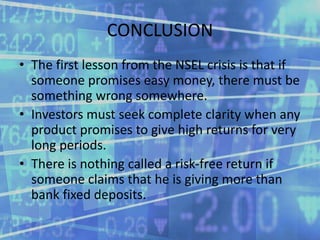

National Spot Exchange (NSEL) was a commodities exchange in India that collapsed in a Rs. 5600 crore (US$0.9 billion) fraud. NSEL failed to repay investors in commodity pair contracts after July 2013. The scam involved illegal activities by brokers and back-end changes at NSEL. Key people involved include Jignesh Shah, founder of MCX and FTIL, who was arrested as the alleged mastermind. The fraud had massive effects, crashing share prices of FTIL and MCX while investigations and arrests continue. Lessons highlight the need for clarity on products promising high returns and understanding that nothing is truly risk-free.