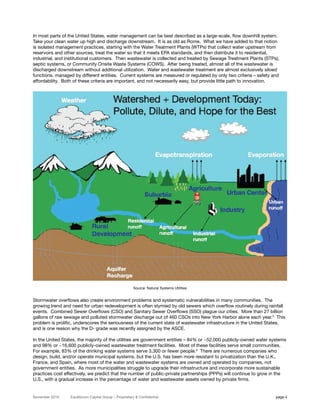

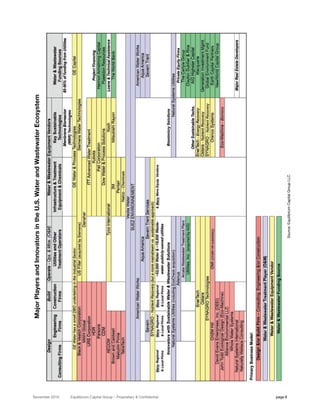

The water and wastewater infrastructure in the United States faces serious challenges and is in need of significant investment and innovation. Current systems are outdated, inefficient, and fail to utilize resources like water and energy. This presents opportunities for more sustainable solutions that optimize water usage, reduce costs, and generate value from waste products. New decentralized and natural treatment approaches are gaining ground and have the potential to transform the industry. The addressable market for sustainable water solutions in the US is estimated to grow from $4 billion currently to over $15 billion by 2020.