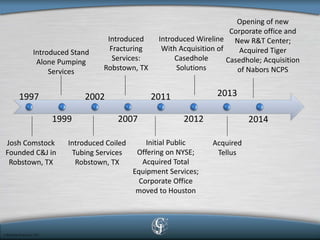

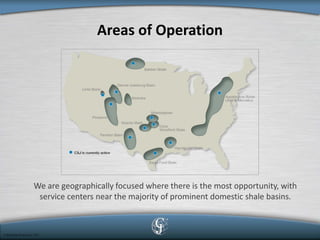

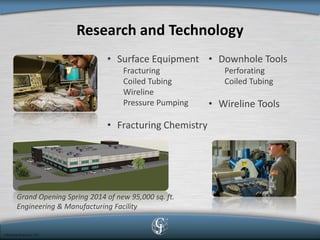

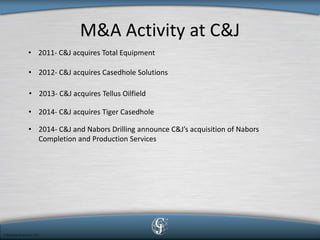

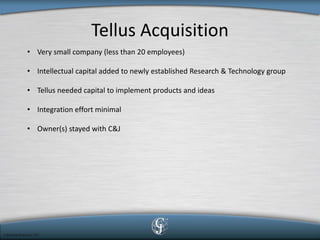

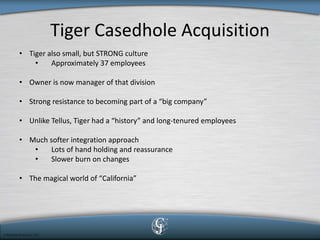

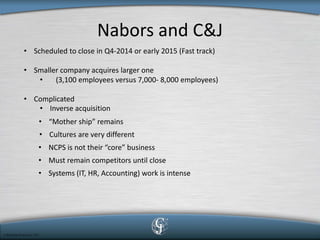

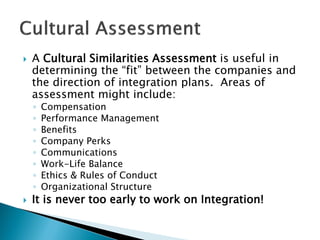

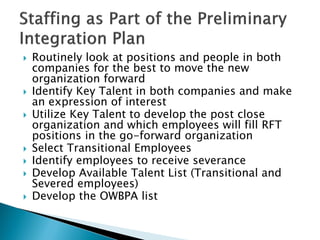

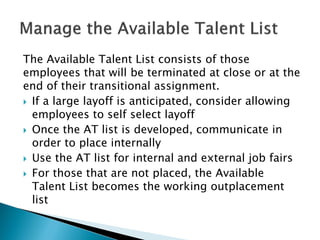

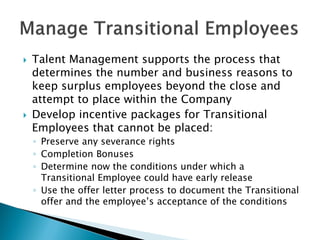

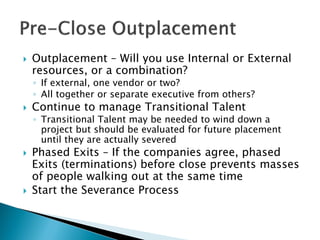

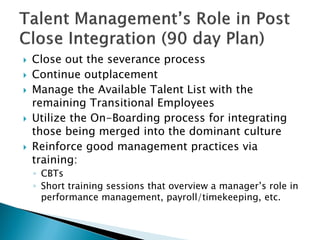

The document discusses the integration and culture development strategies within mergers and acquisitions (M&A) in the energy sector, focusing on C&J Energy Services and its various acquisitions. It emphasizes the importance of HR's role in assessing cultural fit, managing talent, and facilitating smooth transitions during M&A activities. Key insights include the need for effective communication, talent management, and retention strategies during the integration process.