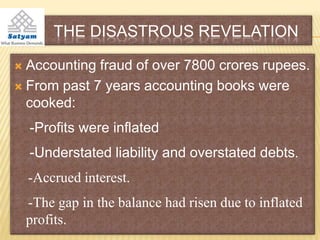

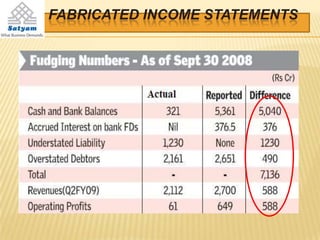

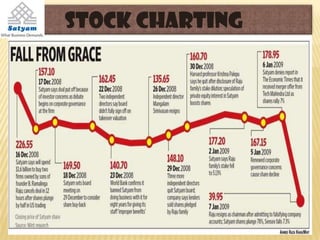

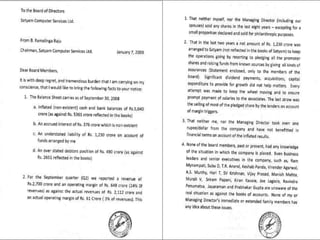

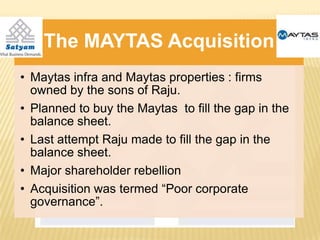

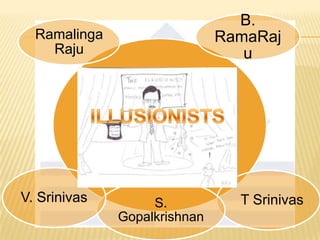

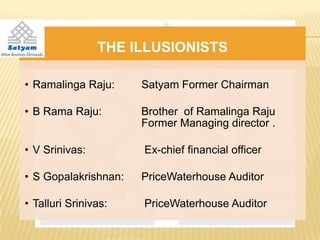

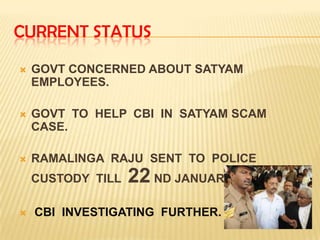

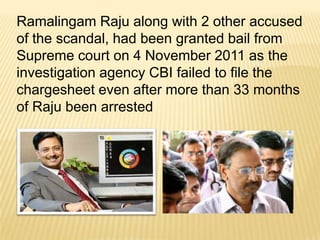

The Satyam Scandal involved accounting fraud of over 7,800 crores at Satyam Computers. In January 2009, the company's founder, Ramalinga Raju, confessed to inflating profits and faking accounts for several years. This resulted in a massive stock price drop. An investigation found that for 7 years, financial statements were fabricated and the accounting gap was attempted to be filled through an acquisition. The scandal impacted 50,000 jobs and India's image. New reforms aimed to prevent such frauds through stricter auditing, compliance and corporate governance standards.