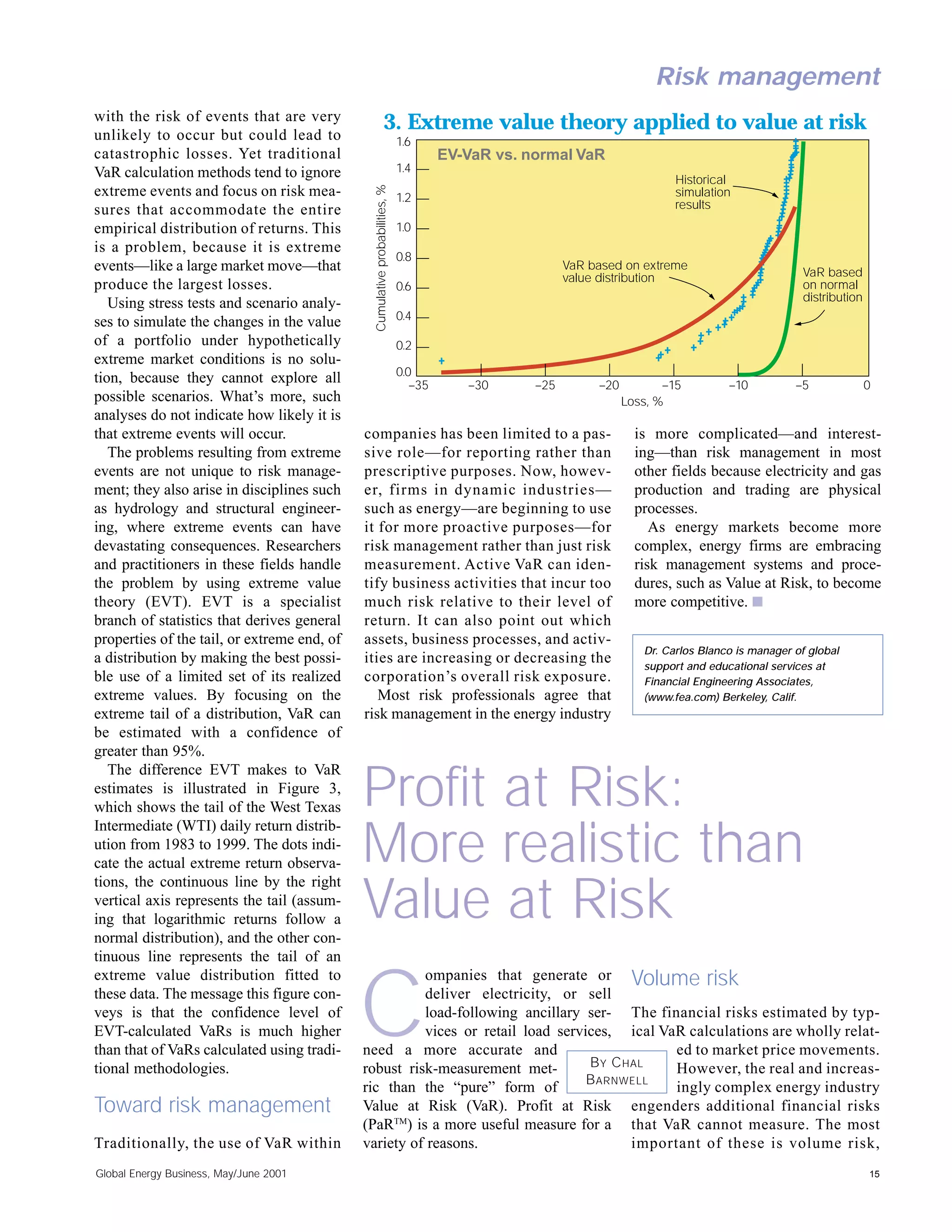

This document discusses various risk measurement methodologies used in energy trading, with a focus on Value at Risk (VaR). It provides the following key points:

1. VaR measures the worst expected loss of a portfolio over a given time period under normal market conditions. It is commonly used in energy trading but has limitations.

2. New risk measures have been developed based on VaR, including Profit at Risk (PaR), Earnings at Risk (EaR), and Cash Flow at Risk (C-far). These aim to address some weaknesses of VaR.

3. The document describes various techniques for calculating VaR, including variance-covariance, Monte Carlo simulation, and historical simulation,

![Global Energy Business is written to meet the needs of the time-constrained energy executive. We

examine energy issues as part of the global economy. We explore the impact of international and local

politics, economics, and politics on the energy business--then deliver concise market intelligence to our

readers. We profile pacesetting executives and innovative companies. Part of our "big picture"

perspective is recognizing that our readers don't operate in a vacuum, that's why each issue includes

provocative market and financial commentary, travel, and leisure articles; and a column that looks at the

lighter side of business.

Please complete the form below to receive a FREE subscription to Global Energy Business.

1. [ ] Yes, start/renew my FREE subscription to Global Energy Business.

[ ] No, I do not wish to receive Global Energy Business.

2. Name:

E-mail address:

Title:

Company:

Address:

City:

State or Province:

ZIP or postal code:

Country:

Phone:

Fax:

3. Primary Job Function (check only one):

[ ] General or Corporate Management - A

[ ] Library or Company - B

[ ] Other (please specify):](https://image.slidesharecdn.com/marketrisk-120823113439-phpapp01/75/Marketrisk-9-2048.jpg)

![4. My company is a (check only one):

[ ] Primary energy supplier - A

[ ] Utility - B

[ ] Developer/independent power producer - C

[ ] Energy services provider - D

[ ] Consultant, contractor, constructor - E

[ ] Energy marketer, trader, broker - F

[ ] Commission, association, or government - G

[ ] Law, financial services, or insurance firm - H

[ ] Other (please specify):

4a. In question 4 above, if you checked PRIMARY ENERGY, what does your company provide

(check ALL that apply)

[ ] Coal - A

[ ] Oil - B

[ ] Gas - C

[ ] Nuclear Fuel - D

[ ] Other (please specify):

4b. In question 4 above, if you checked UTILITY, what services does your company provide (check

ALL that apply)

[ ] Electric - A

[ ] Gas - B

[ ] Water - C

[ ] Telephone/communications - D

[ ] Other (please specify):

State or Province of Birth:

(This personal information is required by auditors to receive a free subscription and will be kept strictly

confidential.) For more information about our privacy policy visit

http://www.globalenergybusiness.com/privacy.html

If you received this form electronically, please email to loretta_applegate@mcgraw-hill.com

If you did not receive this form electronically please sign and date below and

Fax to 1-609-426-7797

Signature Date .](https://image.slidesharecdn.com/marketrisk-120823113439-phpapp01/75/Marketrisk-10-2048.jpg)