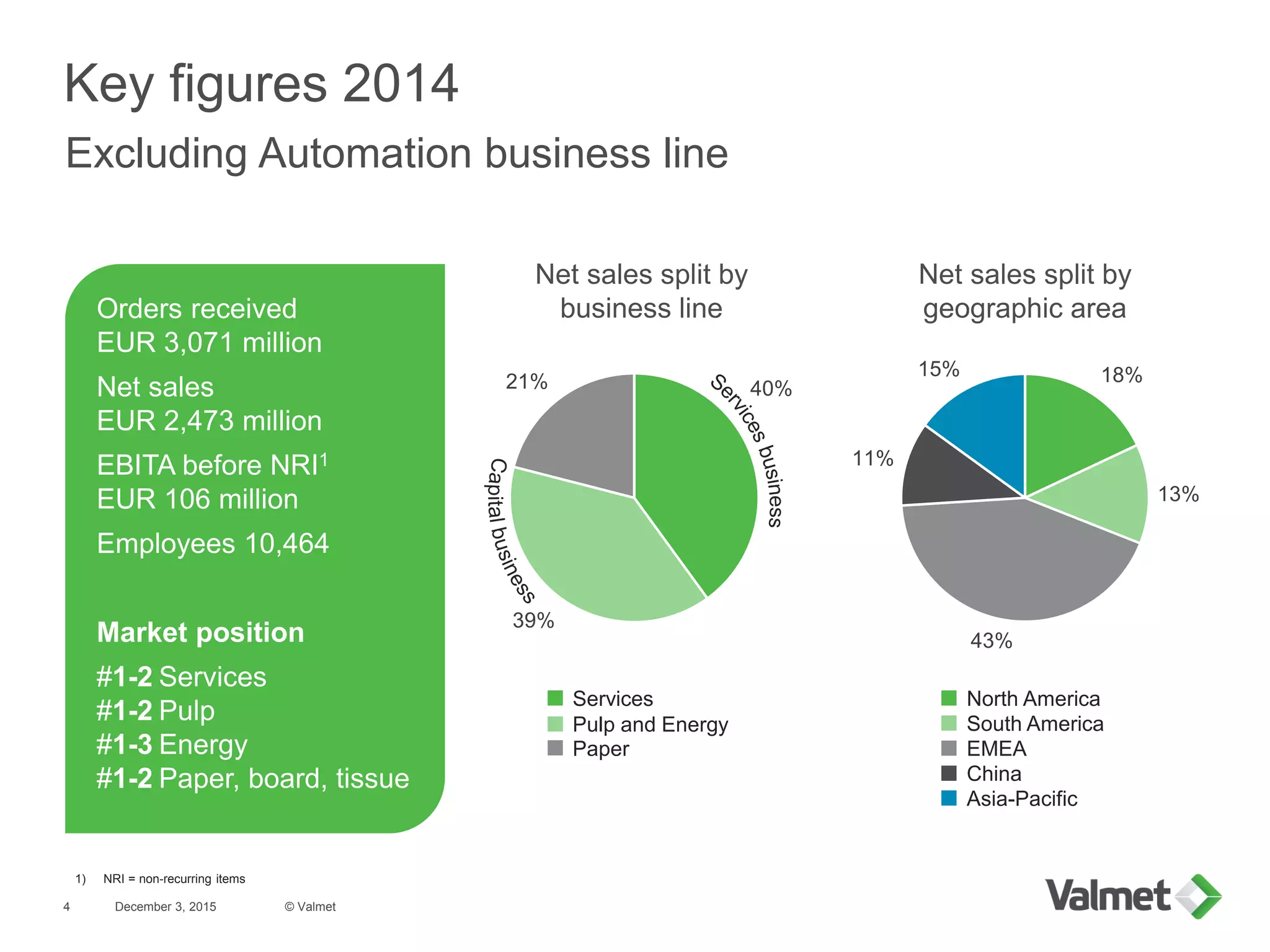

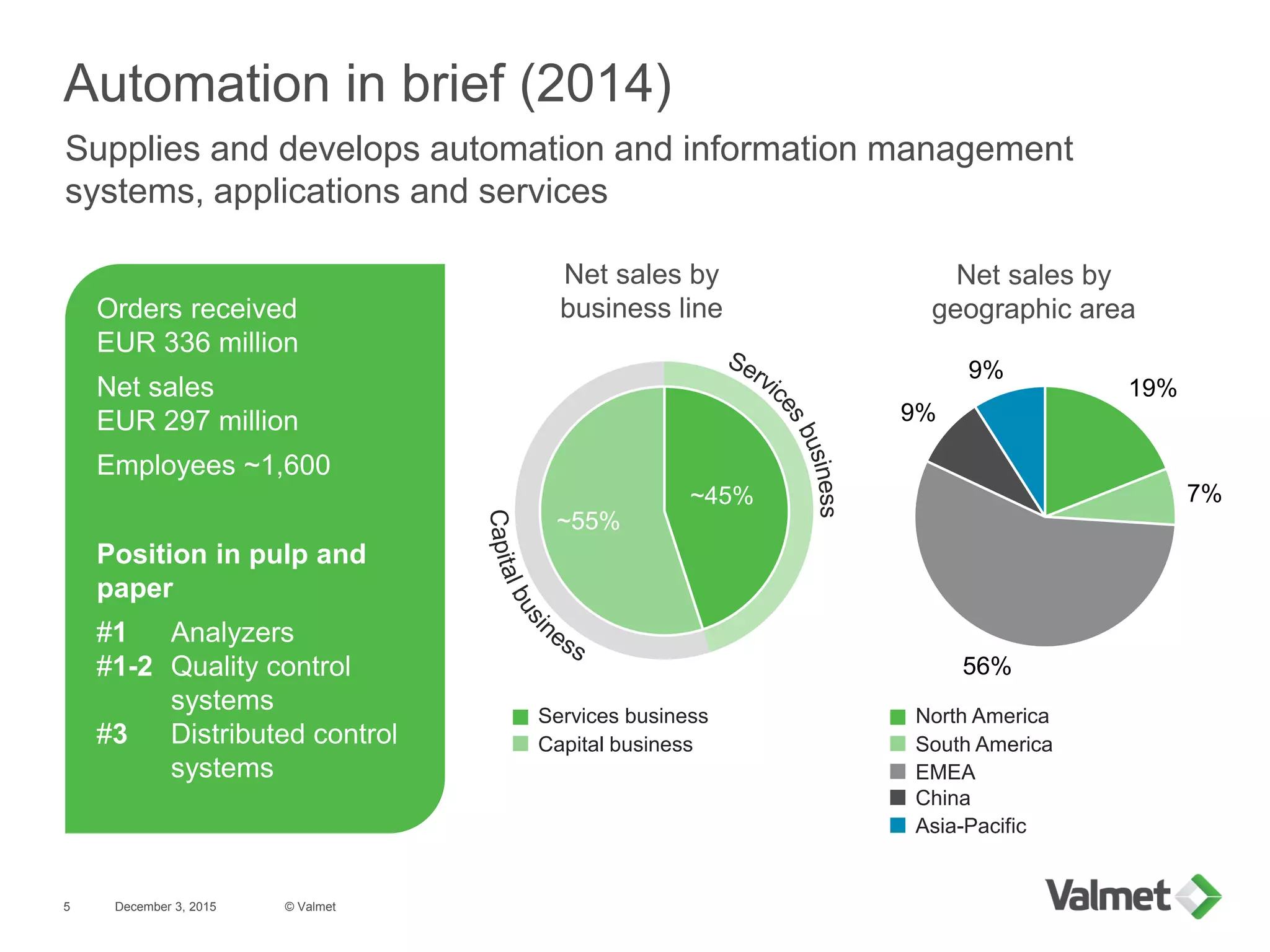

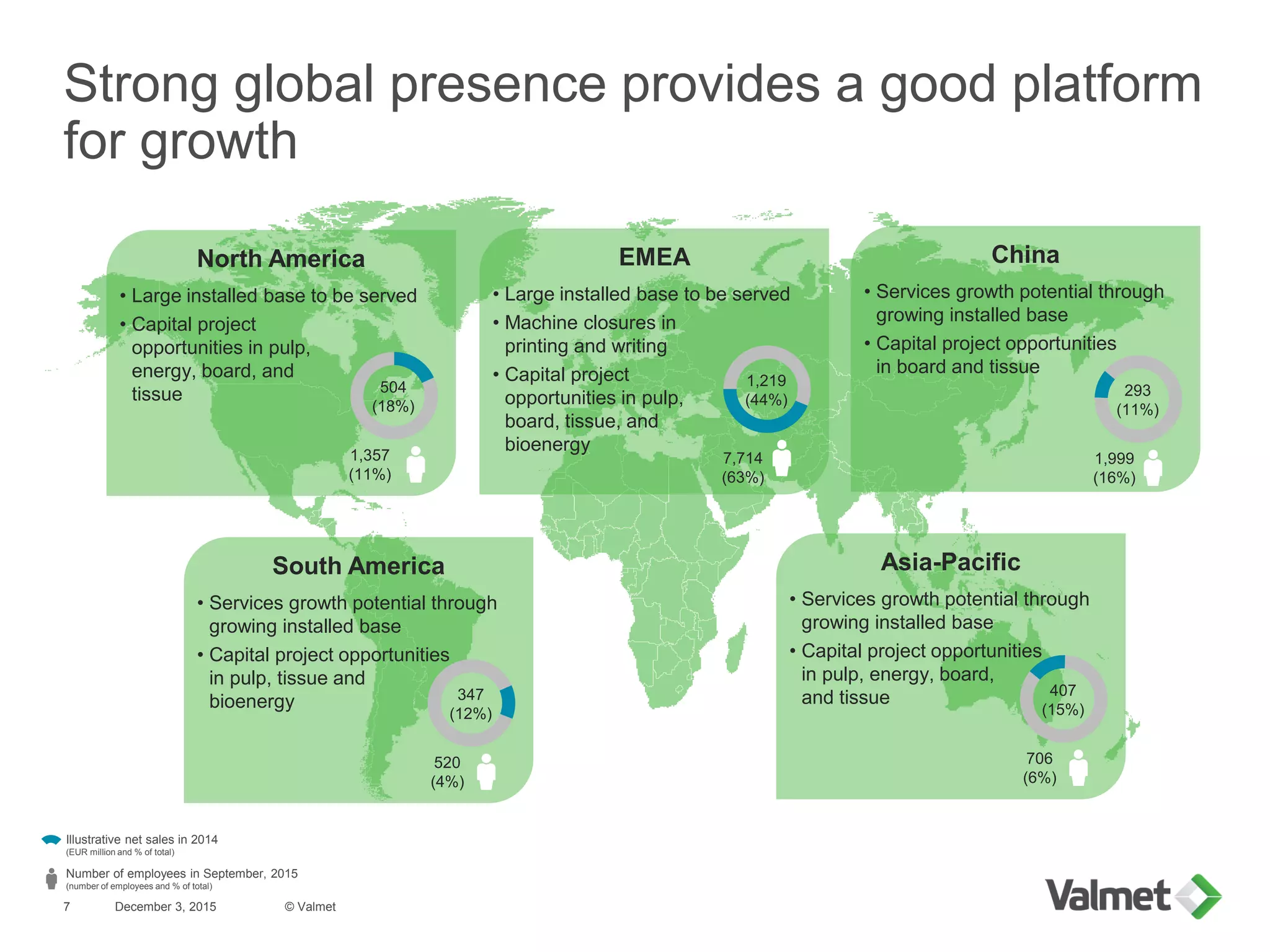

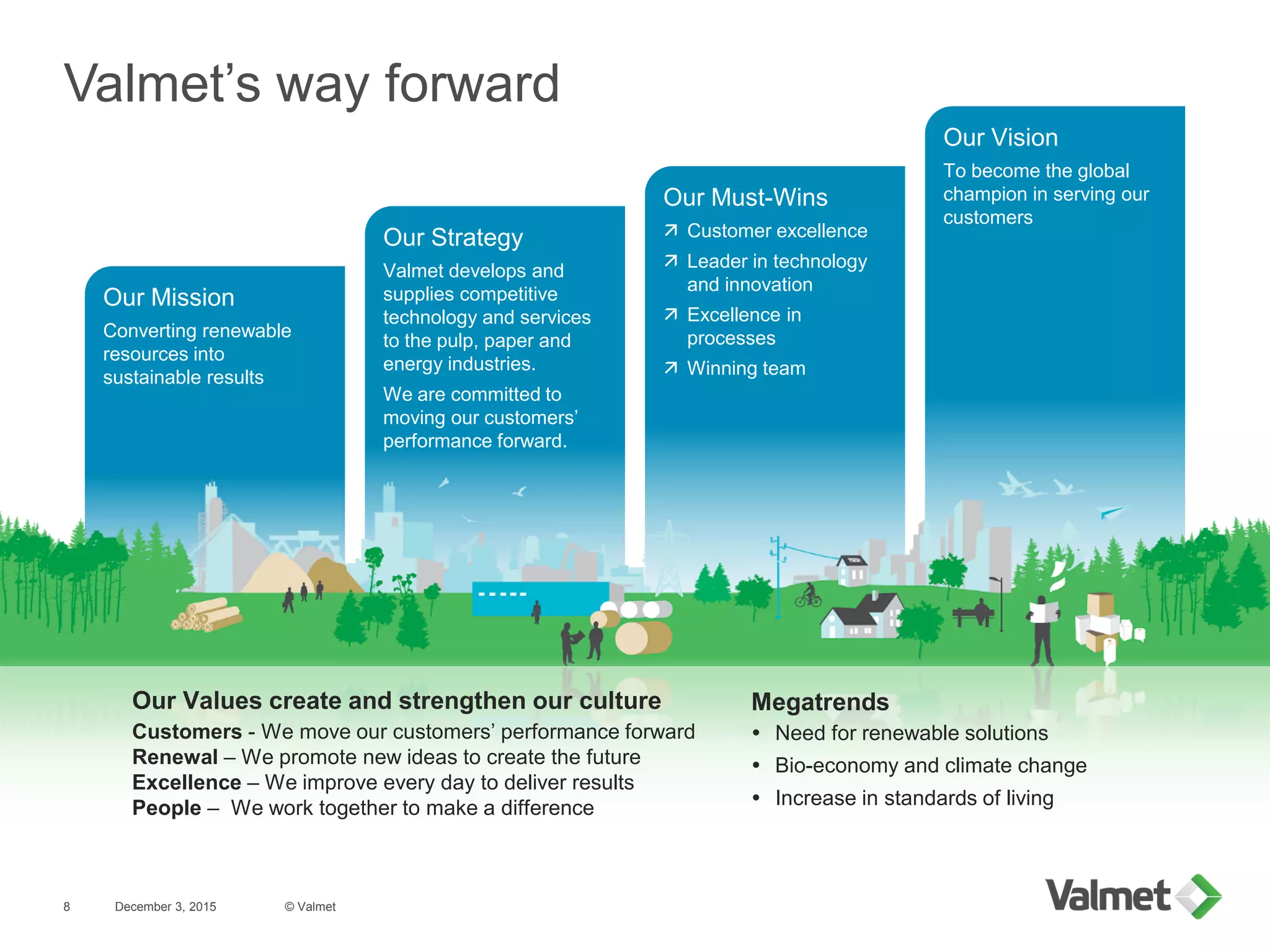

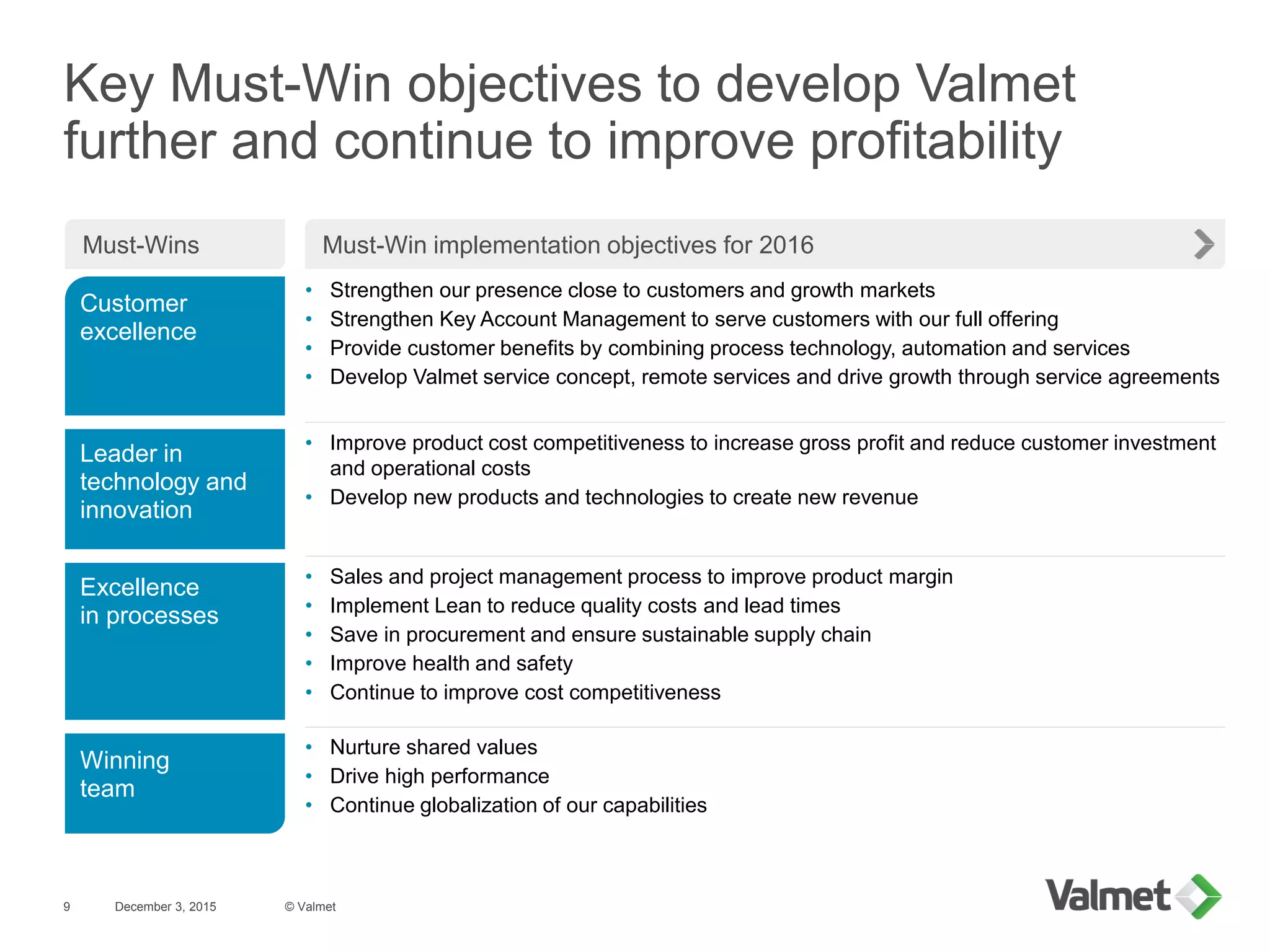

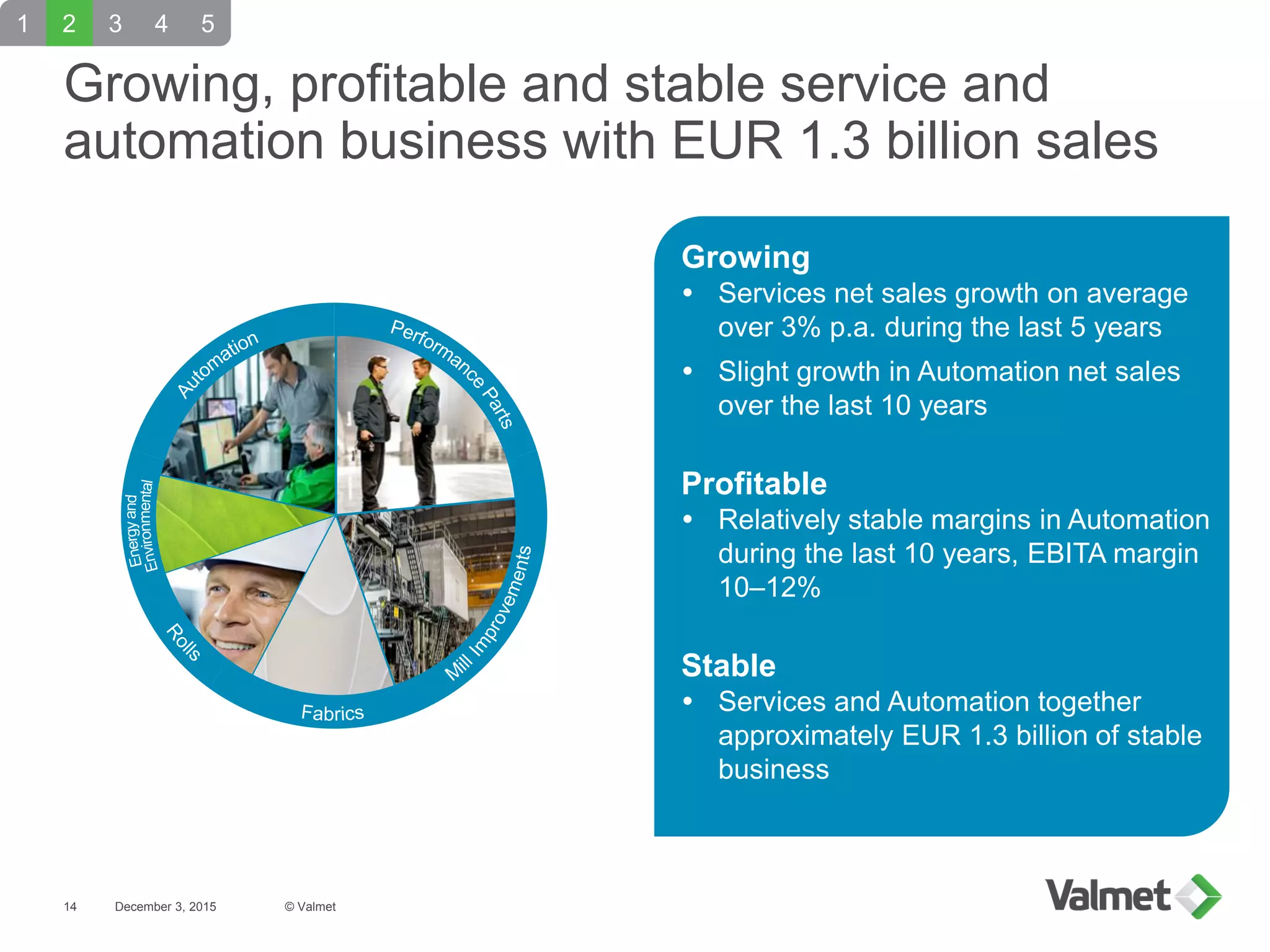

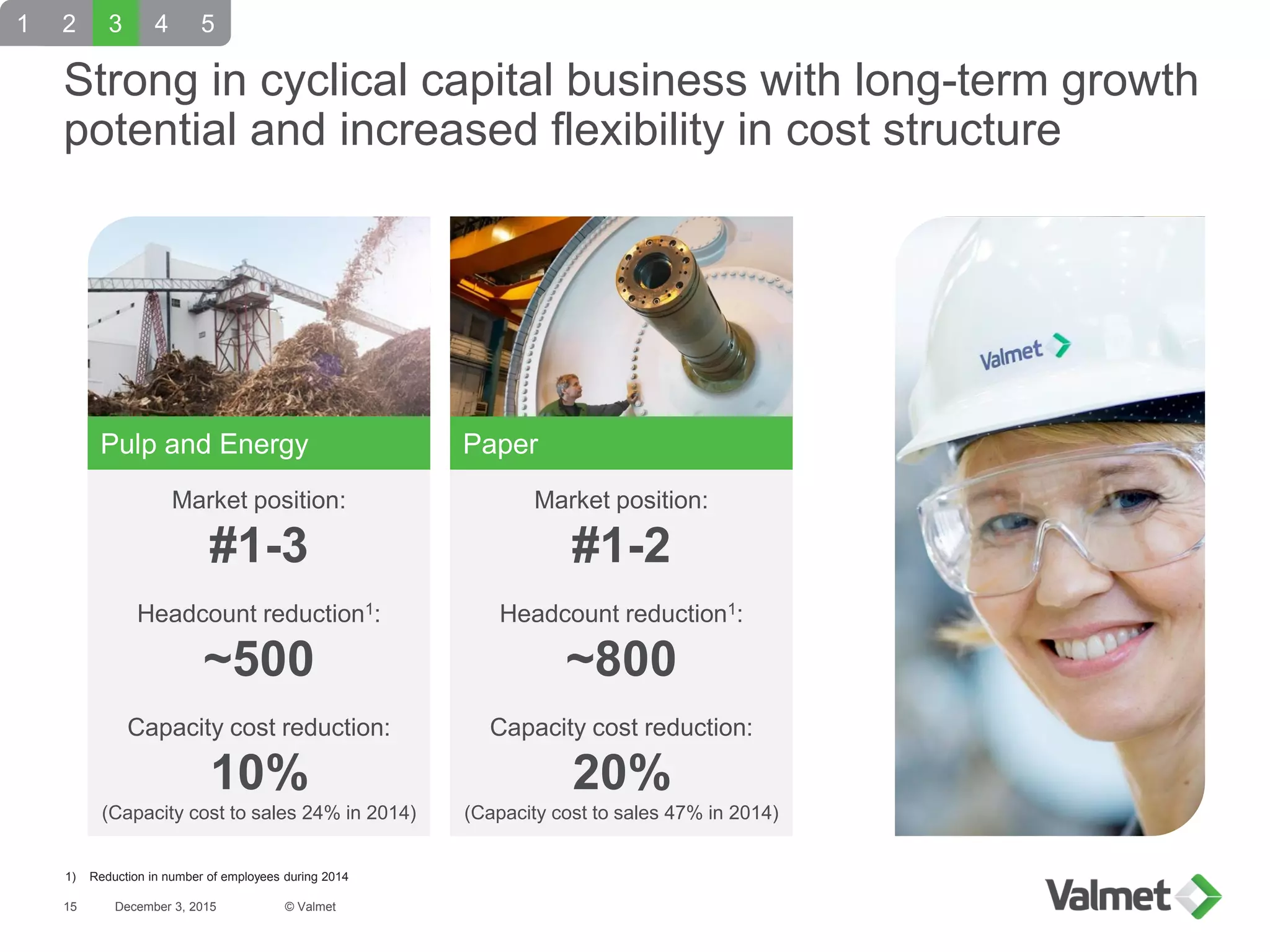

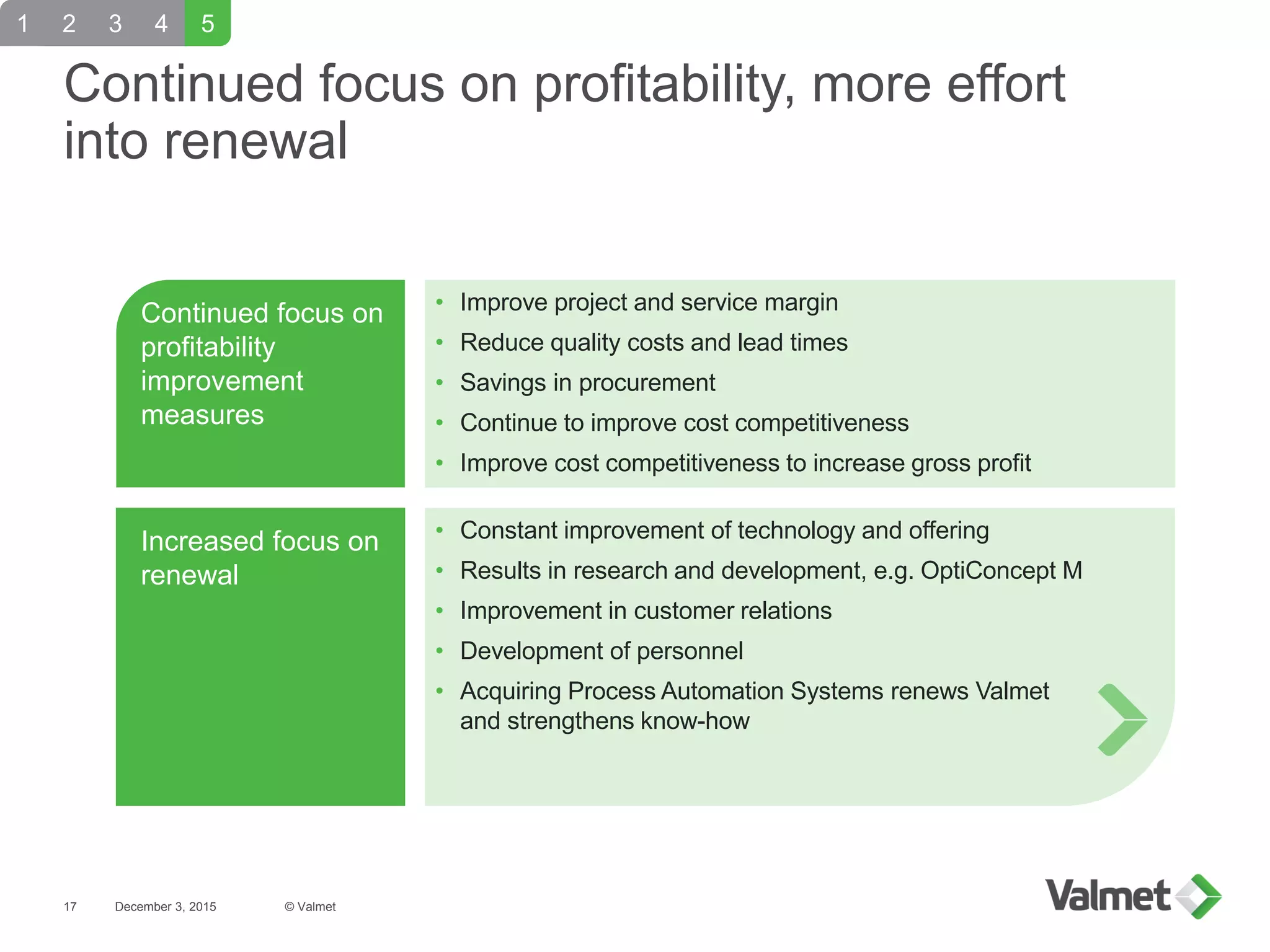

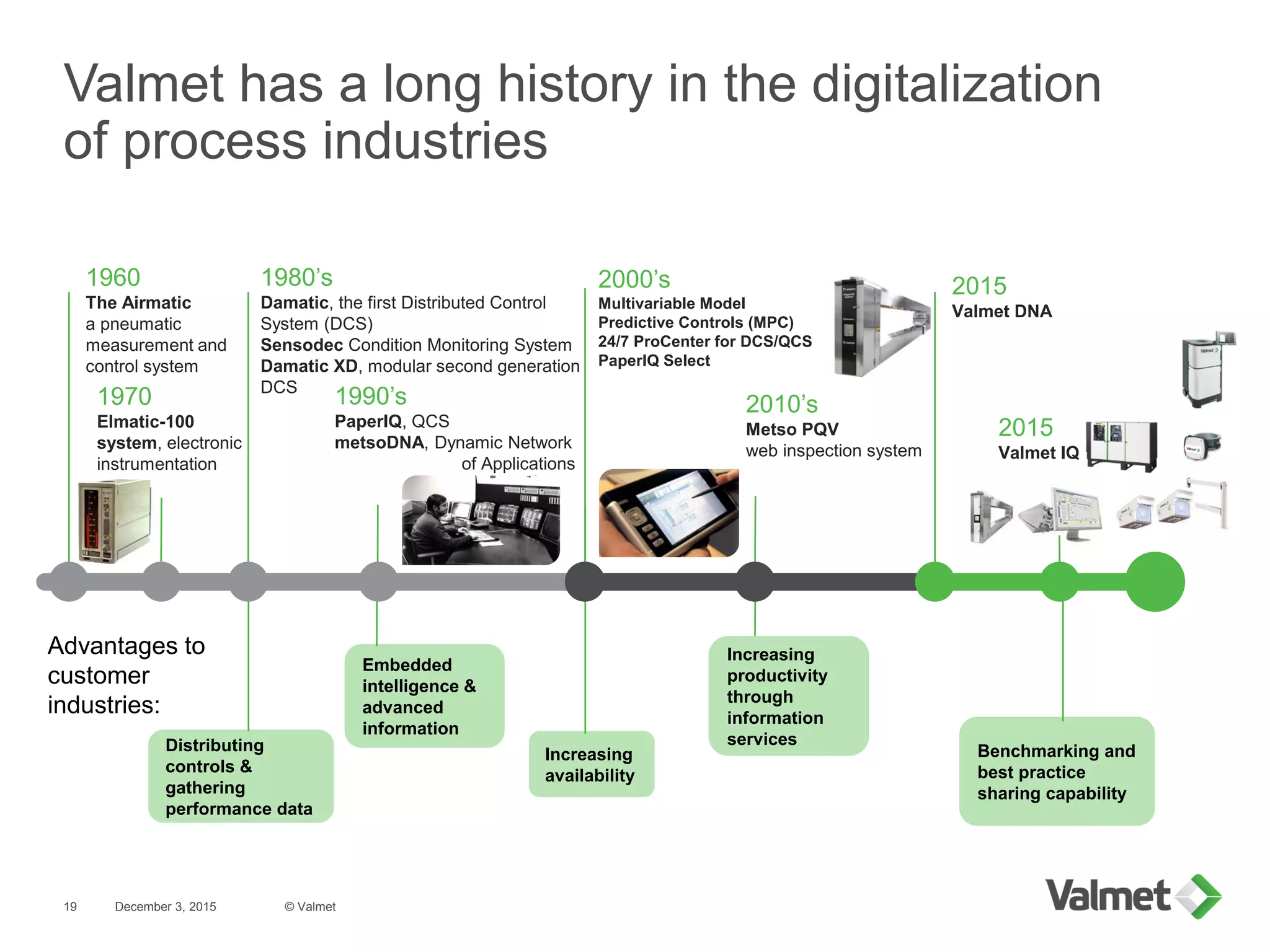

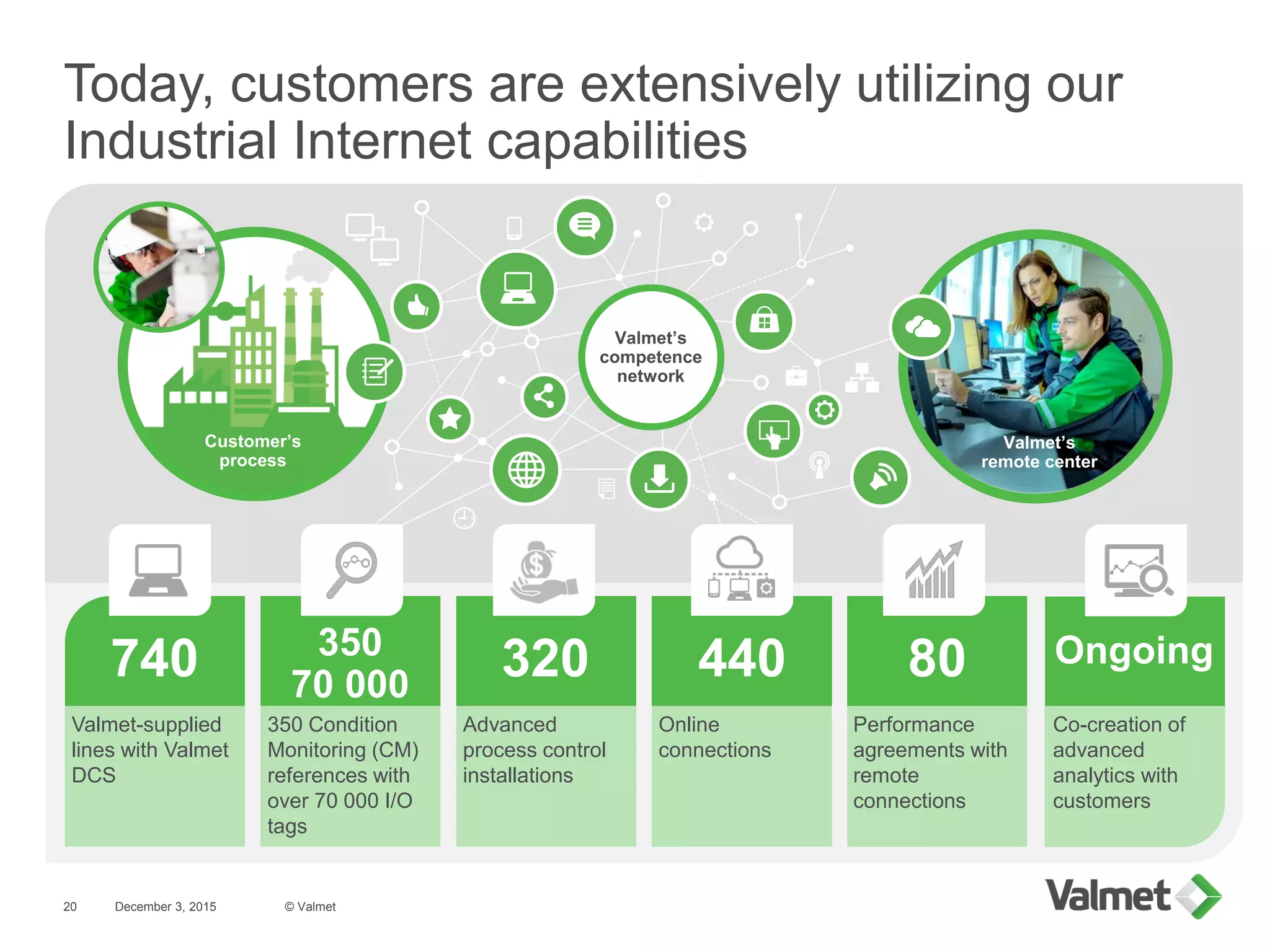

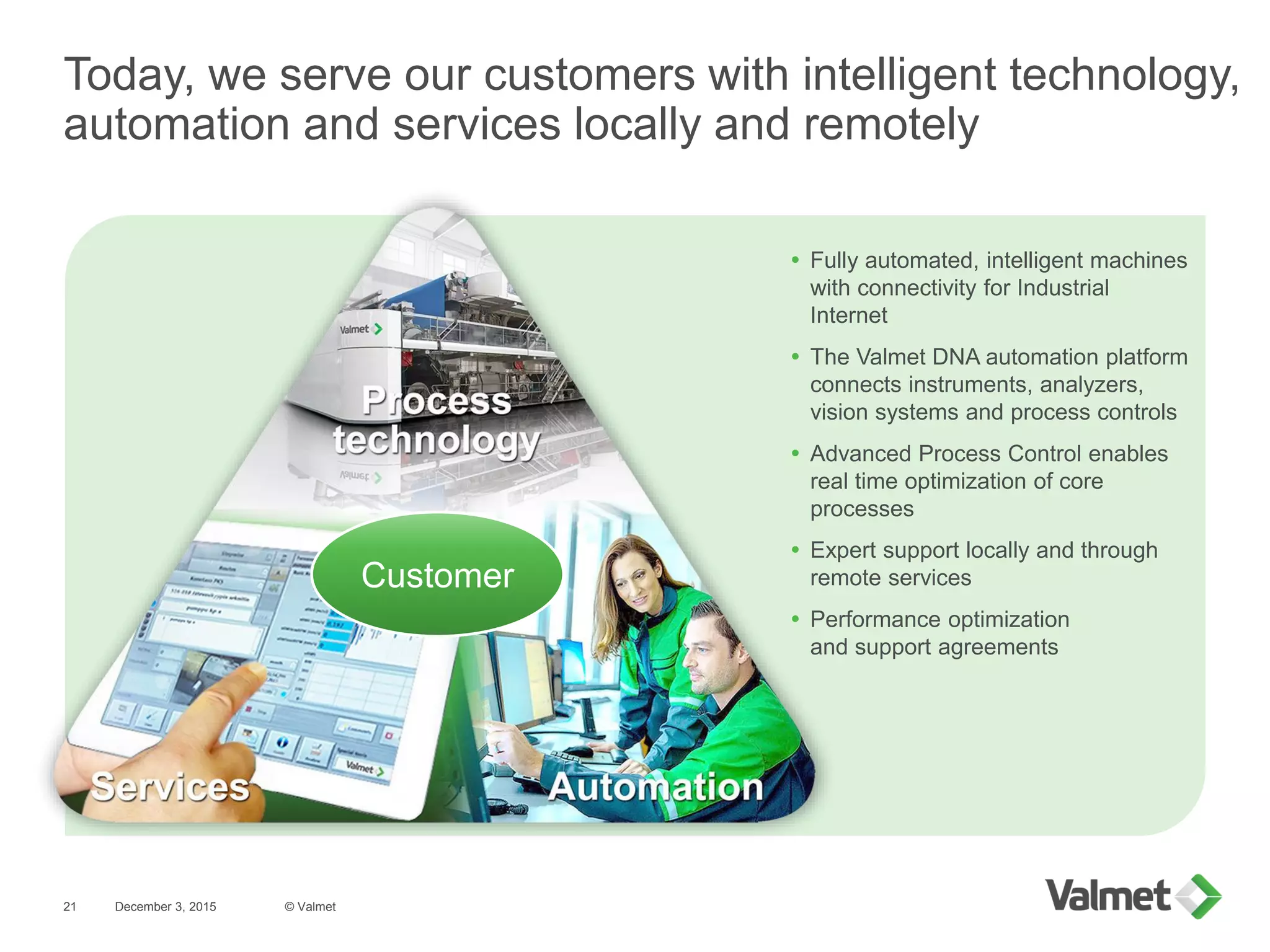

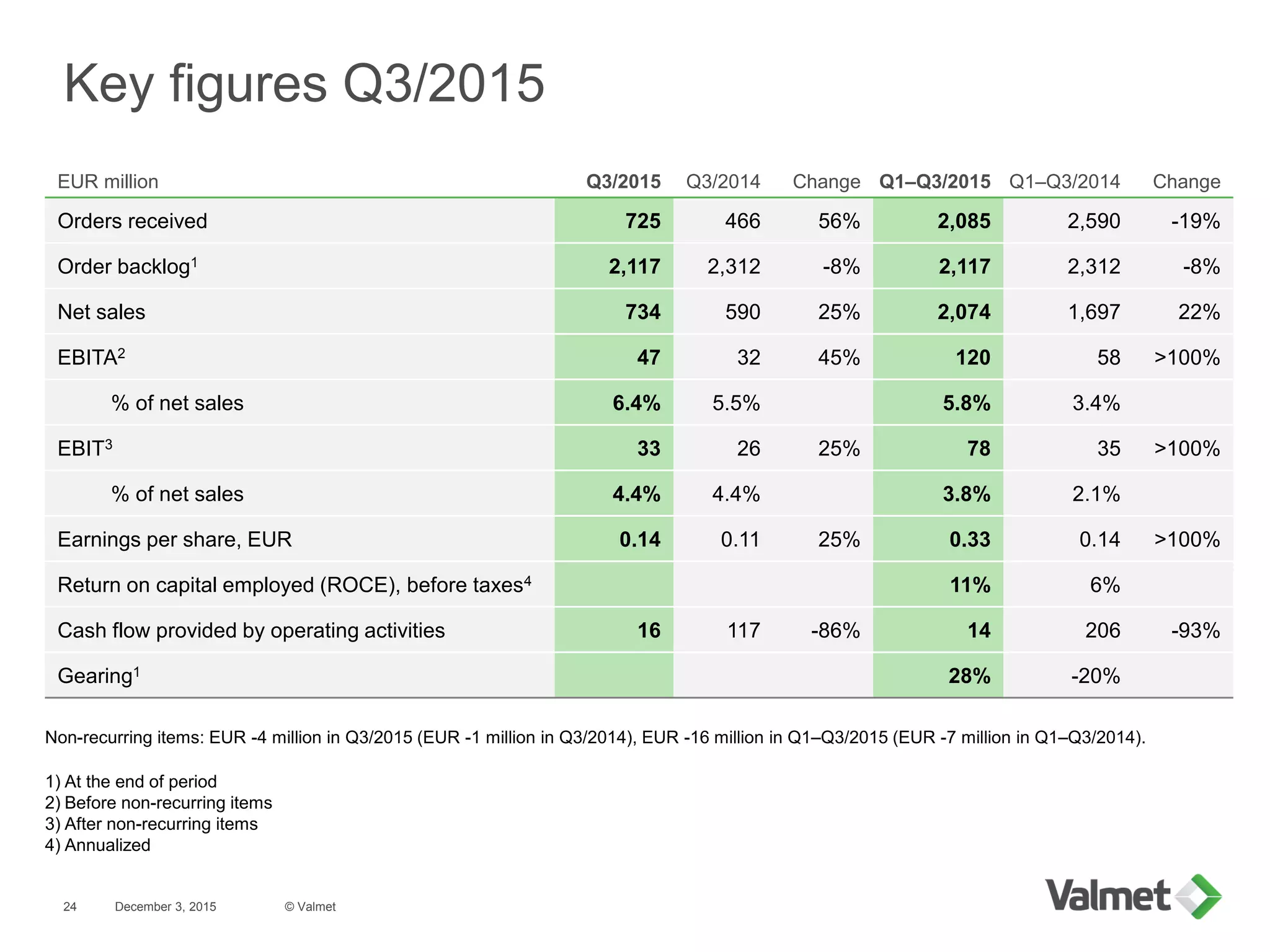

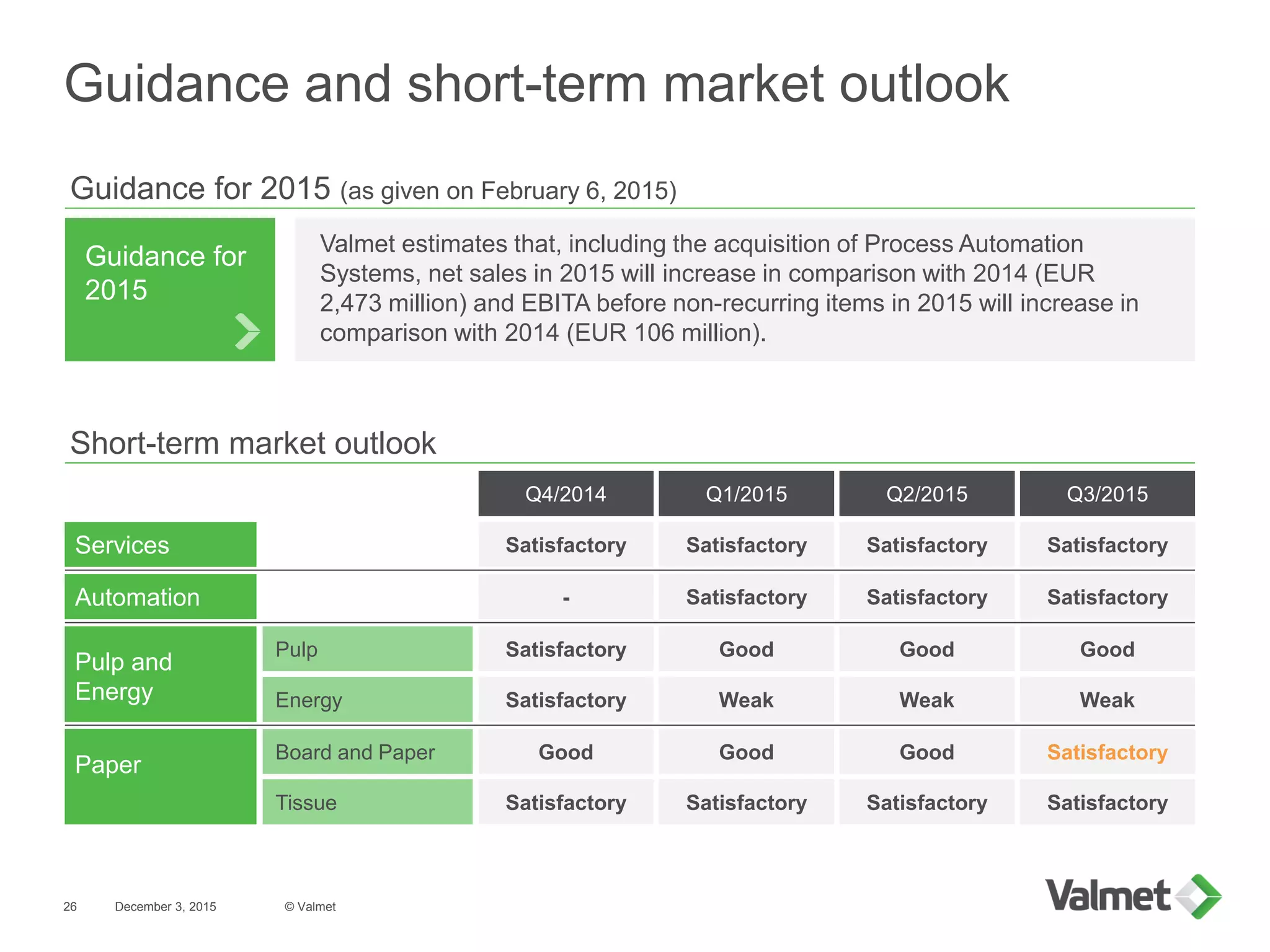

Valmet is a leading technology and service company specializing in process technology, automation, and services for the pulp, paper, and energy industries, with strong market positions and significant sales growth potential. The company aims to enhance customer performance through innovation, global presence, and a focus on sustainable practices. Key strategic objectives include improving profitability, strengthening customer relationships, and capitalizing on growth opportunities in automation and service sectors.