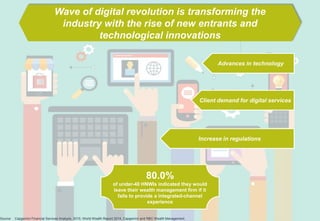

Wealth management trends for 2016 indicate a growing demand for credit among high net worth individuals (HNWIs), leading firms to develop lending solutions and improve efficiencies through utility-based models. There's also a significant rise in cyber threats emphasizing the need for enhanced security, alongside a shift toward digital services and automated advisors driven by changing client preferences. Furthermore, wealth managers are increasingly focusing on client engagement through predictive analytics and personalized wealth-planning tools to address the evolving expectations of HNWIs.