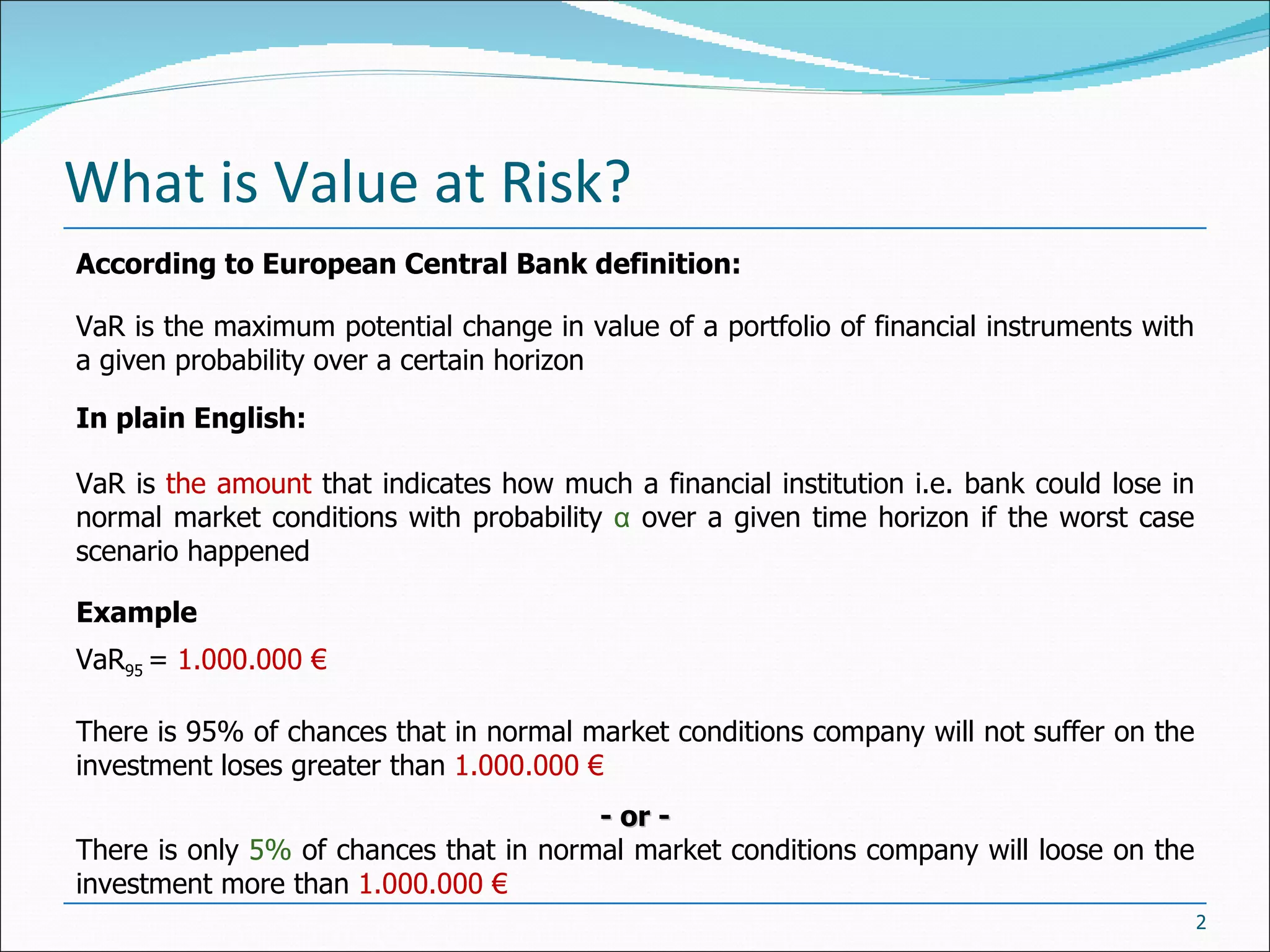

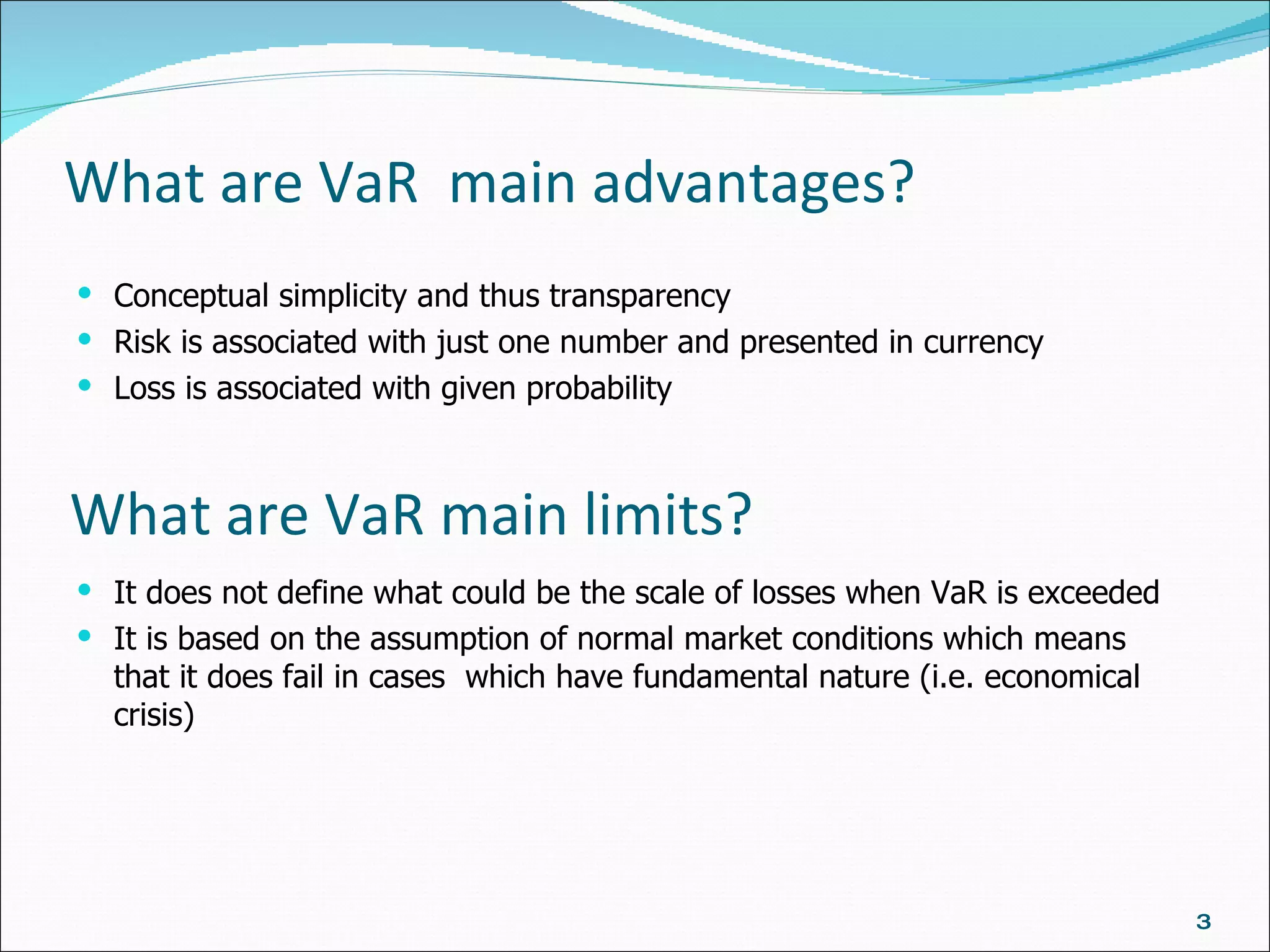

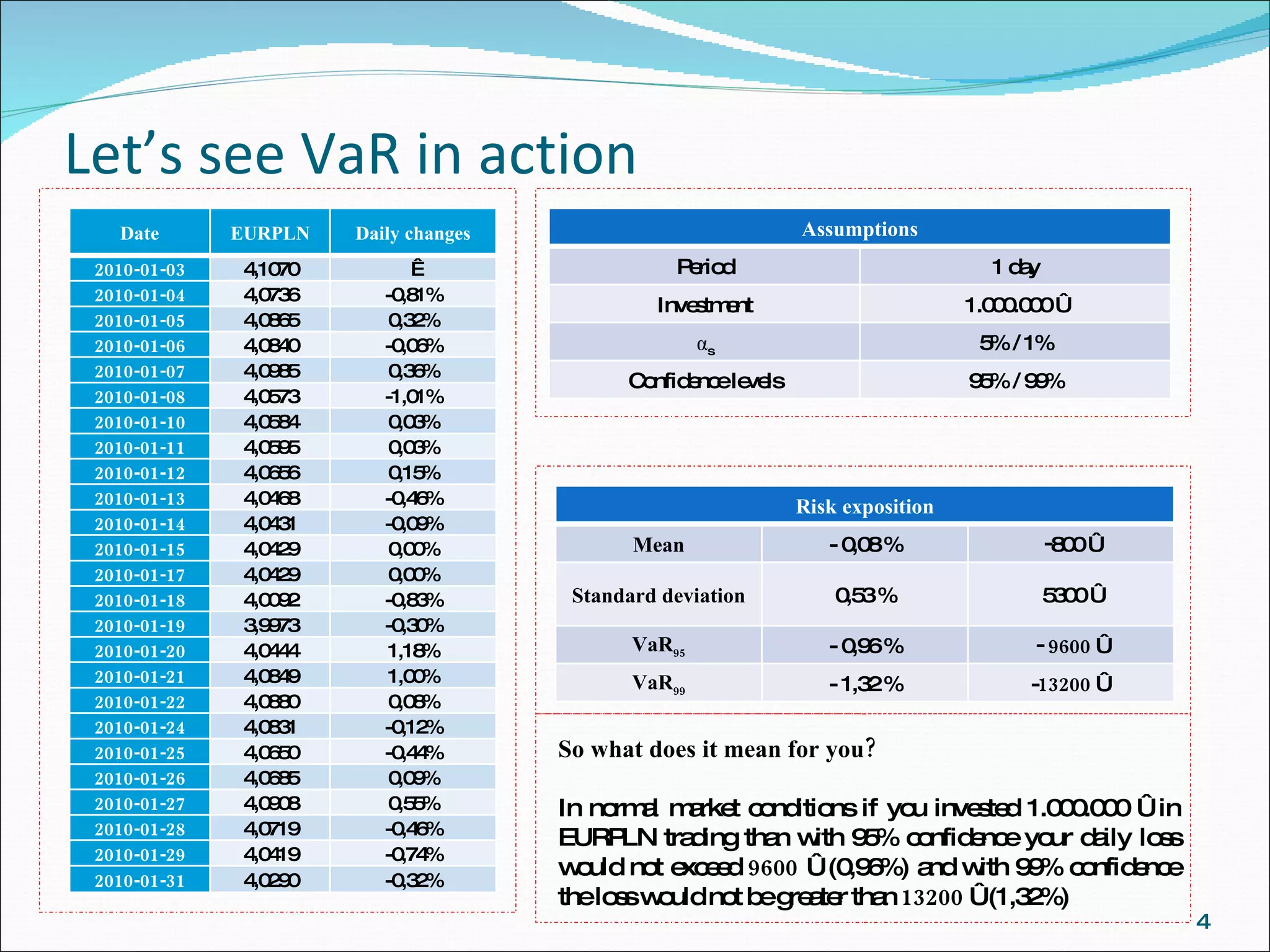

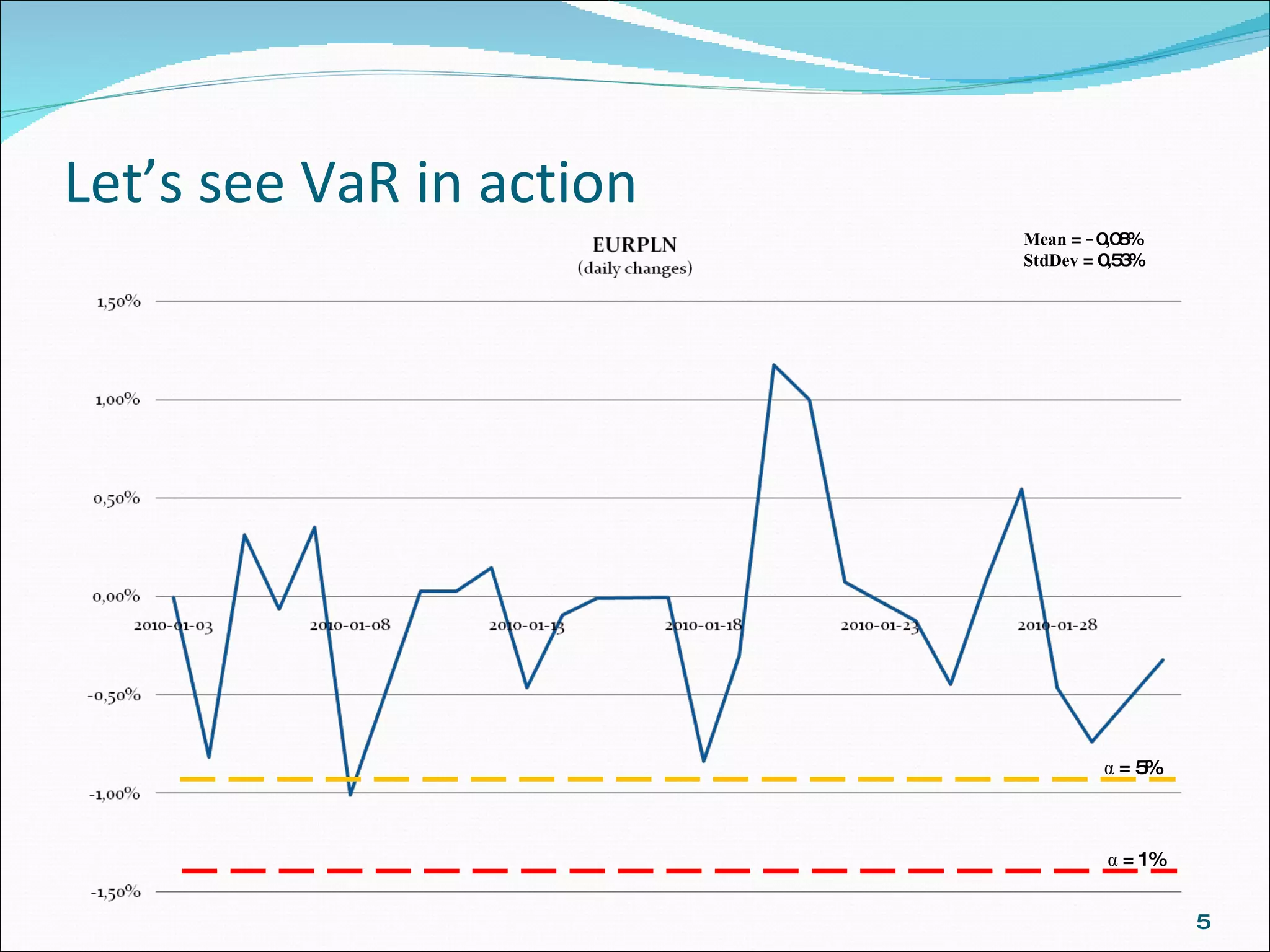

VaR is a method used by financial institutions to measure and manage exposure to risks. It estimates the maximum potential loss over a specific time period with a given level of confidence, such as 95%. For example, a 1-day 95% VaR of €9,600 for a €1,000,000 EURPLN position means there is a 5% chance of losing more than €9,600 based on historical data of daily changes. VaR provides a simple single number to measure risk but does not indicate the scale of losses beyond the VaR amount or account for non-normal market conditions.