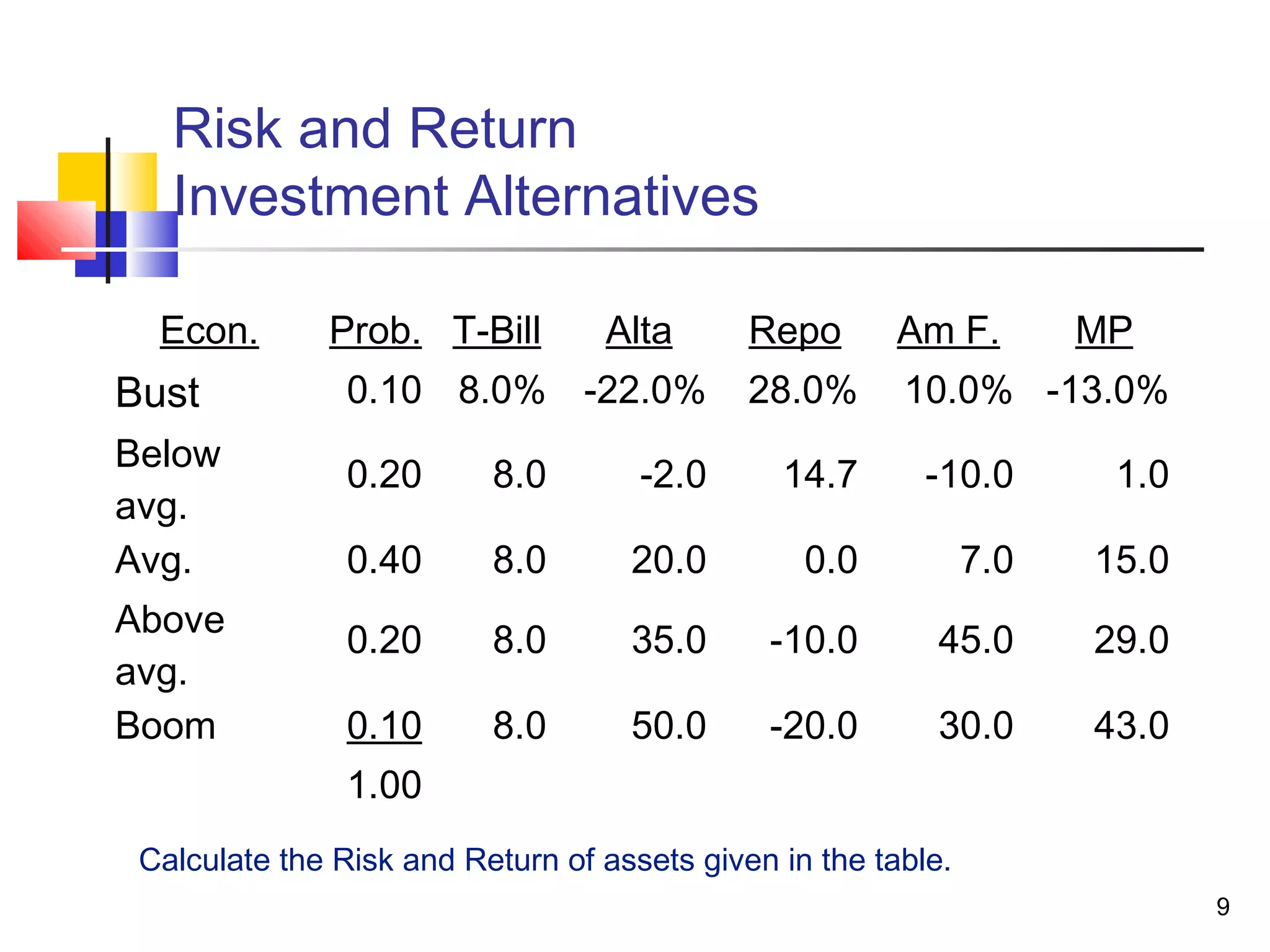

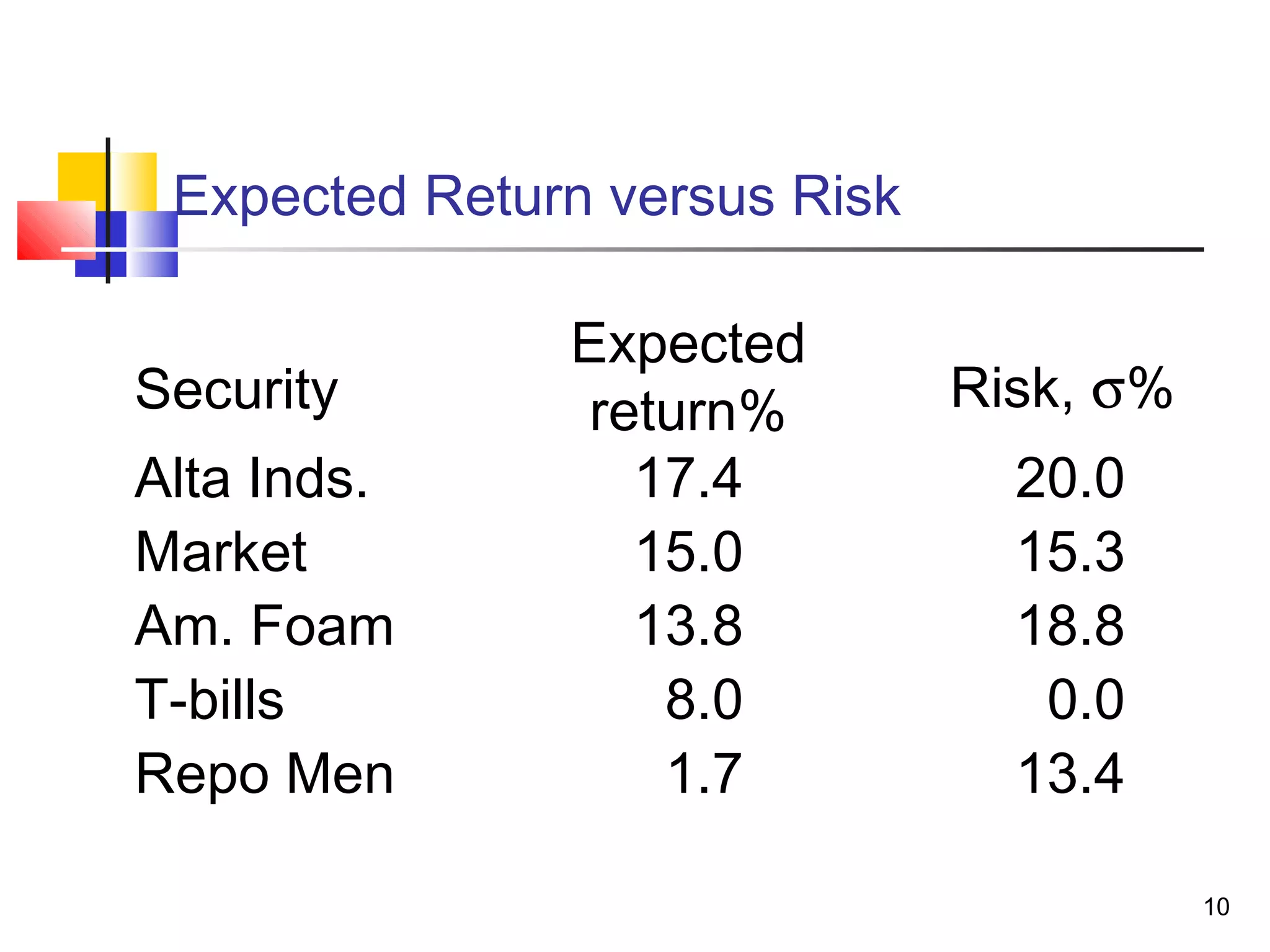

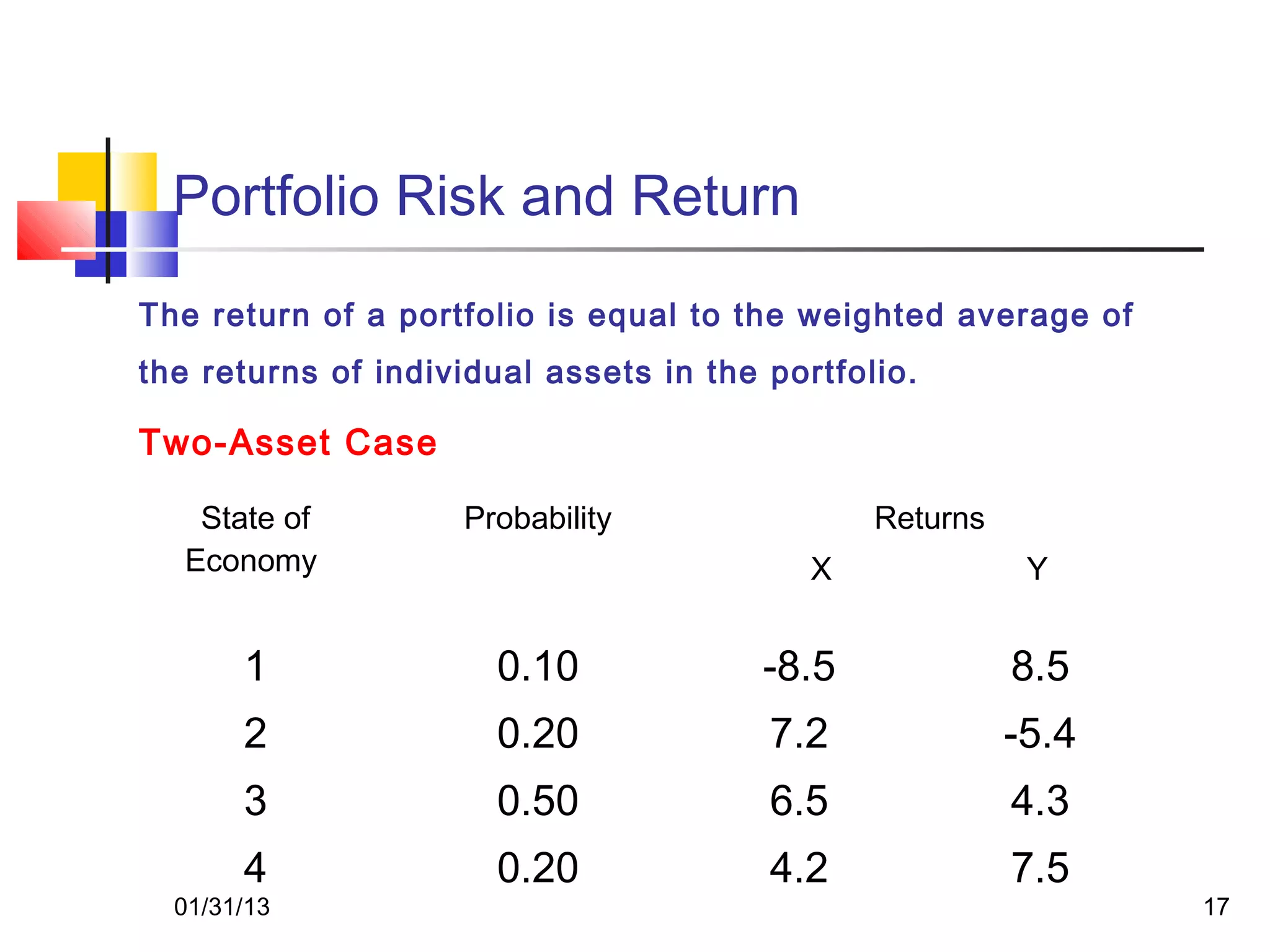

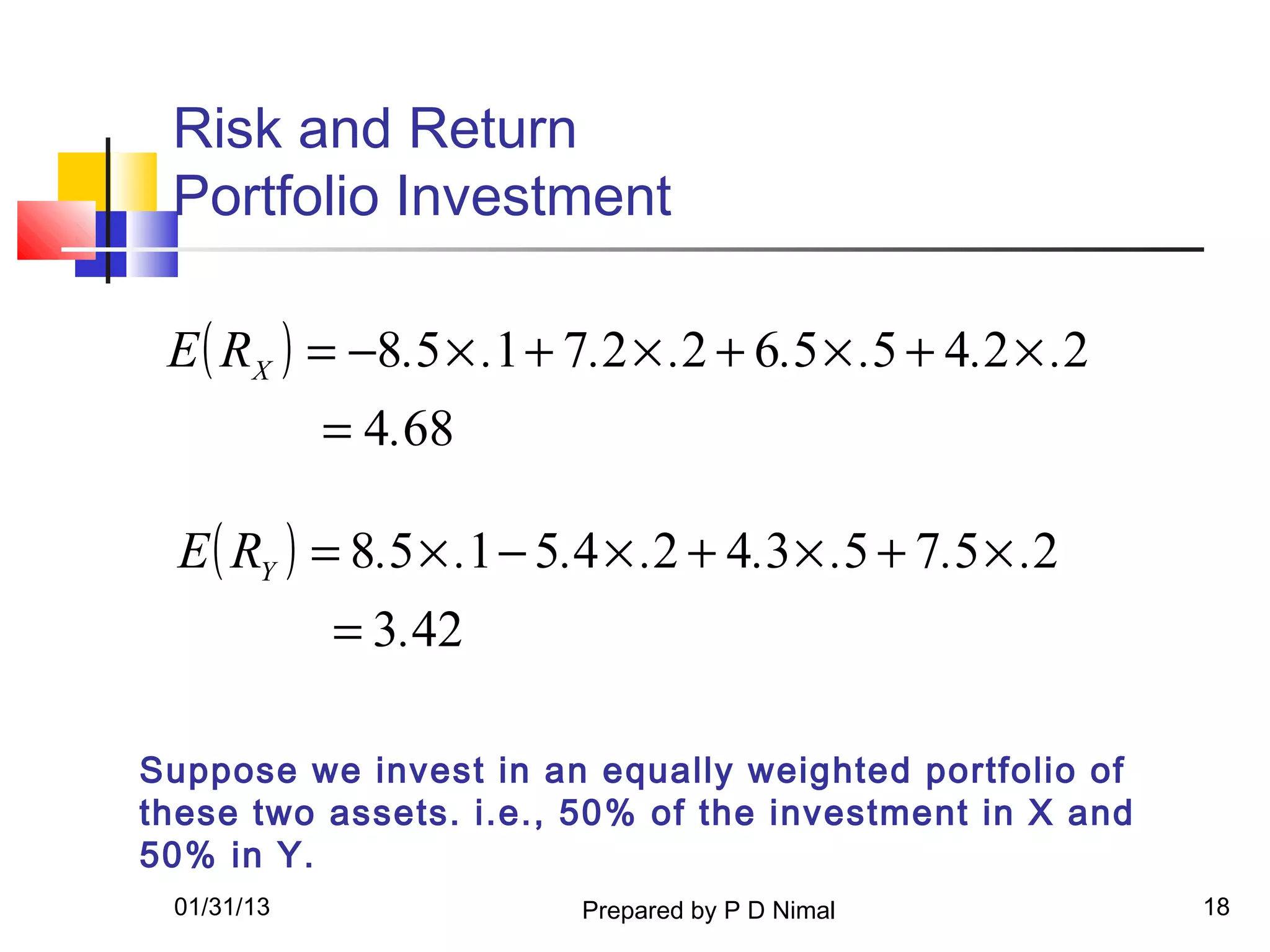

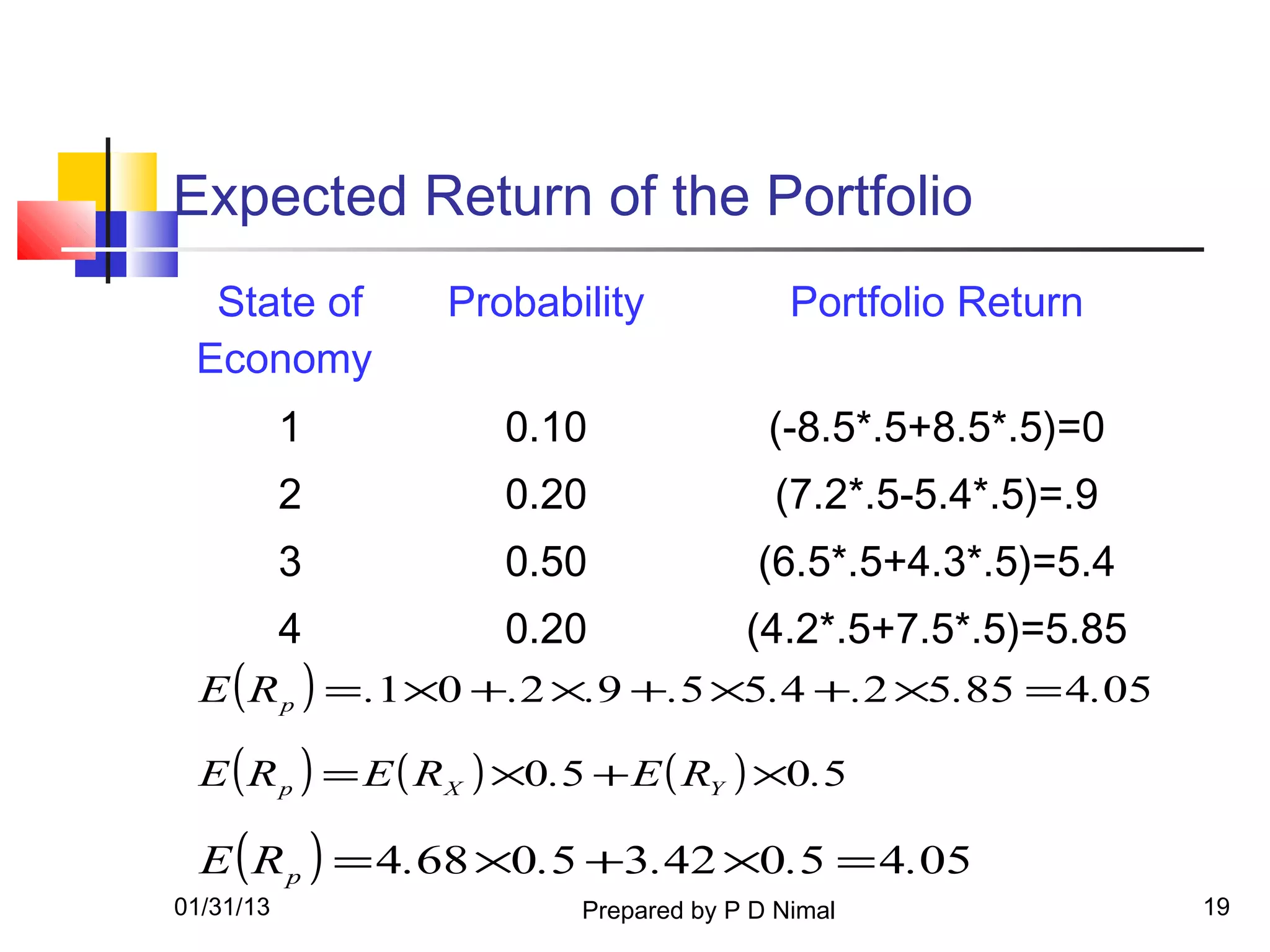

This document discusses risk and return relationships in investment and portfolio management. It covers key concepts such as:

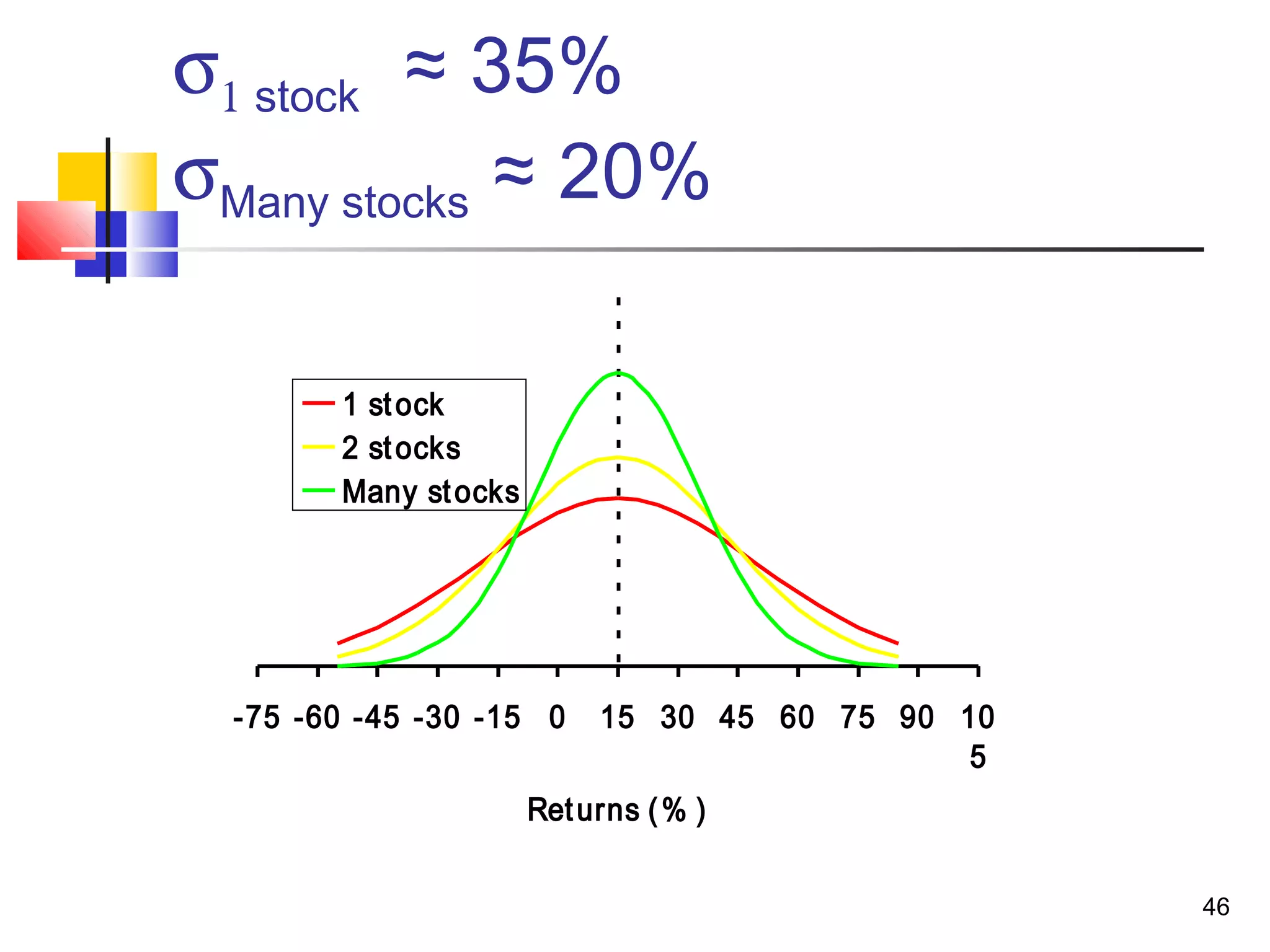

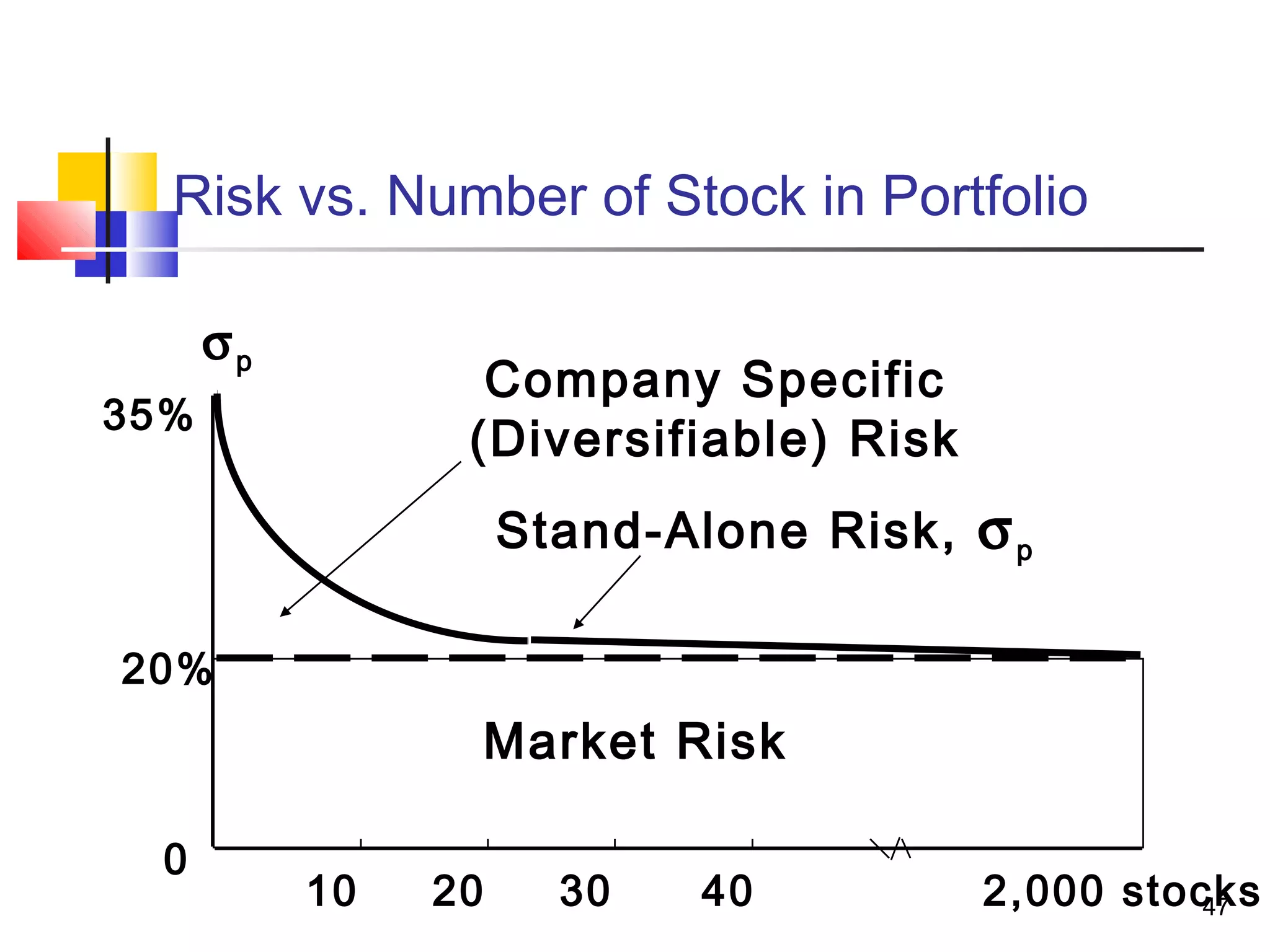

- The relationship between risk and expected return of individual assets. Higher risk is generally associated with higher expected returns.

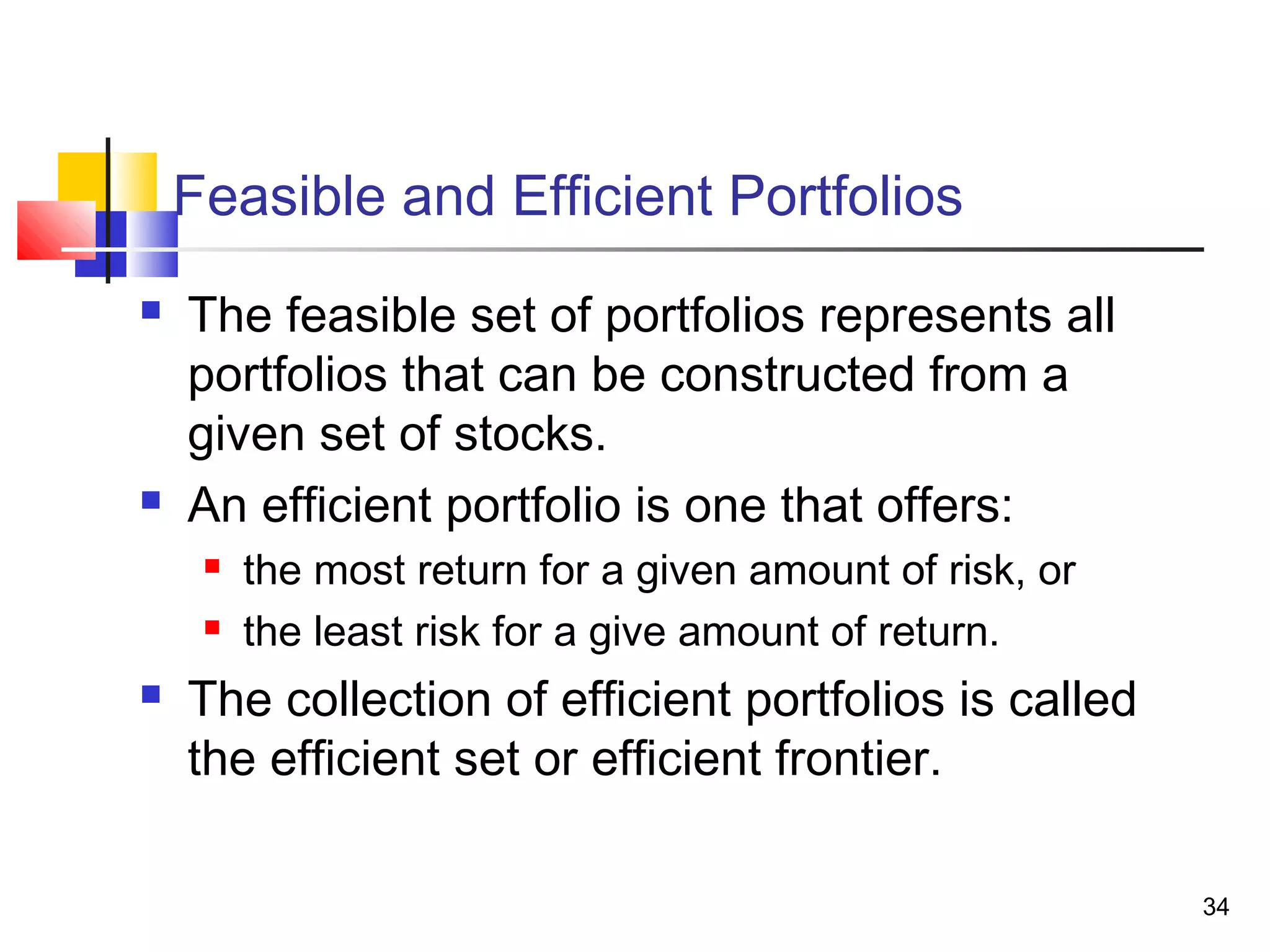

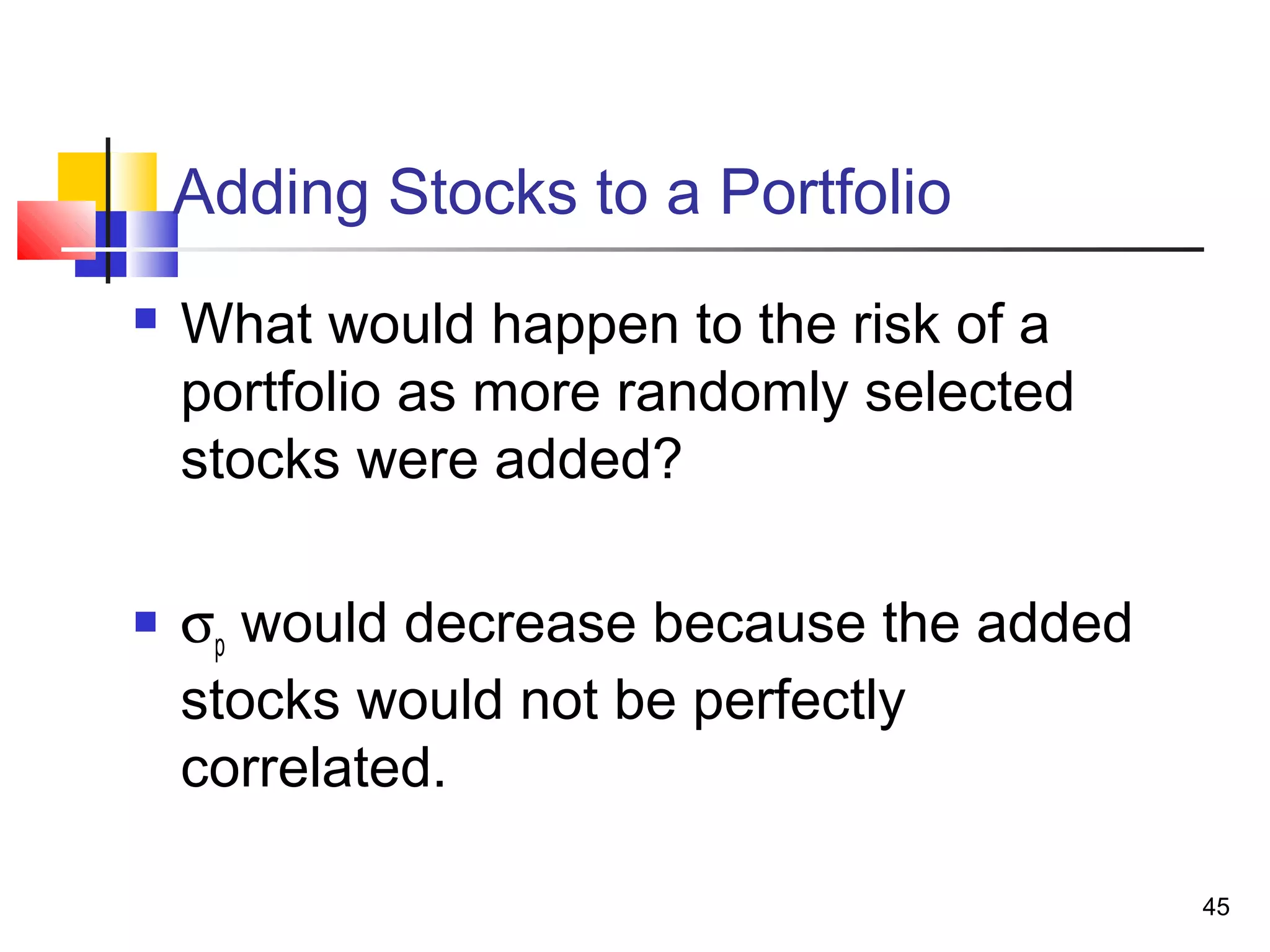

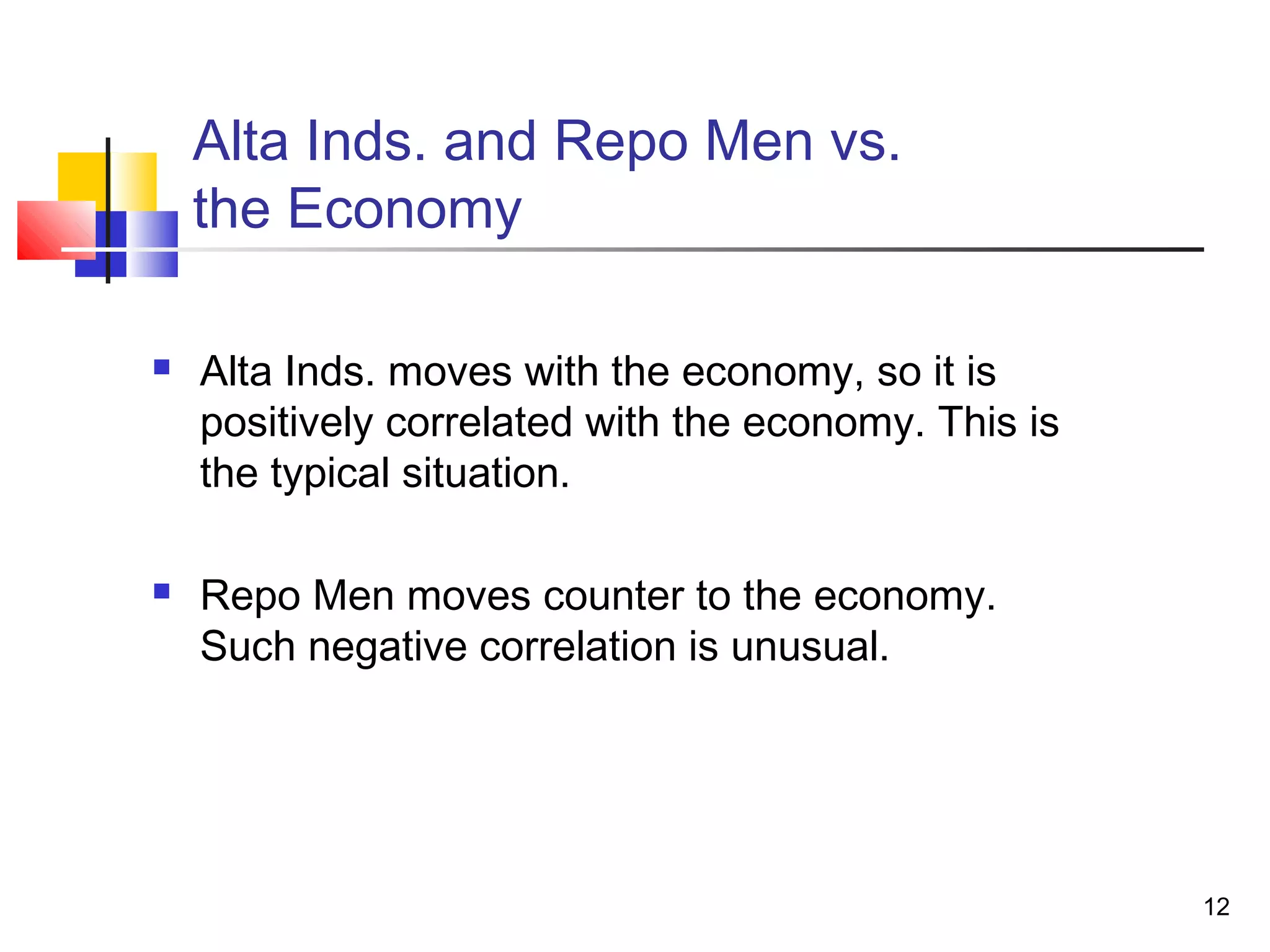

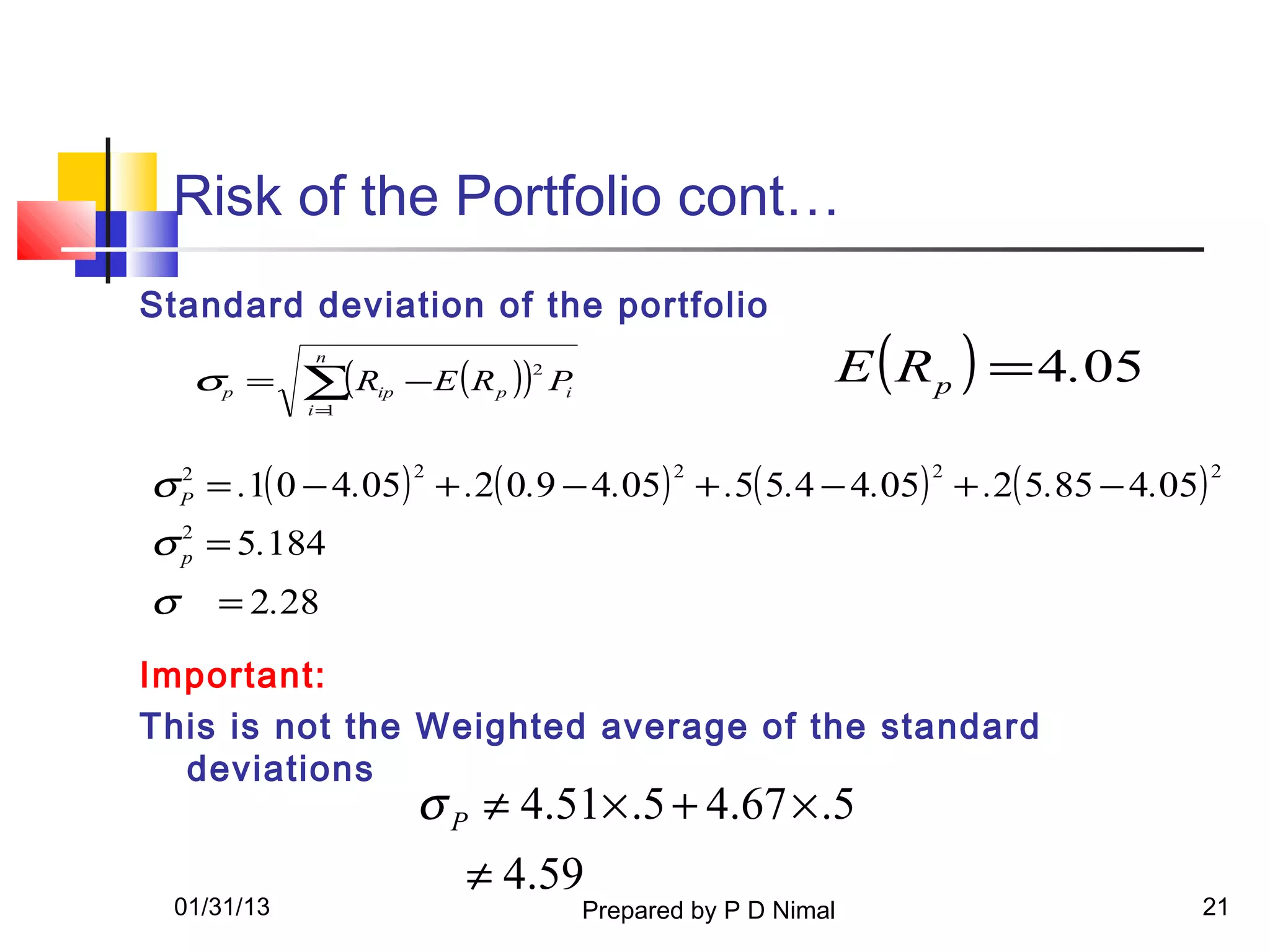

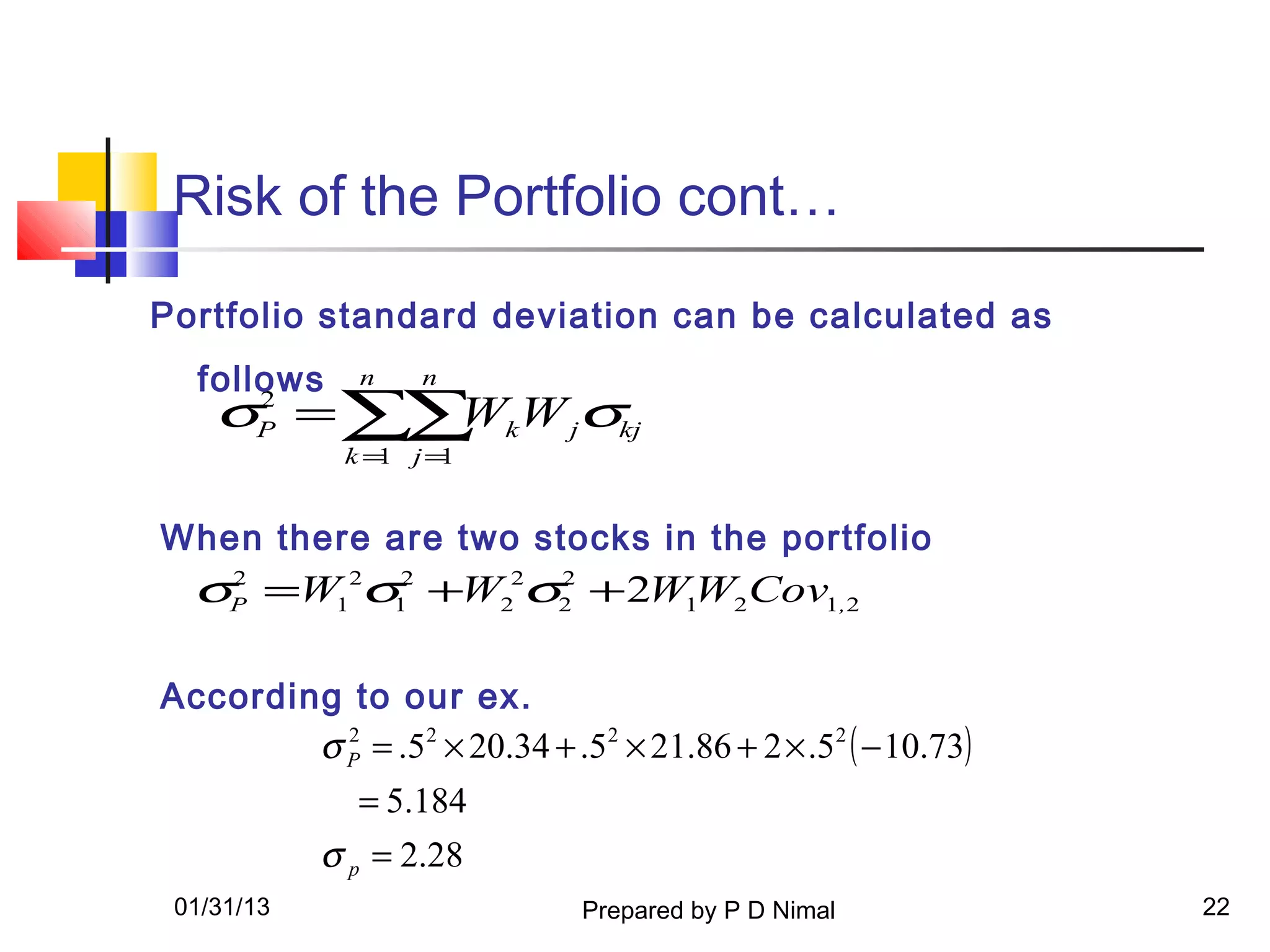

- How portfolio risk and return are calculated based on the individual assets within the portfolio, their weights, and the covariance between the assets. A portfolio's risk can be lower than the risks of individual assets due to diversification.

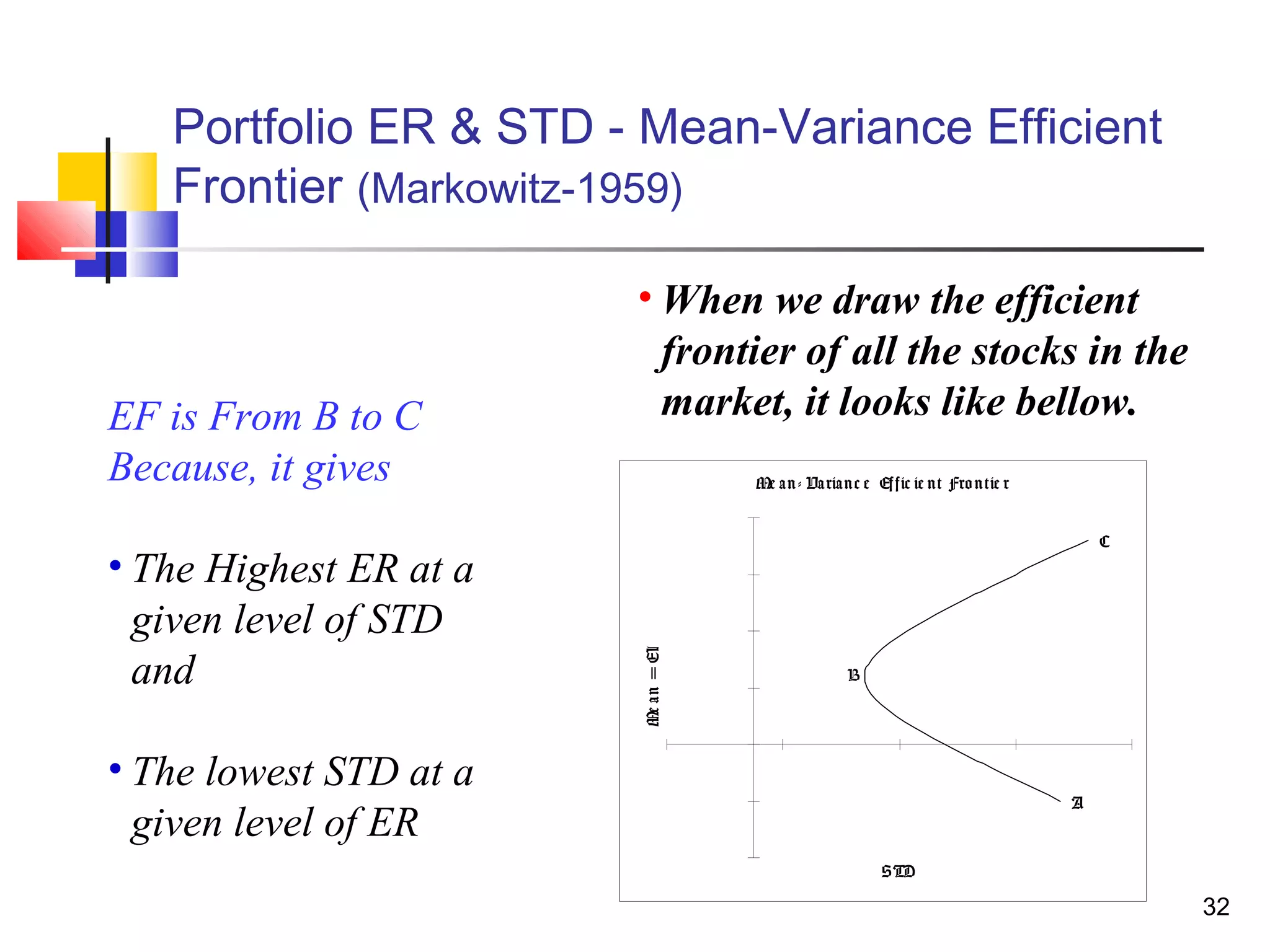

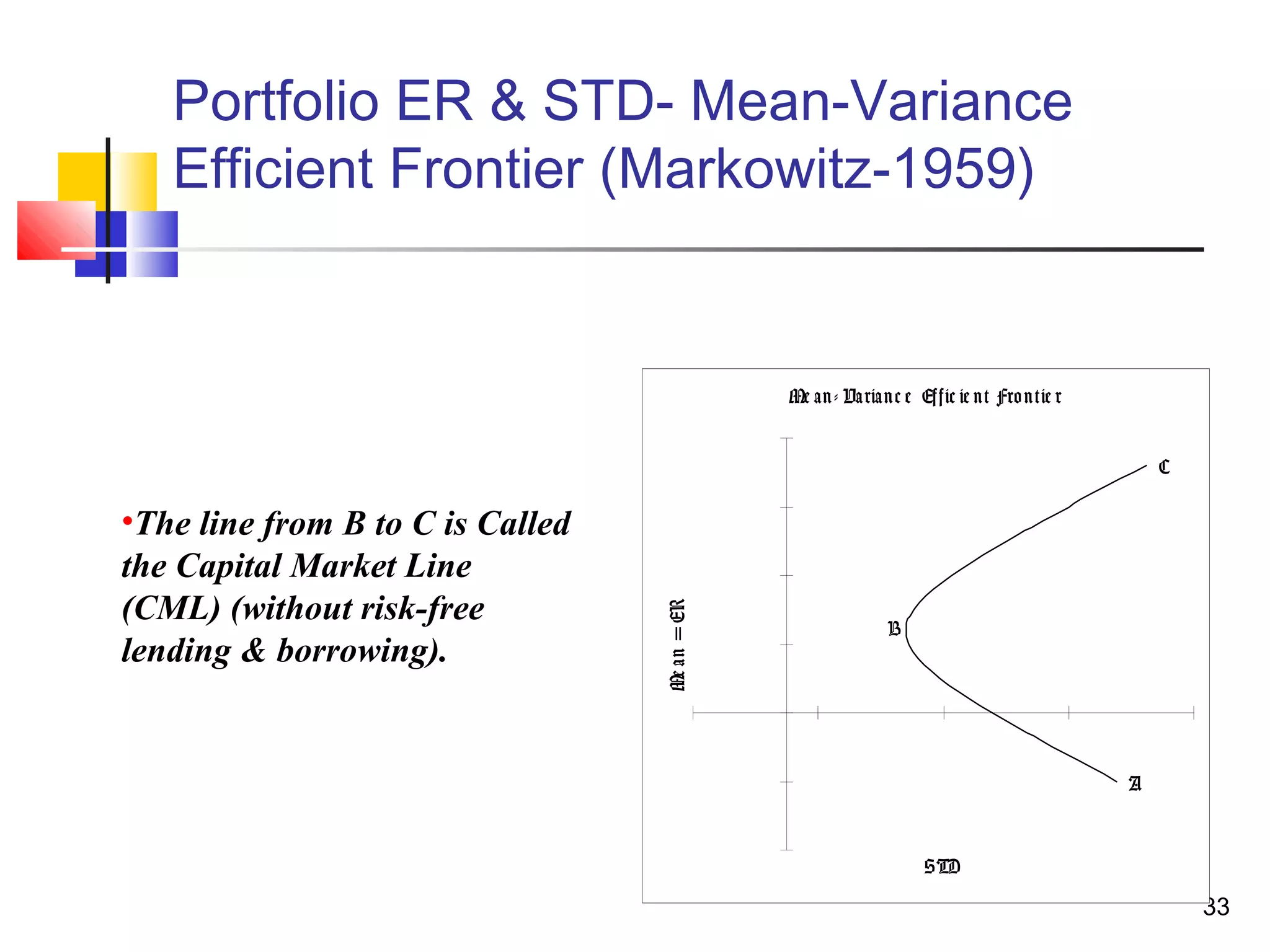

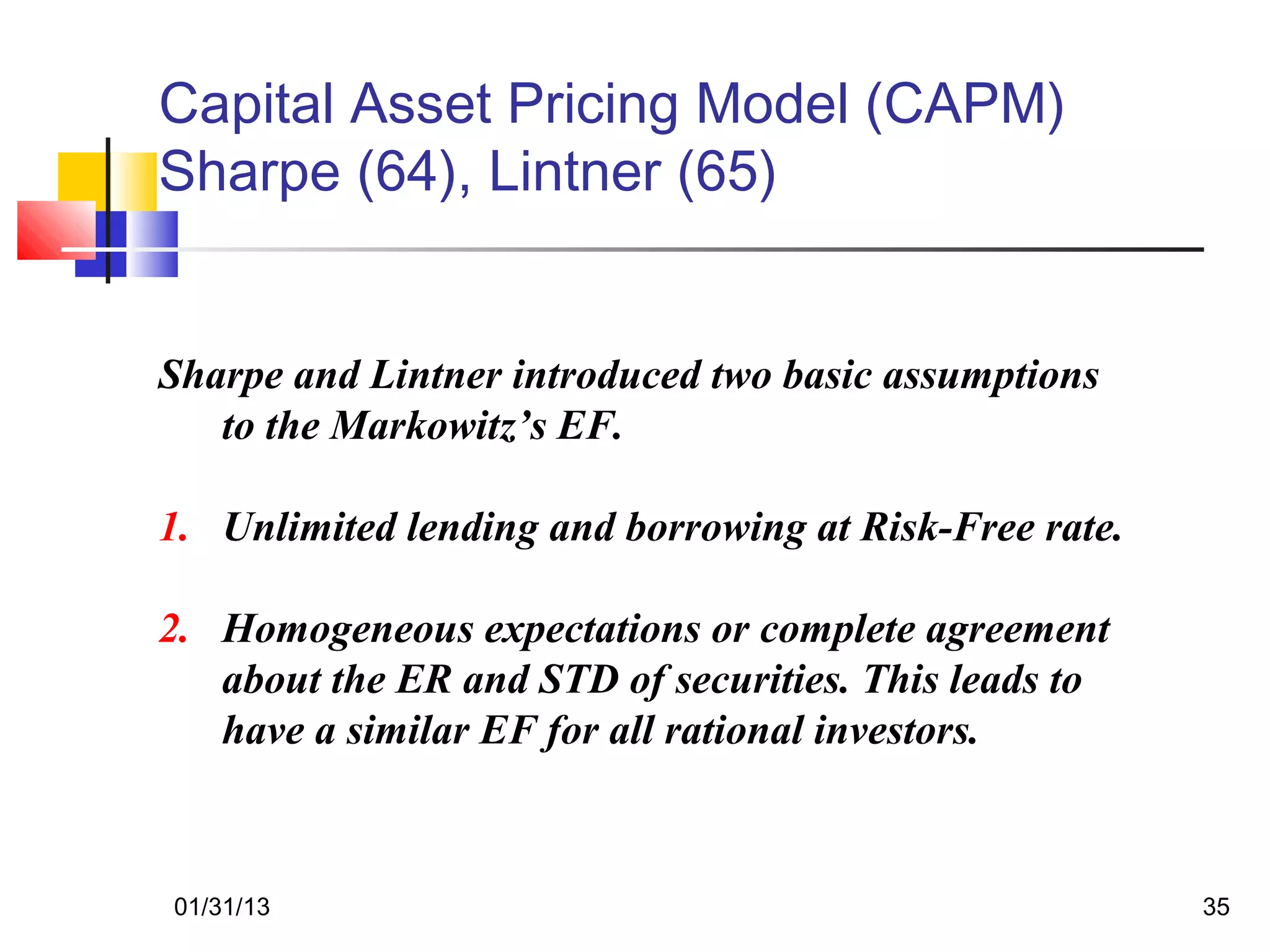

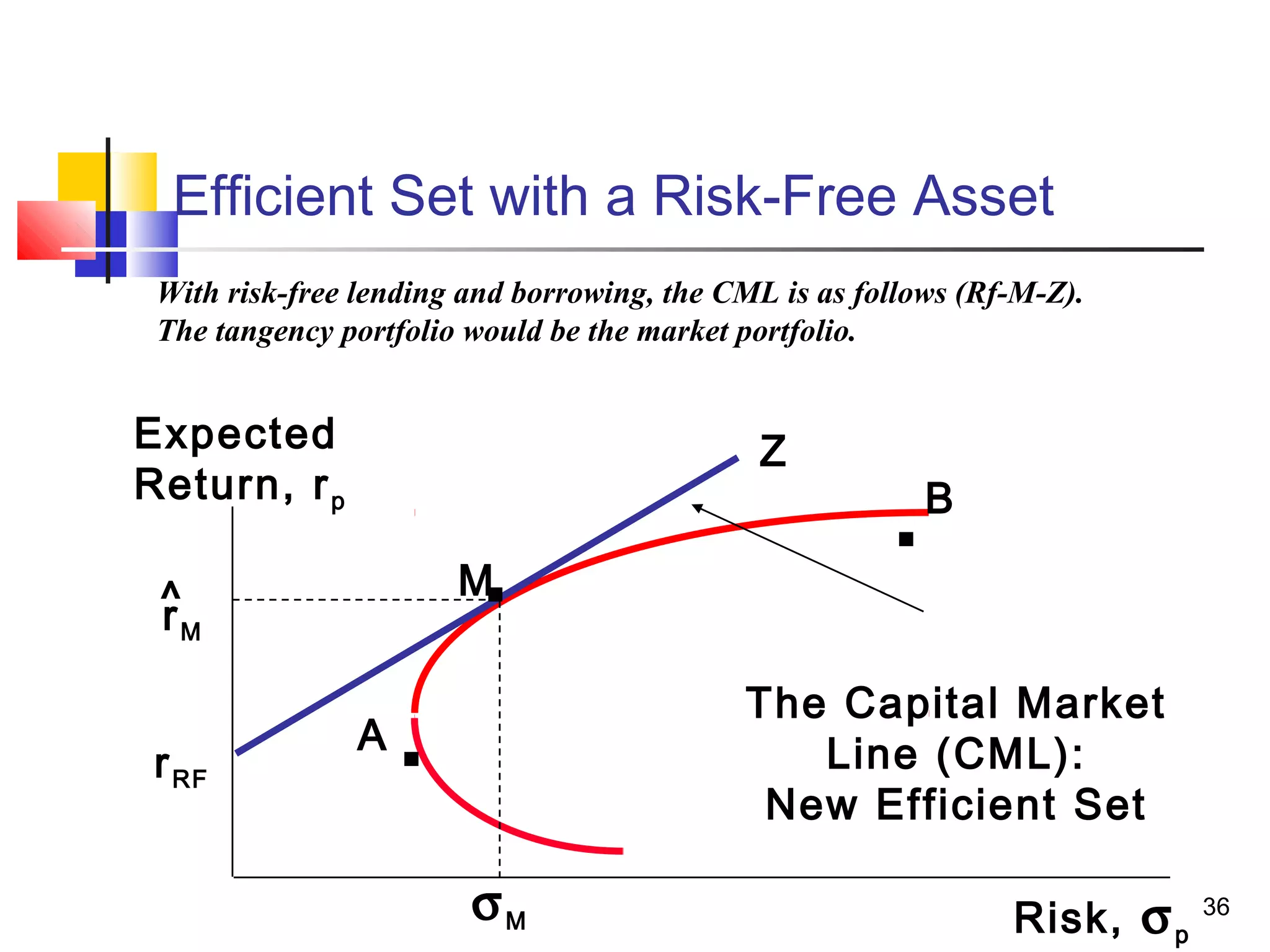

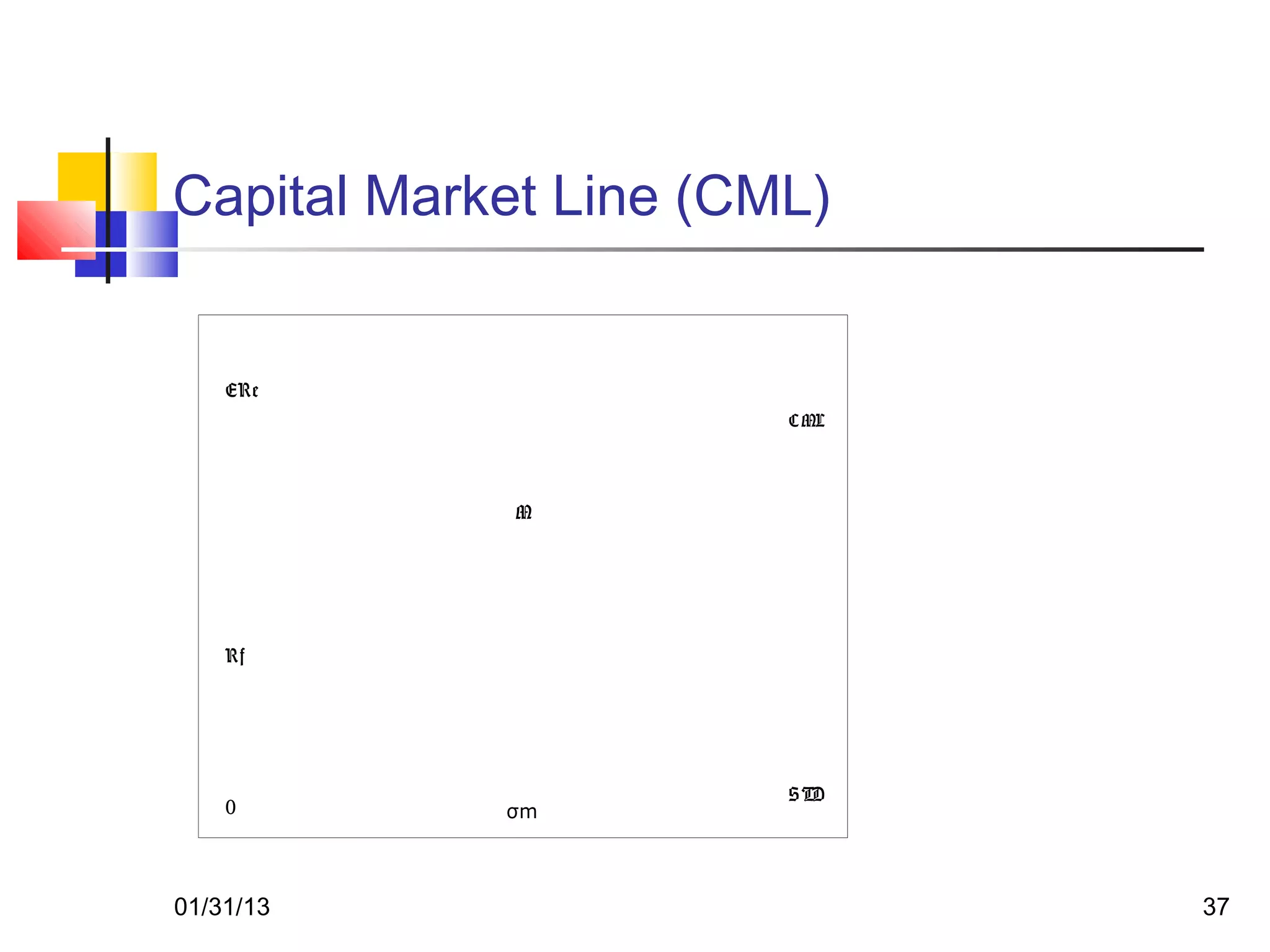

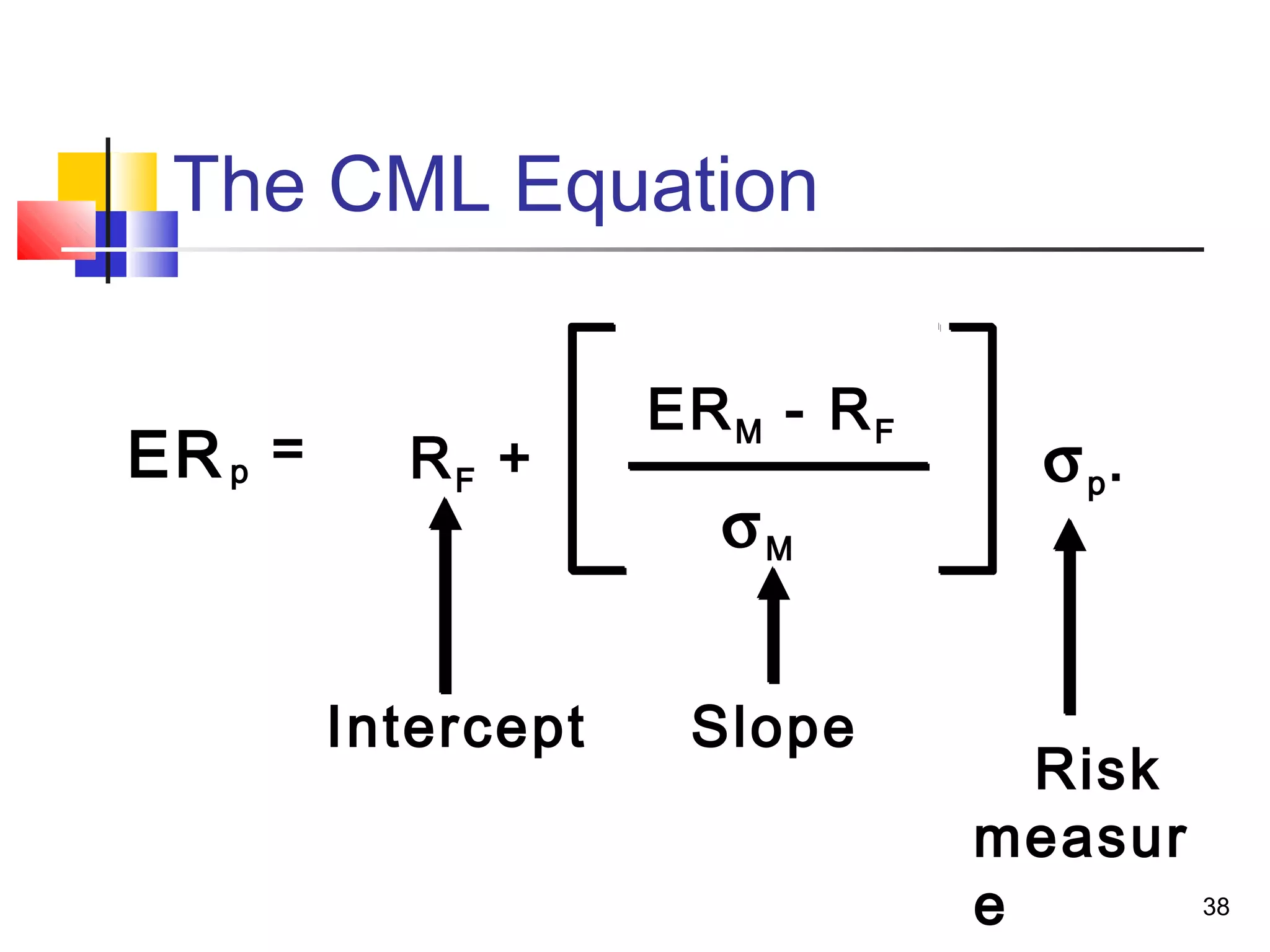

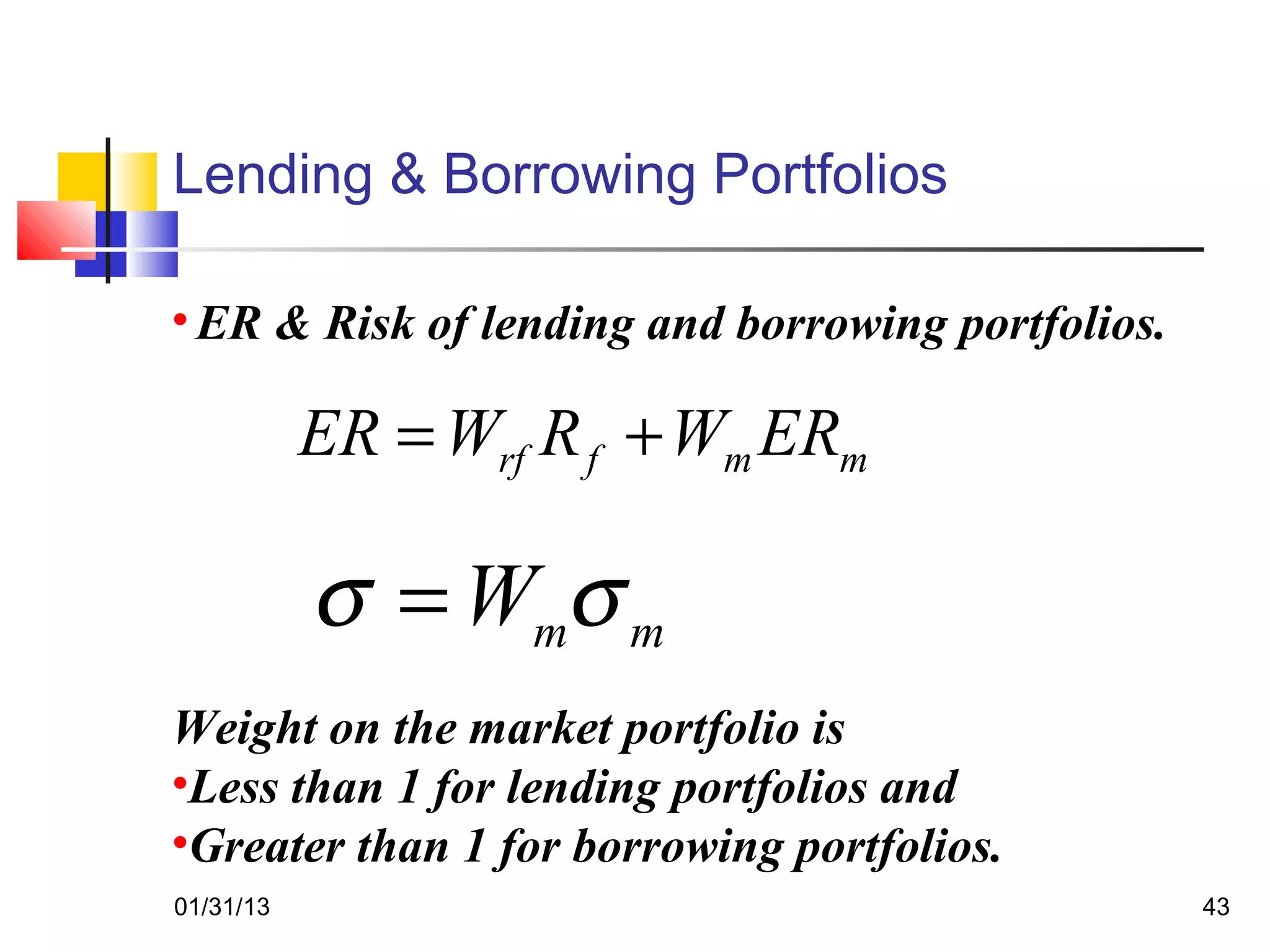

- Important portfolio theory concepts like the efficient frontier and capital market line that show the tradeoff between risk and return for efficient portfolios.

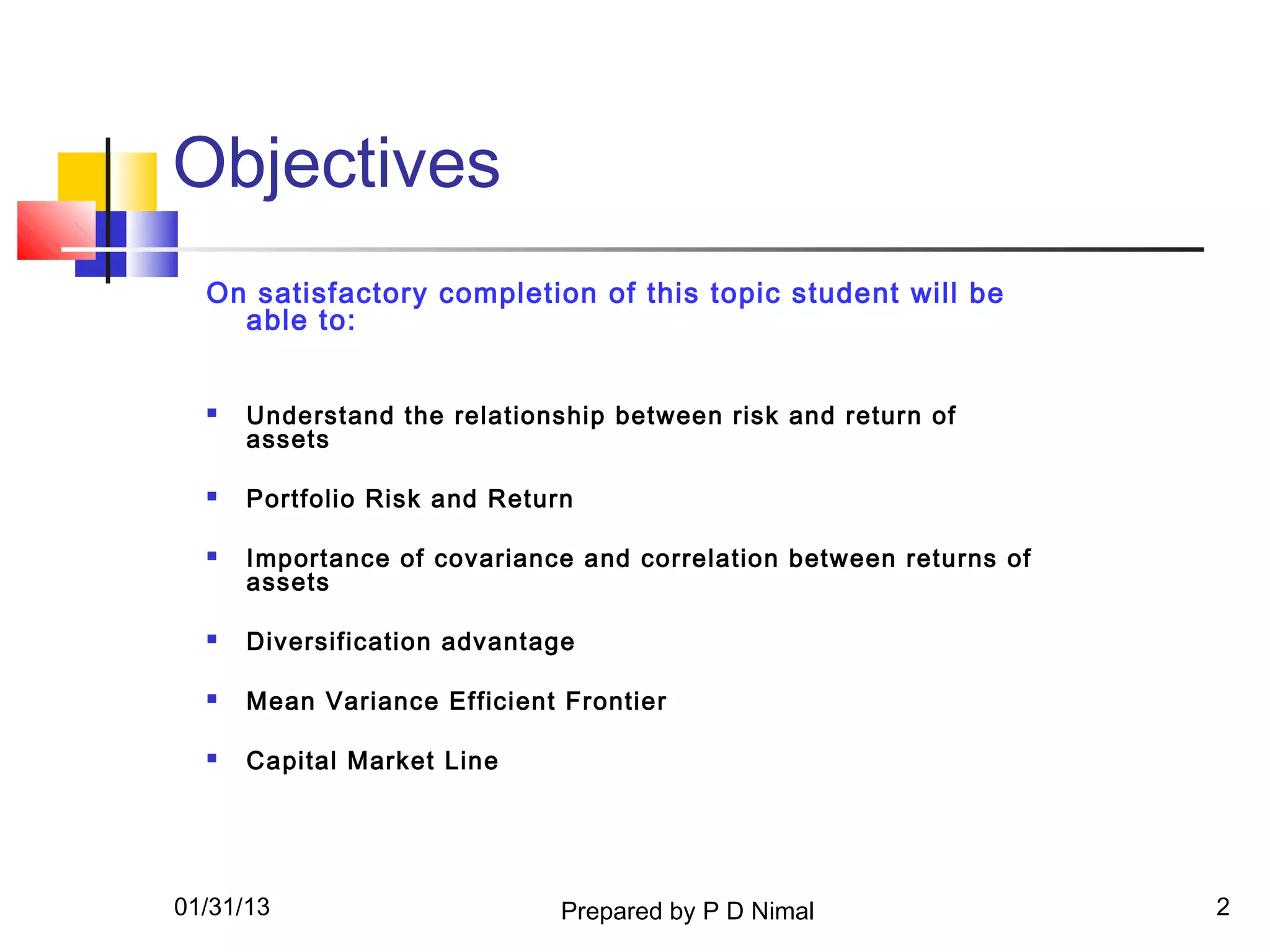

![Expected Return and Risk cont…

n

E( R) =∑ i P

R i

i=1

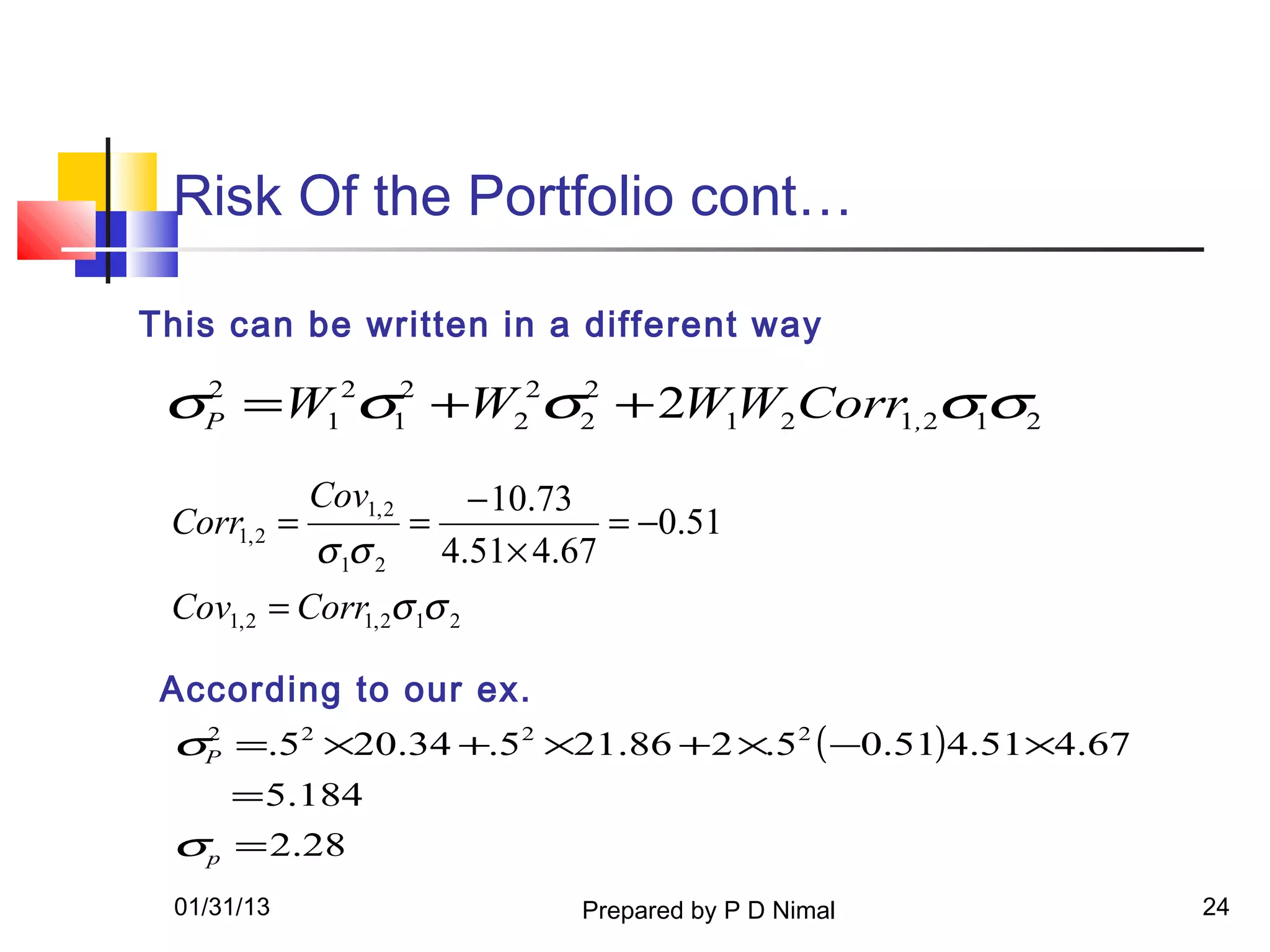

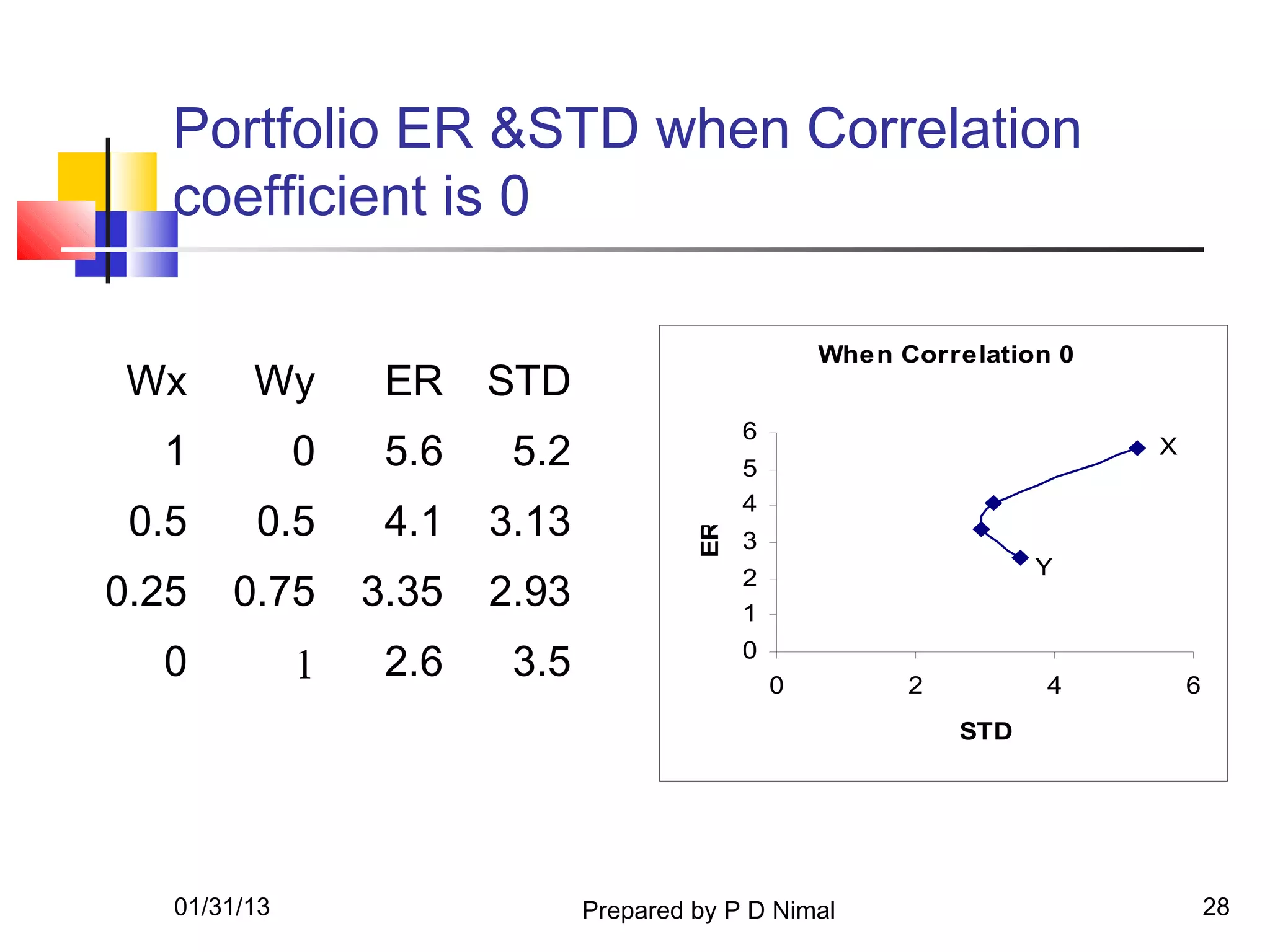

The average dispersion of the return is measured by the

variance or standard deviation. The equation is as follows.

n

σ = ∑ [ Ri − E ( R ) ] Pi

2 2

i =1

Calculate the E(R) and the Standard Deviation of assets

given in the table.

01/31/13 5](https://image.slidesharecdn.com/lesson-4-130131002213-phpapp01/75/Lesson-4-5-2048.jpg)

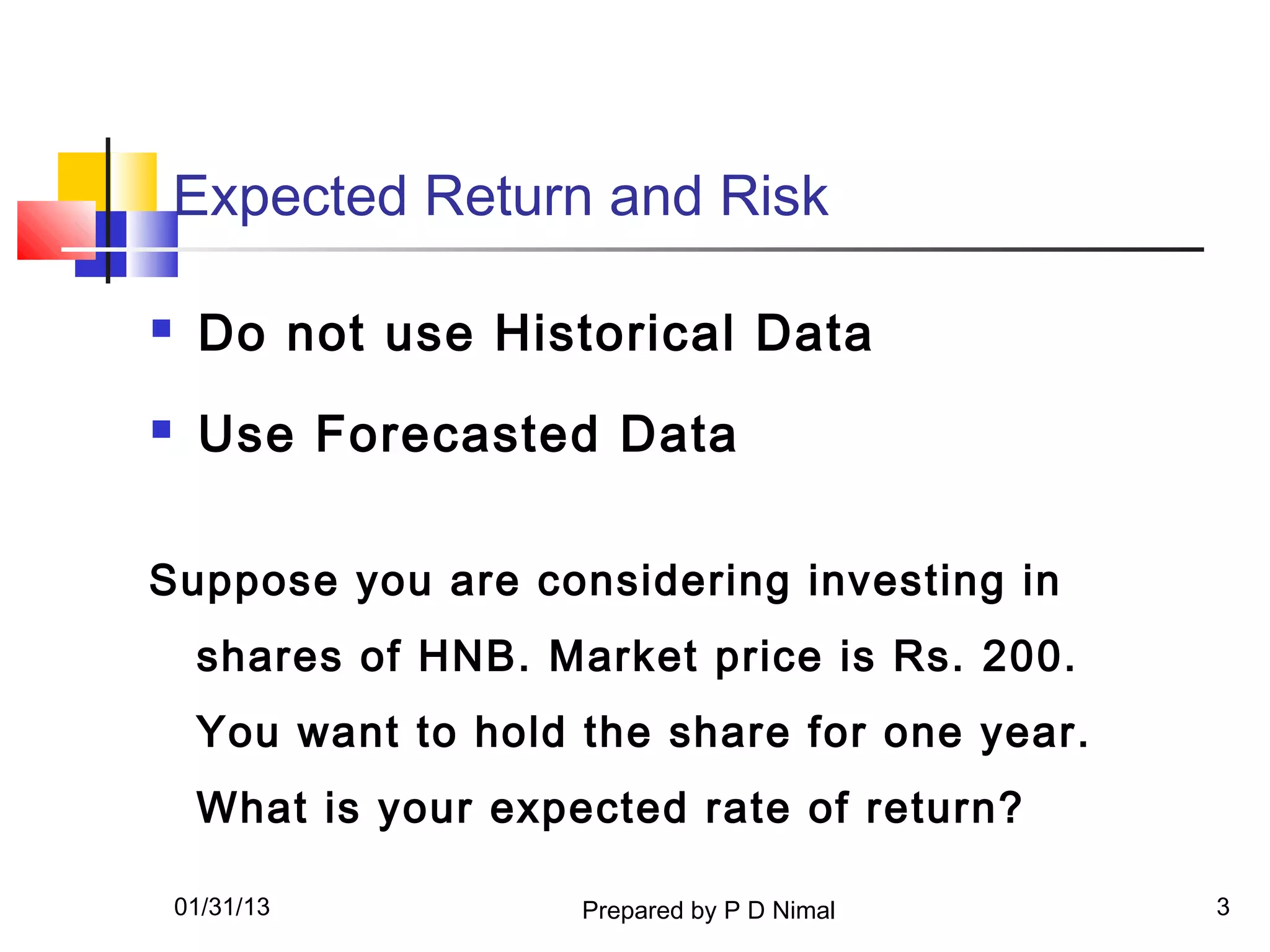

![Expected Return and Risk cont…

n

E( R) =∑ i P

R i

i=1

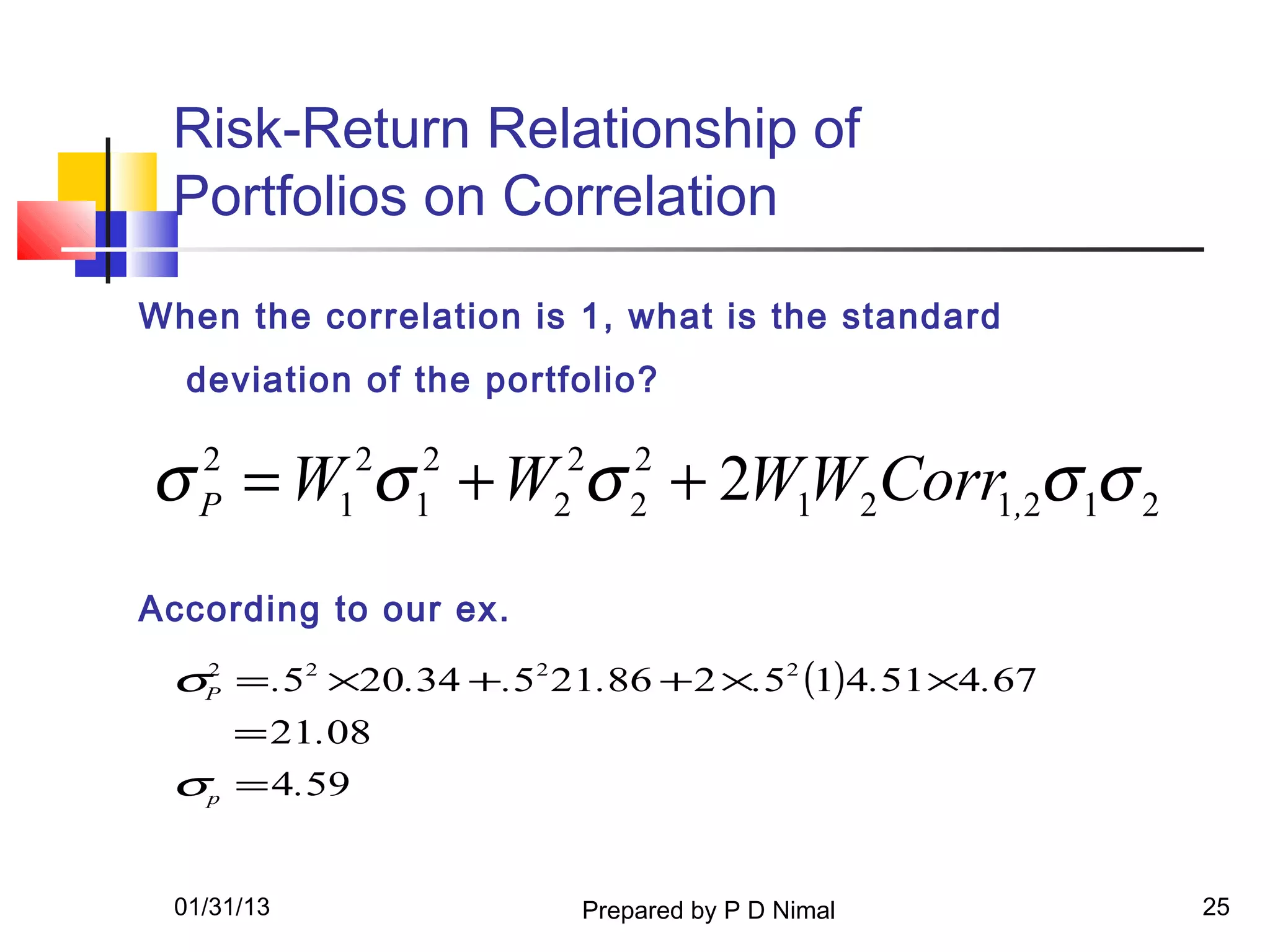

E ( R ) = 17.5 × .2 + 11.2 × .3 + 5.4 × .25 − 8.9 × .25

= 5.985

The average dispersion of the return is

measured by the variance or standard deviation.

The equation is as follows.

n

σ = ∑ [ Ri − E ( R )] Pi

2 2

i=1

01/31/13 Prepared by P D Nimal 7](https://image.slidesharecdn.com/lesson-4-130131002213-phpapp01/75/Lesson-4-7-2048.jpg)

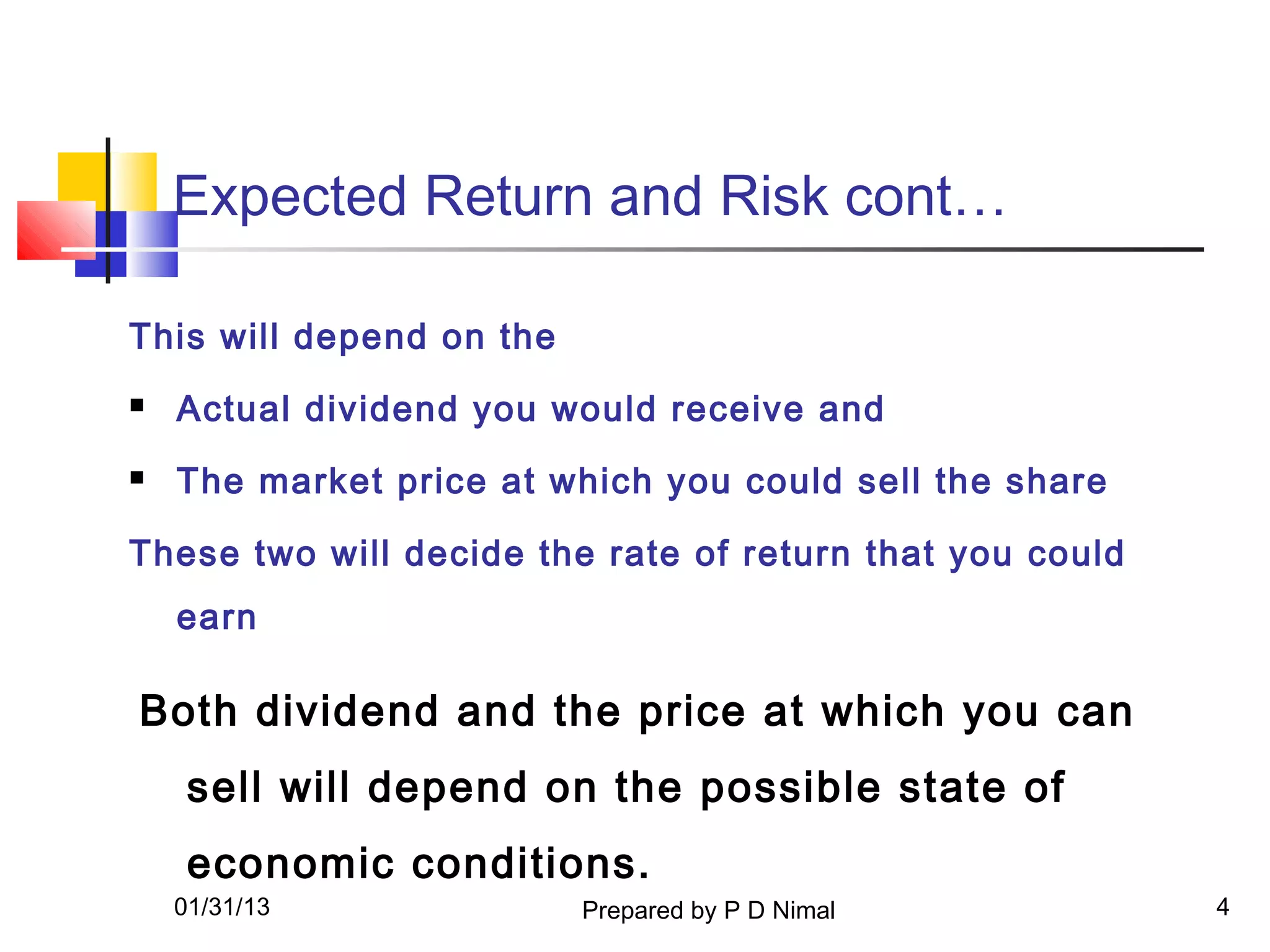

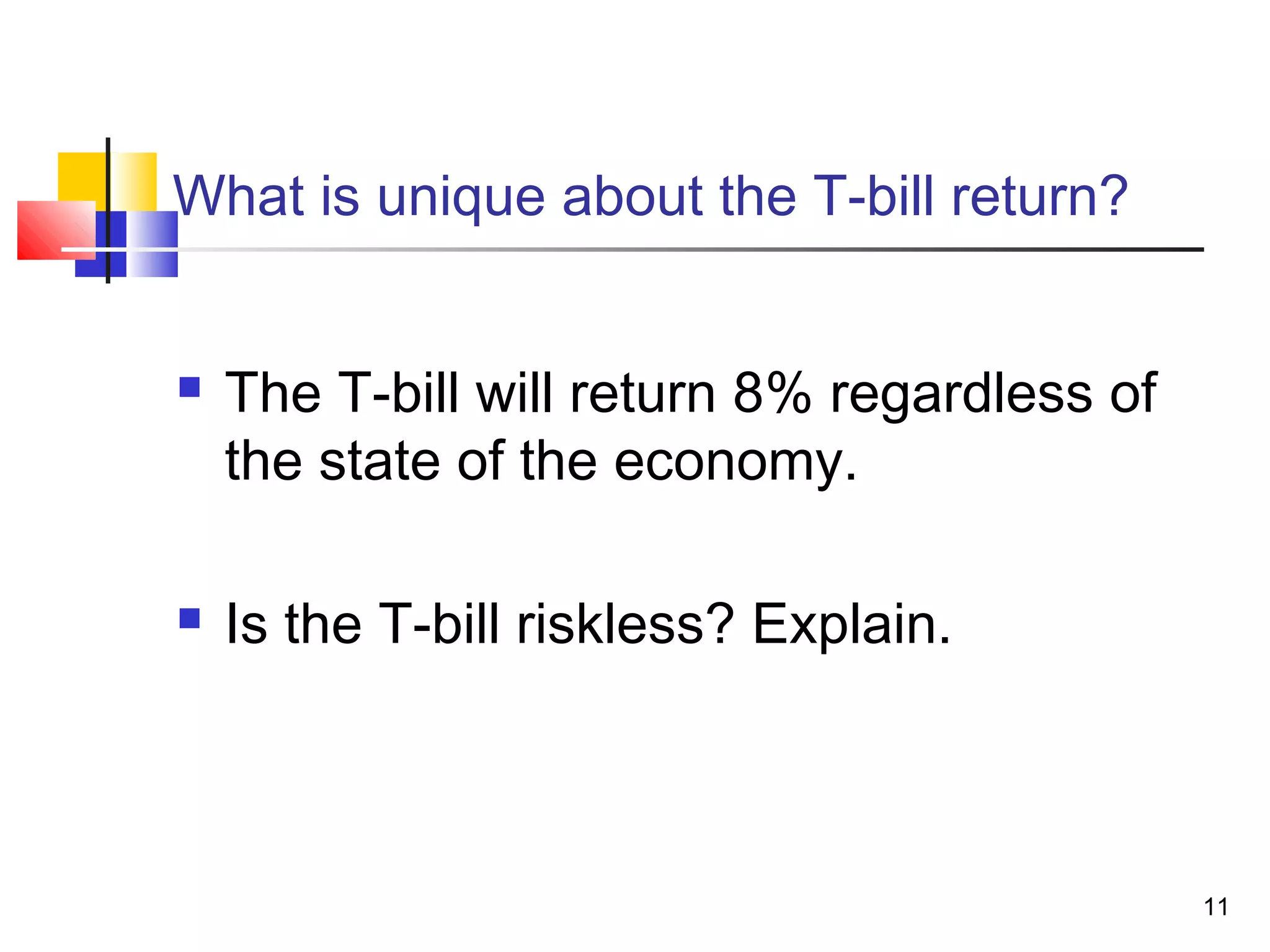

![Expected Return and Risk cont…

n

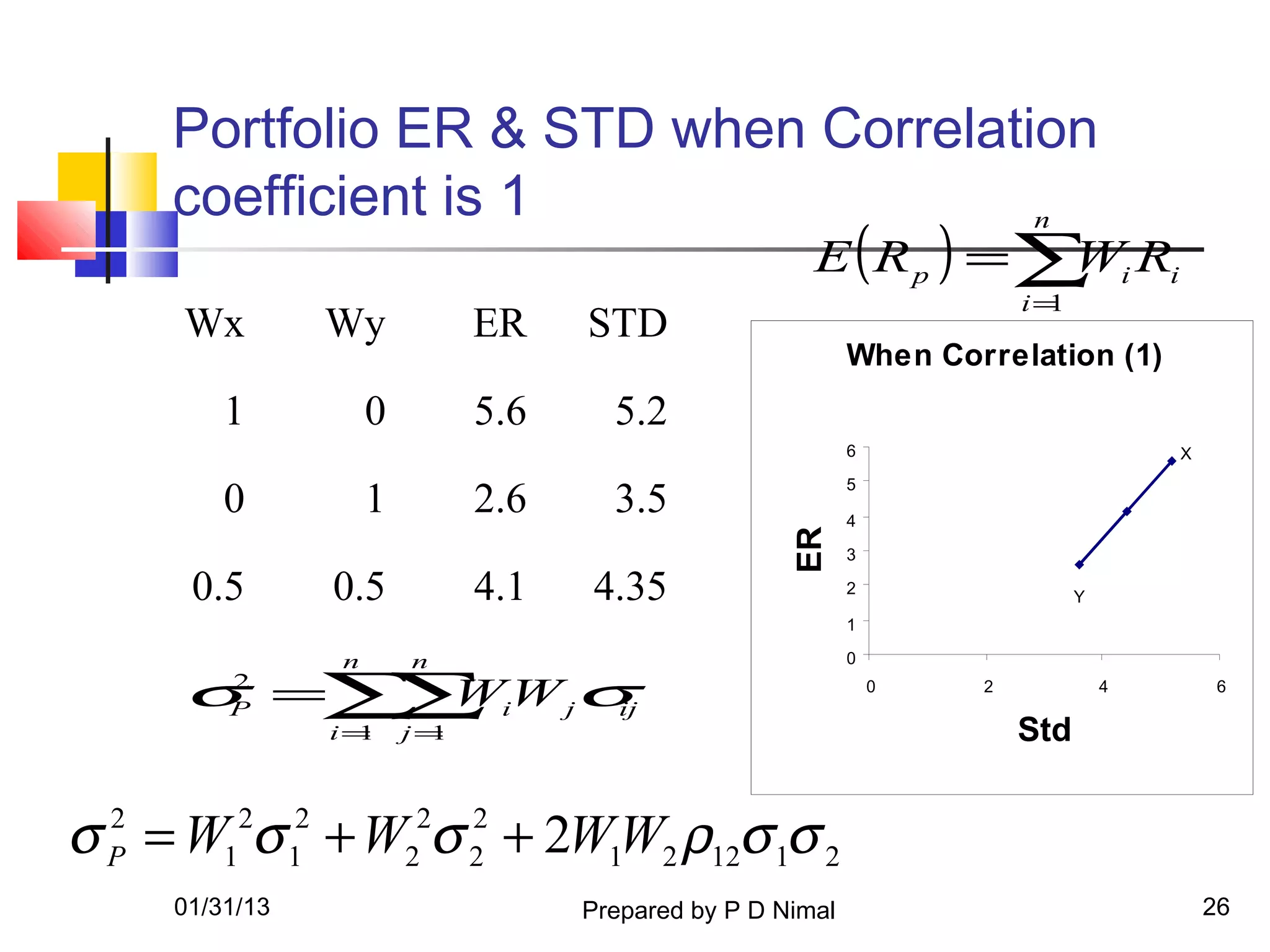

σ =∑ [ Ri −E ( R )]2 P

2

i

i=1

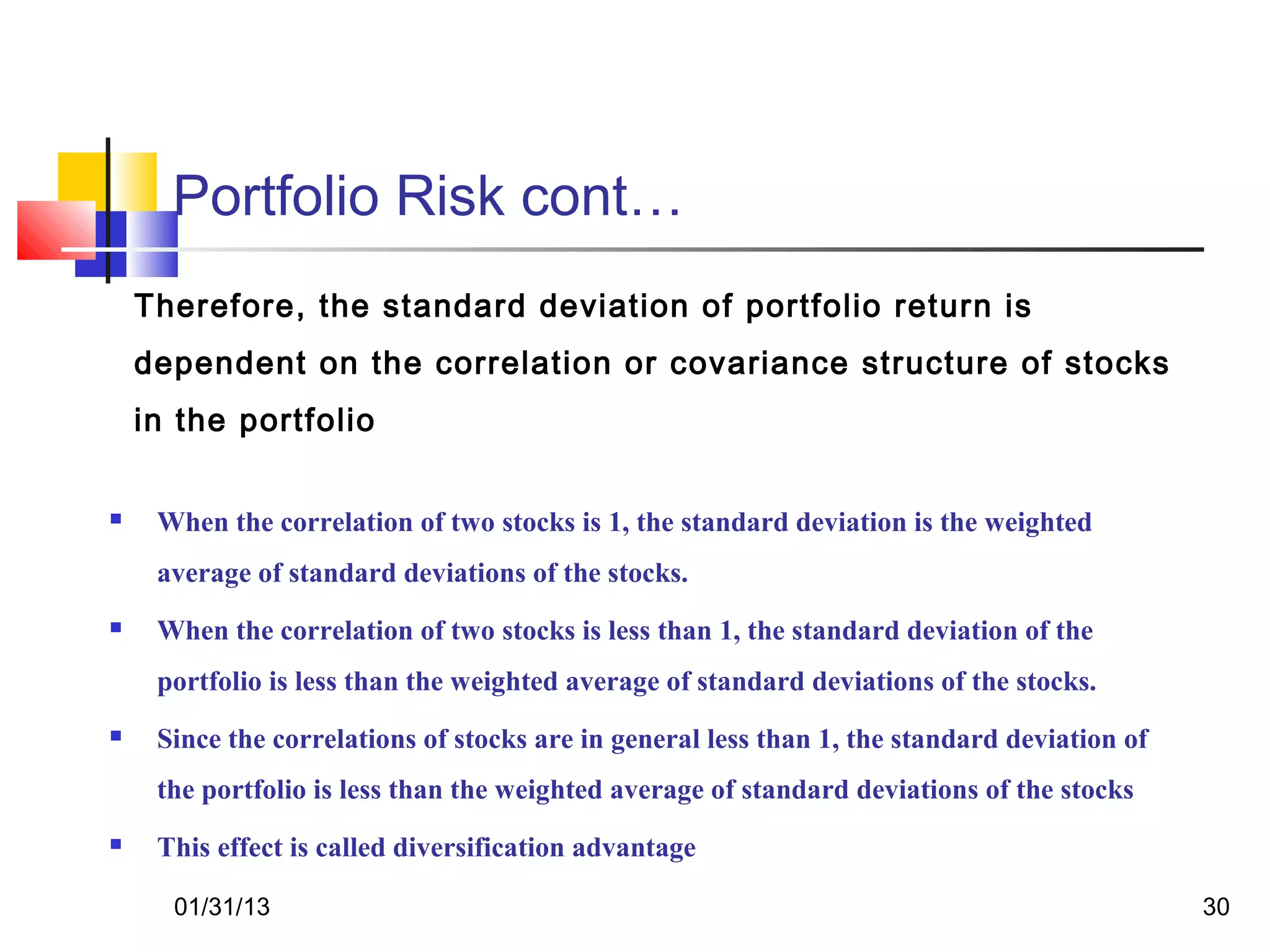

Variance and standard deviation of our example

σ = 90.154

2

σ = 9.495

01/31/13 Prepared by P D Nimal 8](https://image.slidesharecdn.com/lesson-4-130131002213-phpapp01/75/Lesson-4-8-2048.jpg)

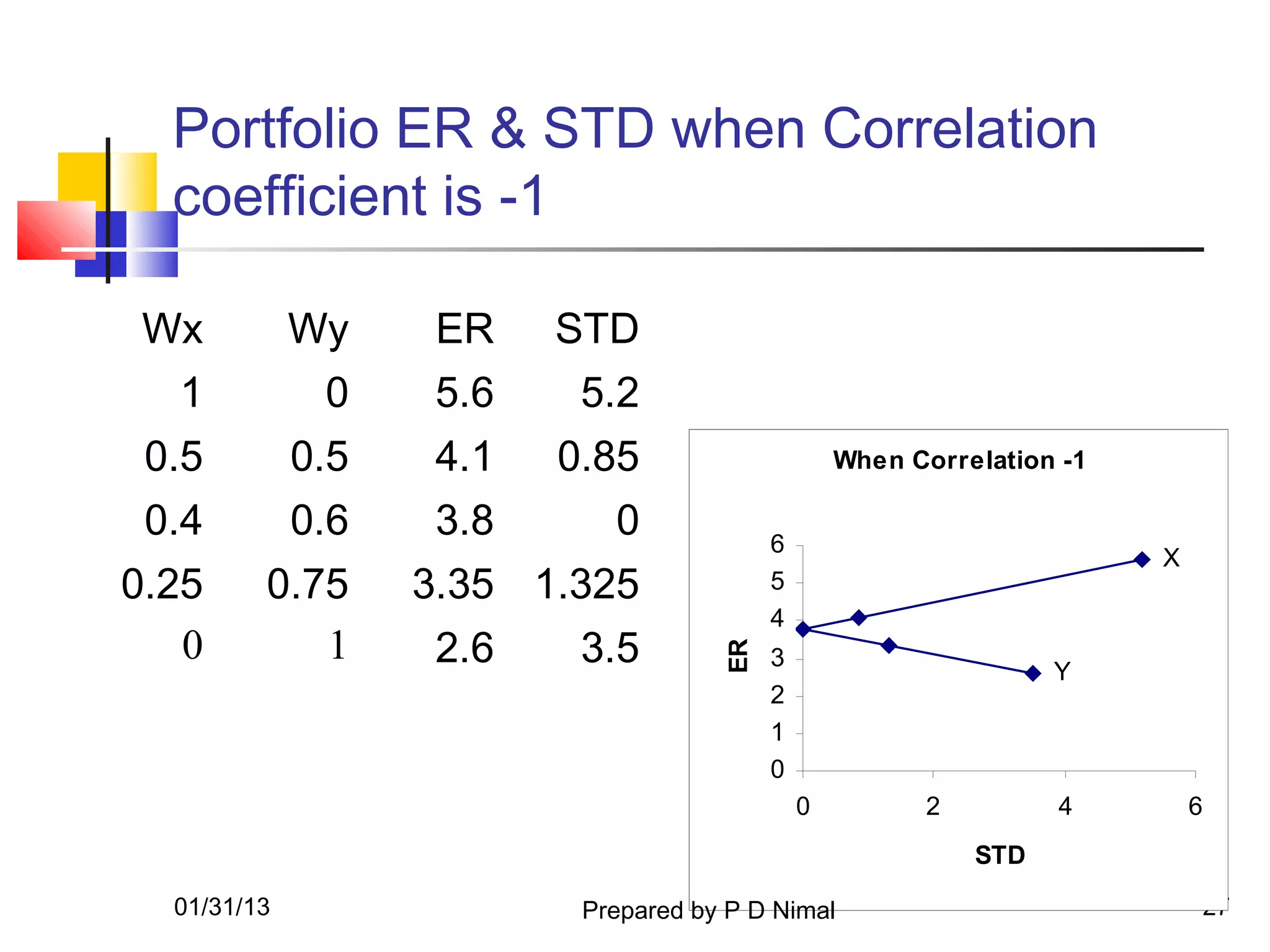

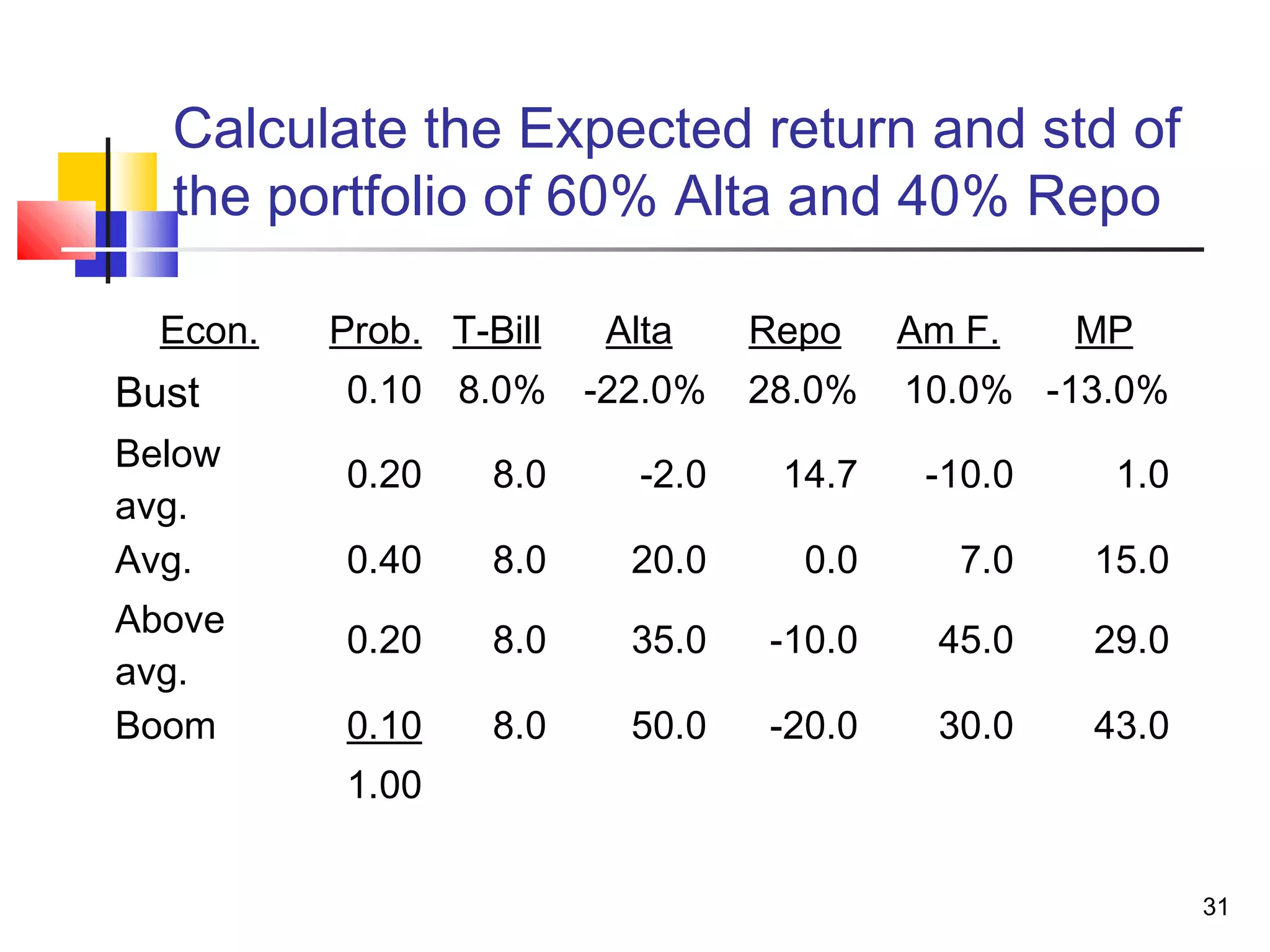

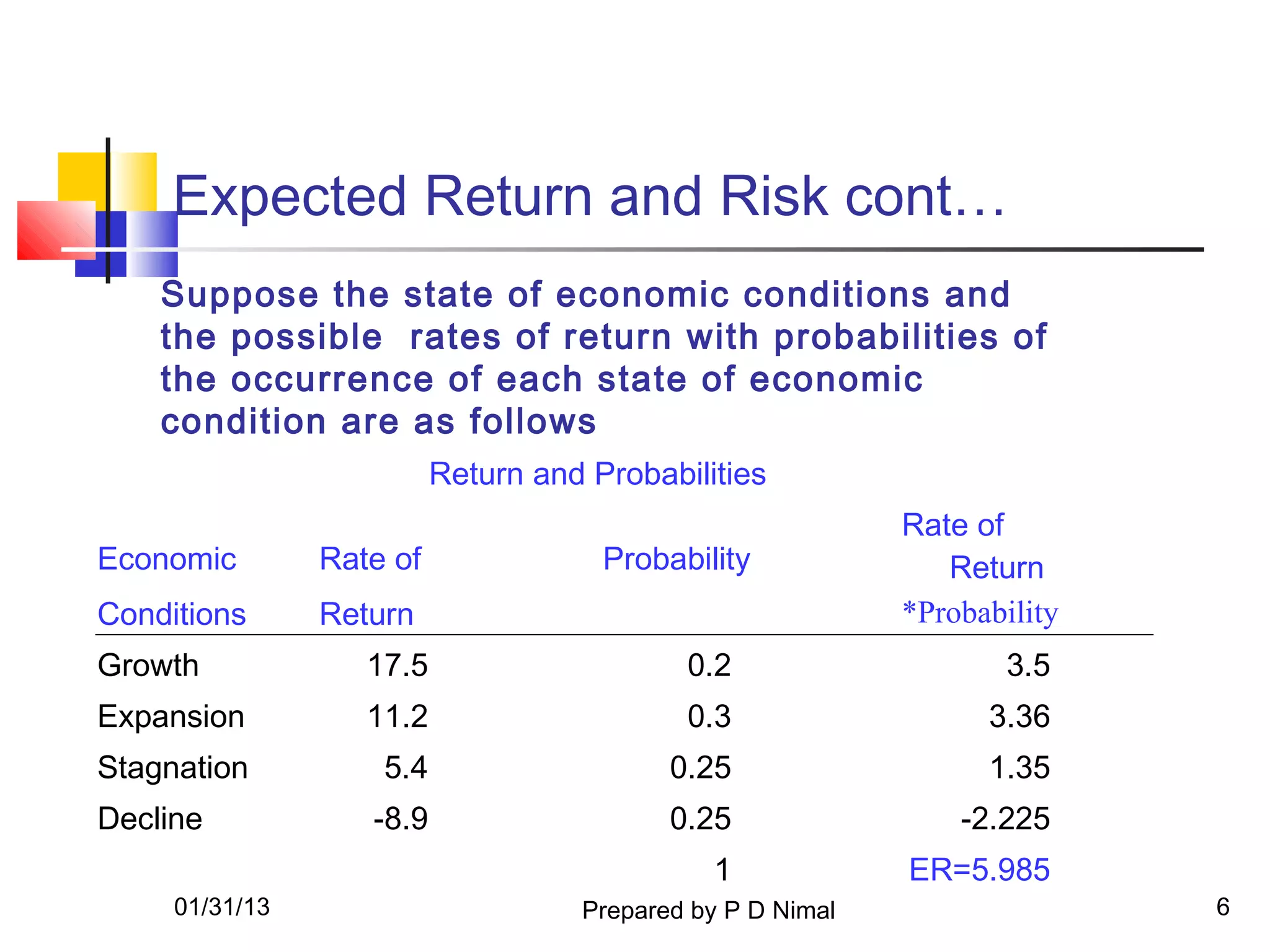

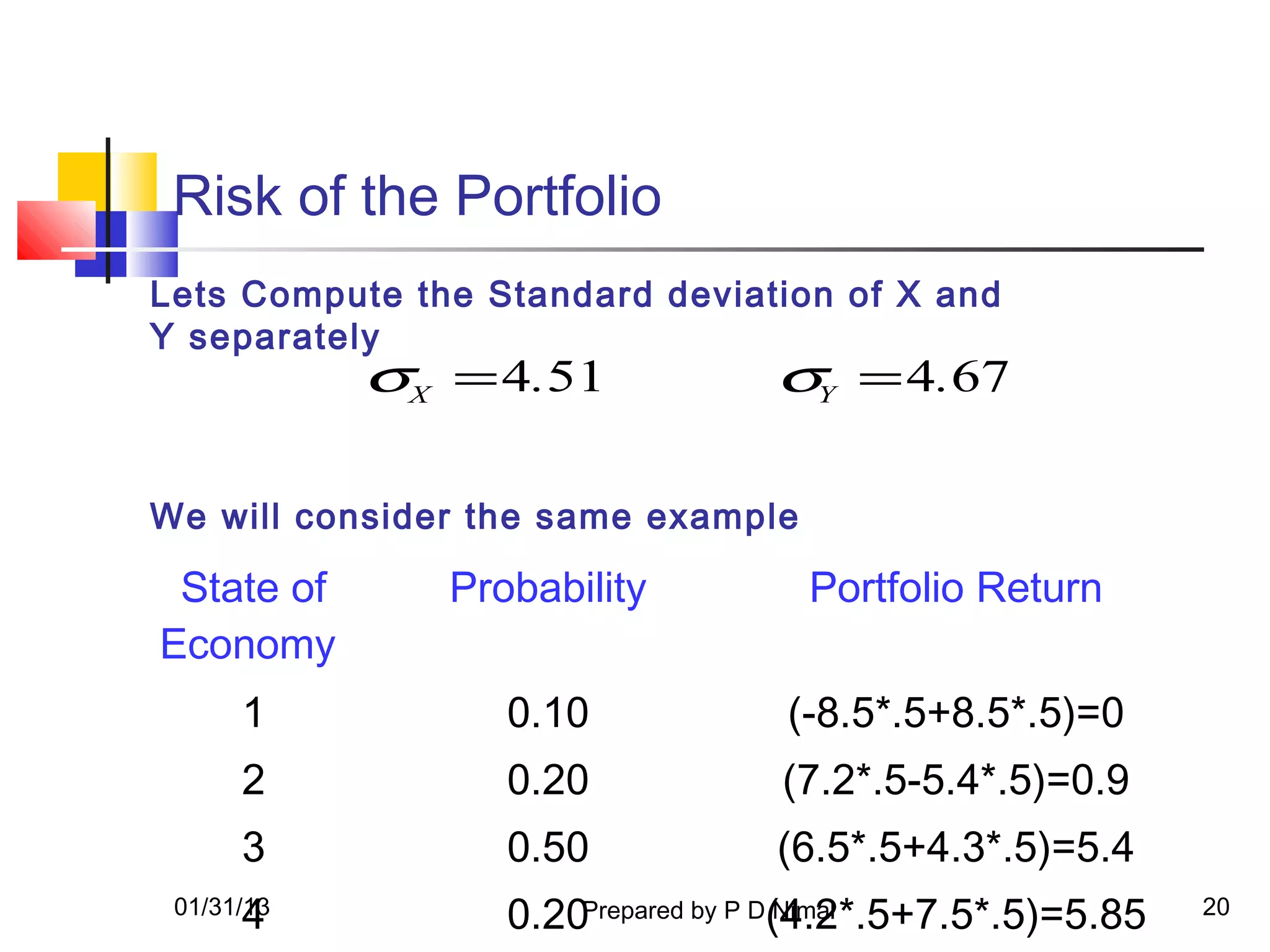

![Covariance between two assets

σ k , j = ∑ [ Rk − E ( Rk )][ R j − E ( R j )]Pi

n

i =1

6 7

X Y P XP YP X-ERx Y-Ery P*6*7

-8.5 8.5 0.1 -0.85 0.85 -13.18 5.08 -6.69544

7.2 -5.4 0.2 1.44 -1.08 2.52 -8.82 -4.44528

6.5 4.3 0.5 3.25 2.15 1.82 0.88 0.8008

4.2 7.5 0.2 0.84 1.5 -0.48 4.08 -0.39168

1 ER 4.68 3.42 Cov -10.7316

01/31/13 Prepared by P D Nimal 23](https://image.slidesharecdn.com/lesson-4-130131002213-phpapp01/75/Lesson-4-23-2048.jpg)