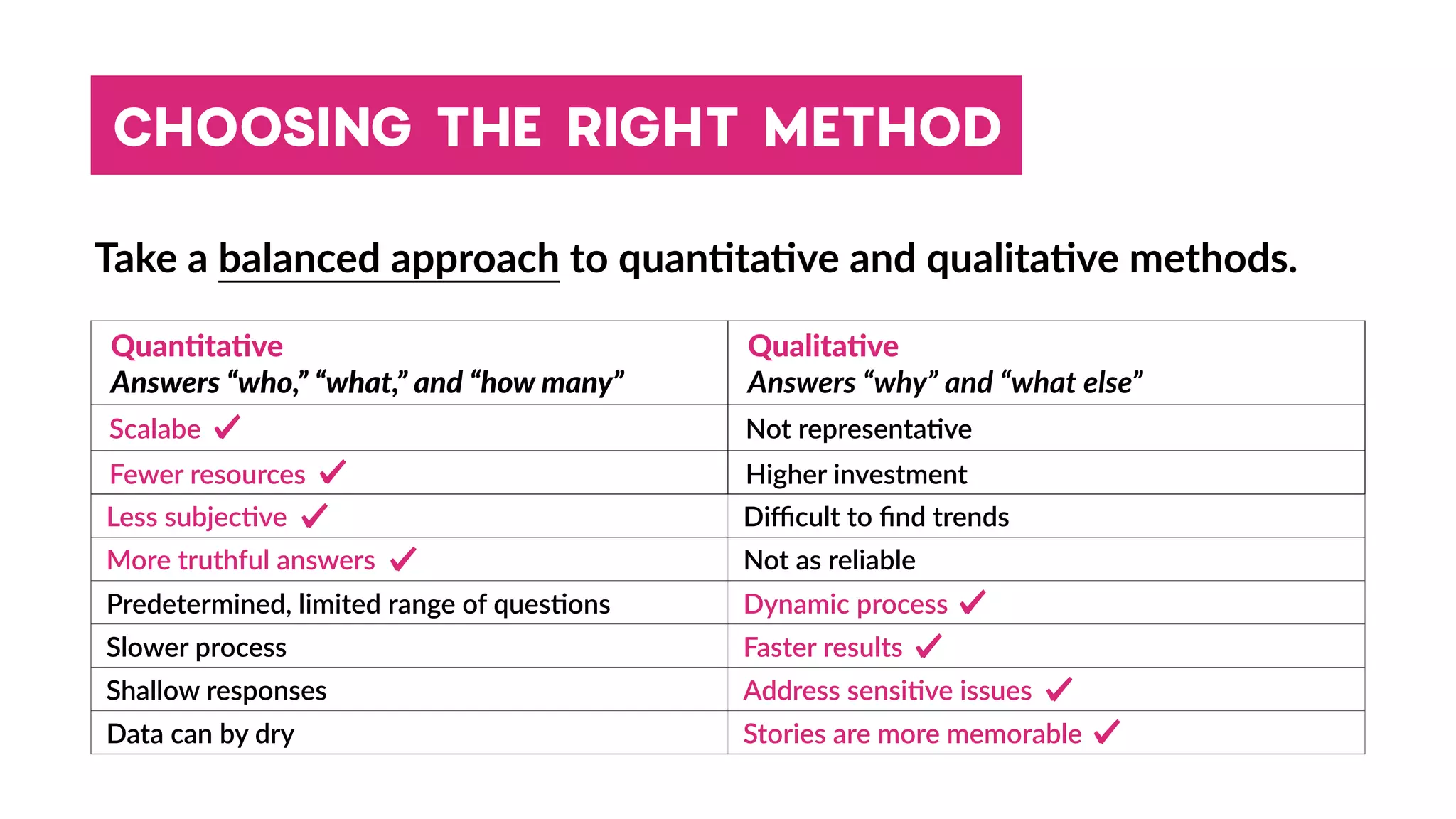

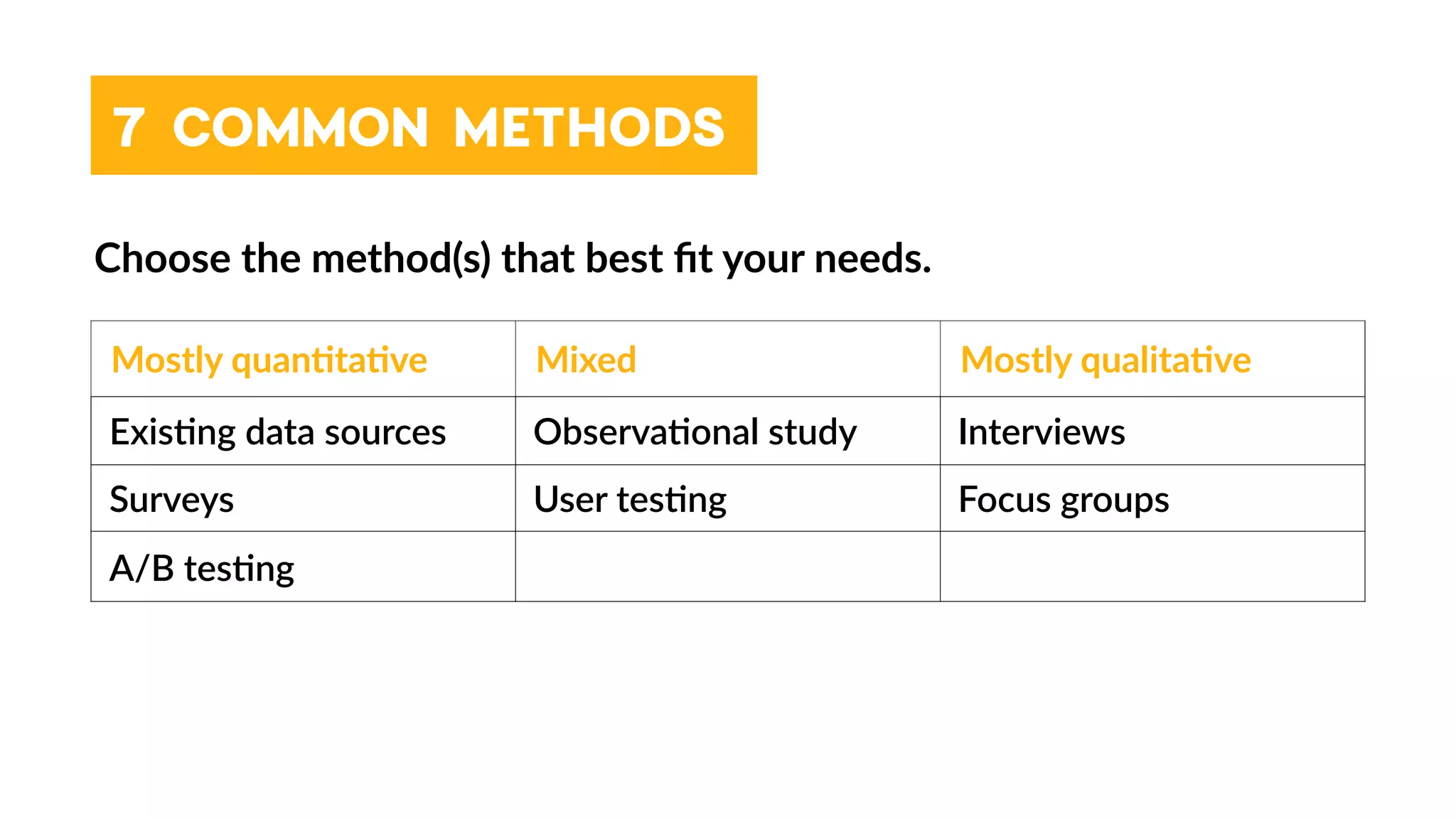

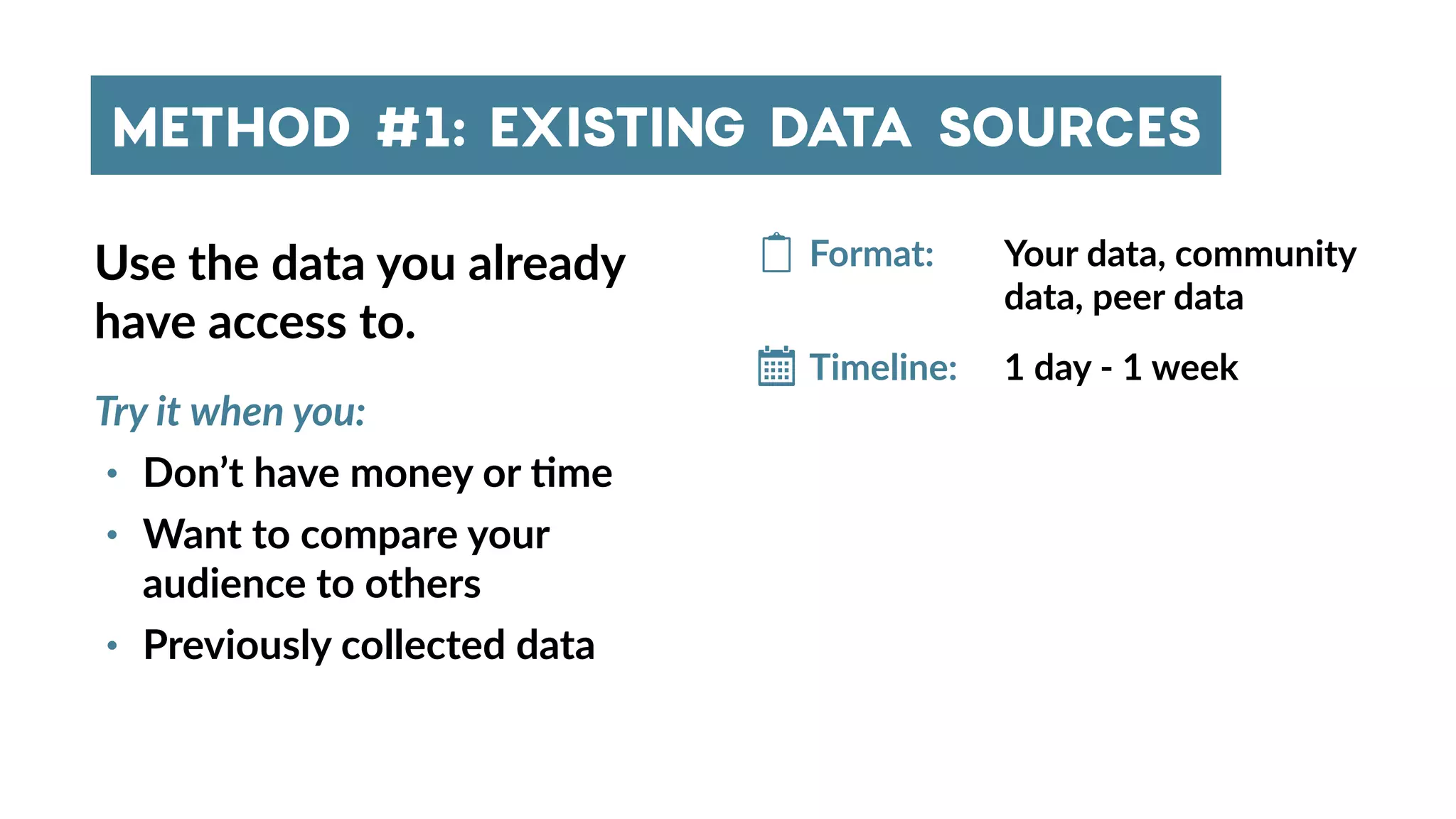

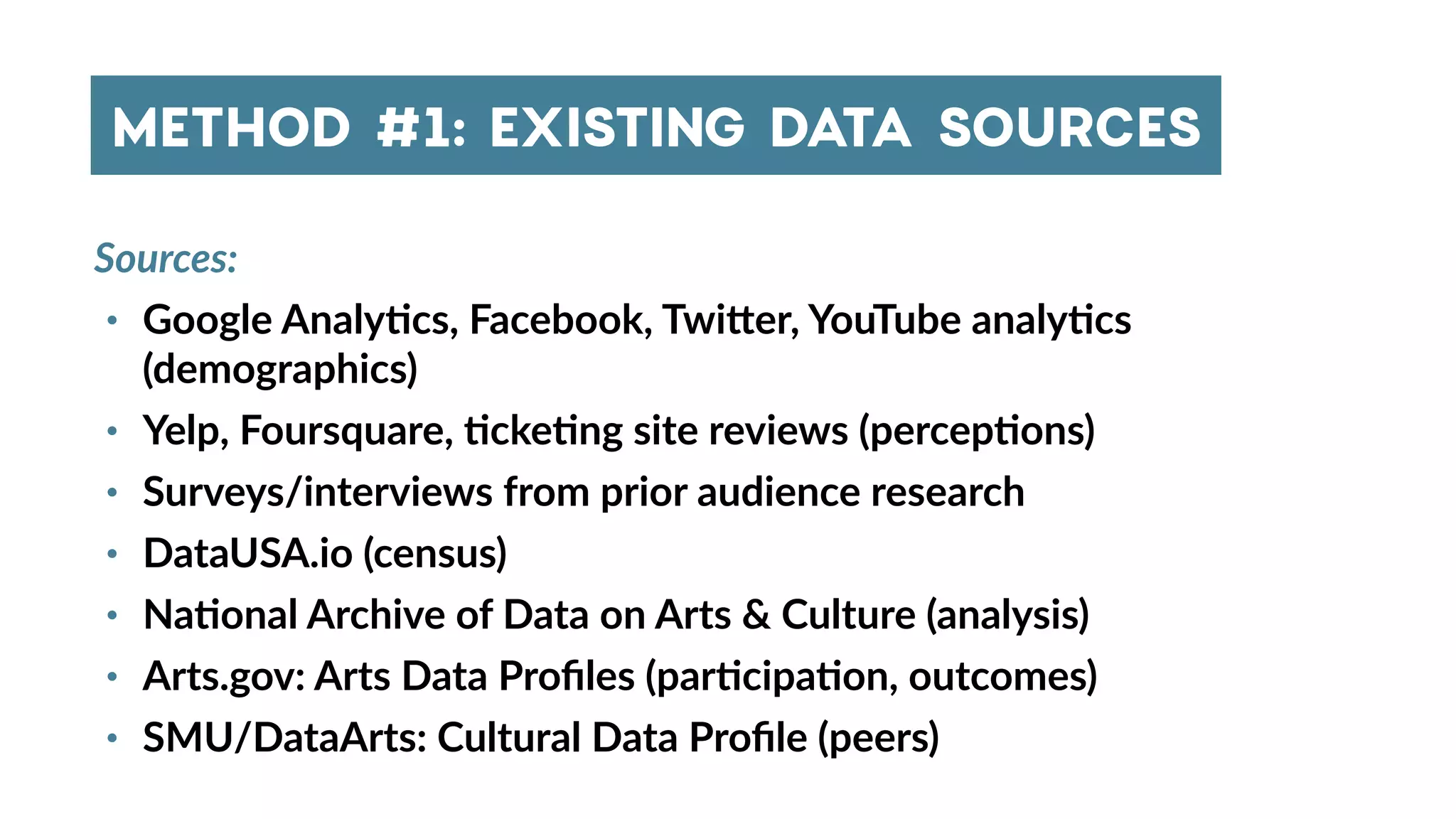

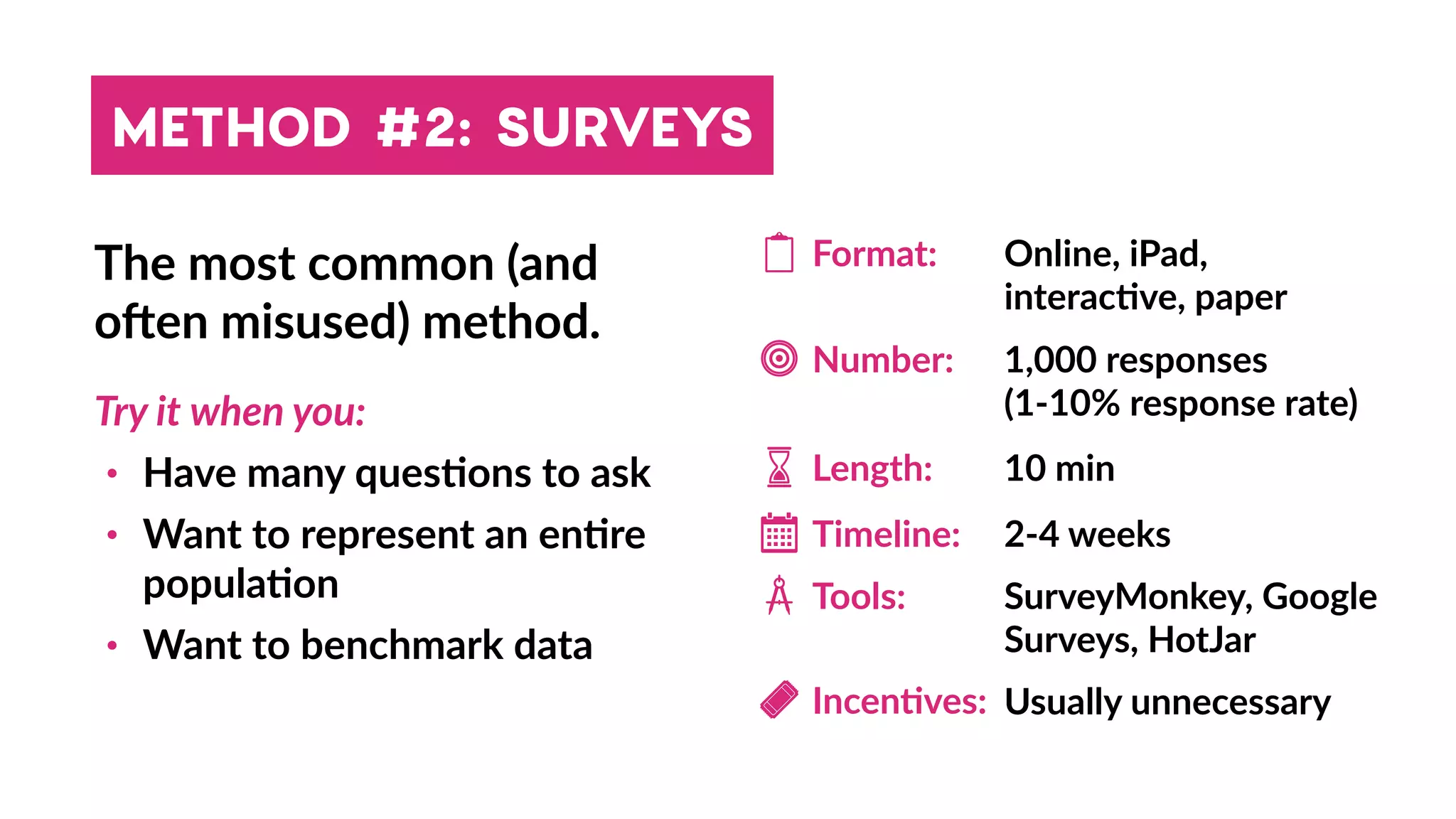

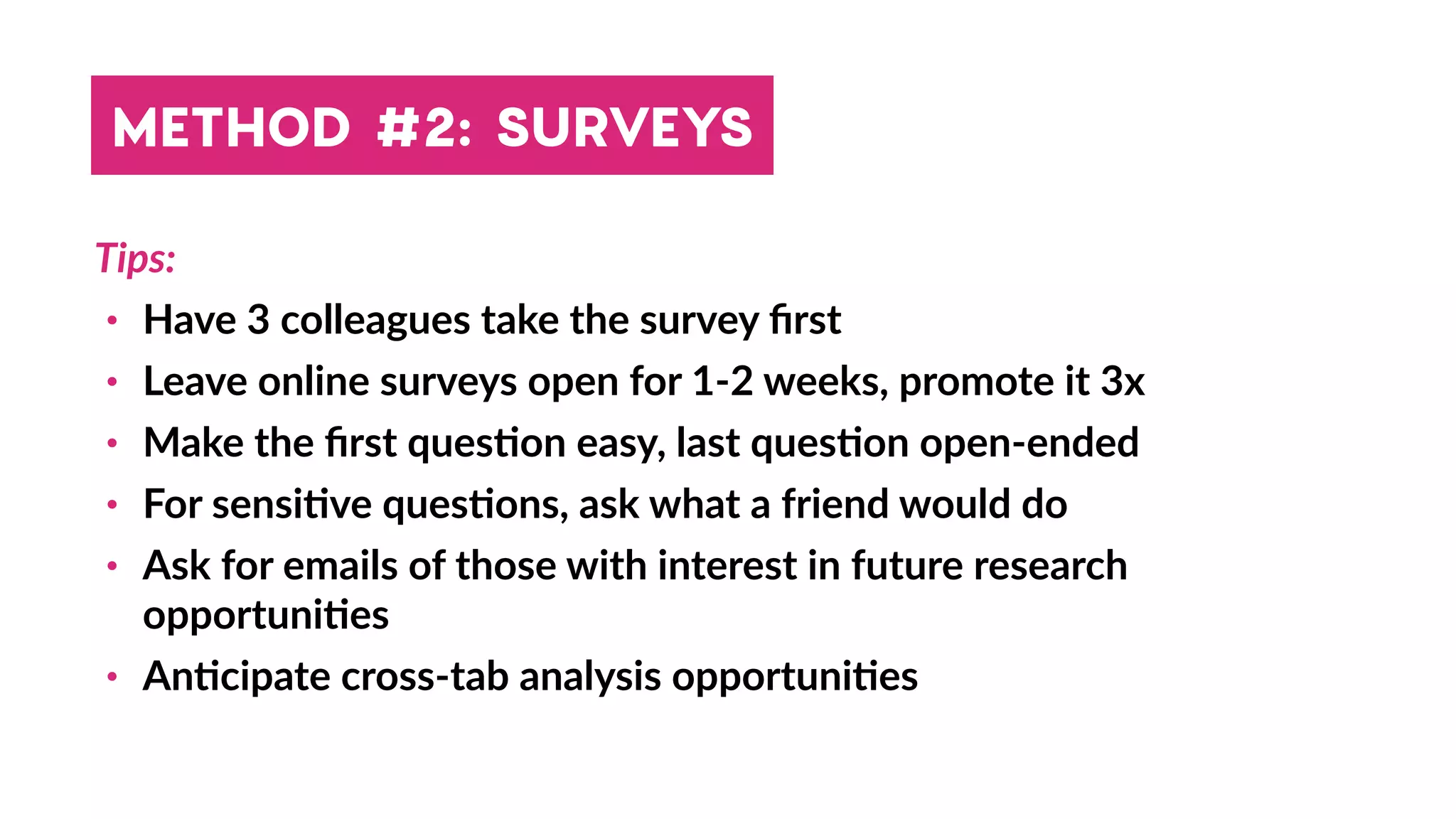

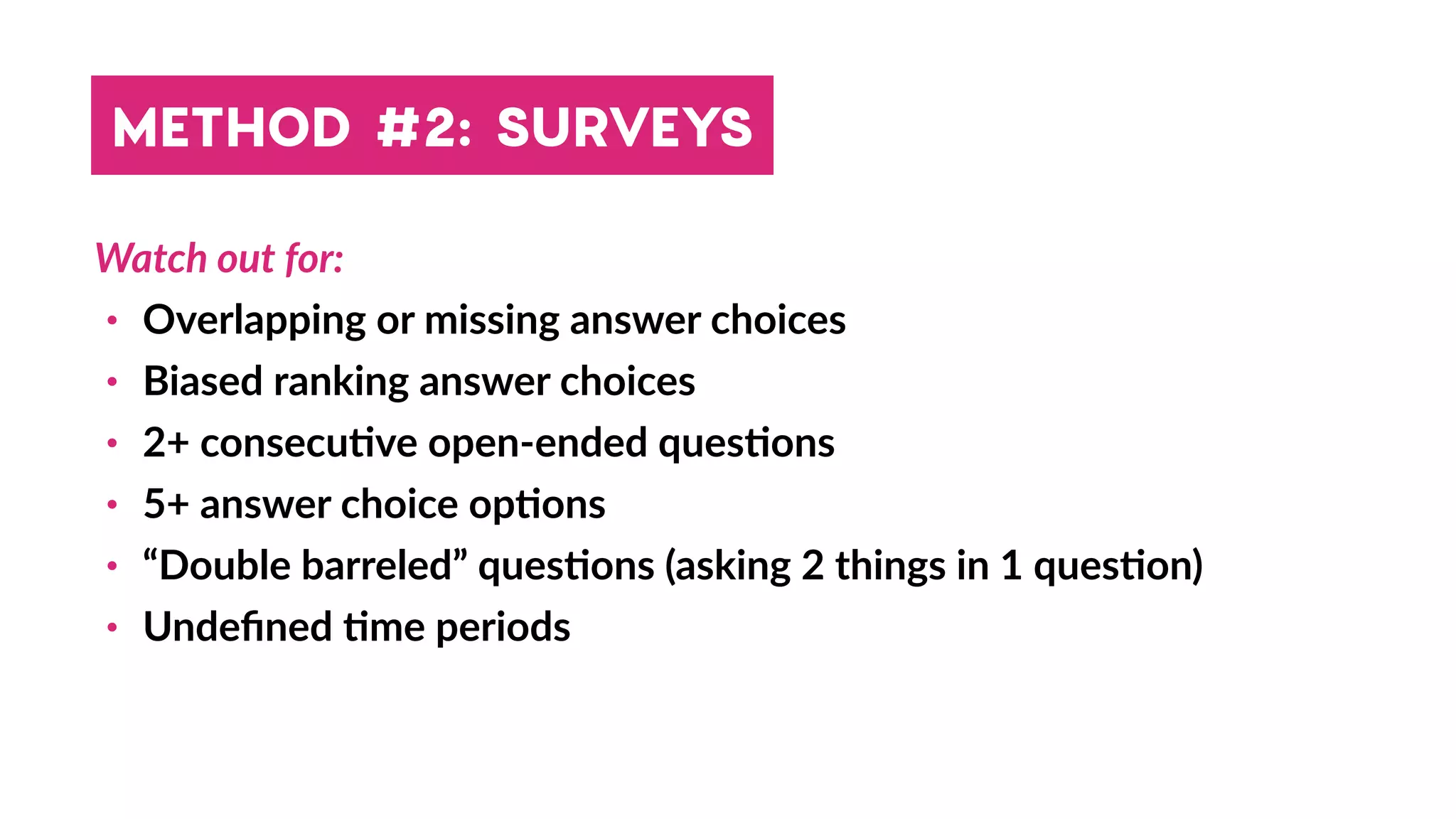

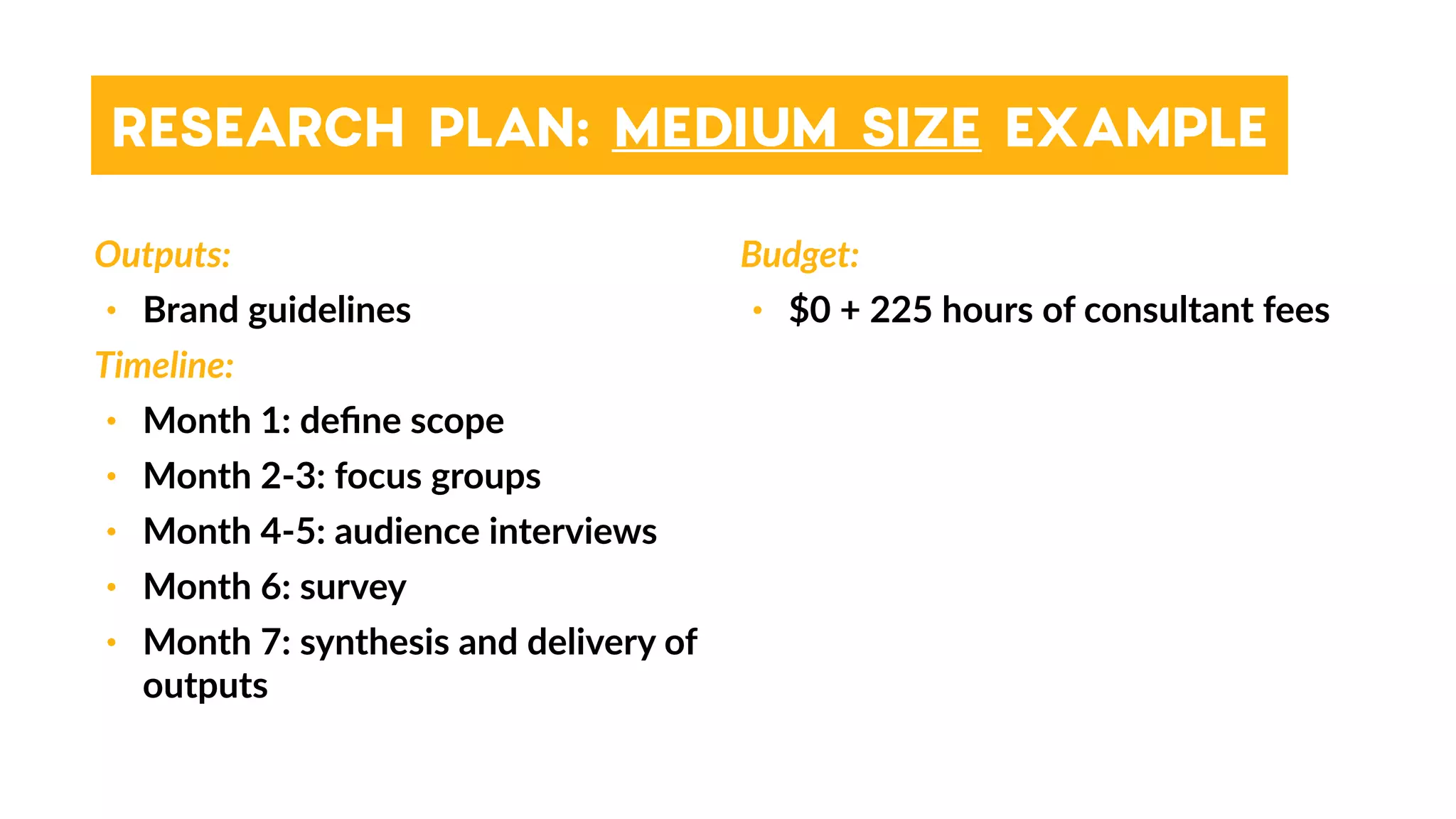

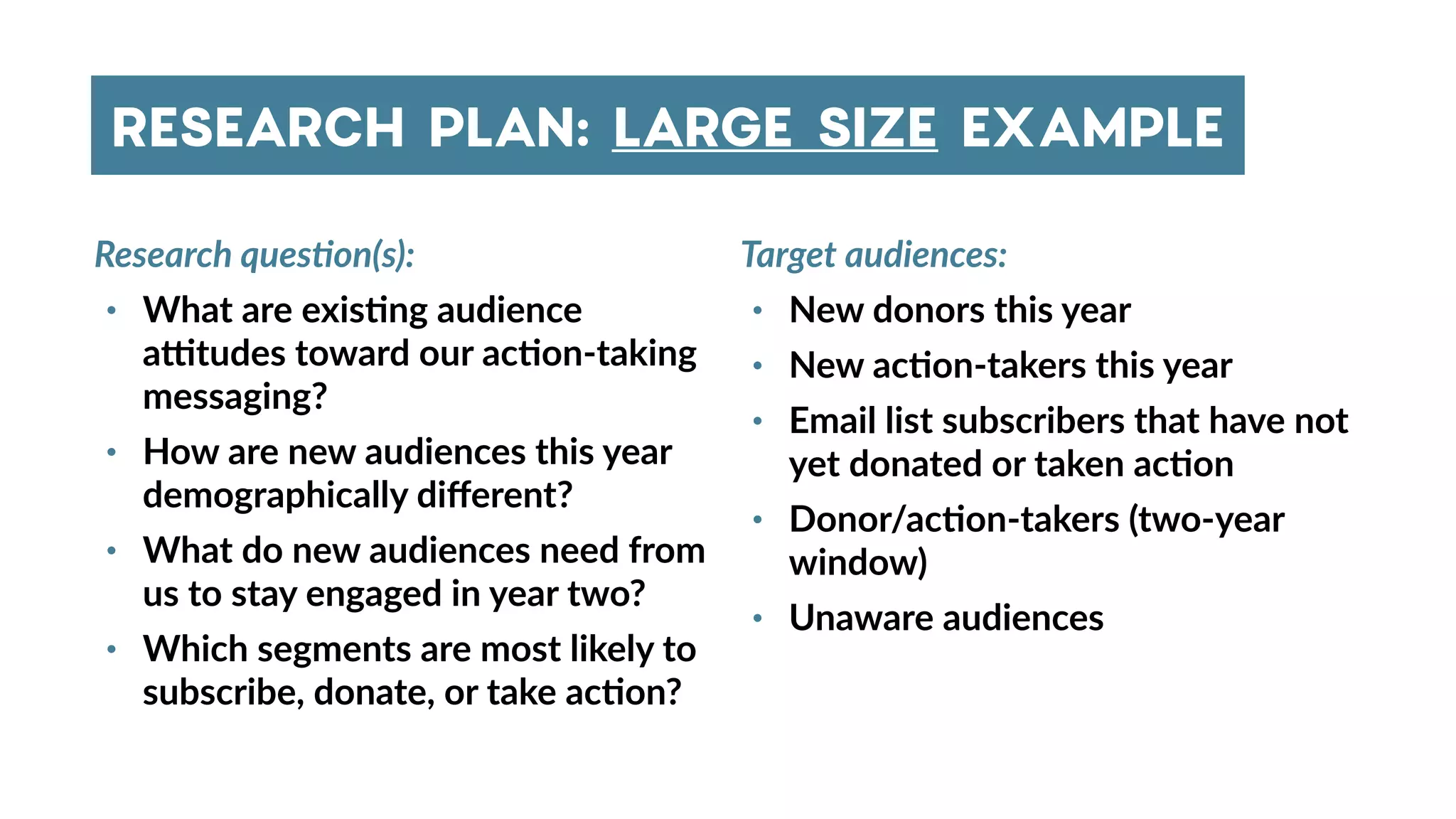

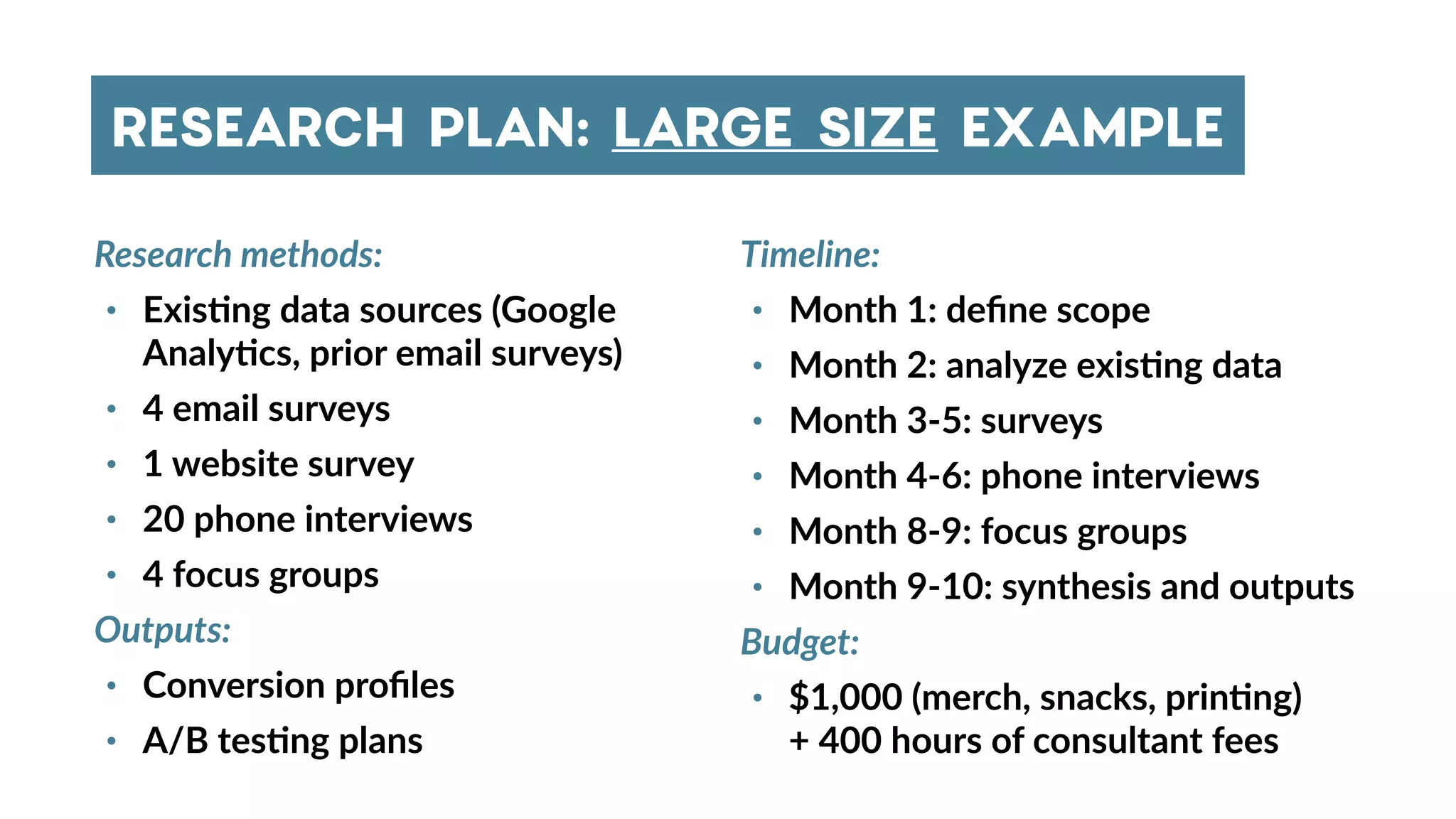

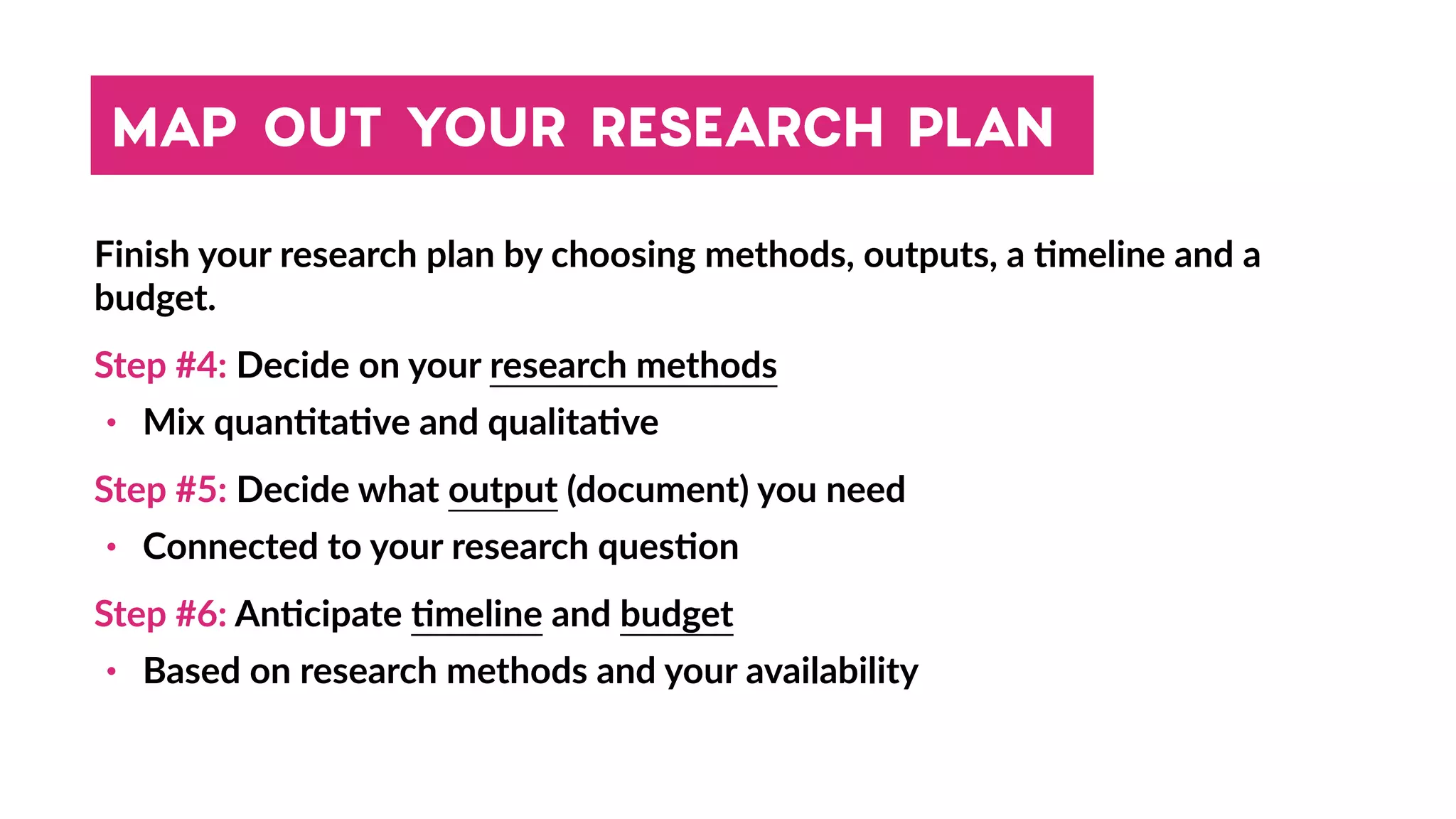

The document is a practical guide for conducting actionable audience research presented at the NAMP Conference 2018. It outlines an audience research strategy that includes defining research questions, choosing appropriate research methods, and utilizing data effectively to drive decision-making. By the end of the guide, participants should be able to plan and execute audience research projects that lead to tangible organizational changes.