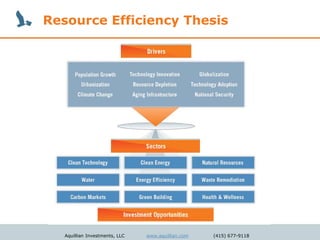

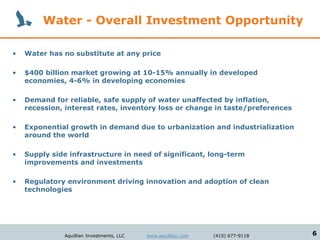

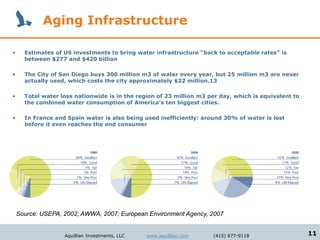

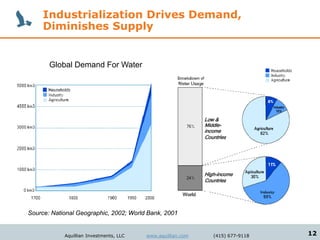

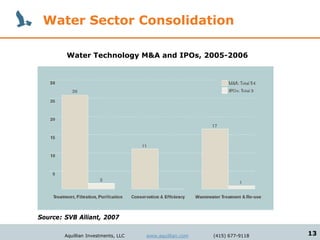

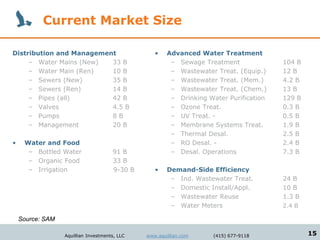

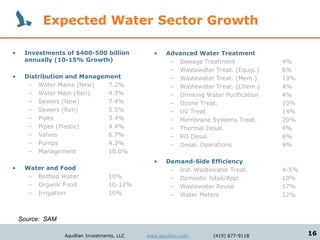

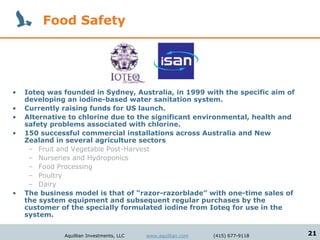

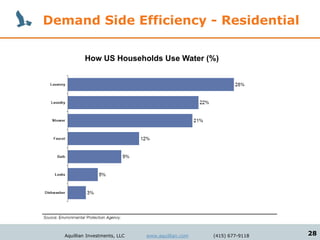

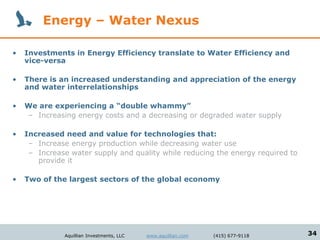

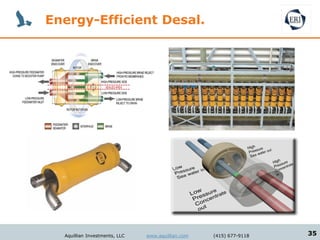

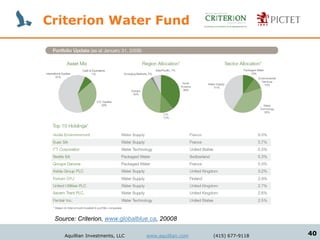

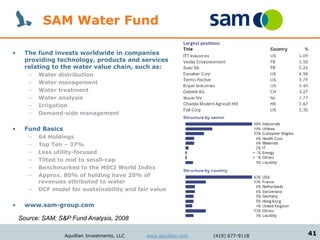

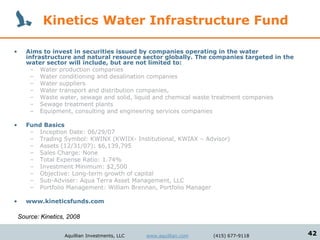

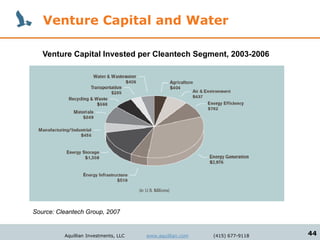

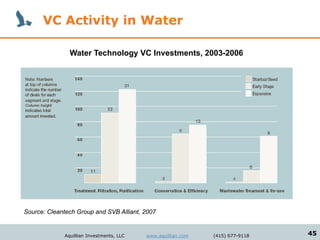

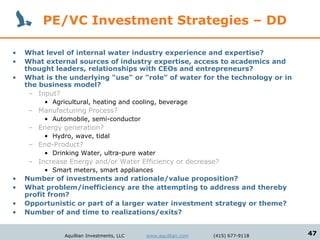

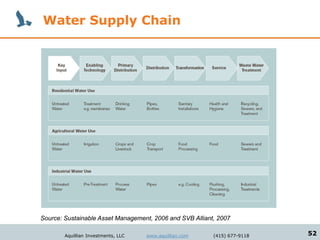

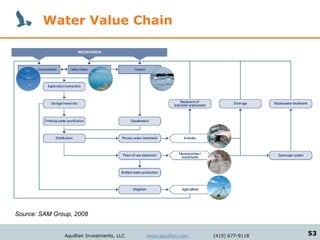

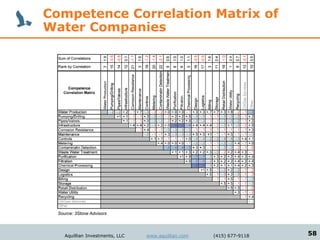

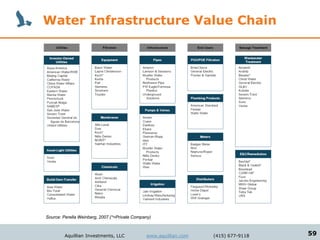

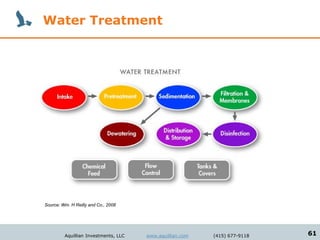

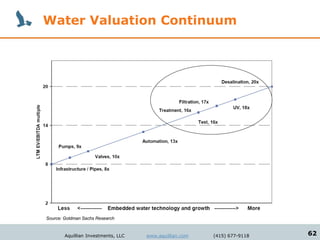

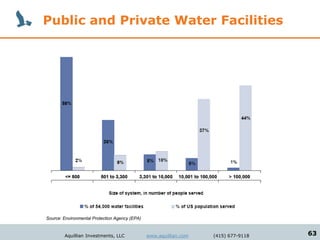

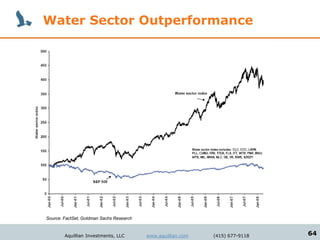

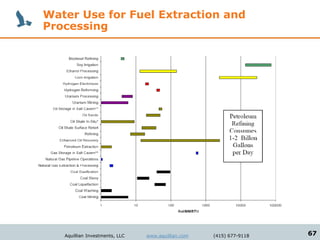

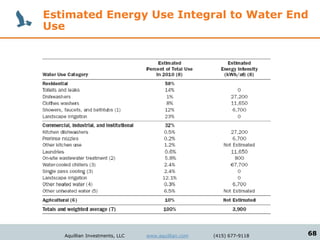

This document provides an overview of investment opportunities in the water sector. It discusses the large and growing global market for water, driven by trends of aging infrastructure, population growth, and regulatory changes. Specific investment opportunities highlighted include water treatment, monitoring technologies, distribution systems, efficiency solutions, and energy generation from water sources. The document also profiles some company examples and lists exchange traded funds and mutual funds with a water focus.