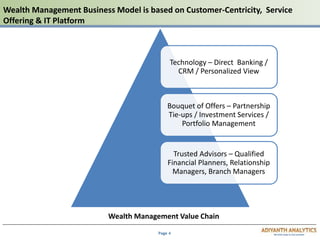

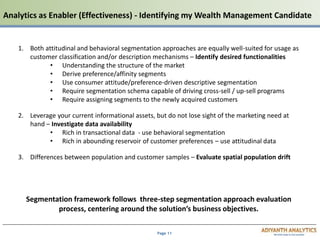

The document outlines a wealth management framework emphasizing customer-centricity and personalized service through analytics. It details critical components for success, including alignment of interests, effective relationship management metrics, and objectives to enhance customer experience and retention. Additionally, it discusses the importance of leveraging data analytics for improving efficiency, identifying client segmentation, and offering tailored financial solutions.