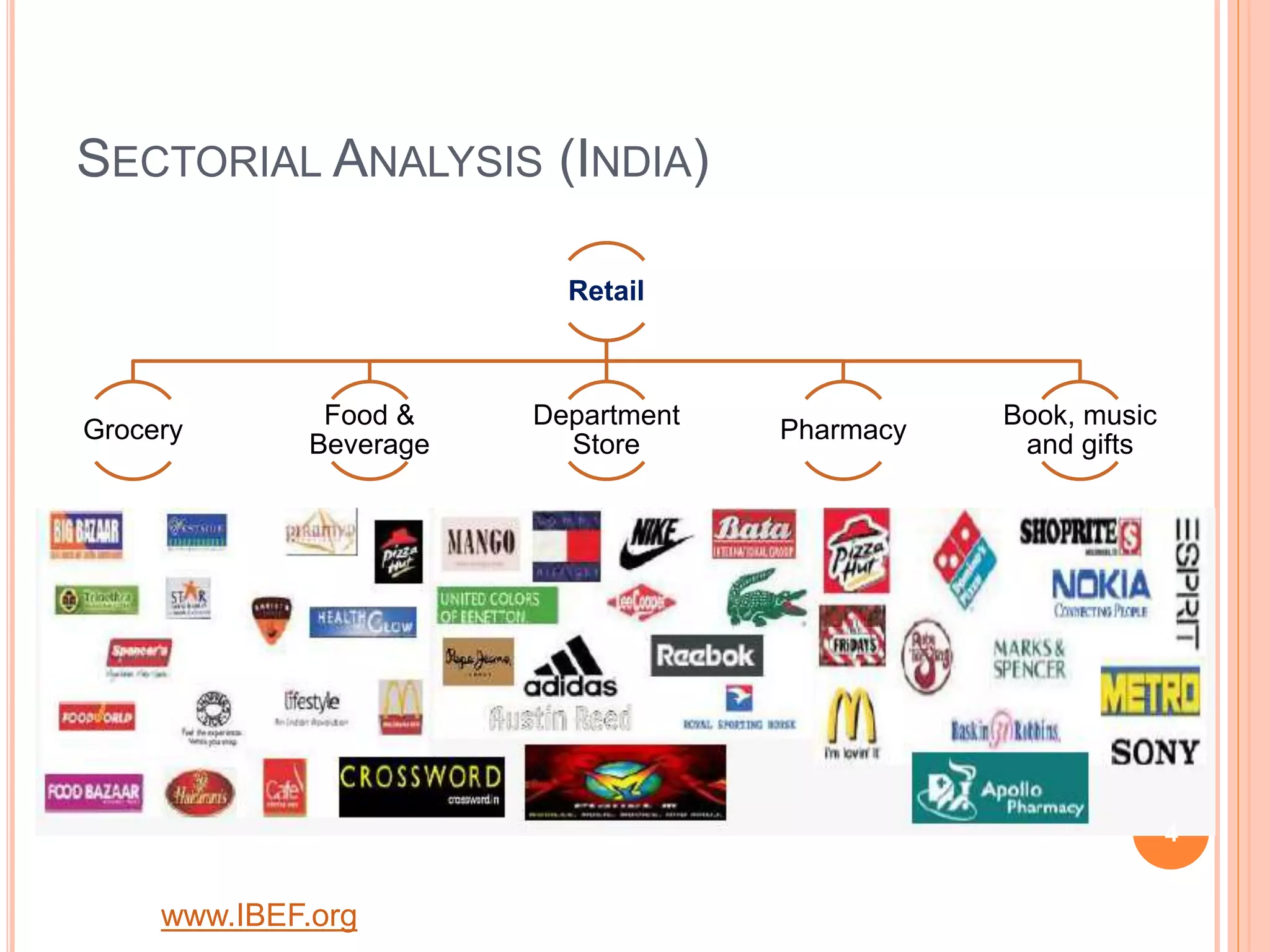

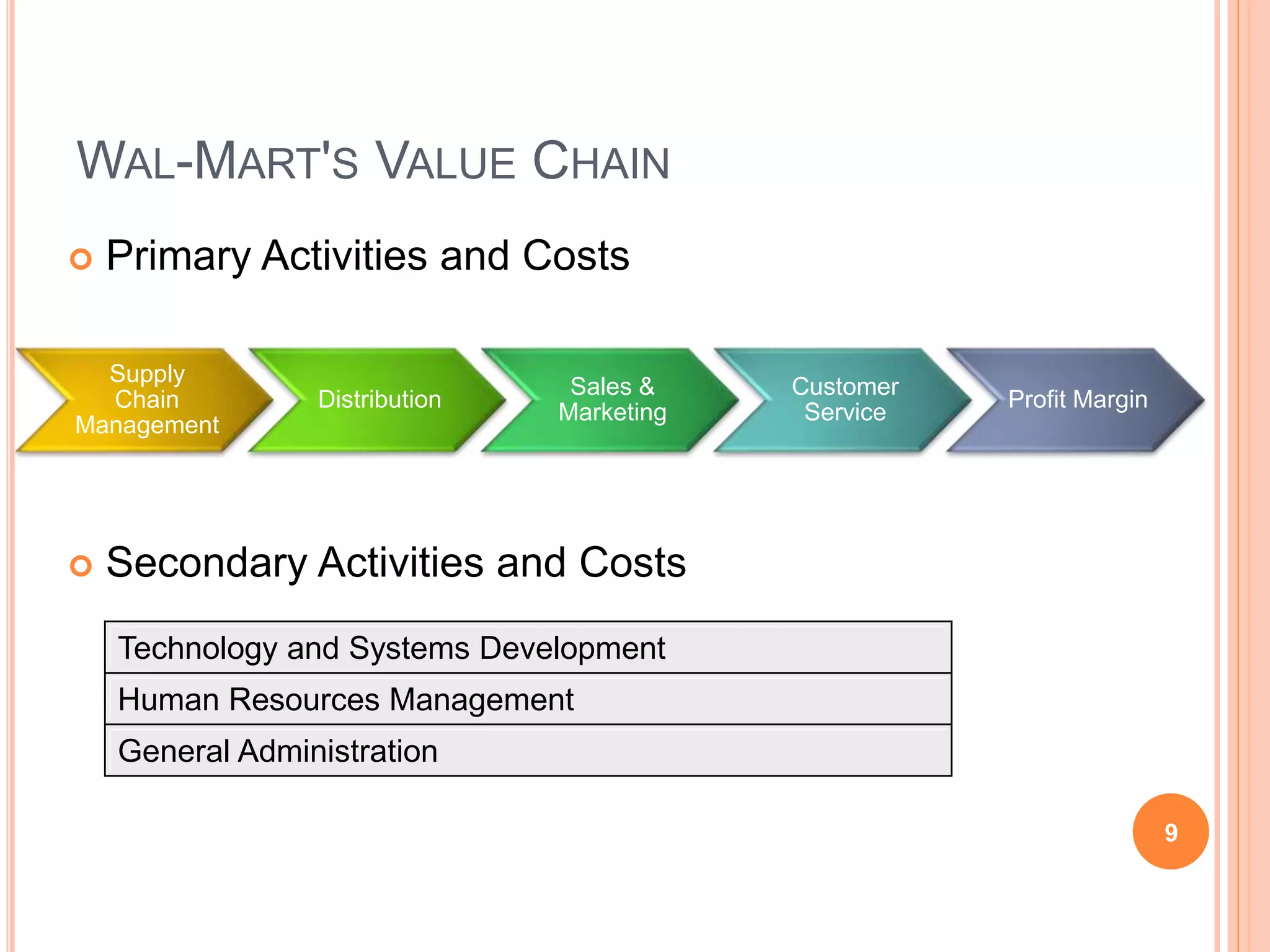

This presentation provides an overview of the retail sector and an analysis of Walmart's business strategies. The global retail market was over $22 trillion in 2014 and is growing. The Indian retail market is expected to reach $1.3 trillion by 2020. Walmart is the largest retailer in the world by revenue, generating $482 billion in 2015. Key to Walmart's success is its low-cost leadership strategy, efficient supply chain management, and ability to undercut competitors' prices. Going forward, opportunities for growth include expanding globally and increasing online sales, while threats include intense competition and potential regulatory issues.