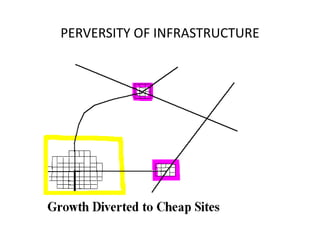

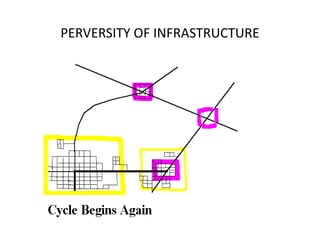

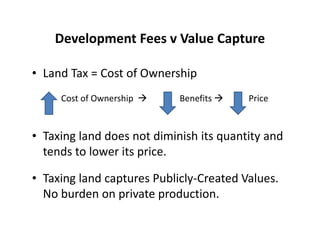

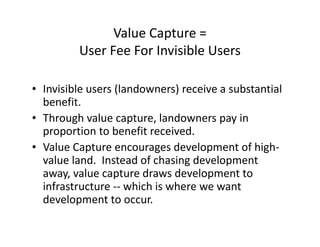

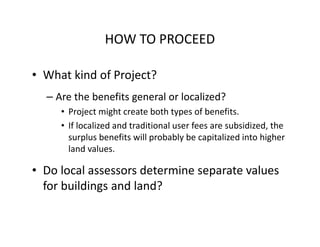

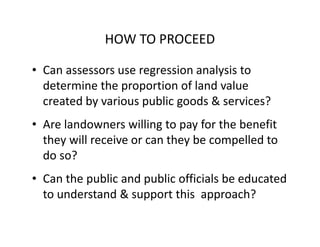

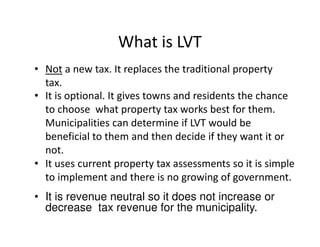

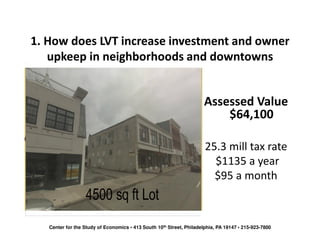

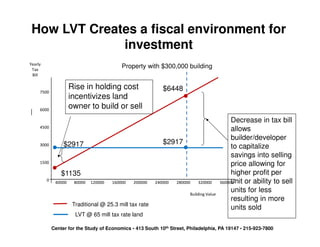

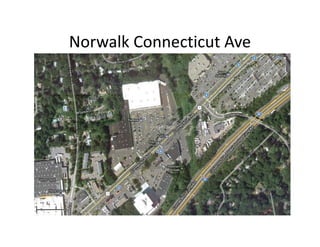

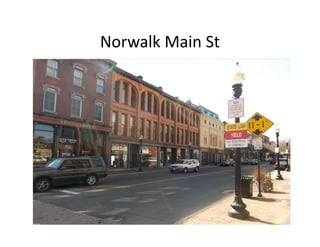

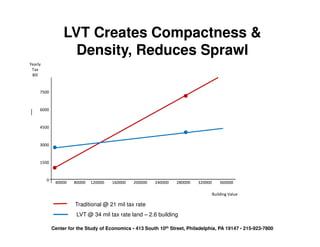

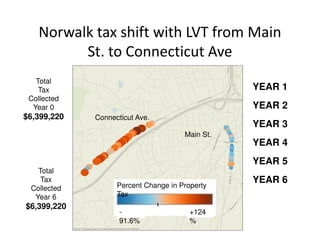

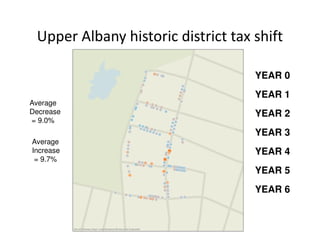

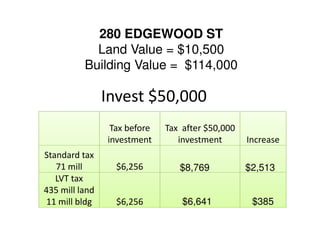

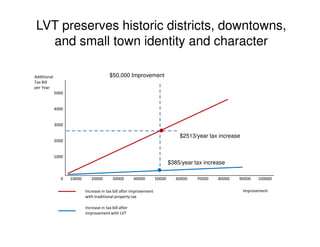

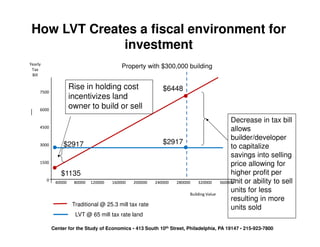

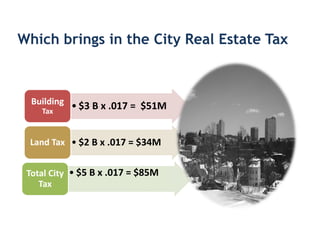

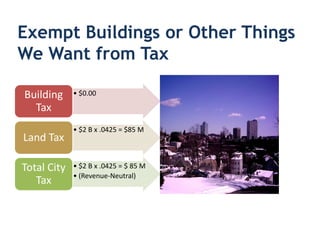

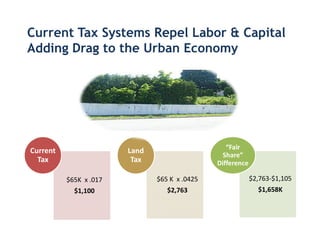

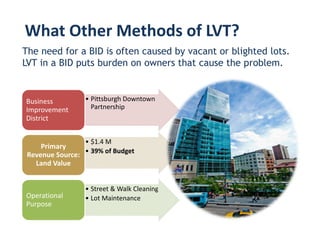

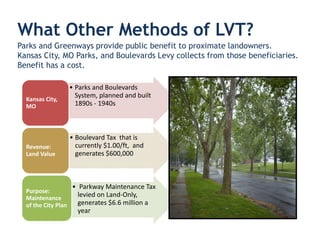

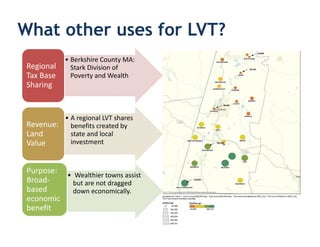

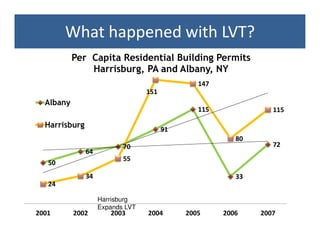

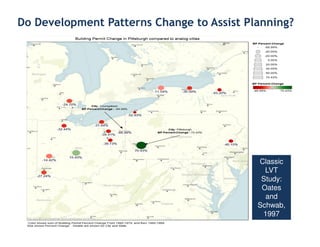

This document discusses using land value tax and value capture to help fund infrastructure in a way that promotes smart growth. It notes that traditional infrastructure funding through user fees and taxes can encourage sprawl. Land value tax and value capture systems recoup some of the increase in land value from public infrastructure investments, distributing the costs more equitably among beneficiaries. This approach can incentivize more efficient land use patterns by encouraging development near existing infrastructure.