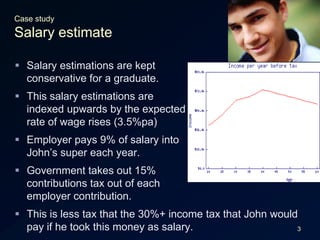

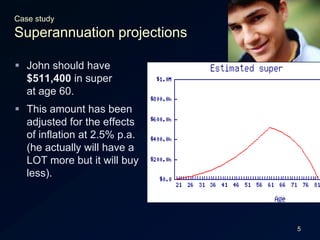

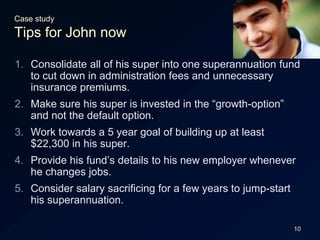

This case study examines John's personal financial planning for retirement. John is currently 20 years old and plans to retire at age 60. He wants $31,020 per year in retirement income adjusted for inflation from his superannuation. The case study estimates John's salary growth over his career, contributions to his super fund from his employer and government, investment returns on his super balance, and projections for how much he will have in his super at retirement age to support his desired income level. It also considers options like salary sacrificing, changing investment risk levels, and working longer to increase his superannuation balance and retirement income.