This document provides closing thoughts on valuation and discusses various approaches to valuation including:

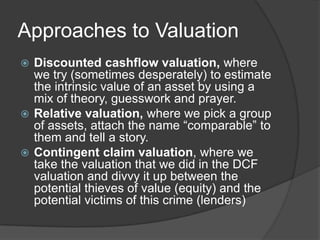

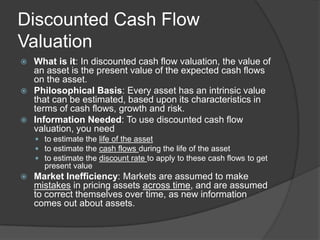

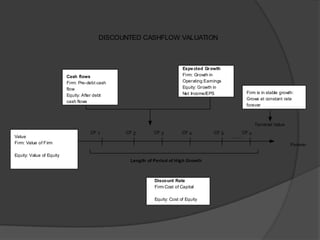

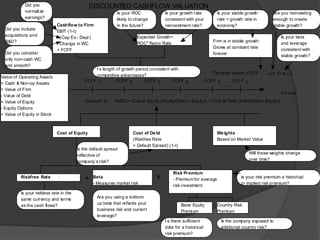

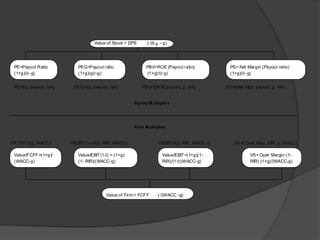

1. Discounted cash flow valuation which tries to estimate intrinsic value using theory, assumptions and estimates of cash flows.

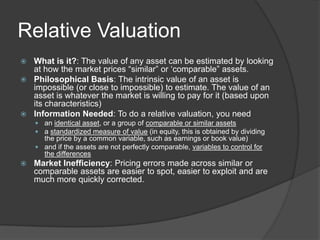

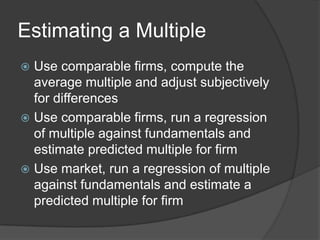

2. Relative valuation which values assets based on comparable assets and controlling for differences.

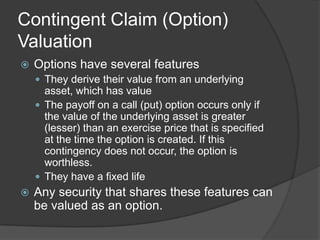

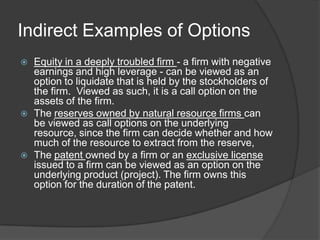

3. Contingent claim valuation which divides asset value between equity and debt holders.

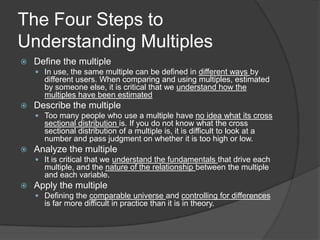

It notes that all valuations contain biases and are imprecise. Complex models do not always provide better information. The document discusses challenges with each approach and emphasizes the importance of fundamentals in valuation.