1) The document discusses the 2009 Satyam scandal where the company's founders inflated revenue and profit figures through fabricated invoices and fake accounts.

2) When attempts to cover up the fraud failed, the founder Ramalinga Raju confessed to the crime in a letter citing inability to cover up the growing discrepancies.

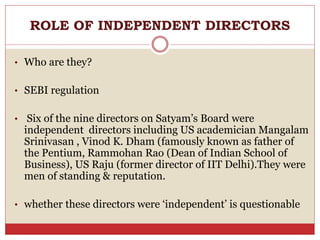

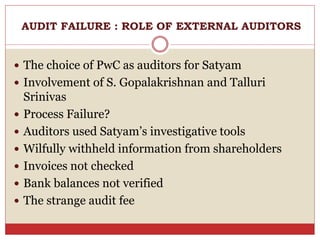

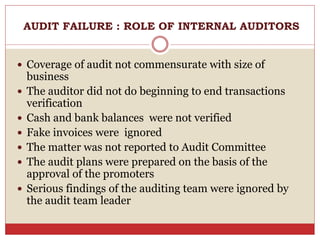

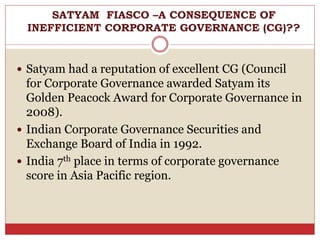

3) Weak corporate governance and a lack of oversight allowed the fraud to continue for years without detection from auditors, directors, or regulators.