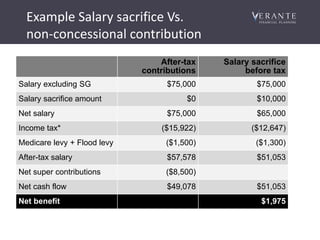

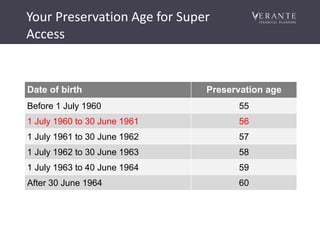

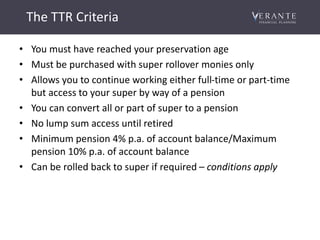

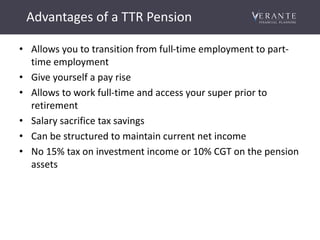

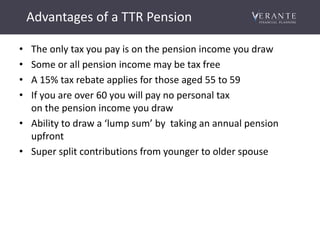

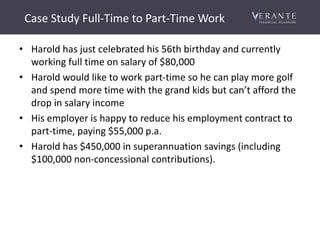

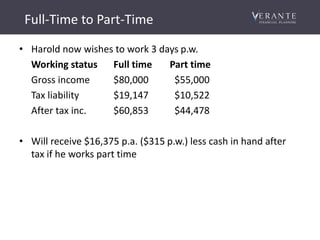

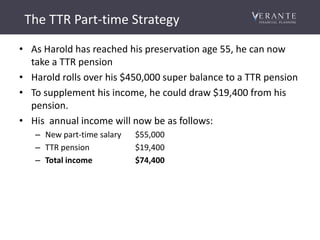

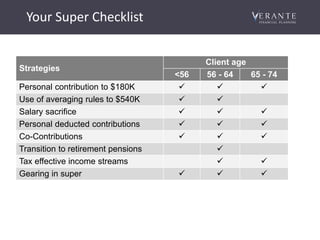

This document outlines financial advice and considerations related to superannuation and transition to retirement strategies, stressing the importance of seeking tailored advice based on individual circumstances. It provides details on contribution limits, tax implications, and access conditions for superannuation funds, along with examples illustrating the benefits of salary sacrificing and pension strategies. It emphasizes that the information is illustrative and should not replace personalized financial advice.